On 8 January 2020, Turkish Competition Authority's (TCA) Economic Analysis and Research Department published its 2019 M&A Status Report ("Report"). The Report includes statistical data on M&A transactions that are concluded by the Competition Board in 2019.1 Featuring as one of the most important data sets for an overlook on M&A deals notified before the Turkish Competition Authority and for foreign investor behaviour, the Report contains significant data especially on deal counts, transaction values and transactions including foreign investments made to Turkish companies.

Highlights from the Report

- The Competition Board concluded a total of 208 M&A decisions in 2019. 38 of these transactions involved all Turkish parties, 51 transactions involved at least one Turkish or foreign party and 115 transactions involved foreign undertakings.2 The target undertakings were Turkish companies in 91 of these transactions, whereby the remaining 113 transactions concerned foreign M&A deals took place abroad. Accordingly, it appears that the majority of the Competition Board's workload regarding the M&A transactions consists of foreign deals that may indirectly affect the Turkish market.

- In 2019, the TCA initiated two Phase II investigations and conditionally approved three transactions with remedies from the parties.

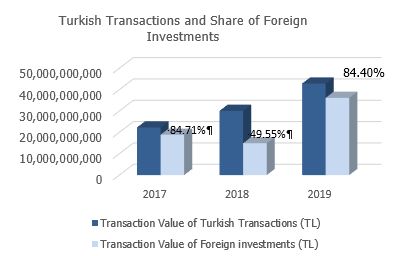

- The total value of the transactions notified to the Competition Authority in 2019 is TRY 2,881,226,706,673. The total value of the 91 transactions involving Turkish target companies and thus directly affecting the Turkish market ("Turkish Transactions") is TRY 42.863 billion.

- The foreign investors are envisaged to invest in Turkish target companies as part of 46 transactions notified to the Competition Authority. The total value of these investments is TRY 36.177 billion.

- About the Turkish Transactions, the line of business with the highest transaction amount has been "electric energy production, transmission and distribution" in 2019, whereby the transaction with the highest value has been cleared in the "financial intermediary operations" sector.

- The highest investment in terms of deal count has been made by Japanese investors with a total number of seven transactions. France comes second with a total number of five transactions and UK, Germany and Netherlands follow France with four transactions each. Investors from USA has only taken place in two transactions.

A Comparative Analysis of 2017, 2018 and 2019 M&A Status Reports

|

Data (Total) |

Report Year |

||

|

2019 |

2018 |

2017 |

|

|

Number of Transactions |

208 |

223 |

184 |

|

Number of Foreign Investment Transactions |

46 |

36 |

47 |

Although the total number of transactions has declined in 2019 compared to 2018, the number of transactions involving foreign investment has increased. In 2019, the number of transactions involving foreign investors remained close to the same data in 2017, but the total value of transactions in terms of TRY has increased by double.

In 2019, the total ratio of the foreign investments within the transaction volume is 84.1% regarding Turkish Transactions. Considering that this ratio was 49.5% in 2018, it can be concluded that the ratio of the foreign investments within the total investments has notably increased compared to the 2018.

Compared to 2017, in 2019 the total value of the transactions in Turkey is higher than 2018 by 42% and 2017 by 92%. In addition, investments that are envisaged to be made by foreign companies in 2019 has increased more than 100% when compared to 2018.

Footnotes

1 The Report also includes transactions which are concluded by the Competition Board in 2019 but notified before 2019. In addition, transactions notified in 2019 but not yet concluded by the Competition Board are not evaluated within the scope of the Report.

2 A single privatization transaction and three other transactions were deemed not notifiable and thus are not included within the scope the analysis.

© Kolcuoğlu Demirkan Koçaklı Attorneys at Law 2019

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.