The Upcoming VBER Series

As the EU Commission's review of the Vertical Block Exemption Regulation comes to an end, we will share a series of alerts dedicated to a specific area of change or business sector impacted by the upcoming rules, focusing on potential practical consequences for companies.

Update on Dual Distribution

The main legal framework in the European Union governing distribution agreements (Vertical Block Exemption Regulation "VBER") expires end of May 2022. The European Commission ("EC") has published the revised draft VBER as well as a revised draft of its accompanying guidelines (Guidelines on Vertical Restraints – "Guidelines") in July 2021. The EC has suggested significant changes in the revised version of the VBER and its Guidelines. Some of the changes can offer more flexibility to suppliers/brand owners and retailers, but in some instances may lead to stricter rules. The EC grants a transition period to any agreements which are in place before 01 June 2022 (when the new rules enter into force) as such agreements need to be compliant with the new rules by end of May 2023. One of the topics of debate relates to proposed changes with respect to information exchange in the context of so-called "dual distribution".

One of the topics of debate relates to proposed changes with respect to information exchange in the context of so-called "dual distribution".

What is the issue?

Agreements that fall into the safe harbor of the VBER are legally permissible, no further assessment is required. The VBER applies to vertical relationships only. This means, that the VBER will only apply where the parties to the agreement are active on separate levels of manufacture or trade (for instance to arrangements between a manufacturer of branded goods and a retailer of such goods). Where the parties are each active on the manufacture and the wholesale or retail level for competing products, the VBER cannot apply. Such relationships are assessed under the horizontal guidelines. There are a few nuances to when a party is considered a manufacturer:

- A wholesaler or retailer that provides specifications to a manufacturer to produce goods for sale under the wholesaler's or retailer's brand name is not considered a manufacturer of such own-brand goods and consequently not a competitor of the manufacturer. In such a scenario, where the products are manufactured by a third party, the wholesaler or retailer subcontracting the production of the goods, will be considered active on the downstream level only, and not on the manufacturing level. Therefore, the supply relationship with such wholesalers or retailers that sell such third party manufactured own branded goods falls within the safe harbor of the VBER

- This is different where the own-branded goods are manufactured in-house (and not by a third party). Wholesalers and retailers that manufacture their own-branded goods in-house are considered as manufacturers, therefore, they compete with any suppliers that manufacture goods and those supply relationships do not fall within the VBER.

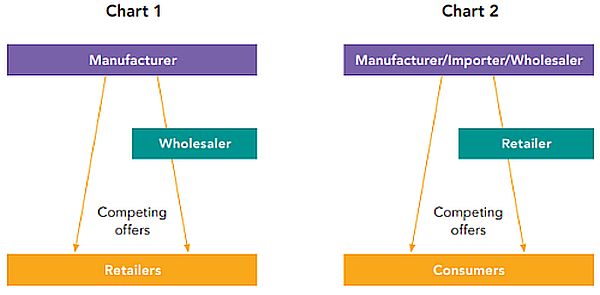

Further, there is the scenario of "dual distribution". Dual distribution relates to distribution arrangements where the manufacturer (or importer or wholesaler) sells products to the next level of trade, i.e. to a wholesaler or retailer, as well as to the wholesaler's or retailer's customers (i.e. retailers or end-consumers respectively). While the manufacturer (or importer or wholesaler) and the wholesaler/retailer do not compete on the upstream manufacture (or wholesale) level, they are rivals on the downstream level (see charts 1 and 2). The issue at hand is whether and to which extent the VBER applies to such scenarios given the combination of vertical and horizontal elements.

What are the risks?

Not only due to the effects of the pandemic, direct to consumer ("DTC") sales have increased significantly over the last years, and it is expected that this trend will further continue. While it makes a lot of sense for manufacturers to push their own sales channels, it does create challenges from an antitrust perspective.

Given the competing activities on the downstream level, there is the risk that manufacturers/wholesalers use the information that they can collect on their wholesalers/retailers as a competitive advantage in the market. Further, the supplier of products could use its negotiation power to get more information than necessary from its retailers in order to use the information for strategic decisions of their DTC channel. This could lead to more transparency and therefore less competition in the downstream market, for instance between the DTC stores and independent retailers. At the same time, some information is absolutely necessary in order to enable the supplier to plan for its production and to take informed decisions on how products could be best placed in the market.

Existing VBER

So far, the VBER and its Guidelines contained very limited guidance on dual distribution.

Under the current regime, dual distribution is fully exempt under the VBER, as long as the supplier and the buyer/retailer's individual market shares do not exceed 30% on the relevant supply/demand market. Dual distribution arrangements are then fully covered by the safe harbor of the VBER.

The New VBER

This will change going forward. In the draft VBER published in summer 2021, the EC proposed that a much lower market share threshold should apply to dual distribution arrangements. The EC suggested to set the threshold for dual distribution agreements at a joint market share of the manufacturer and the retailer at 10% of the downstream retail market. It is still being debated whether these new market share thresholds will make it into the final version of the new VBER. If market shares are below this threshold, any arrangements continue to be block exempted. If the individual market shares do not exceed 30% (i.e. they are within the safe harbor) all dealings apart from information exchange are exempted.

Even if the market share thresholds are exceeded, agreements are not per se illegal. The legality will depend on the likely restrictive effects of such agreements which have to be assessed on a case by case basis.

Practical consequences & recommendations

There has been a lot of criticism from all stakeholders in relation to the new rules on dual distribution. In particular, guidance on permissible forms of information exchange has been requested as part of the new Guidelines, given that the safe harbor for information exchange has been reduced significantly.

The EC reacted to these demands and published new proposed guidance on information exchange in the context of dual distribution in February 2022. They asked for interested parties to comment within a very short time frame of two weeks, given that the final new VBER and its Guidelines are due in a couple of months only. Unfortunately, it seems that the suggested guidance may not be sufficient to create the legal safety that was at stake of most of the demands.

While there has been very limited cases where information exchange in the context of dual distribution has been assessed by national authorities or courts (the main case in the EU being: Danish Competition Council, Hugo Boss, 24 June 2020; side remarks of the German FCO in Dornbracht, 13 December 2011) so far stakeholders had to rely on general guidance on information exchange provided in the horizontal guidelines in order to develop safeguards tackling dual distribution risks.

The EC proposal adds little to the already known guidance. We summarize below the most relevant and potentially controversial types of information which based on the EC proposal can be exchanged, by the supplier or the buyer, irrespective of the frequency of the communication and irrespective of whether the information relates to past, present or future conduct:

- Information relating to the logistics of the supply such on the production, inventory, stocks, sales volumes and returns, all of this information can relate to the future;

- Aggregated information relating to customer purchases, customer preferences and customer feedback, aggregated meaning that one should not be able to identify specific customers, but the information should relate to a number of customers without showing the individual data;

- Information relating to the supplier's recommended resale prices or maximum resale prices and information relating to the prices at which the buyer resells the goods or services, provided that such information exchange is not used to restrict the buyer's ability to determine its sale price, interestingly there is no indication that this information can be communicated only once or a few times, but the EC does state that the supplier or buyer must not disclose future prices at which they resell goods on the retail market;

- Information relating to the marketing of the contract goods, including as information on promotional campaigns for the contract goods, there is no limitation of this information to the buyer's promotional campaigns;

- Performance-related information, which may include information on competing buyer as long as specific/individual competitor data cannot be identified;

- Information relating to the volume or value of the buyer's sales of the contract goods or services relative to the buyer's sales of competing goods or services.

Further, the EC suggests as a possible precaution for companies that exceed the safe harbor of the VBER to use technical or administrative measures, such as firewalls, to ensure, for example, that information communicated by the buyer is accessible only to the personnel responsible for the supplier's upstream activities and not to the personnel responsible for the supplier's downstream direct sales activity. Given the commercial reality of decision making within a company which will mean that at senior level a holistic view of the market conditions is required to make fully informed decisions as well as the fact that most manufacturers' teams are too small to have fully separate teams for the DTC and the wholesale business, the suggestion to implement firewalls may not be entirely helpful without further guidance.

All in all, given that rules are expected to be stricter in future and may be applied with diverging scrutiny by national competition authorities, it will continue to be crucial to have specific and clear do's and don'ts in place that can be easily implemented by the sales teams without obstructing their efficient use of market data.

Originally published 3, March 2022

Visit us at mayerbrown.com

Mayer Brown is a global legal services provider comprising legal practices that are separate entities (the "Mayer Brown Practices"). The Mayer Brown Practices are: Mayer Brown LLP and Mayer Brown Europe - Brussels LLP, both limited liability partnerships established in Illinois USA; Mayer Brown International LLP, a limited liability partnership incorporated in England and Wales (authorized and regulated by the Solicitors Regulation Authority and registered in England and Wales number OC 303359); Mayer Brown, a SELAS established in France; Mayer Brown JSM, a Hong Kong partnership and its associated entities in Asia; and Tauil & Chequer Advogados, a Brazilian law partnership with which Mayer Brown is associated. "Mayer Brown" and the Mayer Brown logo are the trademarks of the Mayer Brown Practices in their respective jurisdictions.

© Copyright 2021. The Mayer Brown Practices. All rights reserved.

This Mayer Brown article provides information and comments on legal issues and developments of interest. The foregoing is not a comprehensive treatment of the subject matter covered and is not intended to provide legal advice. Readers should seek specific legal advice before taking any action with respect to the matters discussed herein.