The Financial Conduct Authority (FCA) has recently published its Enforcement Annual Performance Report for its reporting year ending 31 March 2018. Coverage of this by both the mainstream and industry media tends to focus on the total amount of fines and how this varies from previous years. However, this number is usually dominated by a few large fines, which are themselves often driven by the fined firm's revenue rather than whether the misconduct was indicative of a wider issue in the industry. For this reason the overall amount of fines is a poor metric for either assessing the effectiveness of FCA enforcement overall or considering where the FCA is focusing its attention. The latter question is of considerable interest to authorised firms, as it is helpful in informing the allocation of compliance resources and board attention.

In this note we dig deeper into the FCA's data to address the following questions:

- Is FCA investigation and enforcement activity increasing?

- Where is the FCA focusing its enforcement resources?

- In which areas is the FCA increasing or decreasing its levels of activity?

- How long do enforcement investigations take, and what is their likely outcome?

- What other points of note are there in the FCA report?

We use the FCA's data (both from the current report and previous years) but break it down differently from its presentation in the report. We focus on issues of general relevance to authorised firms rather than those concerning unauthorised business or threshold conditions.

Is FCA investigation and enforcement activity increasing?

The FCA's approach to investigating has changed in recent years, partly as a result of the November 2015 Green Report into the FSA's HBOS investigation. As explained in a September 2017 speech by Mark Steward, FCA Director of Enforcement and Market Oversight, the FCA is now more willing to open an investigation where it suspects serious misconduct may have occurred, even where the prospects of success of an eventual enforcement action cannot be determined. In the same speech, he denied that the FCA would need additional enforcement resourcing, saying that they should instead become "vastly more efficient, strategic and focused, especially in conducting investigations more quickly and expediently".

The FCA data shows that the regulator is indeed conducting more investigations. It also shows that it is issuing fewer fines:

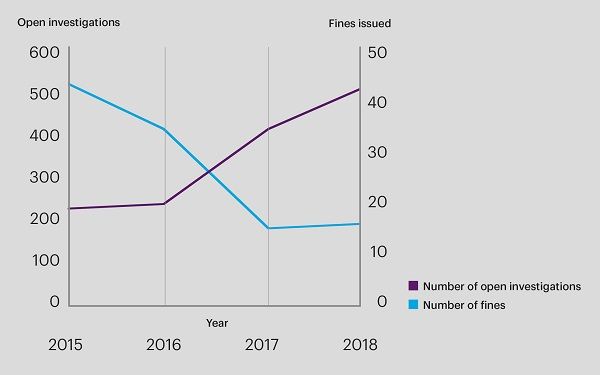

FCA open investigations and fines issued

Chart shows the number of open investigations at 31 March in each year, and the number of fines issued in each year ending 31 March

It is fair to point out that the number of fines issued is a relatively crude metric, as it misses important cases where the FCA takes other action against firms, such as requiring them to compensate customers or investors. It is, however, better in our view than either the total amount of fines, or the total number of final notices, which are heavily weighted towards routine cancellation cases.

The dramatic reduction in fines issued, at a time when the number of open investigations is increasing equally dramatically, seems to corroborate the concerns of some in regulated firms who feel that the Enforcement division is struggling with its current workload, resulting in investigations that meander for months before being closed with little or no explanation. It seems that FCA Enforcement's efficiency drive has some way to go.

Where is the FCA focusing its enforcement resources?

The FCA breaks down its open investigations by subject matter, though not by industry sector. The main areas of focus are shown below:

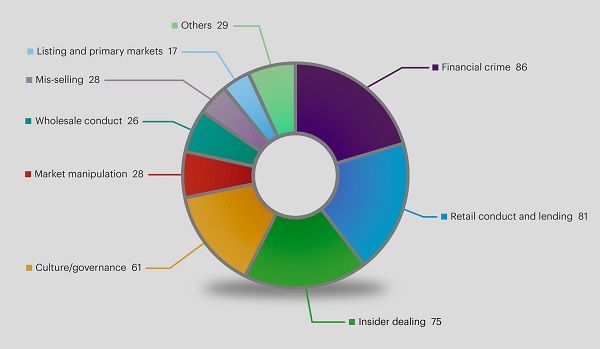

FCA investigations by subject matter

Chart shows the subject matter of open investigations at 31 March 2018. "Other" includes misleading statements (12 investigations), client money/assets (9), financial promotions (7) and benchmarks (1).

The data shows that market abuse (insider dealing and market manipulation) and financial crime are the top areas of FCA investigations, together amounting to 45% of all open investigations. Retail conduct and culture and governance are the other two main areas. Despite the recent emphasis given by the FCA to primary market disclosure, the number of open investigations in this area is relatively low.

In which areas is enforcement activity increasing or decreasing?

A comparison of open investigations in the main areas of FCA focus for the last three years is shown below:

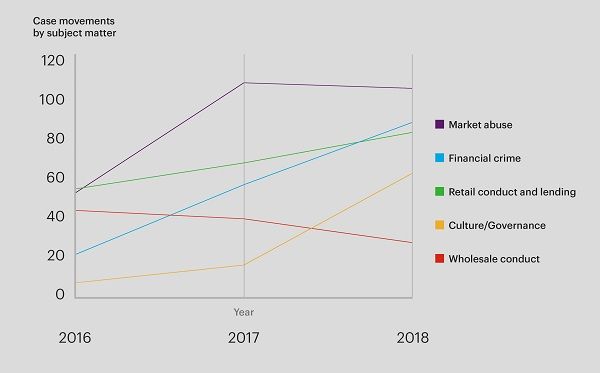

Case movements by subject matter

Chart shows the number of open investigations for each subject matter at 31 March in each year.

The data show that:

- culture and governance investigations have grown very rapidly, especially in the last year. This is unsurprising given the high focus the FCA as a whole has given to culture in recent years, and the pressure the regulators are under to show that the Senior Managers and Certification Regime (SMCR) delivers results. No doubt the roll-out of the SMCR to all FCA authorised firms next year will lead to yet more investigations;

- market abuse investigations grew very rapidly in 2016-2017, though they actually went down slightly in the following year;

- both financial crime and retail conduct investigations have grown steadily over the last two years, with financial crime growing especially rapidly;

- wholesale conduct investigations have gone down over the two years, which is remarkable given the large increase in investigations overall. This may well be due to the decrease in investigations related to LIBOR and FX misconduct over time. Wholesale firms should bear in mind that the market abuse category will include wholesale cases.

How long do enforcement investigations take, and what is their likely outcome?

The report contains data on the length of time of enforcement cases, from the start of formal investigation to closure. For a civil or regulatory case that was ultimately settled, the average time has doubled from 16 months three years ago to 32 months in 2017/18. The average length of all cases, including those where no further action (NFA) was taken, has remained roughly the same over that time at 19 months. This perhaps reflects the greater proportion of NFA cases in the total caseload.

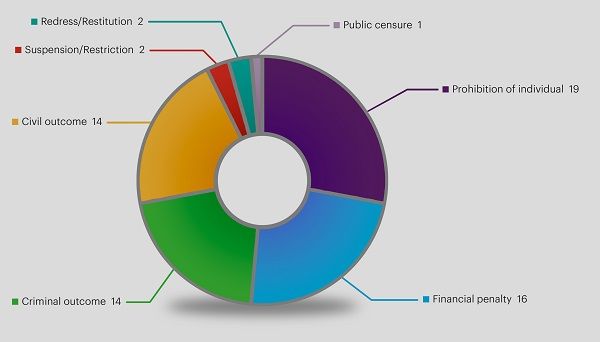

Where an investigation resulted in a public outcome in 2017/18, the breakdown of FCA sanctions was as follows:

FCA public outcomes

Other points of interest

There are a number of other points of interest in the FCA report:

- the FCA emphasises its investigations in relation to money laundering, including systems and controls to prevent it, in its sections on both retail and wholesale conduct;

- in its section on retail conduct, the FCA notes that it has increased its focus on pensions cases;

- the FCA also flags its work in primary markets, and especially the sponsor regime for premium listed companies;

- the FCA repeats its commitment to publish a consultation paper "later this year" following a review of its penalty policy. As the FCA has been promising since 2013 to review this policy, the paper will be awaited with great anticipation.

Dentons is the world's first polycentric global law firm. A top 20 firm on the Acritas 2015 Global Elite Brand Index, the Firm is committed to challenging the status quo in delivering consistent and uncompromising quality and value in new and inventive ways. Driven to provide clients a competitive edge, and connected to the communities where its clients want to do business, Dentons knows that understanding local cultures is crucial to successfully completing a deal, resolving a dispute or solving a business challenge. Now the world's largest law firm, Dentons' global team builds agile, tailored solutions to meet the local, national and global needs of private and public clients of any size in more than 125 locations serving 50-plus countries. www.dentons.com.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.