- with readers working within the Basic Industries industries

Major consumer products companies (CPGs) face tough terrain. The first half of 2024 saw several formerly thriving companies report disappointing results, and most experience a drop in sales volumes – all while facing rising costs and relentless pricing pressures that squeeze profit margins. In this article, we focus on two major challenges CPGs are grappling with, and explore the strategies the more resilient companies are employing to weather the storm.

Two key pressures facing CPGs:

1. A volatile operating environment

The economic landscape for CPGs is marked by volatile post-pandemic conditions and slow volume recovery, with the cost-of-living crisis shattering consumer confidence. Skyrocketing food prices, which from 2020 to 2023 comprised 58% of the past decade's total food inflation in the U.S., have further squeezed household budgets, leading to a drop in grocery volumes.

Despite CPGs hiking prices to counteract cost increases and volume losses, budget-stretched consumers have reached their limits. CPGs now need to double down on new strategies to boost volumes.

2. The rise of the private label

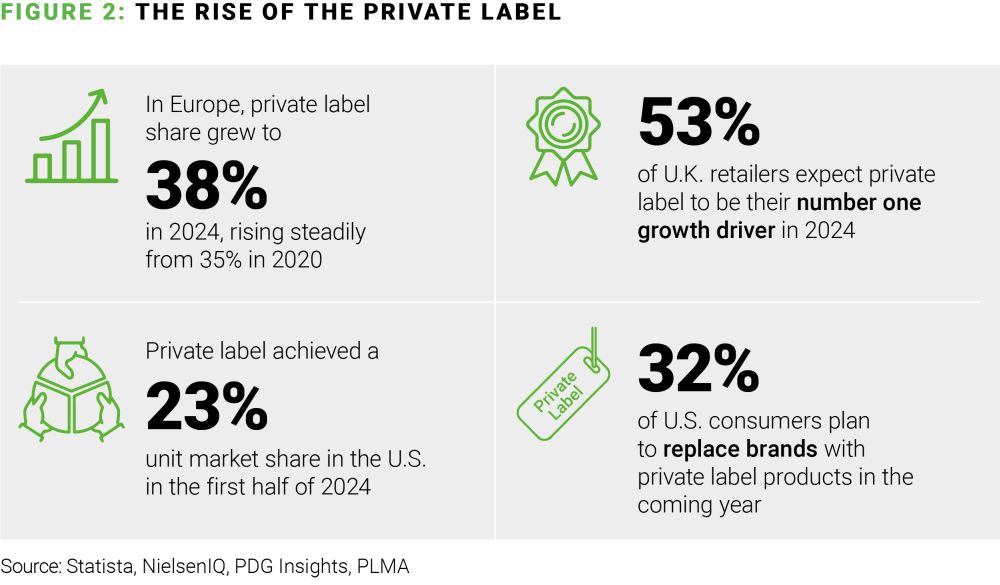

Compounding the struggle for CPGs is the increasing popularity of private labels. Price-sensitive consumers are not only consuming less overall, but are shifting their loyalty to value brands and increasingly to premium supermarket own-brand goods – a trend magnified by retailers increasing pricing pressure on CPGs.

Private label growth shows no signs of deceleration, with 90% of U.S. shoppers stating they would continue buying private label brands even if inflation becomes less of a concern. Retail media's rise acts as a further boost, as in-store promotions enable retailers to advertise their own brands.

In Europe, private label share has risen steadily from 35% in 2020 to 38% in 2024, with frozen and chilled foods holding the highest share. The U.K. reports the highest proportion of private label share in grocery retail – a significant 52% – with well-established brands across both the value and premium sectors, including Sainsbury's Taste the Difference and Tesco Finest.

Private label penetration in the U.S. has historically lagged Europe, but the gap is closing, with most of the U.S. market share shift of the last three years driven by more spending on private brands. We previously shared how the continuation of that transition over the next five years – from 18% market share to an anticipated 30% – represents a $100 billion opportunity for retailers, and a corresponding $100 billion threat to CPG toplines.

CPGs must prioritize productivity and recover lost volumes to remain competitive

We believe CPGs will struggle not only to return to pandemic growth levels – when restaurant closures resulted in overconsumption – but to pre-pandemic levels. Facing these growth challenges, and with political uncertainty across the U.S. and Europe, CPGs need to sharpen their strategies to recover ground in 2025.

What can we learn from those doing well?

1. Build a continuous productivity mindset

Unilever, Danone, and Tyson Foods have all embraced a continuous productivity mindset across their value chain.

- Unilever reported a solid 4.1% underlying sales growth in the first half of 2024, with volumes up 2.6% and a 17.1% rise in underlying operating profit, thanks to a 250bps increase in operating margin to 19.6%. The company's Growth Action Plan is all about efficiency and a laser focus on its 30 Power Brands, which drive 75% of turnover. With a strong commitment to expanding gross margin, Unilever is pouring more investment into innovation, and eyeing €800 million in cost savings over the next three years through its Productivity Program and ice cream business separation.

- Danone is also making strides, boosting its operating margin by 45 basis points to 12.69% in the first half of 2024. This improvement is driven by a robust 257bps increase in margin from operations, the final benefits of 2023 carry-over pricing, and continued record productivity.

- Tyson Foods is sharpening its focus on operational efficiency, particularly in its Chicken segment, achieving its best adjusted operating income in eight years by enhancing supply chain management, reduced working capital, and enhanced order fill rates. The company has closed nine processing plants over the past year, and downsized operations at several factories.

These companies are clearly prioritizing efficiency and innovation to drive growth and profitability.

Imperatives:

CPGs should be targeting a minimum of 5% gross productivity

annually across the whole organization.In our experience, CPGs must

step up five key capabilities to achieve this:

- A rigorous, continuous and communicated pursuit of productivity across all functions, starting with zero-based budgets and productivity targets.

- A "no stone unturned" approach. Re-examine traditional productivity levers including the organizational operating model, working capital, order fulfilment rates, procurement effectiveness, lean processes, supply chain and margin management, as well as more transformational opportunities, e.g. plant closures and M&A.

- A committed initiative plan, supported by active programme management to establish pace and communications, and to pragmatically predict and unblock obstacles to progress, in tandem with wider business strategic plans.

- Rapid adoption of analytics to identify trends in large datasets (for example consumer behaviours), enabling adjustments to marketing, production, and distribution strategies, and surfacing unseen root causes as well as cost and inefficiency drivers.

- Transformation as a continuous mindset, with teams empowered to think like "business owners" and embrace continuous improvement, rather than seeing transformation as a one-off "get it done" program or, even worse, "not relevant to me".

2. Offset volumes lost to private labels

Mondelez, Kellanova, and Procter & Gamble (P&G) are demonstrating how to reclaim volumes lost to private labels.

- Mondelez is notably expanding its core brands like Oreo, Cadbury and Ritz, by introducing new product variations, targeted promotions, and expanded distribution to cater to diverse consumer preferences, including new pack sizes priced at $3-4 in North America. Limited-edition offerings of co-branded Oreo cookies, including Star Wars and Mario collaborations, are also boosting sales.

- Kellanova has responded to private label growth by utilizing data-driven, personalized marketing to target consumers more effectively, including using cookies and tracking pixels to personalize Kellogg's email pop-ups based on consumers' browsing behavior.

- P&G has maintained pressure on product innovation and premium positioning to compete with private labels and defend market share. P&G's steady stream of new, high-quality offerings differentiates products from lower-cost alternatives; its new Oral-B iO portfolio contributed to 70% of category growth in 2023, with 30% of iO users trading up from a manual brush.

Imperatives:

To recover volumes and reclaim unit share lost to private labels,

CPGs must:

- Take an unvarnished look at true brand strength. Relentlessly shed brands that consumers don't see as differentiated; use willingness to pay as your guide.

- Optimize price-pack architecture by consumer segment and channel. Use a multistage process that includes category diagnostics, consumer insights, ideation and testing to determine which pricing and pack configurations will yield the best results.

- Exploit brand value. Leverage power brands to create new products that align with shifting consumer preferences, such as health-focused, premium, unique flavors, and rotating or seasonal items.

- Pressure-test the innovation process to drive truly differentiated new product offerings, and put mechanisms in place to identify and kill losing propositions early in the process, versus just prior to launch. Focus innovation on convenience, functionality, and either better-for-you or indulgence.

- Invest in AI-enabled trade promotion optimization to secure advantage. Most CPGs have returned to (or are exceeding) pre-pandemic promotional spend levels. Those that integrate AI into their trade promotion optimization approach have the opportunity to drive more sales with less trade spend.

- Manage the separation of exit brands tightly, to both de-risk RemainCo operations and stranded costs, and build the most compelling value creation story to potential buyers – through reducing liabilities, limiting entanglements, rapid cost-out, and empowering a strong management team to drive further value creation.

The bottom line

To thrive in an increasingly challenging environment, CPGs must develop a sharper productivity mindset, withstand the pressure from private labels, and win over value-conscious consumers. Leveraging economies of scale and skill, optimizing product portfolios and exploiting brand value will be the route to sustainable – and profitable – growth.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.