- within Intellectual Property topic(s)

- in European Union

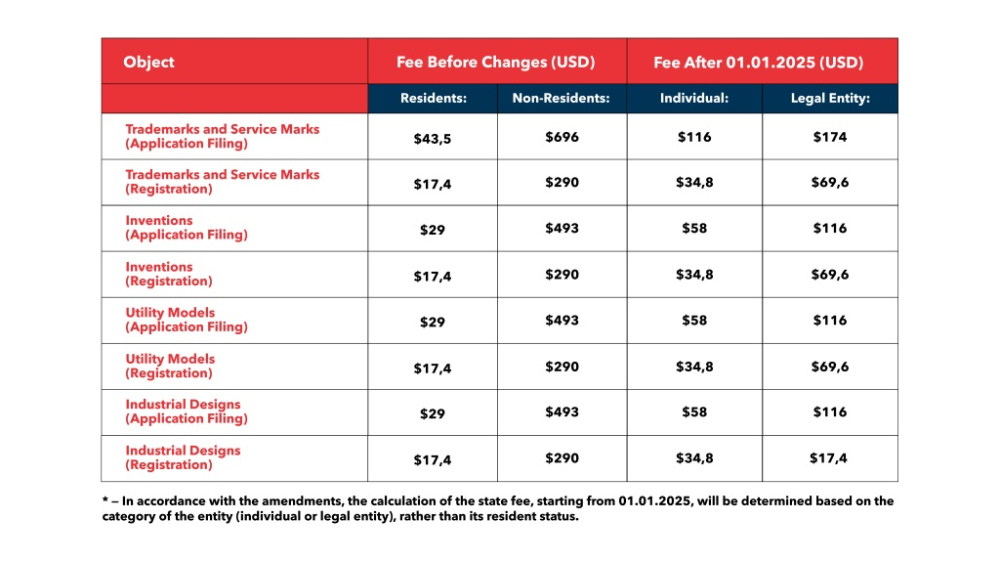

The amendments introduced to the Law of the Republic of Uzbekistan "On State Duty" significantly modify the method of calculating fees for intellectual property registration. The previously existing differentiation of rates based on the resident or non-resident status of the applicant has been abolished. Instead, the state duty rate is now determined according to the applicant's category—either an individual or a legal entity.

As a result of these changes, the calculation procedure for state duties has been revised, impacting all stages of intellectual property registration. For clarity, the key changes in state duty rates, including those applicable to application submission and registration, are outlined in the table below.

In particular, the amendments to the Law establish the following state duty rates for granting legal protection to trademarks, service marks, geographical indications, and appellations of origin:

- Filing an application for trademark registration and conducting an examination:

-

- For individuals: 4 times the Base Calculation Value1 (BCV) (116 USD)

- For legal entities: 6 times the BCV (174 USD)

- Trademark registration:

-

- For individuals: 1.2 times the BCV (34.8 USD)

- For legal entities: 2.4 times the BCV (69.6 USD)

Regarding the state duty for granting legal protection to inventions, utility models, and industrial designs:

- Filing an application for a patent and conducting an examination:

-

- For individuals: 2 times the BCV (58 USD)

- For legal entities: 4 times the BCV (116 USD)

- Registration and publication of information:

-

- For individuals: 1.2 times the BCV (34.8 USD)

- For legal entities: 2.4 times the BCV (69.6 USD)

Thus, the newly introduced amendments serve to unify the approach to calculating state duties and streamline the process of intellectual property registration in Uzbekistan.

Footnote

1 BCV - Base Calculation Value. (1 BCV ≈ 29 USD)

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.