Biopharma and life sciences organizations are navigating economic pressures and labor market changes, while prioritizing pay transparency and retaining and attracting top talent.

Employee pay trends show a careful balance between managing salary budgets amid economic pressures and increasing transparency, with rising demand for specialized roles and skills shaping compensation strategies globally.

Trends in employee pay

Employee pay isn't only important to employees. Organizations also rely on compensation programs to support many objectives. Companies in the biopharma and life sciences industry are balancing adjusting compensation to address economic pressures and evolving labor market dynamics, while prioritizing pay transparency and attracting and retaining top talent.

Planned salary budget increases

Inflationary pressure, concerns related to cost management, and the anticipation of a recession or decline in business results are among the top factors influencing 2025 budget plans. This is a departure from the prevalent concerns of recent years when business leaders were contending with tight labor markets and evolving employee expectations. As a result, many organizations are preparing for 2025 budget increases that are slightly lower than that of recent years but more in line with the actual spend they've made in 2024.

The regional salary budget data indicates that clients must adapt their compensation strategies to regional market dynamics, as differing growth rates underscore the importance of customizing approaches to attract and retain talent, while also managing economic factors like inflation and cost control.

| Region | Planned increase |

|---|---|

| North America | 3.6% |

| Asia Pacific | 4.9% |

| Central & Eastern Europe | 6.0% |

| Latin America | 4.9% |

| Middle East & Africa | 4.8% |

| Western Europe | 3.5% |

Source: WTW 2024 Salary Budget Planning Survey Report – Global (December edition)

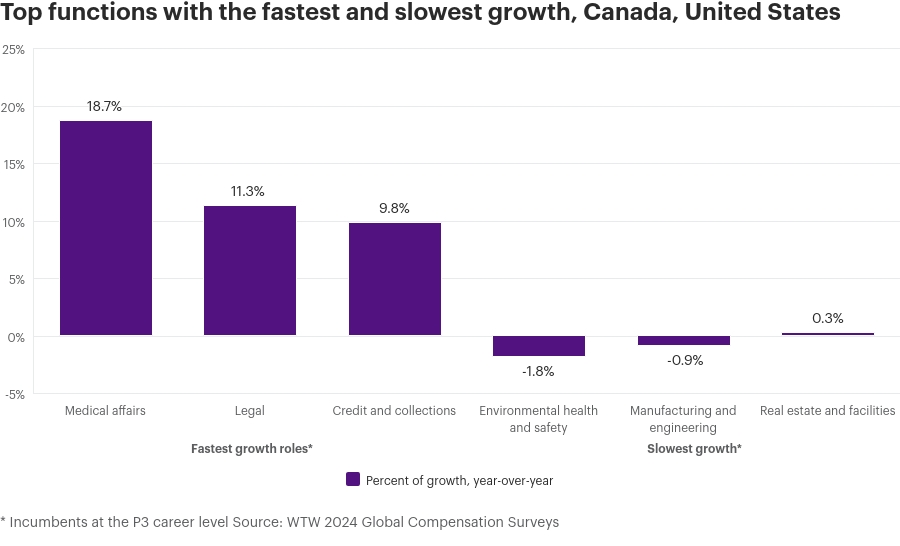

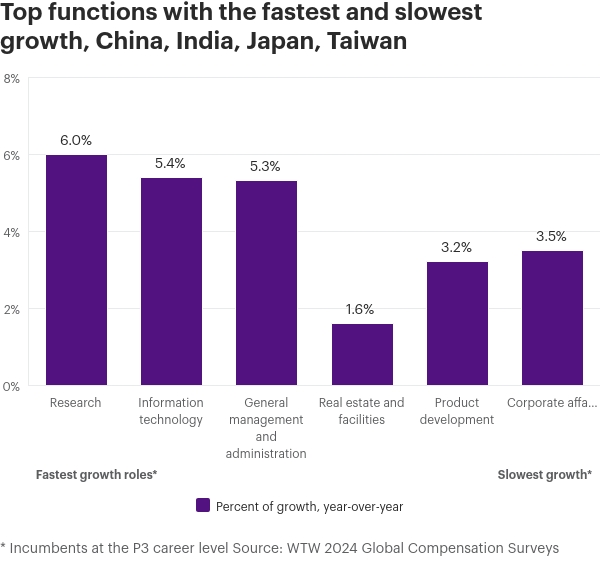

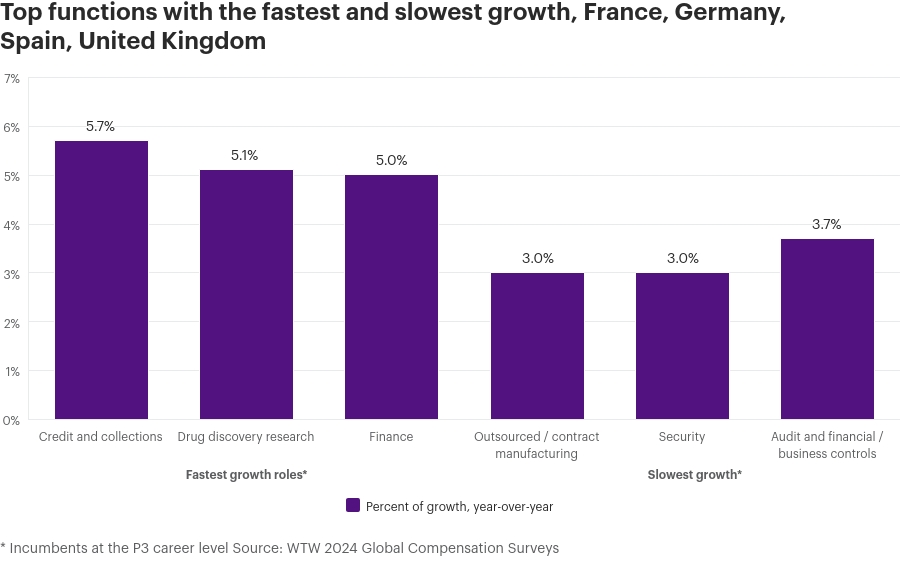

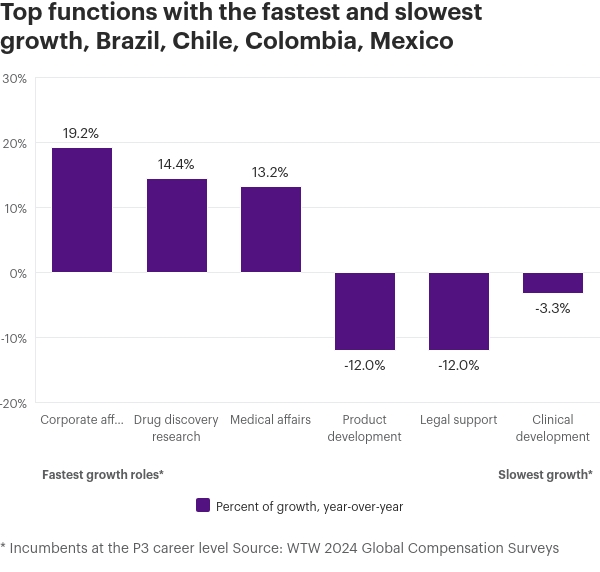

Industry disciplines and functions seeing the fastest and slowest compensation growth

Changing labor market and economic conditions as well as socio-economic trends have increased the pressure on organizations to update their pay programs, according to the results of our 2024 Pay Effectiveness & Design Survey's global results. The following charts show job families (functions) that are seeing the fastest and slowest compensation growth.

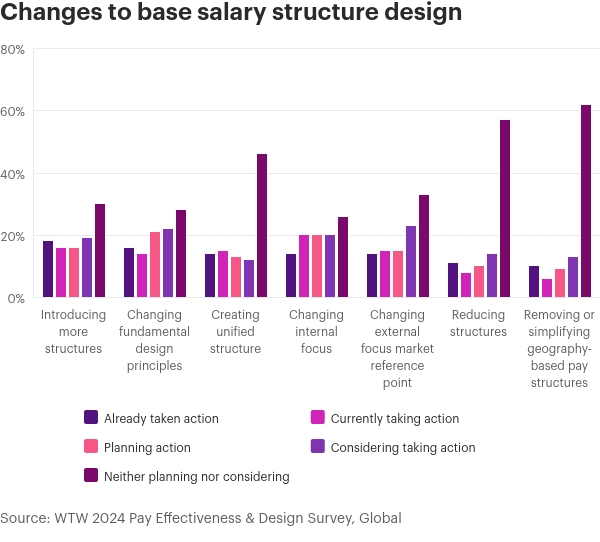

Changes to base salary structure design

Most respondents to the global Pay Effectiveness & Design Survey indicated that they have already made changes or are planning or considering making changes to their base salary structure design through fundamental shifts.

Compensation communication

Multiple factors are encouraging increased levels of pay program communication within organizations.

Factors affecting increased levels of pay program communication

| Pay program communication drivers | Percent |

|---|---|

| Increasing regulatory requirements | 64% |

| Company values and culture | 51% |

| Environmental, social and governance / diversity, equity and inclusion agenda | 51% |

| Employee expectations | 46% |

| HR's confidence in pay programs | 42% |

| Leadership's confidence in pay programs | 38% |

International and global organizations generally approach the way they communicate pay program information on an organization-wide basis, with local variation where required.

Trends in attraction and retention

Employee attraction and retention is one of six core objectives for pay programs in organizations around the world, especially as employees are most likely to say pay is a driver of attraction and retention, according to WTW's 2024 Global Benefits Attitudes Survey.

Drivers of attraction and retention

| Driver | Percent | |

|---|---|---|

| Attraction | Pay (including bonus) | 56% |

| Job security | 34% | |

| Flexible work arrangements (e.g., working remotely, flexible work hours) | 32% | |

| Retention | Pay (including bonus) | 43% |

| Job security | 39% | |

| Working environment (e.g., location, facilities) | 32% |

Average voluntary attrition rate, by region

Voluntary attrition is highest in Asia Pacific, while voluntary turnover is lowest for Western Europe. Many organizations still report issues with sourcing talent, including reporting a shortage of available labor supply.

| Region | Voluntary attrition rate |

|---|---|

| North America | 8.3% |

| Asia Pacific | 9.8% |

| Central & Eastern Europe | 7.5% |

| Latin America | 6.8% |

| Middle East & Africa | 5.6% |

| Western Europe | 6.1% |

41%of organizations report labor shortages in multiple talent segments.

In-demand jobs and skills

| Region | In-demand jobs | In-demand skills |

|---|---|---|

| North America | 1. Chemist 2. Warehouse associate 3. Production operator |

1. Compliance management 2. Documentation & records management 3. Biopharma testing |

| International | 1. Medical representative 2. Sales representative 3. Account manager |

1. Compliance management 2. Sales management 3. Documentation & records management |

| Europe | 1. Laboratory technician 2. Quality engineer 3. Account manager |

1. Compliance management 2. Sales management 3. Documentation & records management |

Highest and lowest headcount expectations, by industry and region

| Region | Largest planned increases | Lowest planned increases |

|---|---|---|

| Asia Pacific | Biopharma & life sciences | Retail |

| Central & Eastern Europe | Biopharma & life sciences | Construction |

| Latin America | Retail | Transportation |

| Middle East & Africa | Construction | Transportation |

| North America | Real estate | Manufacturing (non-durables) |

| Western Europe | Real estate | Retail |

Organizations are sharing pay information with job candidates

Two-thirds of organizations around the world are already or are planning/considering communicating pay rate or pay range information to job candidates, according to our 2024 Pay Transparency Survey's global results.

77%of organizations are more likely to communicate

the

hiring rate / range for the job to external job

candidates.

56%of organizations apply a consistent approach for all job levels and types to external job candidates.

Organizations with operations in locations with increased legislation tend to apply a more consistent approach across the entire enterprise when sharing pay rates and ranges with prospective employees.

Locations sharing pay rates and ranges with prospective employees:

- 86% of U.S. employers

- 63% of UK employers

- 60% of EU employers

- 58% of Canadian employers

Trends expected to shape 2025 rewards

01

Artificial intelligence (AI) and generative AI in life sciences

The use of AI and generative AI continues to expand across various life sciences domains, including drug discovery, clinical trials and manufacturing. Organizations are increasingly integrating AI to accelerate decision making, enhance productivity and personalize medicine. Investments in AI for analytics and decision making are set to rise significantly, with a focus on tangible outcomes and improved efficiency.

02

Multi-omics integration

Multi-omics approaches, which integrate data from genomics, proteomics, metabolomics and other "omics" fields are driving advances in precision medicine and drug discovery. These methods allow for a holistic understanding of biological systems, enabling more accurate disease diagnosis and targeted treatments.

03

Rise of digital health technologies

The adoption of wearable health devices, continuous monitoring systems and AgeTech is transforming how patients manage their health. These technologies empower consumers with personalized insights into their conditions and foster preventive care through real-time data sharing with healthcare providers.

04

Personalized medicine and gene therapies

Gene therapies and personalized medicine are becoming more prominent, with breakthroughs in treating conditions like rare genetic disorders and cancer. Technologies like CRISPR and CAR-T cell therapies are pivotal, supported by advancements in gene editing and delivery systems.

05

Sustainability in research and operations

Biopharma and life sciences organizations are prioritizing sustainability by adopting green laboratory practices, reducing waste and developing eco-friendly manufacturing processes. This trend aligns with global efforts to address climate change while ensuring efficient resource utilization in research and production.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.