Keywords: EMIR, OTC derivatives, derivative contract

On 19 December 2012 the Commission adopted the majority of the subordinate legislation necessary to implement Regulation (EU) No 648/2012 of the European Parliament and of the Council of 4 July 2012 on OTC derivatives, central counterparties and trade repositories ("EMIR"). The majority of that legislation is likely to become law in or around March 20131 and some risk mitigation requirements will apply at that point. It appears that, although the first clearing obligation may not apply until the summer of 2014, the first reporting obligation may apply from 1 July 2013 and further risk mitigation obligations are likely to apply in or around September 2013. In addition, firms may need to make a number of notifications and applications for exemptions to the Financial Services Authority / Financial Conduct Authority in early 2013. At present, therefore, firms ought to be assessing whether they will be ready for EMIR to come into force. The quick start guide at page 4 sets out some of the things that firms should start to consider.

What does EMIR do?

1. EMIR:

(a) imposes clearing obligations on eligible derivatives (Article 4);

(b) imposes reporting obligations on all OTC derivatives (Article 9); and

(c) requires the implementation of new risk management standards, including operational processes and margining, for all OTC derivatives that are not cleared by a central clearing party ("CCP") (Article 11).

The Markets in Financial Instruments Regulation ("MiFIR") which is currently being negotiated will contain provisions regarding the trading of derivatives but indications are that it may not be adopted until Q4 2013. It should contain requirements that derivatives subject to the trading obligation can only be traded on regulated markets, multilateral trading facilities ("MTFs"), organised trading facilities ("OTFs") or approved third country venues.

2. EMIR contains the framework of the new regime but many of its obligations are dependent upon further detail being set out in subordinate legislation. The Commission has now adopted all the required subordinate legislation save that:

(a) related to margin and capital for non-centrally cleared trades (Article 11(3) and 11(4) EMIR); and

(b) specifying the contracts between third country counterparties that have a direct, substantial and foreseeable effect within the EU and the cases where it is necessary or appropriate to prevent the evasion of the provisions of EMIR (Article 4(4) and Article 11(14)).

In these respects further international coordination is necessary before EU rules can be developed.

Does it apply to me? (Scope)

3. EMIR applies to any entity established in the EU that is a legal counterparty to a derivative contract2, including interest rate, foreign exchange, equity, credit and commodity derivatives. It applies to EU firms even when trading with non-EU firms and has extraterritorial effect in some circumstances.

4. EMIR identifies two main categories of counterparty to a derivatives contract:

(a) 'financial counterparties', which includes financial institutions such as banks, insurers, MiFID investment firms, UCITS funds and, where appropriate, their management companies, occupational pension schemes and alternative investment funds managed by a manager authorised or registered under AIFMD 3; and

(b) 'non-financial counterparties', which covers any counterparty that is not classified as a financial counterparty, including entities not involved in financial services4.

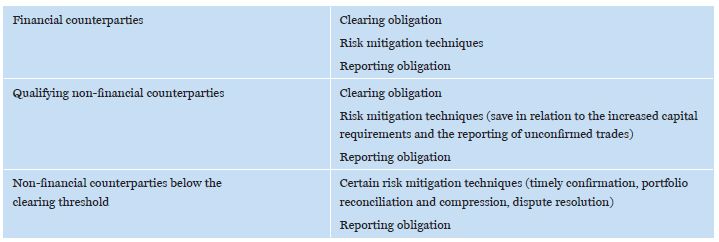

5. The provisions in EMIR apply differently to non-financial counterparties whose positions in OTC derivative contracts exceed a clearing threshold ("qualifying non-financial counterparties") than to those whose positions do not. In general, qualifying non-financial counterparties are treated in the same way as financial counterparties. The provisions applicable to the different types of counterparty are as follows:

6. It is the responsibility of the non-financial counterparty to determine whether or not its positions exceed the clearing threshold and to notify the European Securities and Markets Authority ("ESMA") and the relevant national regulator if this is the case. In essence, hedging transactions are excluded from non-financial counterparties' calculation of their positions in OTC derivative contracts. The calculation of positions must include all OTC derivative contracts entered into by the non-financial counterparty itself or other non-financial counterparties within its group which are not objectively measurable as reducing risks directly related to the commercial activity or treasury financing activity of the counterparty or of its group5. The thresholds differ according to the type of derivative contract6 and are determined by taking into account the systemic relevance of the sum of the net positions and exposures per counterparty and per class of OTC derivative: they, and the criteria for establishing which contracts can be deemed to be for hedging purposes, are set out in the subordinate legislation adopted by the Commission on 19 December 20127.

EXEMPTIONS

7. There is not a complete exemption from EMIR but there are exemptions available from some of its requirements:

(a) intra-group transactions may qualify for exemptions from the clearing obligation and bilateral collateral requirements when certain conditions are met (Article 11(7) - (12));

(b) there is a three-year exemption from the clearing obligation available to certain transactions of pension schemes (Article 89(1)).

Pension schemes may, however, question the practical value of the exemption as they are not exempt from the risk mitigation requirements that are applied in respect of non-cleared trades.

8. In order to take advantage of these exemptions, counterparties must apply to their national regulators with evidence that they meet the relevant criteria. Information about the process for making notifications and the information that will need to be provided to the FSA will be available on the FSA website in early 2013.

EXTRATERRITORIAL EFFECT

9. The clearing obligation applies to contracts entered into by a financial counterparty or a qualifying non-financial counterparty in the EU and a third country entity provided that the third country entity would be subject to the clearing obligation if it were established in the EU8.

10. Both the clearing obligation and the risk mitigation requirements apply to contracts between third country entities that would be subject to the clearing obligation if they were established in the EU, provided that the contract has a "direct, substantial and foreseeable effect within the" EU "or where such an obligation is necessary or appropriate to prevent the evasion of any provisions of" EMIR9. In other words, the intention appears to be that entities engaged in OTC derivatives trading activities outside the EU should establish whether or not they would be a financial counterparty or qualifying non-financial counterparty if they were established in the EU. We await draft subordinate legislation on the contracts that have such a direct, substantial and foreseeable effect and the cases where it is necessary or appropriate to prevent evasion of EMIR but there has not been any further detail on how entities outside the EU should establish what class of counterparty they would be were they incorporated in the EU10.

11. The quick start guide set out on the following page is a non-exhaustive list of some of the things firms should start to consider. The issues included in this list are explained in more detail in the body of this note.

A quick start guide: What do I need to do and by when?

1. Are you are a financial counterparty ("FC") or a non-financial counterparty ("NFC")? If you are a NFC, are you a qualifying non-financial counterparty ("QNFC") or do your positions in OTC derivative contracts not exceed the clearing thresholds? If you are a QNFC, notify ESMA and your national regulator. (See paras 5 - 6.)

2. Will you be applying to your national regulator for exemption from any of the requirements of EMIR? (See paras 7 - 8.)

By approximately March 2013:

3. Which timely trade confirmation requirements apply to your contracts? Put in place procedures for the confirmation. (See para 14.)

4. You may delegate your obligations relating to trade confirmations but you will remain responsible for compliance*. Thus establish systems and procedures to provide the necessary confirmations or engage third party service providers to do this (and other tasks such as portfolio reconciliation) on your behalf.

5. If you are a FC, you need to set up procedures so that you have the ability to report unconfirmed trades that have been outstanding for more than five business days to your relevant national regulator on a monthly basis. (See para 15.)

6. FCs and QNFCs need to prepare, if you are not already doing so, to mark-to-market on a daily basis the value of outstanding OTC derivative contracts in accordance with the subordinate legislation. (See para 16.)

7. As regards reporting, do you have a relationship with a trade repository? If not, you need to consider establishing one before the first reporting obligation applies (possibly on 1 July 2013). If you plan to delegate your reporting obligation, you will need to ensure that your counterparties are willing to accept that responsibility or delegate that task to a third party. (See paras 19 - 22.)

By approximately September 2013:

8. Agree procedures and processes with your counterparties in relation to portfolio reconciliation and dispute resolution. (See para 17.)

9. Carry out portfolio reconciliations with your counterparties or delegate the task to a third party. (See para 17.)

10. If you have more than 500 outstanding bilateral OTC derivative contracts, put in place the required procedures on portfolio compression. (See para 17.)

11. Are you a member of clearing houses for all the cleared markets in which you are active? If not, can you become a clearing member? If not, you will need to enter into client clearing or indirect clearing arrangements with a broker before the first clearing obligation applies (possibly in summer 2014). (See paras 23 - 24.)

* See paragraph 88 of ESMA's "Final Report, Draft technical standards under Regulation (EU) No 648/2012 of the European Parliament and of the Council of 4 July 2012 on OTC derivatives, central counterparties and trade repositories" dated 27 September 2012 (ESMA/2012/600).

Risk mitigation requirements, including exchange of collateral

12. EMIR introduces new risk mitigation requirements for all uncleared OTC derivative trades, including timely confirmation of the terms of the contract (where possible by electronic means), portfolio reconciliation, portfolio compression and dispute resolution procedures. There are additional requirements for counterparties subject to the clearing obligation (financial counterparties and qualifying non-financial counterparties) which involve a daily valuation of outstanding contracts and having in place risk-management procedures that involve "the timely, accurate and appropriate segregated exchange of collateral"11. Financial counterparties will be subject to increased capital requirements if such collateral is not exchanged.

13. The risk mitigation requirements are not drafted so as to be dependent upon the coming into force of a clearing obligation. They are drafted so as to apply to OTC derivatives not cleared by a CCP, regardless of whether any CCP has been authorised to clear under the EMIR regime. The procedures and arrangements for timely confirmation, portfolio reconciliation, portfolio compression, dispute resolution and contract valuation, as well as the dates from which they will apply12, are set out the subordinate legislation adopted by the Commission on 19 December 201213. The timely confirmation and daily valuation requirements are likely to apply from around March 201314.

14. Until 31 August 2014, the requirements for timely confirmation differ depending on:

- whether the relevant contract is a credit default swap or interest rate swap, or another type of derivative contract; and

- whether the contract is concluded with a non-financial counterparty below the clearing threshold.

After 31 August 2014:

- a contract between financial counterparties and qualifying non-financial counterparties must be confirmed by the end of the business day following its date of execution;

- a contract with a non-financial counterparty below the clearing threshold must be confirmed by the end of the second business day following its date of execution.

15. In addition, there is a requirement for financial counterparties to have in place the procedures to report to their relevant national regulator on a monthly basis the number of unconfirmed trades that have been outstanding for more than five business days.

16. Financial counterparties and qualifying non-financial counterparties must mark-to-market on a daily basis the value of outstanding contracts. They may mark-to-model when market conditions prevent marking-to-market. Market conditions that prevent marking-to-market and the criteria for using a mark-to-model are set out in the subordinate legislation15.

17. The requirements relating to portfolio reconciliation, portfolio compression and dispute resolution16 are likely to apply in or around September 201317. The frequency of portfolio reconciliation depends on the number of outstanding contracts which are not centrally cleared and whether the counterparty is a financial counterparty, a qualifying non- financial counterparty or a non-financial counterparty below the clearing threshold. All counterparties with 500 or more outstanding contracts must have in place procedures so that they can determine regularly (at least twice a year) whether to conduct a portfolio compression exercise in order to reduce their counterparty credit risk. They must also be able to justify to their national regulator why they have not carried out a portfolio compression exercise.

18. The level and type of collateral to be exchanged and the segregation arrangements will be determined in subordinate legislation to be drafted jointly by the three European Supervisory Authorities and adopted by the Commission. The draft has been delayed to ensure consistency with the global development of international standards by the Working Group on Margining Requirements of the Basel Committee on Banking Supervision and the International Organisation of Securities Commissions. It is not yet clear when these standards will be developed and thus when the exchange of collateral will be mandated but it appears unlikely that this requirement will apply until after 2014.

The reporting obligation

19. The reporting obligation applies to all derivative contracts not just OTC contracts. Trade repositories need to be registered - or recognised if in a third country - by ESMA under EMIR before the reporting obligation can take effect. The dates for the start of the reporting obligations are set out in the subordinate legislation adopted by the Commission on 19 December 201218. They are as follows:

- 1 July 2013 for credit and interest rate derivatives if a trade repository is registered for a particular derivative class by 1 April 2013 and 90 days after registration if there is no registered trade repository by 1 April 2013; and

- 1 January 2014 for all other derivatives if a trade repository is registered for a particular derivative class by 1 October 2013 and 90 days after registration if there is no registered trade repository by 1 October 201319.

20. EMIR backdates the reporting obligation to derivative contracts which were entered into before 16 August 2012 and remained outstanding at that date and to derivative contracts entered into on or after 16 August 2012.

21. Once the reporting obligation has come into effect, both counterparties must report the details of every derivative contract they have concluded, modified or terminated within one working day of the conclusion, modification or termination. It is possible to delegate the reporting obligation or to make one report on behalf of both counterparties but each counterparty remains legally responsible for the report20.

22. The subordinate legislation adopted by the Commission on 19 December 2012 sets out the data that must be reported to trade repositories. Data to be reported includes the parties to the contract (or the beneficiary), the type of contract, its underlying maturity, notional value, price and the date of settlement, as well as any posted collateral and mark-to-market or mark-to-model valuations in some circumstances.

The clearing obligation

23. In essence, EMIR requires that OTC derivatives contracts which ESMA has determined are subject to a mandatory clearing obligation must be cleared by a CCP if the contract is between any combination of financial counterparties and non-financial counterparties whose rolling average position over 30 working days exceeds the thresholds. The clearing obligation does not apply to non-financial counterparties whose rolling average position over 30 working days does not exceed the thresholds.

24. The clearing obligation will not take effect until CCPs have been authorised - or recognised if in a third country - to clear under the new EMIR regime and the Commission has adopted a recommendation from ESMA regarding the class of OTC derivatives contracts which should be subject to the mandatory clearing obligation, the dates from which the obligation takes effect and the minimum remaining maturity of the OTC derivatives contracts which are subject to the obligation. Verena Ross, the Executive Director of ESMA, said in a speech on 4 December 2012 that, according to ESMA's projections, the first clearing obligation should apply from the summer of 201421.

Footnotes

1. The European Parliament and Council have a period of a month to exercise a right of scrutiny over certain pieces of the legislation ie until 20 January 2013. This period can be extended by another month and the Parliament, although not yet the Council, has requested such an extension ie until 20 February 2013. The legislation will be published in the Official Journal of the European Union immediately after the receipt of a notice of 'non-objection' from the European Parliament and Council and will mainly enter into force on the twentieth day thereafter, although some of the risk mitigation provisions shall apply 6 months thereafter. It on this basis that we estimate the dates of application of the risk mitigation requirements, although the dates may be brought forward if the Parliament does not use all of its extended period.

2 Defined as a financial instrument set out in points (4) to (10) of Section C of Annex I to Directive 2004/39 (MiFID).

3 See Article 2(8) EMIR.

4 See Article 2(9) EMIR.

5 See Article 10(1) - (3) EMIR.

6 A distinction is drawn between credit and equity derivatives on the one hand and interest rate, foreign exchange, commodity derivatives and all other derivatives on the other.

7 See Articles 10 and 11 of the Commission Delegated Regulation with regard to regulatory technical standards on indirect clearing arrangements, the clearing obligation, the public register, access to a trading venue, non-financial counterparties, risk mitigation techniques for OTC derivative contracts not cleared by a CCP.

8 See Article 4(1)(a)(iv) EMIR.

9 See Articles 4(1)(a)(v) and 11(12) EMIR. This provision mirrors similar language in Article 722(d) of the US Dodd-Frank Wall Street Reform and Consumer Protection Act 2010. Hence the need for international coordination on the cross-border effect of the regulations implementing the G20 agreement.

10 It is unlikely that national regulators will provide guidance on EU law.

11 Op. cit. at fn. 7 Article 11(3).

12 Op. cit. at fn. 7, Article 21.

13 Op. cit. at fn. 7.

14 They will apply from the day that the relevant subordinate legislation enters into force, that being the twentieth day after the regulation is published in the Official Journal of the EU.

15 Op. cit. at fn. 7, Articles 16 - 17.

16 Op. cit. at fn. 7, Articles 13 - 15.

17 They will apply six months after the entry into force of the subordinate legislation.

18 See Article 5 of Commission Implementing Regulation with regard to the format and frequency of trade reports to trade repositories.

19 On 19 December 2012 the Commission adopted subordinate legislation which set out the data that must be reported to trade repositories, the details required in an application for registration as a trade repository and the data to be published by trade repositories. A trade repository currently authorised or registered in the EU to collect and maintain records of derivatives must apply for authorisation or recognition within 6 months of the date of entry into force of the subordinate legislation. The clock is thus beginning to tick on the time at which the reporting obligation will take effect.

20 See Article 9(1) EMIR.

21 See "ESMA's role in markets reform", a speech by Verena Ross at the ICI Global Trading and Market Structure Conference. The speech is available on the ESMA website.

Previously published on 21 January 2013.

Visit us at mayerbrown.com

Mayer Brown is a global legal services provider comprising legal practices that are separate entities (the "Mayer Brown Practices"). The Mayer Brown Practices are: Mayer Brown LLP and Mayer Brown Europe – Brussels LLP, both limited liability partnerships established in Illinois USA; Mayer Brown International LLP, a limited liability partnership incorporated in England and Wales (authorized and regulated by the Solicitors Regulation Authority and registered in England and Wales number OC 303359); Mayer Brown, a SELAS established in France; Mayer Brown JSM, a Hong Kong partnership and its associated entities in Asia; and Tauil & Chequer Advogados, a Brazilian law partnership with which Mayer Brown is associated. "Mayer Brown" and the Mayer Brown logo are the trademarks of the Mayer Brown Practices in their respective jurisdictions.

© Copyright 2013. The Mayer Brown Practices. All rights reserved.

This Mayer Brown article provides information and comments on legal issues and developments of interest. The foregoing is not a comprehensive treatment of the subject matter covered and is not intended to provide legal advice. Readers should seek specific legal advice before taking any action with respect to the matters discussed herein.