With the pandemic reshaping entire industries and defining new customer profiles, chief financial officers (CFOs) must enable shifts to new opportunities. Financial functions are being digitally transformed to support enterprise ambitions with vital data. However, global businesses should not forget the data needs of an important group of stakeholders - local governments.

Digital transformation

A consensus, confirmed by interactions with our clients' finance leaders, is that the finance of the future is digital by default, highly centralised, with data available on demand. This objective requires that immediate steps are taken, including a review of the technology landscape, reassessment of the operating model, and getting a clear picture of the planning and budgeting strategies and tools.

As in many other areas, the first step is the one that matters most. A solid start here would be to have a strategy in place, which is clearly formulated, flexible and crafted by multidisciplinary teams. In case you are looking for some inspiration on where to begin, take a look at this strategy document created by a team led by a mathematician. Even though it was created for a government, many pillars - from data policy to impact on labour and ethical considerations - are not uncommon to global businesses.

And still, a recent CFO survey by Workday suggests that only 45 per cent of CFOs have a mature digital transformation programme. How mature is yours?

Tax

In the latest Global Business Compliance Index (GBCI) by TMF Group, apart from ranking the countries in terms of business complexity, we have highlighted some key global trends. One is tax enforcement: given the recent rounds of economic stimulus across the world, our experts predict that there will be an increased tax burden for companies in the coming years as governments look to reduce their budget deficits.

Another trend identified in the GBCI is digitalisation, which can substantially simplify the process that businesses are required to go through with tax authorities. However, in some instances the teething problems can have the opposite effect in the short term: introducing change can lead to complexity.

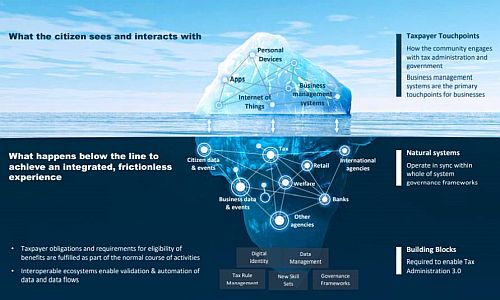

Figure 1 - Vision of Tax Administration 3.0

As an example, businesses are already investing in tools and processes to meet the new requirements effective from 1 January 2022 in Romania (SAF-T reporting obligations) and in Portugal (to include a QR code and a unique number on invoices).

And Tax Office 3.0 is on the way. For more information on this, see this OECD discussion paper. Similar to business digital transformation, tax processes are about to become more automated, interactions more user-friendly and the experience a frictionless one.

Those plans are definitely of interest, not just to business software vendors, but to CFOs and tax leaders. All of these trends will definitely impact decisions on the future state of tax functions (centralised versus local, outsourced versus in-house), budgeting and resourcing (including greater emphasis on digital talent).

Combining the two (digital taxformation)

Here are a few practical hints that we have seen working both for TMF Group and for our clients undergoing a finance transformation:

1.Start with the basics - data and definitions

At TMF Group, we have complete central visibility on all statutory deliverables in more than 80 jurisdictions where we operate in-country. Whether a mandatory filing or on-demand submission, real-time or end of period, direct tax or statistics submission, electronic or paper-only return, all are diligently tagged and recorded. While this attention to detail may seem a tiny step, experience shows it alone can save hundreds of hours of work through the stages of clients' lifecycles.

2.Define a tax operating model

Dedicate some time to define the right level of centralisation of your tax teams and your sourcing strategy. Some useful criteria for company-level and activity-level sourcing decisions could revolve around internal competences, transition costs, competitive advantage and specialised providers' maturity.

3.Have a tax technology strategy in place

Practice shows that a documented strategy is vital not only for corporate business management systems but also for tax technology. As an example, both the selection and the implementation process for global financial statements software goes much smoother if there is a well-articulated technology strategy document in place.

4.Document processes and deviations

Tax processes may be a black box for many businesses because of multiple local variations. While documenting all aspects of tax processes is probably unfeasible, a pragmatic solution is to have key tax processes documented. Try to design and collect data not only on standard tax processes, but also on necessary country-driven deviations - that again will help in centralisation efforts.

5.Handle transactional data smartly

Often local statutory books for various entities live their own life. And then the reconciliation between corporate books (many times from global enterprise resource planning and local books is not a walk in the park.

Talk to us

For us at TMF Group, whether a business must have a set of statutory books duplicated in local software in more than 80 countries is part of our organisational knowledge, allowing us to bring efficiencies to clients' taxformation.

For more details, visit our page on global tax compliance management, or make an enquiry today.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.