- within Antitrust/Competition Law topic(s)

- in United States

- with readers working within the Business & Consumer Services industries

- in United States

- within Antitrust/Competition Law, Insolvency/Bankruptcy/Re-Structuring, Food, Drugs, Healthcare and Life Sciences topic(s)

- with readers working within the Banking & Credit industries

COMPETITION

Amendment Condition for Garanti Bankası Bonus Program

On 12 December 2024, the Turkish Competition Board (the "Board") assessed the negative clearance and individual exemption application concerning the Bonus Credit Card Program Sharing Agreements ("Bonus Agreements") signed between Garanti Bankası and other member banks1 under the Bonus Program.2

Upon examination of the provisions in the Bonus Agreements, the Board considered that certain clauses may have restrictive effects on the activities of banks and/or payment service providers. Therefore, the Board's review focused on the following provisions:

- Prohibition on other banks or payment service providers from offering services to merchants already enrolled in the Bonus Program;

- Prohibition on banks and payment institutions from contacting merchants that are already in a relationship with another Bonus Program member; and if the relationship ends, the imposition of a one-month waiting period before providing services;

- Termination of the agreement if a Bonus Program member bank joins in another multi-bank credit card program;

- Requirement for banks exiting the Bonus Program to collect cards with Bonus logo issued to their customers within less than nine months, to deactivate installment and bonus point features on such cards, and to issue replacement cards without the Bonus logo;

- Obligation for expenditures made with cards with Bonus logo to be processed only through the POS terminal of the Bonus Program member bank;

- Prohibition on member banks from conducting promotional campaigns targeting customers of other member banks;

- Requirement for payment institutions to avoid statements or practices that suggest Bonus-branded services are less advantageous than other card programs.

Upon reviewing complaints and collecting information from numerous member business establishments, the Board concluded that the Bonus Agreements are not eligible for negative clearance and cannot benefit from a block exemption, on the grounds that they give rise to anti-competitive effects in the markets for single-payment and installment payment services via credit cards, within the framework of the regulations outlined above.

Nevertheless, the Board evaluated individual exemption conditions and found that the provisions (i), (iii), and (v) in line with the sequence above could benefit from individual exemption. However, the remaining clauses were deemed excessively restrictive and, therefore, individual exemption could not be granted to the Bonus Agreements as a whole. The Board stated that individual exemption may be granted to the relevant provisions if the following amendments are made:

- Regarding provision (ii):

-

- Exclude from the scope any negotiations initiated at the request of the member business establishments to receive offers and remove the one-month waiting period stipulated in the provision;

- Regarding provision (iv):

-

- Set a minimum period of nine months for banks exiting the program to replace cards with Bonus logo and remove provisions prohibiting installment payments and bonus point accumulation on such cards during this period;

- Regarding provision (vi):

-

- Narrow the scope of the Campaign restrictions so that they apply only to persistent and directly targeted campaigns against other member banks;

- Regarding provision (vii):

-

- Remove all clauses prohibiting payment institutions from stating that the Bonus brand is more expensive or less advantageous compared to other loyalty programs.

In line with the Board's decision, the parties were required to amend the agreements within nine months. Otherwise, it was stated that cooperation under the Bonus Program must be terminated, or enforcement actions would be initiated against the parties.

Conditional Approval For The Joint Venture of Petrol Ofisi and Ege Enerji

With its decision dated 15.08.20243, the Turkish Competition Board granted conditional approval for the establishment of a joint venture under the joint control of Petrol Ofisi and Ege Yeni Nesil Enerji Yatırım ve Yönetim A.Ş. ("Ege Enerji") to operate in the field of biodiesel production.

Furthermore, the Board assessed that DB Tarımsal Enerji ve Sanayi Ticaret A.Ş. ("DB Tarımsal"), which currently operates under the sole control of Ege Enerji and is active in the biodiesel production market, holds a dominant position in the said market. The Board examined the effects of the transaction in the horizontal markets and found that the joint venture would lead Ege Enerji to indirectly increase its production, thereby raising the demand for raw materials (such as vegetable oil and waste vegetable oil). In this context, the Board evaluated whether the transaction would hinder competitors' access to raw materials. It concluded that other biodiesel producers would not face difficulties in accessing inputs, as raw material supply appears capable of scaling in response to increased demand. The Board further assessed the capacity expansion capabilities of competitor producers in the event of potential price increases and concluded that competitors would be able to counter the strategies pursued by the joint venture and DB Tarımsal by increasing their own production.

The Board highlighted that the biodiesel production market and the related markets are of a regulated nature and supervised by the Energy Market Regulatory Authority ("EMRA"). In this context, it noted that any conduct by the joint venture or DB Tarımsal that could harm competition could be addressed through intervention by EMRA. Consequently, the Board found that there would be no significant lessening of competition in the horizontally affected markets.

Regarding the vertically affected markets, the Board identified a vertical relationship between the biodiesel production market (upstream market) and the diesel fuel distribution market (downstream market), in which Petrol Ofisi operates. The Board considered that, if a significant portion of the joint venture's output is allocated to Petrol Ofisi, the company could have both the ability and the incentive to engage in input foreclosure strategies againts its competitors in the diesel fuel distiribution market. In this regard, it was noted that Petrol Ofisi might refrain from supplying biodiesel to its competitors or could apply discriminatory pricing practices by offering less favorable terms compared to those offered to itself, thereby adversely affecting competition in the downstream market.

The Board also noted the risk that Petrol Ofisi might gain indirect access to commercially sensitive information of its competitors through the joint venture, which could be used in a manner that could harm their competitiveness.

To address these competitive concerns, the transaction parties submitted a remedy package to the Turkish Competition Authority where they committed to:

- Allocate a minimum quota for the supply of biodieselto Petrol Ofisi's competitors in the downstream market;

- Cap the volume of biodiesel production to be supplied to Petrol Ofisi at a specified maximum level;

- Avoid offering less favorable terms to Petrol Ofisi's competitors; and

- Establish a Chinese Wall to restrict Petrol Ofisi's access to commercially sensitive information within the joint venture.

Finding such behavioural remedies sufficient to eliminate the competitive concerns arising from the transaction, the Board granted conditional approval to the notified transaction.

Finally, the Board further evaluated whether these commitments would have any implications for another transaction concerning the acquisition of BP's operations in Türkiye by Petrol Ofisi. It concluded that the commitments provided within the scope of this joint venture are adequate to address competitve concerns, irrespective of any future assessment regarding acquisiton of BP.

No Investigation Launched Against Akbank, Ziraat Bankası and Halkbank

Following the rulings of the Ankara 17th Administrative Court and the Ankara Regional Administrative Court4, the Turkish Competition Board re-evaluated the complaints previously filed against Akbank, Ziraat Bankası, and Halkbank, and decided not to initiate an investigation5.

To recall, the three banks in question were accused of coercing or directing customers seeking housing or vehicle loans to purchase insurance policies exclusively from companies for which the banks acted as agents. However, in its earlier decision dated 4 March 20216, the Board had concluded that there was no need to take action, citing a lack of concrete evidence supporting the allegations.

This decision was later brought to the administrative courts. Although the Ankara 17th Administrative Court initially rejected the annulment request, the Ankara Regional Administrative Court overruled the First Instance Court's decision and annulled the Board's decision. In its reasoning, the Regional Administrative Court emphasized that customer complaints gathered from various websites and correspondence between customers, banks, and insurance companies had been submitted to the TCA, and that the complainant competitor company could not reasonably be expected to provide further concrete documentation as it was not a party to the relevant contractual relationships. Accordingly, the Board's decision to dismiss the complaint based on the lack of concrete documentation without conducting a preliminary investigation was found to be unjustified, and the decision in question was annulled.

Upon re-assessment of the complaint following the court rulings, the Board reached the following conclusions:

- Aksigorta and Akbank, as well as Türkiye Sigorta, Ziraat Bankası, and Halkbank, are part of the same economic entity, and therefore, there is no cartel or concerted practice violation;

- The vertical agreements between the banks and insurance companies are not of a nature that would lead to foreclosure in the market;

- Lastly, although Halkbank, Ziraat Bankası, and Vakıfbank, , have a market share exceeding 40% in the commercial loan and mortgage loan markets, which may be considered an indicator of dominant position, there is no conduct constituting abuse of dominant position.

Finally, regarding the allegation that Halkbank purchased insurance on behalf of customers without their knowledge and charged insurance premiums directly to their bank accounts, the Board referred to the relevant banking and personal data protection regulations, concluding that such conduct, if proven, would not fall under the scope of the Law No. 4054 on the Protection of Competition.

As a result, the Board terminated the preliminary investigation without initiating a formal investigation into the three banks.

Frito Lay Needs to Open Its Stands To Competitors

The investigation initiated against Frito Lay on the grounds that it obstructed competitors' activities at retail outlets, hindered their sales, and excluded competitors from the market, was concluded with the imposition of an administrative fine and behavioral remedies, as per the Turkish Competition Board decision dated 13.02.2025.7

It is emphasized in the reasoned decision that Frito Lay maintains its dominant position in the packaged chips market and that only Frito Lay and Doğuş possess an effective distribution network, resulting in a duopolistic market structure in the traditional channel.

The Board found that Frito Lay had secured exclusivity at retail outlets through verbal agreements, discount practices, and the provision of product stands. The Board further revealed that Frito Lay had developed strategies to exclude its competitors and diminish their visibility.Having conducted a chronological assessment of Frito Lay's conduct violationg competition, the Board decided to apply the new regulation on fines8, noting that there would be no difference in adminisrative monetary fine compared to the previous regulation. Accordingly, an administrative fine of approximately TRY 1.3 billion was imposed on Frito Lay.

In addition to the administrative fine, the Board concluded that a number of behavioral remedies were necessary to restore effective competition. In this context, Frito Lay is required to:

- Terminate all financial advantages (such as discounts, additional rebates, concessions, or "Dükkan Senin" points) provided to traditional channel retail outlets outside of standard purchasing procedures, including those offered through distributors;

- Introduce a precondition to its employee bonus system ensuring that employees do not interfere with the availability or visibility of competing products at sales points, implement regular compliance training, and establish internal audit mechanisms.

More notable remeides were imposed concerning retail outlets smaller than 200 m², with obligations to be applied without exception to every basket/shelf on each Frito Lay stand. The measures include:

- A maximum of one Frito Lay stand may be placed in each retail outlet, along with at most one additional single-row hanger or similar promotional material;

- If no stand of a competitor producer is present in the store, 30% of each basket on the Frito Lay stand must be allocated to competitors' products. The designated section must be visibly separated and labeled with a sign reading, "This section is reserved for competing chips products." If no competitor products are available, the section must remain empty;

- Even if another producer has a stand in the store, 30% of the Frito Lay stand must still be made available to other competitors who do not have a stand of their own, upon their request;

- Competitors may, upon request, place their own brand images or promotion visuals in the designated areas allocated to them, provided the overall integrity of the Frito Lay stand is preserved;

- Neither Frito Lay nor its distribution channels may give direct or indirect instructions or suggestions regarding the placement or positioning of competing products on the stands;

- Frito Lay must adopt contractual measures to ensure retailer compliance with these obligations and must communicate all stand usage conditions in writing.

The decision also stipulates that all obligations must be fulfilled within 90 days and that the stand-related measures will be subject to review after two years.

Red Flag from the Competition Board on Exclusivity Practices in Electric Charging Stations

The Turkish Competition Board has concluded its investigation against the exclusivity practices between Otoyol İşletme ve Bakım AŞ ("OİB") and ZES Dijital Ticaret AŞ ("ZES") regarding the provision of electric vehicle (EV) charging services at Oksijen-branded motorway service areas on the Istanbul-Izmir Motorway ("O-5"), through settlement and commitment mechanisms.9

In the investigation, the Board examined allegations of abuse of dominance through contractual exclusivity practices and discriminatory behavior between OİB and ZES. The case was resolved through settlement with respect to the exclusivity practices and through commitments regarding the other allegations.

In the Board's assessment of the settlement and commitment decisions, OİB's conduct was evaluated within the motorway service area operation market, while ZES was considered to operate in the electric vehicle charging services market, which includes both AC and DC fast charging units.

Regarding the geographic market, the Board identified a "lock-in effect" due to high switching costs for consumers (e.g., motorway exit and re-entry tolls, fuel costs, time loss), which lead to dependence on the incumbent provider on the same motorway line. Therefore, the relevant geographic market was narrowly defined as the "O-5 Izmir–Istanbul Motorway".

Following its assessment, the Board found that ZES holds a 100% market share on the O-5 Motorway in the EV charging market, and that OİB holds a monopolistic position in the operation of motorway service areas. Exclusive arrangements in the EV charging services market was found to restrict new market entry, negatively affect consumer welfare, and exclude competitor firms from the market.

Within the scope of the investigation, OİB offered the following commitments:

- No exclusive agreements will be signed with any EV charging service provider on the O-5 Motorway.

- The agreements signed with operators at Oksijen facilities will avoid discriminatory terms.

- Existing agreements will be amended in line with these principles.

- Compliance with these commitments will be reported to the Board every six months for a period of five years.

The Board also referred to similar investigations by the UK Competition and Markets Authority ("CMA"), emphasizing that long-term exclusivity agreements can significantly hinder market entry by competitors. Accordingly, it concluded that such practices substantially restrict competition. Following this decision, the relevant service areas are expected to be opened to other EV charging infrastructure operators.

Update to Block Exemption Communiqué on Specialization Agreements

With the publication of Communiqué No. 2025/2 on Specialization Agreements in the Official Gazette dated 26 June 2025, the Turkish Competition Authority has repealed the former Communiqué No. 2013/3. The new Communiqué redefines the conditions under which specialization agreements between undertakings relating to production or distribution may benefit from a block exemption from the prohibition in Article 4 of the Law No. 4054 on the Protection of Competition (the "Law").

The Communiqué introduces both substantive and linguistic updates to key concepts. For example, the definition of a "potential competitor" has been revised to require an assessment based on concrete evidence rather than abstract possibilities. Similarly, the term "distribution" is now interpreted more broadly, encompassing not only logistical processes but also the commercialization of products.

The overall market share threshold required to benefit from the block exemption has been lowered from 25% to 20%. Accordingly, the combined market share of the parties to the specialization agreement must not exceed 20% in any market where the relevant products are offered.

If the products in question are also used as input in the production of other products by one or more of the parties, the 20% threshold must be met separately for both the main market and the input (downstream) market.

Unlike the previous regulation, which relied solely on one-year data, the new framework allows for the use of a three-year average under certain conditions. This aims to mitigate the impact of temporary market fluctuations and ensure more balanced assessments.

The Communiqué also introduces new rules regarding the duration of the exemption. The previous system allowed for different exemption periods where market shares exceeded 25% but remained below 30%. This structure has been simplified: under the new rules, agreements that initially fall below the 20% threshold but later exceed it may continue to benefit from the exemption for two years from the point the threshold is first breached.

Finally, the Communiqué provides for a transition period for agreements that were exempt under the former rules but do not comply with the new conditions. Such agreements must be brought into conformity with the new rules within two years following the year in which the new Communiqué enters into force. During this period, no sanctions will be imposed under Article 4 of the Law.

Minority Stakes and Cross-Shareholdings as Useful Tools for Anticompetitive Coordination: Select Examples from the U.S. and the EU

The antitrust implications of minority shareholdings and cross-shareholdings have been increasingly coming under scrutiny globally. The recent lawsuit filed in the United States (the "U.S.") against various asset management companies, including BlackRock, and the decision taken by the European Union concerning Delivery Hero and Glovo indicate that structures involving minority or cross-shareholdings could potentially facilitate anti-competitive coordination.

The U.S. Perspective: BlackRock Case

In the U.S., a lawsuit was filed by several US states against asset management firms BlackRock, State Street, and Vanguard due to their significant cross (common) minority shareholdings in numerous coal producer companies that are competitors. The Federal Trade Commission ("FTC") and the Department of Justice ("DOJ") sought to intervene in the case by arguing that cross-shareholdings even on a minority level enabled coordinated actions among defendant companies, artificially reducing coal production, inflating prices, and harming consumers, thereby having competition law implications.

The FTC and the DOJ emphasized in their joint statement that coordinated conduct facilitated through common shareholdings across competing firms, aimed at restricting output or raising prices, violates competition laws even if pursued in alignment with broader social objectives such as environmental policies or climate goals.

Although the case proceeding is still ongoing, several inferences related to competition law can be drawn from the FTC and DOJ's stance:

- Under Section 7 of the Clayton Act, which prohibits mergers and acquisitions that substantially lessen competition, share acquisitions are exempt if they are (i) solely for investment purposes and (ii) not intended to reduce competition or create monopolization in the relevant market. In other words, the Clayton Act permits such transactions provided the investments remain entirely passive at inception and thereafter, and investors exert no anti-competitive influence on company management or operations. However, if firms like BlackRock actively and coordinately use their cross-shareholdings to reduce competition in specific markets, they would not benefit from the exemption provided by the Clayton Act for "passive investment" and non-competition-restricting conditions.

- Consequently, even if minority shareholders lack direct control rights, holding shares in multiple competing undertakings may indirectly affect these firms' competitive conduct, constituting a potential violation under competition law.

At the current stage of the BlackRock case, it appears feasible for asset management companies to participate in management processes and influence commercial decisions of the firms in which they hold cross-shareholdings, provided that they do not lessen competition between these competing firms. Nevertheless, subsequent developments in the case hold significant potential to clarify under which circumstances cross-shareholdings may raise competition law concerns. The court's forthcoming evaluation could provide valuable guidance not only in the instant case but also for similar corporate structures.

The EU Perspective: Delivery Hero/Glovo Decision

Delivery Hero gradually increased its unilateral minority shareholding in competitor Glovo starting in 2018 and ultimately obtained sole control in 2022.

The European Commission found that over the four-year period when Delivery Hero remained as minority shareholder, the companies engaged in anti-competitive conduct, including (i) no-poaching agreements, (ii) exchanges of competitively sensitive information, and (iii) geographic market allocation. These actions progressively eliminated competition between the companies and established a multilayered structure of anti-competitive coordination. In this context, it was revealed that Delivery Hero and Glovo exchanged "strategy documents" and organized "information-sharing meetings" to discuss:

- current and future pricing,

- current and future commercial strategies, and

- information regarding new offerings.

Although market allocation was recognized as a separate infringement, it essentially stemmed from Delivery Hero's systematic interference in Glovo's commercial decisions either directly (through exercising or threatening to exercise veto rights) or indirectly (by influencing other Glovo shareholders). Consequently, Delivery Hero and Glovo coordinated entry into markets where neither was yet active, consciously avoiding entry into markets already occupied by the other.

These infringements were facilitated through Delivery Hero's minority shareholding in Glovo. While holding shares in a competitor is not inherently illegal, in this particular case, it facilitated multi-layered anti-competitive interactions. It also enabled Delivery Hero to access commercially sensitive information, influence Glovo's decision-making processes, and coordinate both companies' commercial strategies.

In conclusion, the BlackRock case and Delivery Hero/Glovo decision underscore the necessity for firms to exercise caution regarding strategic and passive investments to avoid competition law infringements. Competition authorities will closely monitor even minority investments, especially in concentrated or strategically significant markets, emphasizing the increasing importance of comprehensive competition law assessments in investment strategies.

INTERNATIONAL TRADE

A Strategic Signal for Near-Shorers: Türkiye's Free Zones Hit Record Exports in May 2025

I. Introduction

In May 2025, Türkiye's free zones posted an all-time high monthly export figure of USD 1.18 billion, marking an 11.2% increase compared to the same month in 2024 and sharply underscoring their accelerating role in the country's trade architecture.10 With nearly 60% of the exports from free zones in the year January – May 2025 consisting of medium and high-tech products, this milestone may suggest a strategic reorientation - positioning free zones as dynamic hubs that support Türkiye's broader export ambitions.

The figures show sustained demand for Türkiye-based manufacturing and assembly - especially in medium and high-tech industries. For companies seeking to shift production closer to the European markets, Türkiye's free zones may be an attractive choice compared to other near-shore destinations - in terms of both growth and cost efficiency.

II. Understanding Free Zones: Definition and Advantages for Companies

Free zones in Türkiye are specially designated areas where businesses enjoy a unique regulatory and fiscal environment designed to foster export-oriented production and international trade. Their primary purpose is to boost Türkiye's competitiveness in global markets by facilitating seamless production, trade, and logistics activities. Key advantages for companies located in Turkish free zones include:

- Customs and Tax Benefits: Companies operating within free zones benefit from exemptions on customs duties, VAT and corporate tax. Imports of raw materials, machinery, and equipment used in production processes can be made duty-free, significantly reducing operational costs.

- Simplified Procedures: Free zones have streamlined customs clearance and administrative processes, facilitating faster movement of goods and reducing bureaucratic delays. This efficiency supports just-in-time manufacturing and quicker access to global markets.

- Strategic Location and Infrastructure: Free zones are strategically positioned near major ports, airports, and logistic hubs, providing companies with superior connectivity to European, Middle Eastern, and Asian markets. Modern infrastructure and support services further enhance operational efficiency.

- Specialized Free Zones: Türkiye has developed specialized free zones dedicated to sectors like technology, biotechnology, renewable energy, and advanced manufacturing. These zones provide tailored incentives, specialized infrastructure, and research & development support, encouraging high-value-added investments.

Together, these advantages make Turkish free zones an attractive destination for international companies seeking a cost-efficient, strategically located base to enhance export capacity and regional market access. The government continues to prioritize expanding and modernizing free zones to align with evolving global trade dynamics and investor needs.

III. What's Driving the Current Momentum?

- Policy Support: As part of Türkiye's broader economic strategy, the Ministry of Trade has outlined a comprehensive framework for enhancing the role of free zones in the nation's export ecosystem. Central to this vision is the goal of increasing the number of active free zones from 19 in 2024 to 24 by 2028. Further, the plan emphasizes attracting high-value-added and technology-intensive investments, aligning with global competitiveness standards.11

- Connectivity and Logistics Efficiency: Türkiye's customs union with the European Union and other free trade agreements give free zone-based exporters fast-track access to European, Middle Eastern, and the Commonwealth of Independent States markets. Investments in port and rail integration, bonded warehousing, and digital customs clearance have improved export operations.

- Geo-Political Shift: With global firms re-evaluating over-dependence on distant supply chains, Türkiye offers a politically stable, business-friendly, and cost-effective alternative for regional operations.

IV. Legal & Strategic Considerations for Investors

- Licensing & Operational Set-Up: To operate in free zones, companies must obtain an operating license through a detailed application to the Ministry of Trade. Certain foreign exchange controls apply. For example, foreign companies are required to bring-in any cash portion of their capital in foreign currency.

- Tax Optimization & Compliance: Beyond tax exemption, certain tax breaks and incentives are offered to companies operating in free zones. For example, tax breaks may be offered to companies on income tax applicable on employee wages if 85% of the FOB value of their sales are export sales. Careful planning is needed to ensure the most tax-efficient structure is created.

- International Trade Strategy: Although physically located within Türkiye, free zones are legally considered outside its customs territory. This unique status offers companies a strategic edge in international trade. Goods brought into free zones are exempt from customs duties and trade restrictions unless they enter the Turkish domestic market - making these zones ideal for manufacturing, storage, and transshipment aimed at export markets.

However, this structure also limits direct access to Türkiye's domestic market, as goods entering the national economy from free zones are treated as imports, triggering customs and regulatory compliance. As such, free zones seem to be best suited to export-oriented operations rather than consumer-focused strategies within Türkiye. When integrated into broader trade and investment planning, they serve as an effective low-risk entry point for foreign investors and a valuable hub in Türkiye's evolving role as a regional production and logistics center.

V. Conclusion

Türkiye's record-breaking free zone exports are more than a statistical high - they signal a policy-backed transformation in how the country positions itself in global trade. As governments and multinationals alike rethink supply chain resilience and regional market proximity, Türkiye's free zones offer a compelling blend of fiscal incentives, strategic location, and export-oriented infrastructure. For international companies evaluating production diversification, nearshoring, or regional hubs, these zones present a well-regulated, cost-effective platform aligned with Türkiye's ambitions to become a high-tech, high-value export leader.

Trade Policy Defense Instruments – 2025Q2 Recap

1) New Investigations

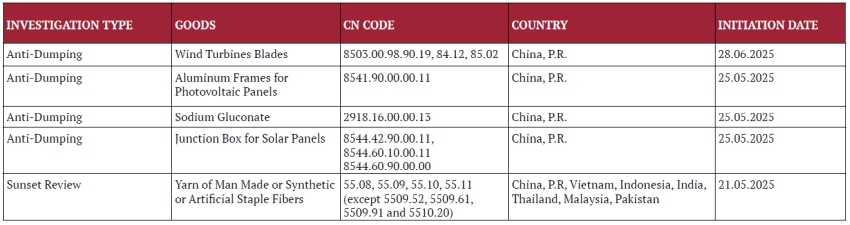

In the second quarter of 2025, the Turkish Ministry of Trade ("Ministry") initiated four anti-dumping investigations and one sunset review covering products from seven countries.

Given the existing anti-dumping measures on photovoltaic cells assembled in modules from the People's Republic of China, as well as anti-circumvention measures targeting the same products originating from Malaysia, Vietnam, Thailand, Croatia, and Jordan, it is clear that the solar energy sector remains a key priority for the Ministry.

In this quarter, the Ministry did not initiate any anti-subsidy, anti-circumvention or safeguard investigations.

2) Measures Adopted

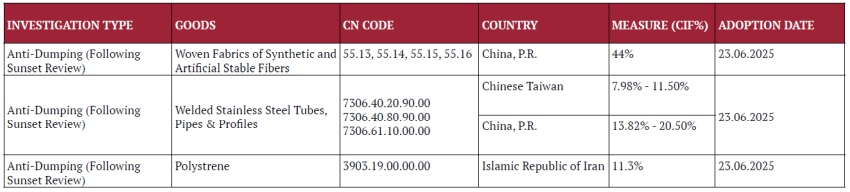

The Ministry decided to maintain three anti-dumping measures as the result of three separate sunset reviews.

Unsurprisingly, the textile and steel sectors are featured in this quarter as well - and remain high on the Ministry's agenda.

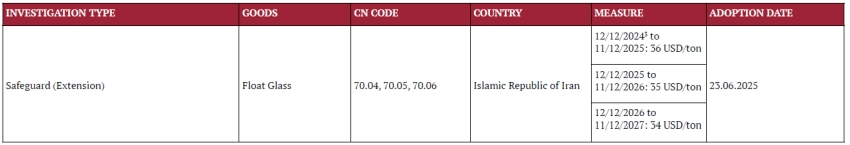

The Ministry also decided to maintain the safeguard measures applicable against imports of float glass products originating in Islamic Republic of Iran since 2015:

In this quarter, the Ministry did not adopt any anti-subsidy or anti-circumvention measures.

Trade Remedy Spotlight

Sunset Review on Stainless Steel Pipes: Türkiye Maintains Measures on Chinese and Taiwanese Imports

In June 2025, Türkiye's Ministry of Trade ("Ministry") concluded its sunset review investigation concerning anti-dumping measures on imports of certain stainless steel pipes from the People's Republic of China ("China") and Chinese Taiwan ("Taiwan"). The Ministry determined that removing existing duties would likely lead to the recurrence of dumping and material injury to the domestic industry, thus recommending the continuation of the current measures.

Product Scope and Market Conditions

The investigation covered welded stainless steel pipes under CN codes 7306.40.20.90.00, 7306.40.80.90.00, and 7306.61.10.00.00, commonly used in construction, industry, and energy infrastructure. Although the market shares of Chinese and Taiwanese imports have declined in recent years - falling to 3.7% and 0.9%, respectively - the Ministry found that both countries possess significant idle export capacity and global market share (China: 25%, Taiwan: 3.8%)

The Ministry concluded that these suppliers could quickly redirect exports to Türkiye if duties were lifted.

Evidence of Likely Dumping and Injury

According to the Ministry, Chinese import prices last depressed the estimated fair market prices by 25% to 45% in 2020, while Taiwanese imports have not exerted price-depressing effects on domestic producers since that year. Similarly, Chinese import prices were last found to undercut domestic prices by 10% to 30% in 2020, whereas Taiwanese imports have not undercut domestic prices since 2020. Nevertheless, the Ministry found their continued presence - combined with their ability to ramp up exports - strategically risky.

In addition, the domestic industry's economic indicators showed deterioration despite the existing duties. Local producers reported:

- Negative profitability from domestic sales (unit profit index fell to -225),

- Decreased productivity (down to 48 index points compared to 100 in 2020),

- Declines in working capital and equity strength, and

- Significant fall in return on investment (from +826 to -1516 index points)

This decline persisted despite moderate market share recovery and stable employment levels - indicating that the measures in place were still necessary to sustain the local industry, and their removal would risk undoing these fragile gains.

Global Context

The report also highlighted that similar anti-dumping measures remain in force in other jurisdictions. The United States, Brazil, Thailand, and the Eurasian Economic Union continue to apply duties on Chinese products in this category, while the United States and Thailand also maintain measures against Taiwanese stainless steel pipes.

Final Decision and Measures

Based on its findings, the Ministry reaffirmed the continuation of the existing duties as established in 2018. This decision reflects Türkiye's broader trade defense strategy, which aims to protect critical industrial sectors - particularly metals and manufacturing. It also sends a clear signal to global exporters that Türkiye will continue to deploy trade remedies when its domestic industries are threatened, even in cases where the price effects of the targeted imports have diminished.

Footnotes

1. Denizbank, TEB, Şekerbank, ING Bank, Türkiye Finans, Alternatifbank ve ICBC.

2. Board Decision, 12 December 2024, No. 24-53/1172-505

3. Board Decision, 15 August 2024, No. 24-33/780-327

4. Ankara 17th Administrative Court, File No: 2021/931, Decision No: 2022/1965, dated 10 October 2022; Ankara Regional Administrative Court, 8th Administrative Chamber, File No: 2023/74, Decision No: 2023/1514, dated 1 November 2023.

5. Board Decision, 15 August 2024, No. 24-33/785-322

6. Board Decision, 4 March 2021, No. 21-11/153-M.

7. Board Decision, 13 February 2025, No: 25-06/152-78

8. You may access our article on the new regulation on fines issued by the Turkish Competition Authority here.

9. Board Decision, 9 January 2025, No: 25-01/8-6

11. The Ministry of Trade Strategic Plan for 2024 – 2028 https://ticaret.gov.tr/data/5b921d6513b87613646656ac/Ticaret%20Bakanl%C4%B1%C4%9F%C4%B1%202024-2028%20Stratejik%20Plan%C4%B1.pdf

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.