- with readers working within the Securities & Investment industries

Newgate Compliance Managing Director, Matthew Hazell, outlines the steps Alternative Investment Fund Managers ("AIFMs") need to take in order to prepare for the new UK prudential regime. This article forms part of our IFPR readiness series.

The Financial Conduct Authority (FCA) is introducing a new UK Investment Firm Prudential Regime (IFPR) with effect from 1 January 2022 which will impact sub-threshold and full scope AIFMs that are authorised to conduct MiFID investment services (portfolio management, investment advice etc) outside of the funds they manage. The proposals will have an impact on the requirements AIFMs will have to meet from that date.

DETERMINE YOUR FIRM'S CLASSIFICATION

The first step is to determine which prudential category your firm falls into under IFPR which will be one of the following:

- 'Small and non-inter connected' (SNI) firm; or

- firms that are not SNIs (Non-SNI).

See which category your firm falls into by reviewing the thresholds from our previous factsheet, noting that aside from the on-and off-balance sheet total, thresholds only relate to MIFID activities your firm undertakes. The impact of the new regime will differ depending on whether your firm is classified as a "full scope" AIFM versus a "sub-threshold" AIFM.

AIFMS: UNDERSTAND THE IMPACT TO YOUR FIRM

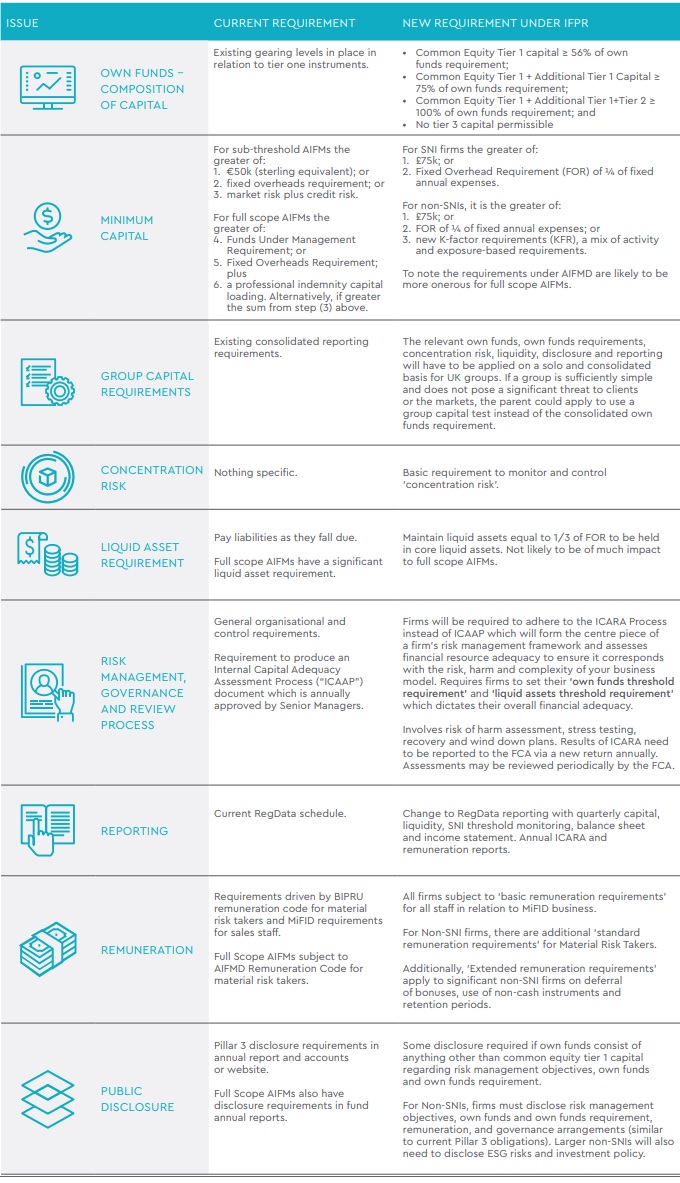

The table below indicates a short summary of current prudential requirements for AIFMs and how they might change following the implementation of IFPR.

NEXT STEPS

Firms should start familiarising themselves with the proposed IFPR changes and starting planning on how to meet the new requirements.

HOW CAN NEWGATE HELP?

Newgate have developed a readiness assessment to undertake a gap analysis of a firm's systems and controls against the requirements identifying any remediation actions to be undertaken.

We have developed an enhanced compliance framework on our proprietary compliance system "GATEway" that encompasses updated polices, assessment documents and the compliance monitoring plan to ensure these changes are considered and complied with on an ongoing basis.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.