1. Introduction

For the past few years, Turkey has tended to use various trade remedy tools more frequently, thus the number of investigations increases in depth and breadth with the aim of supporting domestic industry through its protectionist approach. Whilst ranked seventh among 43 WTO members as user of anti-dumping measures between 1995 and 2014, Turkey occupied one of the leading positions in applying trade remedies in 2015, along with the USA, Brazil and India. Furthermore, the OECD Report on Trade and Investment Measures dated 2015 ranked Turkey second among G20 members for initiation of anti-dumping investigations between Q3 2014 and Q1 2015. Countries most affected by the measures are China, India, Malaysia and Indonesia, as well as other G20 members, with metals, plastic and rubber goods, and machinery sectors being the most affected by the imposed duties.

Similarly, in 2016, the Turkish Ministry of Economy adopted a relatively strict trade policy and became the voice of Turkish producers by promulgating new investigations against various countries in parallel with the economic difficulties in Turkey. However, were trade remedies satisfying in terms of both statistics and legal grounds? This article provides the statistical analysis and overview of main developments in the Turkish trade remedy laws in 2016.

2. Statistical Analysis Of 2016: Could It Be Considered As A Dumping Year?

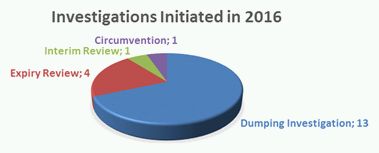

The number of investigations initiated/conducted by the Dumping and Subsidy Research Office of the Ministry of Economy General Directorate of Imports ("General Directorate of Imports") in 2016 illustrates the pace of the strict approach adopted in 2016: nineteen new investigations and thirty completed investigations. The starting point in most of newly initiated and formerly launched but concluded investigations in 2016 were the complaints submitted by the domestic producers regarding dumped imports, interim reviews, expiry reviews and circumvention.

As every case is characterized by the variables such as product concerned by the complaint, the country of origin and imposition of a measure, the statistical evaluations are carried out on the basis of those variables.

2.1. Investigations initiated in 2016

In conformity with the Agreement on Implementation of Article VI of the GATT (1994) ("Anti-Dumping Agreement"), the Turkish legislation on the prevention of unfair competition in imports allows the General Directorate of Imports to conduct a dumping or subsidy examination either ex officio or upon a written complaint of any person or association acting on behalf of the Turkish domestic industry, if it is determined that there exists sufficient evidence on dumped or subsidised imports and injury resulting thereof.

Considering the financial situation in 2016, the investigations were launched against different products classified under seventy-eight customs tariff statistics positions (Turkey's customs tariff system), on the basis of complaints lodged by various Turkish industries such as chemical, textile, steel, copper, glass, tyre, porcelain and solar panel. While approximately 70% of these investigations relate to dumping claims, 21% are expiry reviews.

Table 1

Source: ACTECON based on information available at www.ekonomi.gov.tr

In this regard, the General Directorate of Imports entered year 2016 with the initiation of a dumping investigation against concrete pumps and concrete pump trucks imports from China and South Korea; and it closed year 2016 with the initiation a dumping investigation on heavy plates against China again. Thus, the products originating in the Far East countries (primarily China) became again on the top of the list of the subject of the investigations (i.e. 13 investigations), followed by Russia (3 investigations). Brazil, the USA, Greece, Spain, Italy, Poland, Finland and the Arab Emirates are also on the list.

Table 2

Source: ACTECON based on information available at www.ekonomi.gov.tr

Whilst six of the investigation were initiated against more than one country, the antidumping investigation against imports of "unbleached kraftliner paper" originating in Brazil, Finland, Poland and Russia, and the circumvention investigation against the imports of "hinges" originating in Spain, Italy, Greece and Thailand are the cases where a large number of countries was involved.1

Consequently, the statistics show the increasing use of trade remedies by the Turkish Ministry of Economy, which may also be an indicator of the increase in the awareness of the Turkish domestic industries to apply such mechanism in order to protect themselves from the alleged dumped imports and ensure a proper protection of their interests.

2.2. Investigations completed in 2016

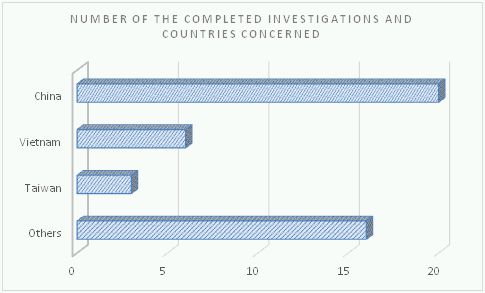

The Law of Turkey (No. 3577) on the Prevention of Unfair Competition in Imports2 sets out different rules and procedures for different types of investigations to be followed by the General Directorate of Imports in imposing a respective measure. For example; although questions of (i) whether the circumstances regarding dumping or subsidy and injury have changed significantly, or (ii) whether the existing measures have been achieving the intended results in removing the injury, shall be evaluated as part of an interim review investigation, the General Directorate of Imports is entitled to impose a measure in an expiry review investigation, if it reaches a conclusion that the expiry of measures would be likely to lead to the continuation or recurrence of dumping or subsidy and injury. In this regard, thirty investigations were concluded in 2016 and surprisingly, more than 50% of these decisions constituted expiry review.

Table 3

Source: ACTECON based on information available at www.ekonomi.gov.tr

On the other hand, the General Directorate of Imports may prefer not to adopt a trade remedy when (i) the complaint is withdrawn during the examination phase (in this case, it shall be considered not to have been submitted), (ii) the complainant no longer cooperates, and/or (iii) the reason for complaint was abolished or one/more condition/s specified for the imposition of a measure are not satisfied in the concerned case. Considering the fact that this is an exceptional situation and the Ministry of Economy closed the investigations without any measure in 26 cases between 1990 and 2016 with only 7 of them in 2000s, it is noteworthy that no measures were adopted in two investigations in 2016 albeit over 90% of the concluded investigations ended with a measure.

One of these two investigations is about the imports of "hot rolled steel" originating in China, France, Japan, Romania, Russia, Slovakia and Ukraine. The investigation was completed without any measure after the withdrawal of the complaint. The other case relates to the imports of "BOPP films" originating in China, India, Egypt and Saudi Arabia. It was closed without any measures, because there was no evidence of any injury during the period of investigation. The latter seems to embody a landmark decision and constitute a precedent for the future investigations.

Not surprisingly, 2/3 of all concluded investigations are concerning the imports from China and Vietnam. In addition to these countries, the Ministry of Economy also concluded investigations about 17 more countries in 2016.

Table 4

Number of the Completed Investigations and Countries Concerned

Source: ACTECON based on information available at www.ekonomi.gov.tr

Consequently, the fact that most of the investigations ended with a measure relates to the Far East countries can be considered as a sign that more investigations against the Far East countries will be on its way in 2017.

3. Turkish Trade Remedy Laws: Any Development In Their Interpretation Or Any New Approach In Their Implementation In 2016?

3.1. Broadening scope of the confidentiality of a complaint

The General Directorate of Imports may initiate either an ex officio dumping or subsidy investigation on its own initiative without an official complaint by the Turkish domestic industry or upon a written complaint by a Turkish domestic industry. In any case, there has to be sufficient evidence on the representativeness of the domestic industry on the basis of product type, the existence of dumped or subsidised imports and injury for the domestic industry caused by such imports. Therefore, it would not be wrong to state that in an anti-dumping investigation, the complaint or any petition provided by the Turkish domestic industry is the main document containing the allegations of unfair trade practices and hence plays a crucial role in ensuring the parties' fundamental right, namely "right of defence".

In this regard, the confidentiality of a complaint in an anti-dumping or review investigation has been one of the contradictive topics raising the question whether the fundamental right of the relevant parties to defend themselves is complied with. Similarly to the Anti-Dumping Agreement, the Turkish Regulation on the Prevention of Unfair Competition in Imports provides for the boundaries/limits of the confidentiality of a document submitted within the scope of a complaint. In this regard, any information whose disclosure would be of significant competitive advantage to a competitor or would have a significantly adverse effect upon a person submitting the information or which is provided on a confidential basis by parties to an investigation, shall, if good cause is shown, be categorised as confidential.

Accordingly, the General Directorate of Imports has been pursuing an approach that broadens the scope of the confidentiality rule (particularly for the complainants) and even sometimes applies this rules that may raise concerns in terms of the effective use of the right of defence by the counter parties, as the complaint is the main document that includes the allegations of the Turkish domestic industry. Especially, in the investigations initiated in 2016, it can be observed that the non-confidential versions of the complaints do not even provide any data (product type representativeness, dumping margin, price undercutting, price suppression, etc.), and it is of a critical importance to indicate the grounds/justifications of a complaint and to ensure the right of defence.

Consequently, in 2016, there was no legal development concerning the implementation of confidentiality rules, while broadening the approach to their application has caused the parties concerned to question the legality of relevant investigations. Within this framework, we believe that it would be extremely beneficial to all the parties involved in the process if the Ministry of Economy develops and issues its guidance (in the form of Communiques/Guidelines) in 2017 to precisely draw the boundaries of the confidentiality principle for the complainants. It would no doubt assist the Turkish domestic producers to properly prepare their complaints and thus it would also prove the opportunity for the parties to use their rights of defence in an effective manner.

3.2. Removal of injury: by means of additional decisions to the Import Regime Decision and anti-dumping measures?

In 2016 Turkey enacted several additional decisions to the Import Regime Decision of the Council of Ministers dated 20.12.1995 and numbered 95/7606 in order to set out additional customs duty that shall be taken into account in respect to the imports of the goods (such as chemicals, tires, ceramics, porcelain, plastics, glass, trees, foods, fruits, etc.) with certain customs tariff statistics positions. According to these decisions, the additional customs duty shall not be applied in cases where:

- the preferential origin of goods (originating in the countries included into the diagonal cumulation of origin system) is certified pursuant to the Free Trade Agreements, which Turkey is a party to;

- the goods are exported to the member states of the European Union with A.TR movement certificate under the customs surveillance through collection of duties on the basis of customs duty rate stipulated in the lists included in the Import Regime Decision.

On the other hand, neither the Turkish customs legislation nor the Turkish anti-dumping regulation provide clarification of the approach to be adopted by the Turkish Ministry of Economy where an additional customs duty against the imports of products (that are already subject of a pending anti-dumping investigation) is regulated by the Council of Ministers through the additional decision to the Import Regime Decision. Therefore, it can be concluded that such regulation does not prevent the Ministry of Economy from adopting an anti-dumping measure even after the imposition of such additional customs duties. However, this certainly raises concerns about the most-favoured nation clause and compensation for domestic industries' injury along with the question whether this could be put forward as an argument within the scope of injury defence.

Therefore, in 2017 the Ministry of Economy may reveal its approach to the arguments put forward by the exporters concerning additional decisions, which already remove the damage to the relevant Turkish domestic industry (if any); and thus there is no need to impose another (anti-dumping) duty, which may hamper the exports to an unfair extent.

3.3. China's non-market economy status

On 11 December 2016 China celebrated its 15th anniversary of its accession to the WTO with an expectation to enjoy all its rights under the Protocol on China's accession to the WTO in 2001 ("Protocol"). The Protocol regulates China's non-market economy status and thus the calculation of normal values in anti-dumping investigations concerning the imports from China. Due to the arguments of "distorted" domestic prices during the accession debates, the Protocol was designed to empower the WTO members to treat China as a non-market economy in the anti-dumping investigations and thus, differently from other members for the determination of price comparability in respect of domestic prices and costs in China, which relates to the determination of normal value of goods. On the other hand, this discretion of the WTO member states was arguably subject to a time limitation - until 11 December 2016.

Therefore, among the hottest topics in 2016 were the questions of whether;

- China's non-market economy status in the WTO would change at the end of 2016,

- implementation of the rules concerning the China's non-market economy status in the Protocol would be applicable for the investigations initiated before 11 December 2016,

- the WTO members would pursue such new policy (considering the political sight of the trade remedies and the fact that China is one of the countries on the top of the list against which anti-dumping duties have been applied mostly), and what would be the consequences of its misapplication.

Albeit many divergent interpretations of these issues by both academics and practitioners all around the world still, the global economies such as the USA, EU and India have opposed the market economy methodology for China for the lack of a rule to automatically grant China market economy status, and because China has not made necessary arrangements/complied with its obligations to deserve such treatment since the distortions still take place.

On the other hand, China closely followed all debates around the world during the whole year and realised the intention of the WTO members not to grant market economy status to China. Provided that it might constitute a breach of the obligations arising from the WTO rules, China on 12 December 2016 applied to the WTO Secretariat for the consultations with the USA and the EU regarding special calculation methodologies used by the USA and EU in anti-dumping proceedings3.

As for Turkey, it has conducted several technical meetings with the Turkish domestic producers' and exporters' unions so to enable them to submit their opinions about the mentioned (potential) change in the China's status. Yet the above-questions have remained unanswered. It appears that the Turkish Ministry of Economy will follow global economies such as the EU and USA and the result of the WTO's dispute consultations will play a determinative role in terms of the Turkey's future policies. Indeed, the evaluations in the last two final disclosures announced at the Turkish Ministry's website regarding the solar panels and concrete pumps reveal that an unfavourable approach will be followed at least in cases where the investigation was launched before 12 December 2016.

Consequently, we believe that the following questions will find their answers in 2017 (particularly, after clarifying the WTO's approach to China's status application):

- whether China's claims regarding the market economy status will be accepted in the investigations initiated after 12 December 2016 or the period of investigation will be accepted as the criterion to follow the market economy rules for Chinese exporters,

- whether the domestic sales of Chinese producers will be taken into consideration in calculating the dumping margins, and

- whether all cost related items will be taken into consideration as it is, or some of the items under the questionnaire (especially costs such as energy) will be still adjusted.

4. Conclusion

Although it cannot be clearly stated whether 2016 was a satisfying year in terms of trade remedies, there is no doubt that great use of trade remedy tools and increasing number of anti-dumping investigations in Turkey with the aim of supporting domestic industry also points out to the potential protectionist approach to be adopted by the Turkish Ministry of Economy in 2017.

Therefore, year 2017 is anticipated to provide not only more statistical data but also an opportunity to clarify some legal controversies in relation to trade remedies and the process. In relation to the latter, we hope that the Ministry of Economy would issue its guidelines on application of confidentiality to assist the Turkish domestic producers to properly prepare their complaints and thus ensure the opportunity for the parties concerned to use their rights of defence in a more effective manner.

Footnotes

1 These are the investigations that are launched in 2016. Similar to the WTO rules, Turkish antidumping legislation provides that antidumping investigations should generally be completed within 12 months of the initiation date, but this deadline may be extended to a maximum of 18 (12+6) months.

2 Law of Turkey (No. 3577) on the Prevention of Unfair Competition in Imports dated 25.07.1999

3 https://www.wto.org/english/news_e/news16_e/ds515_516rfc_12dec16_e.htm

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.