In this article, we explore the importance of integrating funding-related risks into decision-making when managing a low-risk defined benefit pension scheme.

What are funding-related risks?

There are a wide variety of estimates and practical realities, which mean there is inherent uncertainty in the size and shape of a scheme's liabilities.

These are funding-related risks, and examples include:

- Longevity risk: Scheme members live longer than expected.

- Inflation basis risk: The inflation hedge employed does not match actual increases awarded.

- Member option risk: Members' choices and option terms may vary from those assumed.

- Data risk: The data used is wrong or incomplete.

- External shock risk: Akin to a "Blackswan" event where the rules of the game are changed (think GMP equalisation, RPI to CPIH, tax treatment of equities, etc).

"Trustees should... put in place appropriate policies to

mitigate and manage all the key risks [schemes face]... The risks

broadly fall into three categories: employer covenant related,

investment related [and] funding related risks"

Source: TPR's new DB funding

code.

The above quote is one of the asks for UK defined benefit pension schemes as set out in the Pension Regulator's new Code of Practice.

But with improved funding levels, less reliance on employer contributions, and generally lower levels of investment risk being targeted, outcomes will no longer be dominated by the asset side of the equation. Instead, the liability side and funding-related risks will now need to play a more prominent role in decision-making, risk management, and thus scheme outcomes than they generally have in the past.

As such, these risks need to be integrated and managed by trustees and their advisors, and neglecting to take them into account could lead to:

- Excessive caution in investment strategies

- Managing the wrong risks1

Higher returns with lower risk

Higher returns with lower risk is the dream for many making decisions on how to invest assets — and, in the main, is not an achievable goal (without other sacrifices, or a material change in approach).

However, defined benefit pension schemes differ from those simply looking to maximise return, and minimise investment risk, as they are also exposed to funding-related risks as set out above. Critically, this means their overall risk is not solely a function of how much risk is taken in their investment portfolio.

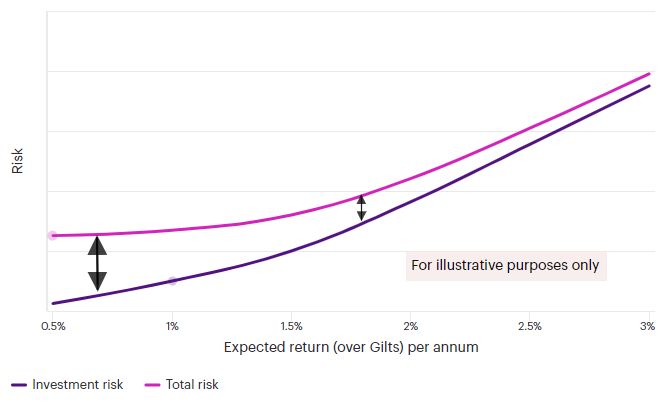

In isolation, targeting a lower investment return has a diminishing marginal impact in reducing overall risk — as funding-related risks become a bigger contributor to overall risk. This is shown in Figure 1.

Figure 1: Comparing investment risk and total risk (including funding-related risks)

At low levels of investment risk further de-risking has little or no impact on overall risk as funding-related risks represent more than 50% of the overall risk

Many of the risks faced by pension schemes cannot be reduced by targeting a lower investment return alone – for example, the risk that a new government will change the tax rules, that positive medical advancements increase life expectancy, or that deflation plays havoc with liability hedging programmes interacting with a 0% inflation floor in scheme benefit structures.

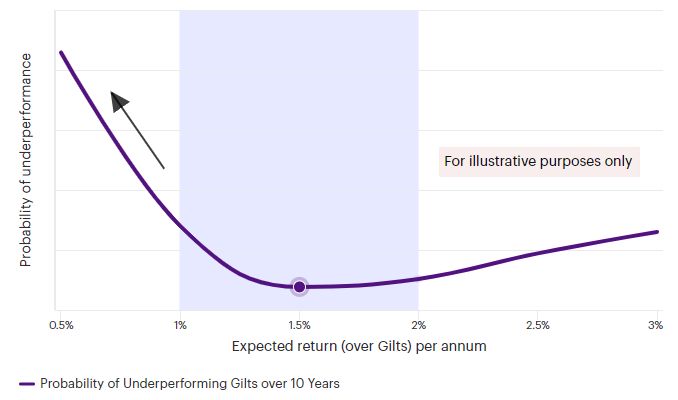

The impact of this is that, over the long term, running a very low level of investment return significantly increases the chance of a pension scheme underperforming its liabilities — as shown in Figure 2.

Figure 2: Chance of underperforming (gilts) liabilities

Managing overall risk over time requires a moderate level of return

Instead, targeting a more meaningful level of return builds a buffer to help protect against negative funding risk outcomes — and increases the chances of pensions being paid in full. Insurers learned this lesson a long time ago and bulk-annuity providers typically target returns in the Gilts+1%-to-Gilts+2% pa range, both to generate a buffer and earn a profit.

Better management of funding-related risks is key at lower return targets

Risk can be reduced further with sensible strategies for mitigating/managing these funding-related risks — further reducing the chance of underperformance.

For example: The risk of scheme members living longer can be effectively managed with longevity swaps; member options can be managed by appropriate alignment between the investment strategy and the terms set for these options; mismatches between liabilities and inflation hedging strategies can be reduced with good governance.

The importance of good measurement

Should I target a higher investment return to build a bigger buffer against funding-related risks? Should I target a higher investment return to pay for a longevity swap? Can I afford to de-risk my portfolio given recent gains?

Without an effective way of measuring risk/return it can be very difficult to answer these questions2. Some assets, such as investment grade credit can see their market values fall meaningfully in the short term but, if the bonds don't default, still provide the income and capital they were purchased to deliver.

Failing to measure risk, and investment returns, in the right way can lead to poor decision making. Building measures that work as part of a wider actuarial framework can improve decision making.

Conclusion

Running a well-funded pension scheme can be very 'low risk' but, somewhat counterintuitively, to achieve this it should avoid being very 'low return'. However, many pension schemes, including those looking to run-on, will have reduced return in a meaningful way over recent years. That means the overall level of returns targeted may be too low to adequately achieve their aims while supporting the effective management of funding-related risks. This presents the opportunity for pension schemes to simultaneously 're-return' and 'derisk'. However, to do this successfully needs true integrated risk management and partnership with advisors who have the experience, and know how, to effectively bring Investment and funding-related risks together.

Footnotes

1 This note Beware of DB pension risk blind spots – What gets measured gets managed delves deeper into the importance of measuring risks accurately to manage them appropriately

2 This note Beware of DB pension risk blind spots – What gets measured gets managed delves deeper into the importance of measuring risks accurately to manage them appropriately

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.