- within Corporate/Commercial Law topic(s)

- in South America

- with Senior Company Executives, HR and Finance and Tax Executives

- in South America

- with readers working within the Accounting & Consultancy, Media & Information and Retail & Leisure industries

Let's Unbundle Section 46 of the Income Tax Act

Section 46 of the Income Tax Act 58 of 1962 (the "ITA") provides roll-over relief where a company distributes shares it holds in another company to its own shareholders, provided that specific statutory conditions are met. These are known as unbundling transactions, and when they qualify under section 46, they offer tax-neutral treatment to both the distributing company and its shareholders.

The provision accommodates both domestic and certain cross-border unbundling transactions, but this article focuses on domestic unbundling transactions as contemplated in section 46(1).

Understanding Unbundling Transactions

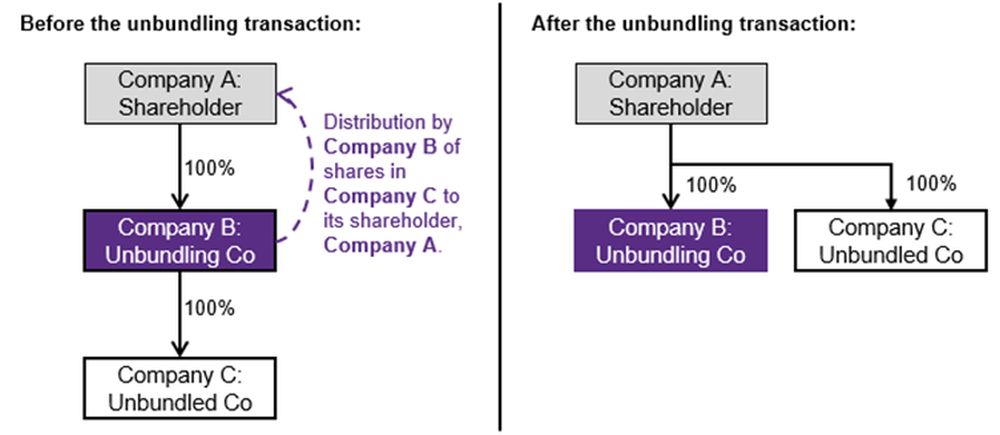

A section 46 unbundling transaction typically involves a company (the unbundling company) distributing shares it holds in another company (the unbundled company) to its own shareholders. The effect is that shareholders of the unbundling company receive direct ownership in the unbundled company, thereby simplifying corporate structures, enhancing strategic clarity, or enabling regulatory compliance.

To qualify for relief, the shares in the unbundled company must be distributed to the shareholders of the unbundling company in proportion to their effective interests. In other words, each shareholder must receive a corresponding shareholding in the unbundled company relative to their interest in the unbundling company.

Practical Application and Reasons to Conclude an Unbundling Transaction

The first question one might ask is: why companies would choose to unbundle? Unbundling is typically pursued to:

- Simplify layered group structures.

- Reallocate base cost for tax efficiency.

- Enhance operational focus by separating distinct business units.

- Comply with regulatory directives, such as those from the Competition Tribunal.

For example, Company C (the unbundled company) might be a promising software development firm working on an innovative product. If Company C seeks to attract investors or strategic partners, it is generally more appealing for such stakeholders to invest in an independent, standalone entity. Unbundling Company C from its holding company, Company B, not only simplifies the investment structure but also protects Company C from potential creditor claims against Company B.

Another practical scenario involves B-BBEE compliance. Suppose Company C aims to achieve or maintain a specific B-BBEE status to access certain markets or contracts, while Company B either does not require such compliance or is not in a position to fund it. Through an unbundling transaction, Company C can pursue its B-BBEE objectives independently. Post-unbundling, Company B's B-BBEE status no longer affects Company C, allowing each entity to align with its own strategic and regulatory priorities.

Section 46 Compliance Requirements

For a transaction to qualify for full roll-over relief under section 46 of the ITA, the following conditions must be satisfied:

- The unbundling and unbundled companies must be South African tax residents;

- The distribution must occur proportionally, based on the shareholders' effective interests in the unbundling company;

- Where the unbundled company is unlisted, more than 50% of its equity shares must be distributed;

- The transaction must not involve disqualified shareholders, nor fall within the statutory exclusions;

- Where applicable, the apportionment of base cost between the shares must be correctly calculated using the relative market values on the date of distribution.

Failure to meet these conditions may result in the forfeiture of relief, with normal income tax, capital gains tax, and dividends tax consequences applying.

Tax Implications for the Unbundling Company

The distribution of the unbundled company's shares by the unbundling company is treated as tax neutral. No income tax or capital gains tax arises on the in-specie distribution of the shares. Additionally, no dividends tax is payable, distinguishing the transaction from ordinary dividends or returns of capital.

The relief effectively defers any tax that would otherwise arise on the disposal of the unbundled company's shares. Importantly, the relief only applies where the transaction complies with the statutory requirements and the shares are distributed in the correct proportion.

Tax Implications for the Shareholders

Shareholders receiving the shares of the unbundled company do not recognise any income or gain at the time of receipt. Instead, they are required to apportion the tax cost of their shares in the unbundling company between the unbundling and unbundled company shares received, based on the relative market values at the date of the transaction.

Conclusion

Section 46 of the ITA offers a powerful mechanism for tax-neutral corporate restructuring through unbundling transactions. When properly implemented, it allows a company to distribute shares it holds in another company to its shareholders without triggering immediate tax consequences.

The relief preserves continuity for both the unbundling company and its shareholders, while allowing for greater strategic flexibility. As with other corporate roll-over provisions, detailed compliance with statutory requirements is essential, and professional advice should be sought to ensure proper execution and to avoid unintended tax exposure.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.