- in European Union

- in European Union

- in European Union

- in European Union

- with readers working within the Retail & Leisure industries

- within Intellectual Property, International Law and Tax topic(s)

Day-in and day-out, people are waking up in a brave new world fueled by technology and innovation. In an environment where billion dollar ideas are actualized overnight, companies need to fight for keeping themselves relevant in the eyes of their customers. The rapid pace of business also redefines the concept of welfare for individuals and communities around the globe.

Of course, this impact driven journey has a transforming effect on the legal and social studies that revolve around the concept of welfare. A vivid example of this is competition law. In an effort to foster competition and safeguard consumer interests, competition law enforcers need to understand the markets and adjust their policies in a dynamic manner. Authorities can adjust their enforcement policies by amending the rules or shifting the decisional practice and paving the way for a new precedent.

In the last couple of months, we have witnessed the practice of both methods, when the Turkish Competition Board ("Board") used the newly adopted SIEC test to block out the acquisition of sole control over a shipping company by one of the existing controlling partners1.

The ruling is of importance for a couple of reasons. First, it marks the first-ever use of the SIEC test to prohibit a transaction in Turkey. The ruling also stands as the sole example, where the Board rejected the transfer of sole control to an already controlling shareholder. Lastly, the Board took a rather restrictive approach by dividing the relevant market into sub-regions, which was an important turning point in the path to the prohibition. As the ruling leaves the floor open for a series of questions about what to expect from the enforcement of SIEC in the future, below you may find our two cents on the issue.

Background of the case

On 22 July 2019, Terminal Investment Limited Sàrl ("TIL") applied for the Board's approval with respect to its acquisition of 50% shares in Marport Liman İşletmeleri Sanayi ve Ticaret A.Ş. ("Marport"). Marport was established in 1996 and provides container terminal services at the Ambarlı port.

On the buy-side, TIL was established by Mediterranean Shipping Company Holding S.A. ("MSC") in 2000 and currently operates 37 active terminals in 26 different locations around the world. Besides Marport, TIL's ventures in Turkey includes Asya port and Assan port.

On the sell-side, the Arkas Group is active in various aspects of transportation by see, air and land. Invested in various port operations, the Arkas Group also owns and operates 19 container ships. Apart from its involvement in maritime activities, the group is also active in automotive, tourism, insurance etc.

Marport, as the target of the contemplated acquisition, has been under joint control by TIL and the Arkas Group since 2001.

Adoption of the SIEC test

On 24 June 2020, the Law No. 4054 on Protection of Competition ("Competition Law") undergone a significant amendment that has been anticipated since 2008. The amendments brought a number of significant changes and introduced new tools - such as de minimis, settlement and commitment mechanisms in antitrust investigations - that were not available to competition law enforces before. Among these tools, there was the SIEC test that changed the structural basis of the merger control regime.

Prior to the amendments, the Board's merger control assessment revolved around the essential question of "whether the transaction creates a dominant position or strengthens an existing one". In other words, Turkey applied the so-called dominance test in the assessment of mergers & acquisitions.

After the amendments, Turkey put the SIEC test in the game, where the Board assesses whether the transaction significantly impedes effective competition, in parallel to the EU merger control regime. The function of the SIEC test is clarified in the preamble of the amending legislation, which states that

"In addition to the transactions resulting in the creation of a dominant position or the strengthening of the existing dominant position, transactions that has the ability to significantly impede the effective competition may also be prohibited"2.

Accordingly, even though the Board is still able to conduct a dominance test, now it has an additional tool for tracking down the transactions that are missed by the dominance test.

The Board's assessment

When we delve into the reasoned decision, we see that the case handlers conducted a detailed assessment of the transaction, which includes debriefing various market players and conducting an economic analysis of the transaction. However, we also see that the decision to prohibit the transaction is based on the impediment of effective competition, without demonstrating any dominance as a result of the transaction.

Another important point to mention is the opinion presented in the file report of the case handlers. After a lengthy and diligent assessment, the case handlers opined that the Board could grant a clearance to the transaction. Despite the positive opinion of the case handlers, the Board took a different view and rejected to clear the transaction.

One of the building blocks of this rejection was the definition of the relevant market. As explained above, the target is engaged in the market for container terminal services. Accordingly, the Board defined the relevant product market as "terminal management for container handling services". The Board further divided such definition into the sub-markets of "terminal services for container handling for transit traffic" and "terminal services for container handling concerning hinterland traffic". This approach was in parallel with the Board's previous decisions in the terminal services sector.

After settling the product market, the Board turned to define the geographical scope of the operations question. When we consider the location-oriented nature of port services, we see that the geographical market definition plays an important role in the ex-ante assessment of the competition law risks. Accordingly, for the "terminal management" fraction of the market, the Board defined the geographical scope as "Northwest Marmara". With respect to the "transit traffic" and "hinterland traffic" fractions of the terminal services market, the Board defined the geographical scope as "Northwest Marmara".

This determination is important as the Board adopted a narrower geographical market definition than its previous decisions. Indeed, in one of its previous decisions, the Board defined the relevant geographical market as "Marmara" for terminal management for container handling services in Ambarlı port3. Similarly, in its Mardas decision, the Board defined the geographical market as "Marmara" and further stated that the effects of the transaction would be focused on the Northwest region of Marmara4. As the Board defined "Northwest Marmara" as a geographical market for the case at hand, the competitive concerns were evaluated in a narrower scope, which contributed to the outcome.

Lastly, another important factor in the decision is the fact that the acquirer was already a controlling shareholder of the target. This means that the market presence of the target, from a competition law standpoint, was already attributable to the proposed acquirer, namely TIL. In the past, we see that the Board has a less strict approach on such transactions with "from joint to sole" type of control changes5. In another example, the Board assessed that the change of control from joint to sole will not result in the horizontal coordination risk between competitors6.

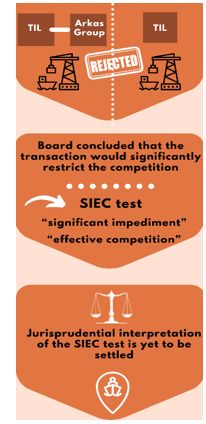

Considering that the acquisition of sole control by one of the joint control holders is a relatively more predictable (and even less risky) scenario, the Board's rejection decision indicates that it handled the matter with a sharper risk perception. In this regard, the Board concluded that the transaction would significantly restrict the competition in the defined markets and rejected to clear the transaction. In doing so, the Board took into account the commercial activities of the acquirer, potential effects on the upstream and downstream markets as well as the characteristics of the sector.

Conclusion

Looking at the 20+ years of enforcement history, we that there are only a bunch of decisions where the Board has actually prohibited a merger or an acquisition. This indicate that the Board has a generally constructive approach towards merger control applications and does not rely on the "reject button" all too easily.

That said, the newly adopted SIEC test has widened the battlefront and set up an additional playing filed between the Board and the transaction parties. In particular, after the adoption of the SIEC test, the Board has the ability to prohibit a transaction, without having to establish that it will create or strengthen a dominant position. Considering that the elements of "significant impediment" and "effective competition" leave room for a certain degree of interpretation, the Board may use this additional elbowroom and adopt a stricter enforcement trend in merger control applications.

As an example of this, the Board concluded that shifting from joint control to sole control over the target would significantly impede effective competition in the market. Considering that TIL has already been exercising joint control over the target for almost 20 years, the Board's assessment could be viewed as an indication of a paradigm shift. Although the jurisprudential interpretation of the SIEC test is yet to be settled, it would be prudent to approach merger control applications in Turkey with an additional layer of caution.

Footnotes

1. Turkish Competition Board's decision numbered 20-37/523-23 and dated 13.08.2020.

2. https://www.tbmm.gov.tr/sirasayi/donem27/yil01/ss215.pdf

3. Turkish Competition Board's decision numbered 09-02/19-12 and dated 14.01.2009.

4. Turkish Competition Board's decision numbered 18-14/267-129 and dated 08.05.2018.

5. TCA Decision Dated 09.07.2015, Numbered 15-29/440-130; Decision Dated 07.08.2014, Numbered 14-26/521-230.

6. TCA Decision Dated 19.07.2017, Numbered 17-23/375-165.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.