On 28 June 2017, the Financial Conduct Authority ("FCA") published the findings of its market study into the UK asset management sector (the " Final Report"), together with a consultation paper (" CP17/18").

The FCA launched its market study in November 2015 (the "Market Study"). The Terms of Reference identified particularly the need to understand whether competition is working effectively, to enable both institutional and retail investors to obtain value for money when purchasing asset management services. (This reflects the additional objective of the FCA, introduced by the Financial Services Act 2012, to promote "effective competition in the interests of consumers in the markets for regulated financial services".)

The FCA has confirmed a number of highly critical findings within its Interim Report (published in November 2016) but the "package of remedies" now proposed stops short of imposing on the industry the sea-change anticipated. Instead it ushers in a period of further consultation. High on that list (with industry responses due by 28 September 2017) are the proposals to strengthen the duties of fund managers and to introduce a requirement that they consider whether or not they are providing value for money. In whatever form these proposals emerge from consultation there are likely to be practical implications for both the asset management industry and its insurers.

The FCA's findings

The Final Report confirmed the following key findings identified in the Interim Report:

- Weak price competition within the asset management industry: of the firms sampled, active charges have remained broadly stable over the past decade, with average profit margins of 36%

- Substantial variation in fund performance and no clear correlation between charges and the gross performance of retail active funds in the UK (indeed evidence suggests that, on average, both actively managed and passively managed funds did not outperform benchmarks after fees)

- A lack of clarity in the communication of fund objectives and charges

- Reliance by smaller institutional investors, typically pension funds and their trustees, on largely unregulated investment consultants

Proposed remedies

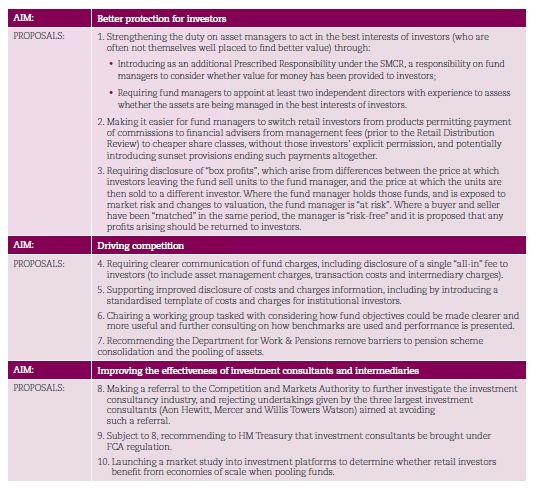

The Final Report proposes a package of ten remedies intended to address those findings, as set out in the table [below].

The headline-grabbing proposal (for its potential impact on consumers) is the introduction of an "all-in" fee, intended to ensure clearer communication of charges. This promises to fulfil two of the FCA's stated aims; both in protecting investors by enabling them to better understand and compare funds, and, thereby, driving competition between those funds.

There is also much in the Final Report that will be of concern to investment consultants, who play a significant role in advising pension funds and trustees on asset allocation. The FCA recommends that HM Treasury consider bringing investment consultants under FCA regulation. The FCA also proposed to reject undertakings given by the three largest investment consultants (Aon Hewitt, Mercer and Willis Towers Watson, which together have at least 56% of investment consultancy revenues) proposing reforms intended to head off a referral to the Competition and Markets Authority ("CMA"). The FCA has since, on 14 September, issued its Final Decision, which confirmed that it would indeed be rejecting the proposed undertakings in favour of a Market Investigation Reference on investment consultancy services and fiduciary management services to the CMA and very shortly thereafter, on 21 September, the CMA published an Issues Statement, which sets out the three main areas of the CMA's investigation. In particular, the CMA will be looking at whether harm is caused by: (1) the difficulties customers face in assessing, comparing and switching investment consultants; (2) potential conflicts of interest between investment consultants and the clients; and (3) barriers to other firms entering, or expanding within, the market. Should it find an adverse effect on competition, it will have to consider what, if any, remedial action (which could include financial penalties) would be appropriate. The CMA has invited interested parties to set out their views on the potential issues and potential remedies by 12 October 2017 for further discussion, as appropriate.

We now turn to focus on the FCA's proposals in relation to fund managers and the governance of investment funds:

Strengthening the duty on fund managers

Under existing FCA rules, fund managers are required to act in the best interest of their investors and prevent undue costs being charged to the scheme or unit holders. These obligations are overseen by the board of directors, although boards are not currently required to appoint any independent members.

The FCA found that boards generally do not consider value for money on behalf of investors, do not always take timely steps to address underperformance, and can lack authority within group structures to challenge commercial strategy.

In the Interim Report, the FCA set out a number of ways in which these issues might be addressed. In particular, the FCA asked whether the duty on fund managers was best strengthened through regulatory reform or through the introduction of a fiduciary duty. (The Law Commission had previously considered this same question and concluded in its report on "Fiduciary Duties of Investment Intermediaries", published in June 2013, that the law did not need substantive change but rather better communication and understanding.) Following consultation, the FCA took the view that statutory change, which would inevitably take time to come into effect, was not the most effective way to strengthen the duties of fund managers or to provide clarity around the FCA's expectations.

Instead, responding to industry feedback, the FCA proposes the following:

1. Introducing a new rule requiring fund managers to assess whether value for money has been provided to investors

Following industry feedback around the precise meaning of "value for money" the FCA has clarified that this includes:

- Identification of economies of scale (when funds reach certain levels of assets under management) and consideration of whether any such savings should be shared with investors;

- Assessment of whether charges are reasonable in relation to costs incurred, quality of service and market rates;

- Consideration of different share classes available to investors and, where multiple share classes are available for a given fund, the fund manager must explain why some investors are in those more expensive classes;

- Assessment of quality of services (including delegated services); and

- Publication of a report, at least annually, setting out the findings of the assessment, and the actions taken or to be taken to discharge the obligation to provide value for money (for example, renegotiation of contracts). This report can form part of the Annual Report or stand alone.

2. Introducing a new Prescribed Responsibility under the Senior Managers and Certification Regime ("SMCR"), which is to be extended to asset managers in 2018, to act in the best interests of investors

Broadly, the SMCR aims to reduce harm to customers by making senior managers personally accountable for Prescribed Responsibilities. The FCA proposes that the chair of the fund manager board (who will be a Senior Manager under the SMCR regime and will therefore need to be approved as fit and proper to do so) be allocated the Prescribed Responsibility of assessing value for money. The chair would be responsible for taking reasonable steps to ensure the board adheres to the current and proposed rules. Further consultation on this proposal will form part of the FCA's consultation on the extension of the SMCR to all financial services firms later this year.

3. Requiring fund managers to appoint independent directors to their boards

The FCA proposes that fund managers be required to appoint a minimum of two (and at least 25% of their total board membership) independent directors to increase scrutiny at board level. In practice, the FCA estimates that this will mean the appointment of approximately 480 directors, each of whom will need to have sufficient experience and expertise. The FCA proposes that each fund manager assess whether or not its chair (allocated the Prescribed Responsibility of assessing value for money as discussed at (2) above) should be an independent director or an executive director. They note that while an independent director may be more robust in challenging commercial interests where these compete with the interests of investors, an executive director will have better day-to-day knowledge of the company and potentially be better placed to make changes to firm culture and values. The FCA proposes that (1) and (3) above take effect 12 months after the rules are finalised.

Comment

On one view, the current requirement on fund managers to act in the best interest of their investors probably already encompasses an obligation to assess "value for money". What the FCA is now proposing is to make that express. The FCA is shining a spotlight on a huge industry (the UK asset management industry is described in the consultation paper as being the second biggest in the world with GBP 6.9 trillion of assets under management) it sees as opaque and perhaps complacent, having become used to sustained high-profit margins in the context of variable fund performance. Fund managers will no doubt be considering what this means for them commercially; what level of profit margin is compatible with value for money? From the consumer perspective, the FCA has highlighted that even relatively modest changes to asset management charging structures could have a significantly positive impact on savings and pensions pots. Although the FCA stopped short of recommending that the Government introduce a new fiduciary duty, the proposed additional Prescribed Responsibility to ensure value for money exposes the individual appointed as chair to individual sanctions under the SMCR regime if they cannot satisfy the regulator that they took "reasonable steps" to prevent, stop, or remedy a breach. Many D&O Insurers will already be considering the investigations cover offered to fund managers in line with the extension of the SMCR in 2018 and this proposal points to one area in which the regulator will be looking. The recruitment of nearly 500 independent directors with the necessary expertise to the boards of fund managers may well present a challenge for the industry. Those independent directors will of course face the possibility of claims against them in their capacity as directors. We expect that few independent directors would wish to take on the additional role of chair (being the Senior Manager responsible for assessing value for money).

Although the Final Report seeks to assure the industry that the FCA does not favour passive funds over active funds (in response to concerns raised in relation to the Interim Report), clearly those funds that do not outperform benchmarks after fees will be in the spotlight. This comes in the context of concerns about "closet index tracker funds" that closely mirror the benchmarks, and which have been identified by some commentators as a source of potential investor claims. With many of the FCA's 10 proposed remedies awaiting further consultation or taking the form of recommendations to other bodies (including HM Treasury and the Department of Work and Pensions), we can expect the consideration and implementation of the Final Report to be gradual. This may come as a relief to those who expressed alarm at the severity of the findings set out in the Interim Report. Fund managers and their insurers are, however, likely to be looking the proposals set out in CP17/18 closely from a governance and risk perspective.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.