The Ministry of Housing, Communities and Local Government has issued a consultation on "implementing reforms to the leasehold system in England". This follows on from the announcement in December 2017 (2017 announcement) that the government intends to implement a ban on the sale of new leasehold houses and impose a statutory cap on ground rents for new leases of residential property granted for terms in excess of 21 years (residential long leases) (see our previous alert). The proposals will have far-reaching implications for those involved in residential and/or mixed-use schemes.

Introduction

This latest consultation seeks views on how to implement four key proposals:

- the ban on the unjustified use of leasehold in new houses;

- the reduction of future ground rents to a nominal financial value;

- measures to ensure that the charges that freeholders must pay towards the maintenance of communal areas are fairer and more transparent; and

- measures to improve how leasehold properties are sold.

Ban on sale of leasehold new build houses

The government believes that "when someone buys a house, it should feel truly their own. House buyers should not be faced with a depreciating lease or a ground rent charge for any other purpose than to pay for the privilege of living in the house they have already bought". As such the government feels the growing trend to sell houses on a leasehold basis is unjustified and warrants legislation banning that practice in all but a few exceptional circumstances.

To implement this ban the government has proposed the following:

- Once in force, the ban should apply,

subject to any agreed exemptions, to the granting of new

residential long leases of houses:

- on any land held as freehold at any time; and

- on any leasehold land acquired from 22 December 2017 (being the day after the 2017 announcement) onwards.

By way of clarification the paper stipulates that the date of grant is the date on which the lease completes. - It should not be permissible to apply to register at the Land Registry a residential long lease granted or assigned in breach of the ban. If any such lease were to be registered by mistake, the homeowner should be entitled to cancel the lease and "have the freehold transferred to them at the earliest opportunity, and with the minimum of cost and disruption to them". It is currently unclear how the proposals relating to assignments are intended to work and what cases they are intended to catch.

- There needs to be a workable definition of what constitutes a "house" though the paper fails to go beyond acknowledging the inherent difficulty of what that might be.

- It is minded to provide exemptions

for the following types of development:

- shared ownership properties;

- community-led housing; and

- inalienable National Trust land and excepted sites on Crown land.

However, it has yet to be convinced to provide other exemptions, for example for retirement living where it claims it has received commentary that such schemes can be restructured to avoid the use of leasehold while still providing the necessary additional facilities.

Commentary

Under these proposals the Land Registry will have primary responsibility for enforcing the ban through preventing the registration of any leases granted or assigned in contravention of it. However, we question whether this approach is really in the buyer's best interest – if a lease cannot be registered, the buyer will only acquire an equitable title to the property (as legal title only passes on registration). This places the buyer, albeit temporarily, in the legal wilderness. As we have seen from recent registration gap cases, there are various actions only a legal owner can take (for example, service of certain notices). Also, unless properly registered in some shape or form, the buyer's interest is at risk of being subordinated to other interests registered in the interim (thanks to the Land Registry's priority rules). Finally, of course, an equitable interest is less marketable. So, while the government envisages the buyer somehow being able to "cancel" the lease and call for the freehold to be transferred to them, it will need to think very carefully about how this can realistically be achieved in the smallest possible time frame and in the context that there may be other third parties, such as lenders, involved.

In relation to "transferring" the freehold to any affected buyer, one thing that the government should try to avoid is the situation we currently have in relation to the statutory enlargement of leases (i.e. conversion of a leasehold interest into a freehold interest) pursuant to the Law of Property Act 1925, which can result in multiple freeholds of the same property (a position recently confirmed in the Law Commission's response paper on reform of the Land Registration Act 2002).

From a developer perspective, if there is any chance that a scheme may require or has been set up on the basis that residential houses will be sold off on a leasehold basis, it is vital to consider the timetable for implementation of the ban so as not to be caught out in the future. The nightmare scenario would be that a developer has acquired either:

- a freehold site; or

- a leasehold site after 21 December 2017,

with the intention of selling off the new houses on a leasehold basis, and those houses are not successfully sold off before the ban comes into force. Here it is vital to note that "grant" means the completion of the lease, not exchange of contracts. So, if left too late, a developer who has exchanged contracts for such sales, but completion is delayed (through no fault of its own), may find that they are caught out by the ban. Further, even if such developments are completed in good time before the ban comes into effect, there is a danger that the perception now of leasehold houses is irrevocably damaged making them less marketable irrespective of whether or not they are being granted on fair and transparent terms and even though there is currently no law against this.

The best advice for developers in light of these proposals is to avoid structuring schemes on the basis that houses will be sold off as leasehold and, so far as possible, to consider restructuring any existing schemes that envisage such sales.

Cap on ground rents for long residential leases

The government view is that, while it is necessary for leaseholders to pay consideration in the form of a ground rent (because the arrangement is a tenancy), "it is unfair for them to be required to pay economic rents at levels which are solely designed to serve the commercial purposes of the developer and any future investors. Furthermore, leaseholders see no material benefits from these payments." These comments and proposals will apply equally to leasehold flats as to leasehold houses.

The proposals include:

- capping ground rents for new residential long leases at £10 per annum – a change to the position set out in the 2017 announcement when the government proposed capping ground rents at a peppercorn;

- legislation to the effect that:

- any provision in a residential long lease that permits (whether triggered by an event or otherwise) a ground rent greater than the cap, or any other replacement charge greater than the cap, will be void;

- new residential long leases must specify the date on which the annual rent is payable; and

- a notice is required demanding payment of ground rent to be made at least 28 days before it is due to be paid and providing that such notice must not include a demand for rent which was payable in a previous year;

- that once implemented it will not be permissible to register at the Land Registry any new residential long lease (whether of a house or a flat) with a ground rent in excess of the proposed cap;

- making an exemption for shared ownership schemes and considering an exemption for community-led housing. For retirement housing the government is not proposing to implement the restrictions on ground rents provided the potential buyer has a choice whether to pay a higher sale price at a ground rent of £10 or a lower sale price with a specified economic ground rent;

- excluding mixed-use leases, for example a lease of a shop with a self-contained flat above;

- applying the ban to the renewal of any existing residential long lease including where such lease is surrendered and re-granted (something that can happen inadvertently if the demise or the term is extended); and

- that the cap should come into force three months after commencement of the relevant legislation.

Commentary

It is interesting that the government has decided to change its position as to the level of the cap for ground rents from a peppercorn to £10. The decision to go with £10 seems entirely arbitrary – if ground rents really are an unfortunate "evil" then why choose the nominal figure of £10, when it is not uncommon for ground rents in the commercial sector to be set at a peppercorn (i.e. no financial value). The consultation seems to have drawn inspiration from the Housing Act 1985 though why it should be influenced by a piece of legislation that is over 30 years old is unclear.

The provisions relating to rendering void any ground rent provisions in excess of the cap are also unclear. For example, there is some ambiguity as to:

- whether such provisions would be void in their entirety or would only allow the landlord to recover up to £10 in ground rent per annum; and

- whether a pre-existing lease that reserves a ground rent but which contains provisions for review resulting in a ground rent of more than £10 are caught. We would assume not but the relevant section of the consultation just refers to "any provision in a lease" rather than "a new lease"

If such provisions are to be rendered void then query why the government is also proposing that a residential long lease containing a ground rent in excess of the cap should not be capable of registration – is it not enough that the offending provision will not apply?

The consultation paper frequently refers to the desire to avoid exemptions being misused or open to gaming yet the exception of mixed-use premises opens up a possible loophole. There has been a rise in the creation of mixed-use spaces for work and living so it is possible that such arrangements could become more popular if they circumvented the cap on ground rents.

Finally, the government's comment that "homeowners should not be faced with ... a ground rent charge for any other purpose than to pay for the privilege of living in a house they have already bought" could come back to haunt politicians. At least one think tank has, in recent months, suggested that one way of equalising the perceived lack of fairness between those who own homes and those who do not is to introduce an annual levy on the value of a person's property, possibly as a replacement of council tax and SDLT. Such a levy could equally be seen as requiring homeowners who have already bought their properties to pay for the privilege of living in their houses.

Ensuring that charges freeholders must pay towards the maintenance of communal areas are fairer and more transparent

Currently residential leaseholders, but not freeholders, have various statutory rights to challenge the reasonableness of charges made for communal facilities. The government is proposing to introduce equivalent rights for freeholders based on the existing leasehold rights set out in the Landlord and Tenant Act 1985, namely:

- a requirement that maintenance charges must be reasonably incurred and that services provided are of a reasonable standard;

- consultation requirements;

- obligations on the provider of services to provide information to the freeholder; and

- an ability to challenge the reasonableness of any such charges at the First-tier Tribunal.

However, the government is also seeking views on giving such freeholders the right to apply to change the management of the services covered by an estate service charge or freehold service charge.

Commentary

It does seem unfair that freehold owners are not given the same protection as leasehold owners when it comes to charges for communal areas. The challenge for the government will be to ensure that any such measures are not unduly complex as that would not be in anyone's interest.

Measures to improve how leasehold properties are sold

The government is "committed to setting fixed time frames and maximum fees for the provision of leasehold information" and has asked for views as to what those time frames and maximum fees should be.

Commentary

There are few details of these proposals, which gives the impression they may have been included as a bit of an afterthought. For example, there is no suggestion as to how these provisions would be enforced. Further, the consultation does not attempt to outline what information would need to be provided. Instead it looks as though the government is looking for direction from respondents.

Legislative timetable

Although the government has given no firm commitment as to when legislation is likely to be enacted to cover these proposals, comments within the paper indicate that the proposal may be taken forward in 2019, meaning that any legislation is unlikely to be enacted until mid-2020 at the earliest.

Conclusion

No-one can doubt that the government has good intentions and that it is in everyone's interest that buyers are treated fairly and transparently, not least to retain confidence in our domestic residential market. However, the key proposals (the ban on leasehold houses and the cap on ground rents) will, as outlined, only help new leaseholders. So the big question is what, if anything, is the government thinking of doing to help existing leaseholders? This question is particularly pressing since, the more the government presses home the need for reform, the less attractive existing leasehold houses or residential long leases with escalating ground rents become (whether they were reasonably granted or not) and this potentially makes the situation of those leaseholders worse, not better.

The consultation relates to England only and will close at midnight on 26 November 2018.

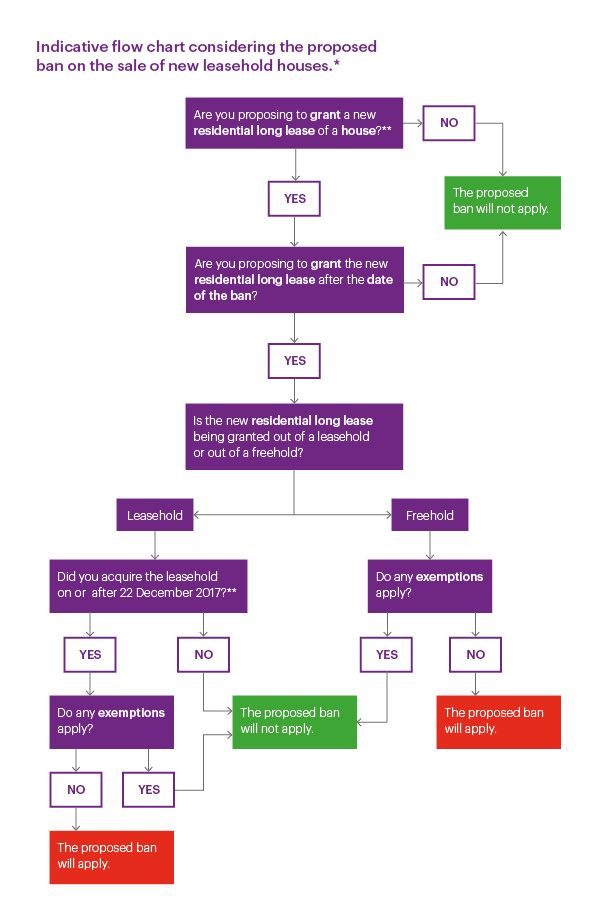

Date of ban: there is no firm timetable as to when the ban will come into effect. The consultation paper suggests it could be mid-2020.

Exemption: it appears the government is preparing to exempt: i) shared ownership properties; ii) community-led housing; and iii) inalienable National Trust land and excepted sites on Crown land. It is possible that other exemptions will be agreed before legislation is enacted. The position with exemptions may change by the time draft legislation is produced.

Grant: means the date of completion of the new residential long lease (rather than exchange).

House: the government has yet to provide a definition.

Residential long lease: though not set out explicitly in relation to the ban on leasehold houses, we assume this will be the same as for the cap on ground rents i.e. residential leases granted for a term in excess of 21 years.

*This chart does not consider the proposed cap on ground rents. Further, as these proposals are currently at the consultation stage, we do not have full details of what is being proposed and the resulting legislation may differ. Nothing in this flow chart should be taken as legal advice – if advice is required, please contact your legal adviser.

** Note that there are proposals for the ban to also apply to assignments of leasehold land once the legislation is in force if a house or houses have been developed on that land after the legislation comes into force. At present it is unclear what this is intended to catch.

Dentons is the world's first polycentric global law firm. A top 20 firm on the Acritas 2015 Global Elite Brand Index, the Firm is committed to challenging the status quo in delivering consistent and uncompromising quality and value in new and inventive ways. Driven to provide clients a competitive edge, and connected to the communities where its clients want to do business, Dentons knows that understanding local cultures is crucial to successfully completing a deal, resolving a dispute or solving a business challenge. Now the world's largest law firm, Dentons' global team builds agile, tailored solutions to meet the local, national and global needs of private and public clients of any size in more than 125 locations serving 50-plus countries. www.dentons.com.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.