We know that the Turkish Competition Authority ("TCA")is not very keen on behavioural remedies. There are several reasons for this, but an important one is the cost and workload involved in monitoring the implementation of behavioural remedies. However, a monitoring trustee selected by the merging parties and appointed with the approval of the Board can carry out monitoring and supervision activities on behalf of the TCA. It would be beneficial for the parties to include the appointment of a monitoring trustee in the package when designing their behavioural commitments.

1. Is it getting harder to get acquisitions approved?

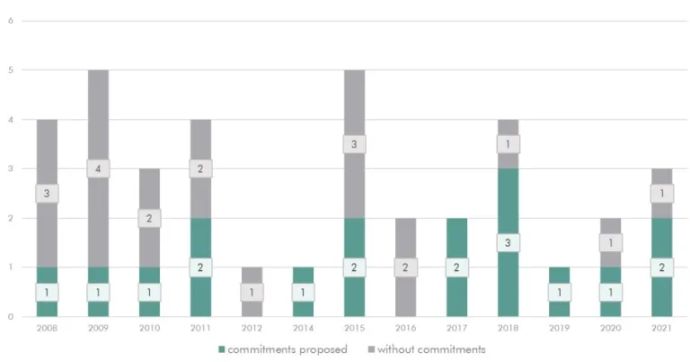

In the seven years between 2015 and 2022, 16 M&A

transactions were subject to Phase II review in Turkey. Three of

these deals were not approved. Of the Phase II reviews, four were

cleared based on behavioural remedies, and three were cleared based

on commitments containing both structural and behavioural remedies.

In other words, the rate of a Phase II review leading to a

prohibition in the period 2015-2022 was 18.75%. It can therefore be

said that the tendency for parties to submit a commitment package

to obtain authorisation as soon as possible for transactions under

Phase II review has increased, especially since 2014 (Figure

1).

Figure 1: Phase II cases submitted with commitments

2. Do behavioural commitments make it easier to get approval?

a) What does the Guideline say?

In its Guidelines on Remedies Acceptable by the Competition

Authority in Merger/Acquisition Transactions

("Guidelines"), the TCA defines structural remedies as

"the divestiture of a specific business unit" and

behavioural remedies as "the regulation of the parties'

future market behaviour" and states that it prefers to

consider the parties' commitments relating to structural

remedies in a merger transaction1. The reasons for

preferring structural remedies to behavioural remedies are that

structural remedies produce the expected results in the short term,

are sustainable and do not require monitoring once implemented. Not

content with this, the Guidelines also list the negative

characteristics of behavioural remedies and justify the attitude

that they can only be accepted under certain conditions and in

exceptional cases. The negative features of behavioural remedies

are listed as follows

- The difficulty of monitoring the behaviour of the undertaking,

- the possibility to act contrary to the spirit of the settlement in a way that does not violate the written commitments; and

- the prevention of behaviour that could actually be pro-competitive2.

The TCA has stated that it would like to see commitments that include behavioural remedies, such as non-discriminatory access to key infrastructure and raw materials3, and that the acceptance of such commitments is subject to certain conditions:

- they are capable of achieving a similar level of effectiveness in addressing competition concerns as structural remedies,

- the absence of an equally effective structural remedy; and

- ensuring that the proposed remedy is fully operational through establishing an effective implementation and monitoring system 4.

Similarly, the Competition & Markets Authority of the UK, in its retrospective review of remedies it has accepted in merger filings, concluded that "behavioural remedies are more complex and carry significantly higher risks than structural remedies and generally require more work both in upfront design and implementation and especially ongoing monitoring, enforcement and review"5.

b) What about implementation?

Leaving aside the principles set out in the TCA's guidelines

and continuing to examine the Phase II review statistics, it can be

seen that 53% of the transactions consist of cases in which the

parties submitted behavioural commitments. We can therefore

conclude from this statistic that the practice is not as

restrictive as the wording of the Guidelines would suggest and that

behavioural commitments can facilitate the granting of

clearance.

This is because it may not always be possible for the parties to

make structural commitments. For example, there is no structural

remedy that an undertaking with a single plant producing an

undifferentiated product and therefore having a single brand can

present to the TCA to acquire a second plant from its competitor,

which alone can facilitate the clearance of the transaction. As

stated in its Guidelines, the TCA is also aware of this difficulty.

We observe that behavioural remedies that meet the above-mentioned

conditions enable or facilitate the clearance of mergers in sectors

that do not raise alarm bells (Table 1).

Table 1: Phase II cases cleared with behavioural remedies

| Industry | Transaction Parties | Year |

|---|---|---|

| Steel tubes & pipes | Borusan/ Mannesman JV | 1998 |

| Printed media | Vatan Gazetesi/ Dogan Medya | 2008 |

| Ground services | THY/ Havas TGS JV | 2009 |

| FMCG | Turyag/ Besler Gida | 2010 |

| Alcoholic beverages | Mey Içki/ Diageo plc | 2011 |

| Movie theatres | AFM/ Mars Sinema | 2011 |

| Baker's yeast | Dosu Maya/ Lesaffre | 2014 |

| Steel cords for tire | Çelikord/ NV Bekaert SA | 2015 |

| Supermarkets | Migros/ Anadolu Endüstri H. | 2015 |

| Supermarkets | Tesco/ Migros | 2017 |

| Agrochemicals | Monsanto/ Bayer | 2018 |

| Port | Mardas Port/ Arkas | 2018 |

| Lenses & glasses | Luxxotica/ Essilor | 2018 |

| Refrigeration compressors | Whirlpool compressor/ Nidec Corp | 2019 |

| Lenses & glasses | Grandvision/ EssilorLuxottica | 2021 |

3. When is the monitoring trustee involved?

a) Why is a monitoring trustee necessary?

Once an appropriate remedy has been designed to address the competition concerns arising from a merger transaction, the competition authority must monitor whether the remedy has been effectively implemented. Competition authorities may appoint third-party experts to act on their behalf for this monitoring task. While a divestiture trustee is used in structural remedies for merger transactions, a monitoring trustee is used in behavioural remedies6. A monitoring trustee is needed to address some of the abovementioned reasons that lead the competition authority to disfavour behavioural remedies. Nevertheless, as far as we have been able to ascertain, a monitoring trustee was only appointed in three of the Phase II reviews listed in Table 1, which are also detailed below.

b) What are the duties and qualifications of the monitoring trustee?

In the Guidelines, the duties and qualifications of the divestiture trustee are mostly mentioned, but the main principle is set forth by stating that "The implementation procedure [...] concerning divestiture remedies [...] shall also be taken into account concerning other remedies, as appropriate [...] The Board may request the appointment of an expert [...] to monitor the implementation of behavioural commitments".7 Indeed, in a decision of the Turkish Competition Board ("Board"), it is stated that "the fact that the behavioural commitment extends over a period of time brings with it the difficulty of monitoring as well as implementation, and undoubtedly, the longer the period in question, the more critical the monitoring becomes. Therefore, it is considered that the above-mentioned duties and powers imposed on the divestiture expert in relation to a commitment that is easy to observe and supervise, such as the divestiture of a business unit, also apply to the monitoring expert appointed in relation to behavioural commitments"8. This interpretation is also put into practice.

Based on the qualifications of the divestiture expert listed in the Guidelines, the following can be said about the duties, qualifications, and conditions for the appointment of the monitoring trustee:

The monitoring trustee will be appointed by and at the expense of the parties to supervise the parties' compliance with the commitments on behalf of the Board9. The trustee will not receive orders or instructions from the parties without the approval of the Board 10. The parties will identify the candidate(s) for the role within 30 days of the Board's conditional clearance decision and submit it to the Board for approval 11 and appoint with the approval of the Board 12. The Board will consider on a case-by-case basis whether the expert has the necessary qualifications. The expert should be independent of the parties and should not be subject to any conflict of interest, i.e., it is not acceptable to appoint the parties' own auditors, investment bankers or lawyers as trustees. Once appointed, the monitoring trustee cannot be dismissed without the consent or request of the Board. Audit or consulting firms may be recommended for this task, as well as persons who have professional experience in the relevant sector and who have the qualifications and resources to meet the requirements of the task. 13. The monitoring trustee's duty ends when the Board receives a letter confirming that the remedy has been fully and correctly implemented and that the transaction has been completed 14.

The EU Commission ("Commission") states that the monitoring trustee should be considered as the eyes and ears of the Commission 15. In view of the duties and powers mentioned above, it is easy to say that this analogy of the Commission also applies to the experts approved by the TCA.

4. In which cases has the Monitoring Trustee been used so far?

a) Anadolu Endüstri Holding/Migros 16

The TCA cleared the transaction concerning the acquisition of the Migros supermarket chain by Anadolu Endüstri Holding ("AEH"), which has subsidiaries with high market shares in the beer and carbonated soft drinks markets, subject to commitments submitted by the parties to address competition concerns. The commitments were as follows.

- Migros to maintain its existing commercial relationships with AEH's competitors,

- Migros to establish relations with new entrants to the beer market on objective commercial terms,

- Migros not to impede the sale of the products of AEH's competitors and to maintain the shelf space and display of the products offered in the beer category,

- AEH shall not interfere with Migros' commercial relations with AEH's competitors in the beer market by any means (meeting, giving instructions, etc.)

The Decision was for a limited period of three years and includes the appointment of a Monitoring Trustee for the follow-up of these commitments. The details of how the Monitoring Trustee will be selected and how she or he will carry out her or his duties are also set out in the Decision.

Accordingly, the reports to be submitted by the monitoring trustee at the end of the 1st and 7th month of each year should include the principles of the contracts that Migros has concluded with suppliers in the beer category and the agreements relating to other commercial activities. No confidentiality clause shall be imposed on the monitoring trustee concerning these agreements, and all types of information shall be made available to her or him 17.

The TCA may ask the monitoring trustee to submit an additional report or to answer certain questions in response to a complaint or if it deems it necessary. The monitoring trustee will also be able to submit her or his opinions and suggestions to the TCA at any time, if necessary 18.

"The monitoring trustee should have the right and authority to have access to all information and documents of the parties and to request administrative assistance from the parties insofar as it is relevant to the implementation of the commitments. In addition, the parties should reimburse the monitoring trustee's expenses and allow the monitoring trustee to appoint consultants as necessary to implement the commitments. However, the monitoring trustee should be obliged to keep confidential all private and business secrets of the parties and third parties" 19.

The TCA also emphasised that the monitoring trustee should be qualified to carry out her or his duties, should not be subject to conflicts of interest and should be independent of the parties. "Therefore, the person to be appointed as monitoring trustee should not be selected from the company's own auditors, investment bankers or legal representatives. The trustee's remuneration must be set at a level that does not compromise her or his independence, impartiality and effectiveness in performing her or his duties. In addition, since the commitment is directed at the behaviour of a nationwide company such as MIGROS in a highly dynamic and fast-moving market, the monitoring trustee should be an independent and reliable party capable of conducting extensive observation and monitoring in the FMCG market, evaluating it and interpreting the relevant contracts." 20

"To ensure that the monitoring trustee can work independently, the parties will not be able to give orders and instructions to the monitoring trustee without the approval of the Board. In addition, the Monitoring Trustee, appointed upon the proposal of the parties and the approval of the Board, cannot be removed from office without the approval or request of the Board."21

"In addition, the duties and obligations of the Monitoring Trustee will be set out in detail in the 'Monitoring Trustee Agreement' to be approved by the Board and to be entered into between the Monitoring Trustee and the Parties."22

We understand from the decision, which we explain in more detail below, that the parties have appointed a market research company as the Monitoring Trustee, considering the conditions set out by the Board above.

b) Tesco/Migros 23

In the transaction concerning the acquisition of the stores of Tesco, another supermarket chain, by the Migros supermarket chain, a monitoring trustee was appointed for some vertical commitments. It was decided to revise the contract of the monitoring trustee appointed concerning the behavioural remedies foreseen in the above-mentioned AEH/Migros acquisition transaction to cover the stores acquired in this transaction and to report to the Board every six months and the above-mentioned issues regarding the duties, powers and qualifications of the monitoring trustee were reiterated24.

c) HAL Optical Investments/EssilorLuxottica S.A. 25

The acquisition of optical retailer GrandVision by optical supplier EssilorLuxottica was subject to a Phase II review by the TCA due to competition concerns arising from a vertical merger. The competition concerns raised by the transaction have been addressed by behavioural commitments given by the parties to the transaction for a period of three years, which may be extended for a further maximum period of three years if the TCA deems it necessary. These commitments include,

- EssilorLuxottica will not engage in bundling, including not refusing to separately supply branded sunglasses, branded optical frames, lenses and ophthalmic equipment products to existing or potential customers,

- Not to apply discriminatory terms and conditions of sale to customers who are on an equal footing with respect to these products,

- To apply to all its customers the same conditions of sale that EssilorLuxottica applies to its retail subsidiaries (including Atasun),

- Atasun, Essilor's retailer subsidiary, has at least the same share of the total value of its purchases from third-party suppliers as its purchases in 2019.

The decision also stipulates that EssilorLuxottica will appoint an independent third party ("Monitoring Trustee") to monitor and report on the implementation of the above commitments within 45 days of the notification of the TCA's summary decision; that the Monitoring Trustee will prepare an annual report containing its opinion on EssilorLuxottica's compliance with the first three commitments; and that the Monitoring Trustee may also submit an interim report at the request of the TCA or ex officio if he or she deems it necessary.

Conclusion

For M&A transactions that give rise to competition concerns to be approved by the Turkish Competition Authority, the parties to the transaction must submit their commitments to the TCA, including structural or behavioural remedies. In cases where the parties can't submit commitments containing structural remedies, the TCA will accept equally effective behavioural remedies. The TCA does not favour behavioural remedies because they are difficult and costly to implement and monitor. To address these concerns, behavioural remedies are more likely to be accepted if they are put on the agenda together with a commitment to appoint a monitoring trustee. There are cases where the TCA has accepted merger transactions with an obligation to appoint monitoring trustees. In these mergers, the monitoring trustee supervises, on behalf of the Authority, the implementation of the behavioural commitments entered into by the parties.

Footnotes

1 Turkish Competition Authority, Guidelines on Remedies Acceptable by the Competition Authority in Merger Acquisition Transactions, 2011, para 18.

2 Ibid, para. 19.

3 Ibid, para. 18.

4 Ibid, para. 19.

5 Competition& Markets Authority, Merger remedy evaluations: report on case study research (publishing.service.gov.uk), p.24.

6 OECD Policy Roundtables, Remedies in Merger Cases, 2011, p. 12-13.

7 TCA Guidelines, para. 82.

8 TCA decision dated 09.07.2015 and numbered 15-29/420-117, para. 330.

9 TCA Guidelines, para. 63.

10 Ibid, para. 64.

11 Ibid, para. 66.

12 Ibid, para. 64.

13 Ibid, para. 67.

14 Ibid, para. 69.

15 Commission of the European Union, Commission Notice on remedies acceptable under Council Regulation (EC) No 139/2004 and under Commission Regulation (EC) No 802/2004 ("Commission Notice"), para. 118.

16 TCA Decision No. 15-29/420-117 dated 09.07.2015.

17 Ibid. para. 354.

18 Ibid. para. 355.

19 Ibid. para. 356.

20 Ibid. para. 357.

21 Ibid. para. 358.

22 Ibid. para. 359.

23 TCA decision dated 09.02.2017 and numbered 17-06/56-22.

24 Ibid. para. 232.

25 TCA decision dated 10/06/2021 and numbered 21-30/395-199.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.