As part of the eagerly awaited Budget on the 30th of October 2024, much of the information regarding changes to Stamp Duty Land Tax was disclosed as well as changes to the surcharge for investment properties. That said, there was less information publicised as to the changes to the Government Right to Buy Scheme for properties across England.

Previously if you were a tenant in a council property, under the Right to Buy Scheme you were able to apply to buy your home and receive a maximum discount, whichever was the lower of the below:

- 70% of the value of your property

- £136,400 if your property was in a London Borough

- £102,400 if your property was outside of London

Changes took effect from the 21stof November 2024 regarding the maximum discount you can receive, whichever is the lower of the following:

- 70% of the value of your property

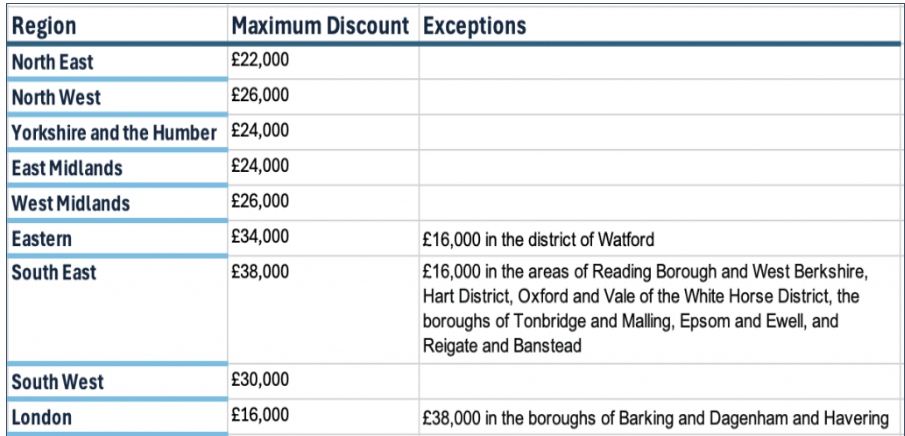

- The maximum discount depending on the region:

The discount is calculated on the number of years you have been a tenant, ranging from 35% for three to five years to a maximum of 70% or the cash maximum available for six years or more.

If you sell your home within ten years of purchasing it via the Right to Buy scheme, you must first offer it back to the relevant local authority or another social housing association who would need to purchase this from you at the full market price. The local authority or social housing association have eight weeks in which to agree to purchase your property. If this time period lapses you are then free to sell your home on the open market in the usual way.

Another important point to remember in relation to the Right to Buy Scheme is that if you sell your home within five years of purchasing it, you must repay a percentage of the discount you received. The percentage is calculated on the market value of your property at the time it is sold. If you sell your property during the first year of the purchase, you will need to repay the full discount. The percentage repayment then reduces to the following:

- 80% in the second year

- 60% in the third year

- 40% in the fourth year

- 20% in the fifth year

Originally published 10th December 2024

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.