- within Antitrust/Competition Law and Intellectual Property topic(s)

- with readers working within the Retail & Leisure industries

Introduction

The global consumer spending landscape is more complex than ever as we prepare to enter 2025. Businesses and consumers alike continue to grapple with the aftershocks of the past few years, marked by significant disruption driven by economic and geopolitical shifts.

The persistent impacts of legacy inflation remain a key driver of consumer sentiment in many regions, as elevated costs of goods and interest rates show little signs of easing in certain markets. While economic policies such as the increase in the U.K. National Minimum Wage and National Living Wage may bring short-term relief for some, they also present the risk of reigniting inflationary pressures for others.

Concurrently, the consumer ecosystem evolves at a rapid pace. Digital technologies, AI-enhanced shopping experiences, and sustainability priorities are reshaping how consumers think and act.

This report examines the global consumer spending outlook for 2025, leveraging insights from more than 15,000 consumers. Will spending patterns continue to be suppressed after a muted 2024? If so, why? And how will consumers keep their finances under control? In answering these questions, we aim to equip business leaders with actionable insights to stay ahead in this dynamic environment.

We hope you find this report valuable.

If you'd like to explore further consumer analysis from our data set by country, sector, or consumer demographic, our authors are available to discuss the findings in more detail.

About this study

Research for Spending, Disrupted: AlixPartners' 2025 Global Consumer Outlook was conducted between September and October 2024. Survey respondents comprised 15,434 consumers from nine countries— China, France, Germany, Italy, Saudi Arabia, Switzerland, United Arab Emirates, the U.K. and the U.S.

Global spending intentions for 2025

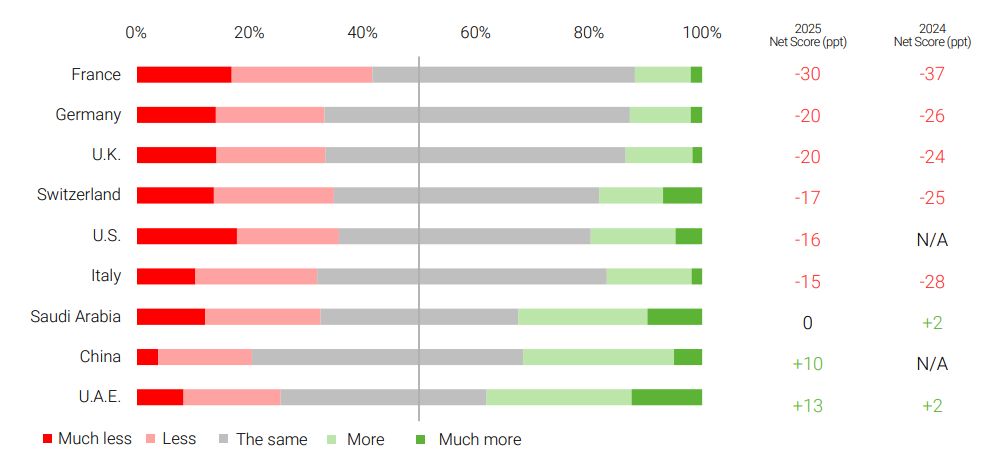

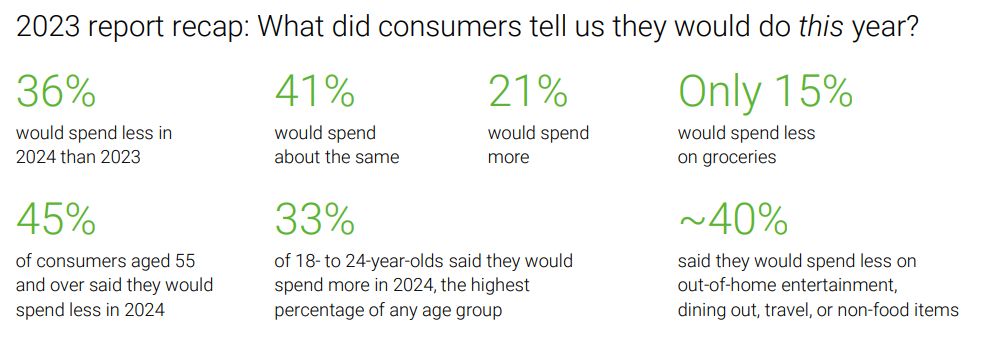

Globally, a cautious and prudent outlook prevails, though not without pockets of optimism. 31% of consumers are planning further spending cuts, although a considerable 47% plan to maintain their current spending levels. Just 19% say they will spend more, equivalent to a net intention for reduced spending of 12 percentage points (ppt).

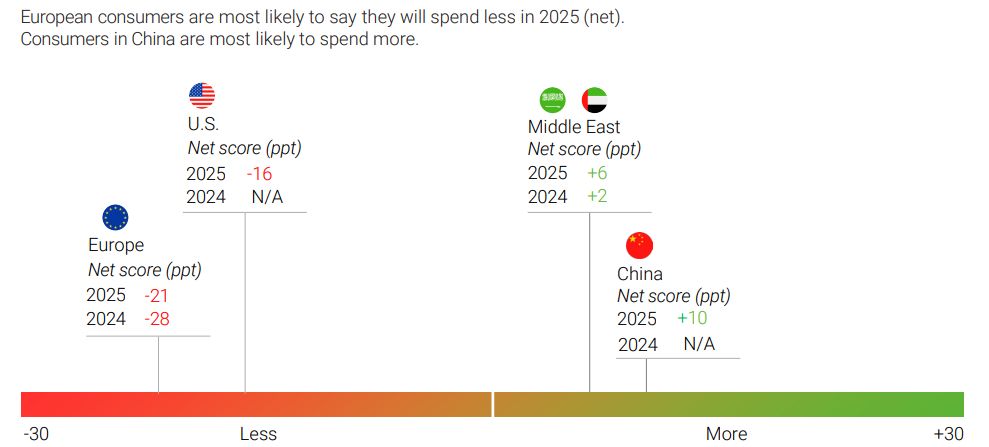

Spending is trending downwards in the U.S. and Europe; consumers in the Middle East and China display more optimism.

In the U.S. and Europe, consumers continue to show restraint in spending plans, with more than one third of consumers intending to cut back, while in the Middle East, we see a relatively balanced outlook. An anticipated 10 percentage point net increase towards spending more in China appears more positive still, yet this should be contextualized by the impact of inflationary pressures (particularly groceries) and low levels of optimism for the future (unattainable property prices, for example) inspiring spending on more immediate gratification.

Figure 1: Global spending intentions by country for 20251

Regional spotlight: Middle East

The outlook in the Middle East diverges from the West's spending contraction, with more positive sentiment among consumers in Saudi Arabia and the U.A.E.

Consumers' spending intentions here for 2025 display a 6 ppt net positive trend towards spending more, in contrast with their U.S. and European counterparts.

This positivity is driven by a more positive macroeconomic outlook, and a lesser inclination or perceived necessity to save. This manifests in increased anticipated spending across all sectors, particularly groceries and clothing, fueled not only by inflationary pressures but also premium purchases and a general optimistic willingness to spend.

Dining out has become more common in the region, especially in Saudi Arabia, reflected by an increase in planned spending on restaurants, bars, and entertainment outside the home. The postpandemic desire to travel also lingers, although Saudi Arabian consumers indicate some tendency toward local staycations due to an expanding tourism offering and its relative affordability.

Despite the region's overall growth narrative, consumption bifurcation remains prevalent. As discount retailers increasingly penetrate the market, some consumers are trading down to more affordable retailers and value brands, particularly in groceries.

There are profitability challenges for some companies in the region, coupled with reports of reduced investments and rationalized operations. This has yet to affect consumer sentiment, though that may adjust next year.

Figure 2: Global spending intentions by region for 2025–net score (ppt)2

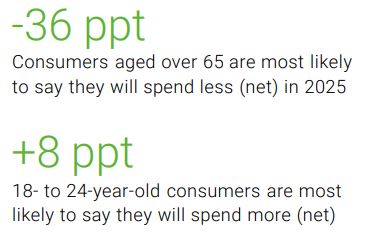

Demographic spending intentions for 2025

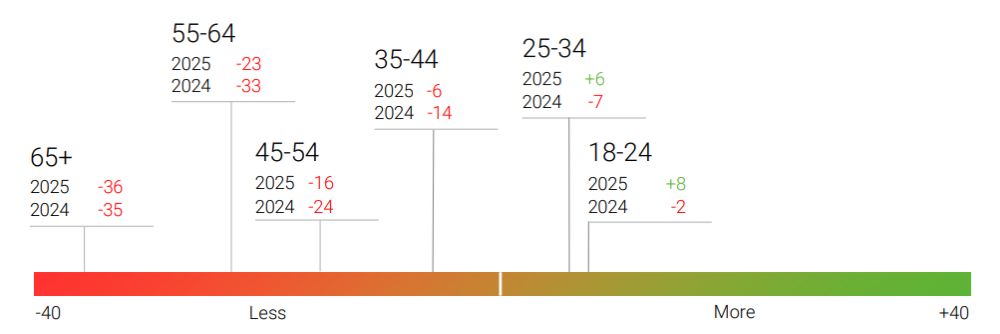

Younger consumers (18–34 age group) display a readiness to spend more—though perhaps a greater share of a relatively smaller budget—whereas the 55+ age group is most likely to spend less.

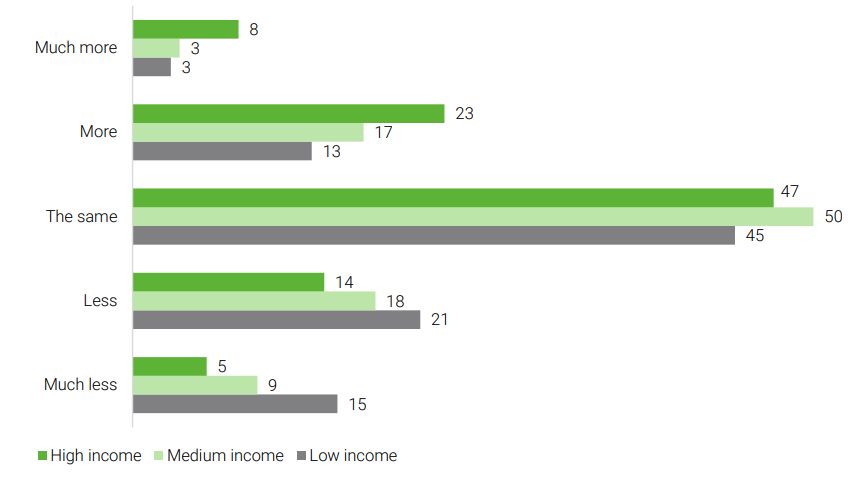

31% of high-income consumers also expect to increase their spending in 2025, particularly on travel and leisure, contrasted with only 16% of low-income consumers. Companies focused on premiumization must strike the right balance, while baselevel stores should be mindful of strategies to retain the customer groups that are trading down.

Figure 3: Global spending intentions by age for 2025—net score (ppt)3

Figure 4: Global spending intentions by income for 2025 (%)

Category spending intentions for 2025

Grocery holds firm, though inflation dictates it is harder to spend less

In retail, the emphasis is on essentials. Only 15% of consumers say they will spend less on groceries globally. Across every country, age group, and income bracket, this is consistent: more than 80% of consumers expect to spend the same or more on groceries in 2025. This reflects how difficult it has become for consumers to reduce spend on essentials, given the impacts of inflation in the past two years.

Discretionary activities will therefore be fighting the greater battle for wallet share, as trade-offs are made beyond the essentials.

Groceries

see the biggest global net swing towards spending more in 2025 (net +19 ppts), but only a 3 ppt net rise in Europe

Non-food retail is at risk

33% of consumers plan to spend less on non-food retail in 2025, while only 16% plan to spend more.

With discretionary spending under pressure, there's a need for retailers to reinforce their value propositions and innovate in terms of loyalty programs and personalized offers to cater to costconscious consumers.

33% of consumers plan to spend less on non-food retail in 2025

To view the full article, click here.

Footnotes

1. "Not applicable" option for consumers from China not displayed (10.4%).

2. "Not applicable" option for consumers from China not displayed (10.4%).

3. 2024 net score excludes China and U.S

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.