On October 28, the Constitutional Court issued the ruling 110-21-IN/22 by which it declared the partial unconstitutionality of the Law for Economic Development and Fiscal Sustainability After the COVID-19 Pandemic. The following are the main effects of such ruling, which has not yet been published in the Official Gazette:

- The amendments to the Law of the Special Regime of the Province of Galapagos are declared unconstitutional. This change will be effective as of the publication of the ruling in the Official Gazette.

- The amendments to the Hydrocarbons Law are declared unconstitutional, except for the exemption of foreign trade taxes on the importation of fuels, hydrocarbon derivatives, biofuels and natural gas made by individuals or national and foreign entities. This change will be effective as of the publication of the ruling in the Official Gazette.

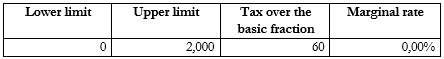

- The tarriff applicable to the popular businesses of the RIMPE regime is declared unconstitutional. This change will be effective as of the fiscal year 2024:

- The following are declared unconstitutional on the

merits with effect as of publication of the ruling in the Official

Gazette:

- The exemption from payment of Inheritance Tax to beneficiaries within the first degree of consanguinity with the deceased.

- The exemption from criminal liability for any crime, including those of a tax nature, to taxpayers who apply the Regime for the Regularization of Assets Located Abroad is eliminated. The Internal Revenue Service must notify the Financial and Economic Analysis Unit (UAFE) of any suspicious activity.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.