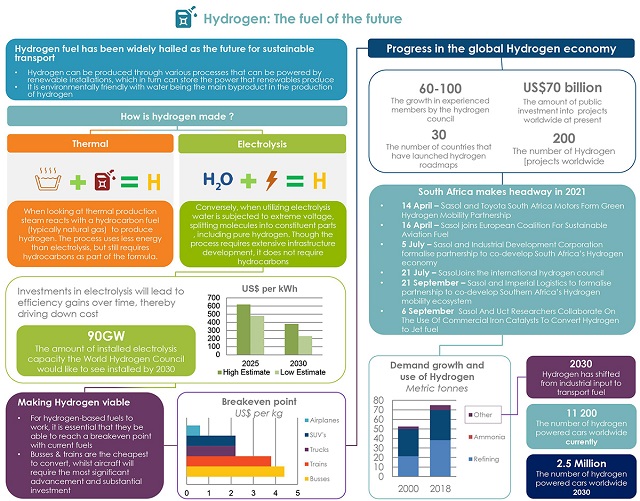

01 Sasol maintains course on South Arica's hydrogen plan

The month of September proved to be another key steppingstone for South Africa's efforts to become part of the global hydrogen economy. Sasol, the partly state-owned fuel company has announced that it had gone into partnership with the University of Cape Town to create catalysts for the conversion of hydrogen and CO2 into sustainable jet fuel, and the project has already shown some promising results. According to reports the partners have already discovered an ideal catalyst, a chemical ion which is already produced in large amounts at one of SASOL's existing plants. Another key partnership actioned this month by Sasol is the agreement between itself and Imperial Logistics to collaborate on the decarbonisation of the local long haul trucking industry. Such a milestone could be challenging to achieve but if actioned would be a revolutionary step in introducing the broader SA economy to hydrogen fuels. The partnerships come off the back of a number of high-level policy announcements this month in support of the country's overall transition plan, including the announcement that the Hydrogen Society Roadmap would be moved from the research phase to the commercialisation phase.

Sources: International Energy Association, Hydrogen Council, US Department of Energy, Sasol; 2021

02 Telecoms privatisation continues in Ethiopia, Angola as both nations look to expand network access

Angola announced in September that it would be privatising its national telecoms company, Angola Telecom, joining the growing list of countries who have done so in recent years. Mid-month the Angolan government announced that it was putting out an international bid to manage, operate and expand the state-owned operator's national and metropolitan transport backbone network. This forms a key part of the country's broader privatisation strategy, which the government hopes will be the answer to Angola Telecom's long history of financial loss and general mismanagement. In parallel, in east Africa the Ethiopian government has announced that it would be putting up 40% of state-owned Ethio Telecom up for auction, a dramatic turnaround from a few months ago when the privatisation of the country's telecoms market was as of yet uncertain. The move aims to further strengthen the position of the company and free up cash flow for additional infrastructure development.

03 South Africa coal divestment accelerates amid diplomatic push and investor pledges

The global fossil fuel divestment movement continues to gather pace with South Africa being one of the more heavily impacted African states. One of the country's largest financial institutions, FirstRand Bank, made the announcement in September that it would cease funding for new coal mines and power plant projects as early as 2026. This comes as a result of the key targets set by the institution to become 'NetZero' in terms of emissions across both its operations and financial investments. The move is a major step towards fossil fuel divestment as South African banks have traditionally been some of the largest stakeholders in hydrocarbons projects across Africa, including the East Africa Crude Oil Pipeline which is set to traverse Tanzania and Uganda, and developing offshore gas reserves like the Mozambique FLNG terminal. In related news, the UK will be dispatching an envoy to South Africa before the November COP26 Climate Change conference to discuss strategies to reduce the country's coal dependence.

04 Sinovac, Aspen move toward African Covid-19 vaccine production

The challenges posed by the rollout of Covid-19 vaccines to Africa's population have increased interest in domestic vaccine production in recent months. Over the course of September a number of new announcements were made which signal that local governments and foreign pharmaceuticals are strongly considering the prospect of developing a local vaccine manufacturing sector. The biggest moves were made by Chinese manufacturer Sinovac who approached the both the Egyptian and South African governments regarding the possibility of producing vaccines domestically. In Egypt such negotiations have already borne fruit, with the announcement on the 1st of September that Sinovac would produce 1 billion vaccines locally for a variety of diseases including Covid-19. In parallel South African pharmaceutical company Aspen announced that it was seeking a license from Johnson & Johnson to produce its vaccine locally – a move which will bode well given the commitment of 31 million vaccines to the country and another 220 million to the African Union.

South Africa receives its first consignment of the J&J Covid-19 vaccine in February of 2021. Having local production centres in the country would cut out the key logistical bottleneck posed by first having to import the vaccines via air cargo. This would also assist in alleviating bottlenecks from local distribution centres given that distribution would occur direct from the manufacturer rather than via port clearance. Image courtesy: GovernmentZA/Flickr

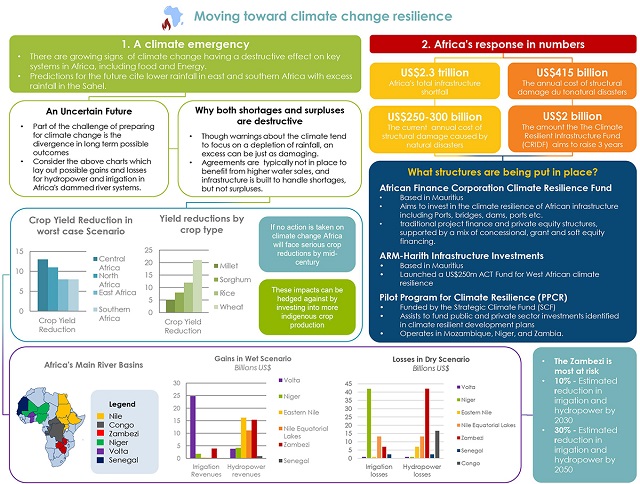

05 African Finance Corporation invests in climate resilience

Africa's ability to weather the oncoming climate change storm received a significant boost in September through the announcement by the African Finance Corporation that it would be creating the Infrastructure Climate Resilient Fund (ICRF)to assist in enhancing Africa's resilience to climate change. The fund will seek to raise US$500 million over the next year and eventually increase this to US$2 Billion over the next three years, with an aim to invest in various projects including ports, roads, bridges, rail, telecommunications, clean energy and logistics. Climate resilience is set to become a vital part of infrastructure planning as Africa is expected to receive blowback from global temperature changes well in excess of its own emissions. Studies have shown that changing weather patterns could have drastic impacts for local economies, with adverse weather conditions(floods, storms, droughts etc) costing local economies as much as US$415 billion a year. Climate resilience is therefore an indispensable investment if the continent is to make progress on its overarching project to end its infrastructure deficits.

Sources: AfDB, World Bank; 2021

06 EV production and sales is set to rise in Morocco, South Africa

A 3D representation of the Opel Rocks – E concept car due 2022. Morocco's privileged position as a key hub in the manufacture of this new model highlights the country's growing importance as a key export partner for the automotive market in Western Europe. Image courtesy: Eric Stainier/Flickr

The large-scale introduction of electric vehicles (EVs) as a genuine contender in the African automotive space has come a little closer to fruition over the course of September following announcements of new investments into some of the continent's premier automotive markets, Morocco and South Africa. Early in the month it was announced that the Stellantis Group would be manufacturing Opel's new EV offering, the Opel Rocks-E at the company's PSA plant in Kenitra. Stellantis came about as a merger between Fiat Chrysler and Citroen with the intent of driving the mainstream adoption of electric cars. Major manufacturers involved in the country have also pledged to source more parts from the local economy in the coming years. with PSA and Renault both pledging 80% up from their current rates of 60 and 65%, respectively. On the opposite tip of the continent South African EV importer Eleksa is set to introduce the CityBug to the market starting at US$13 000 (ZAR 200 000) in bolstering uptake.

07 SAA and Kenyan Airlines sign a memorandum of partnership

Two of Africa's struggling airlines, South African Airways (SAA) and Kenya Airline have banded together to form a partnership aimed at eventually establishing a pan-African airline. Details on the deal remain scant but sources have confirmed that it would not necessarily preclude the airlines individually signing agreements with other airlines in forming parallel ventures. Both companies, prior to recent restructurings, found themselves in the same fiscal debt position burdened with many years of declining profitability due to meddling by their respective governments. The new partnership could provide SAA with a vital inlet to the east African cargo market, which, before the pandemic, was expected to become the largest in the world by the middle of the century. At the same time it will alleviate some of the pressure still lingering over the company as it seeks to regain lost market share not only in Africa, but more broadly across the world.

A Kenyan Airlines plane taking to the skies. The East African country had, prior to Covid-19, harboured ambitions to compete with giants like Ethiopian Airlines in the lucrative east African passenger & cargo markets, but a dramatic turnaround in revenue due to the pandemic has since led to its having to suspend flights and rethink its growth strategy. Image courtesy: Manuel Negrerie/Flickr

08 West African states launch government-backed digital currency amid spike in crypto uptake

Economic uncertainty is one of Africa's biggest challenges which in recent months have prompted tech savvy consumers to adopt the use of crypto currencies as alternatives to fluctuating local currencies thereby posing a new set of legal challenges in states where crypto is yet to gain an official status. Ghana and Nigeria are in the process of collaborating with tech firms for the creation of digital versions of their respective currencies as a way to bridge this gap. Both states have moved swiftly to introduce their own e-currencies with the recent official launch of the e-Naira in Nigeria, while Ghana has been trading with the e-Cedi since late September. The two initiatives fulfil divergent policy objectives however; in Ghana, the e-Cedi represents a small part of a broader effort to digitalise government activities whereas in Nigeria it forms part of an attempt by the government to avert capital flight and crime risk associated with unregulated crypto currency.

09 African Fintech apps Flutterwave and MNT Halan secure US$320 million during recent investment rounds

September has proven to be another key landmark for the ongoing success of the African fintech industry as two of the continent's prominent locally based start-ups secured a significant financial boost in funding from local and international investors. In early September it was announced that MNT Halan secured US$120 million from a broad array of investors with the aim of deepening the firm's first mover advantage and expanding across markets. Similarly, dual-listed yet locally based Flutterwave has secured a US$1.7 billion valuation, ranking it as one of the most successful fintech ventures on the continent. Its operating model could severely disrupt the dominance of banking and mobile money operators by delivering the same service at a roughly 70% lower cost. The app is Francophone Africa's first fintech 'Unicorn' and plans to expand soon to Cote d'Ivoire from its current home market of Senegal where it dominates.

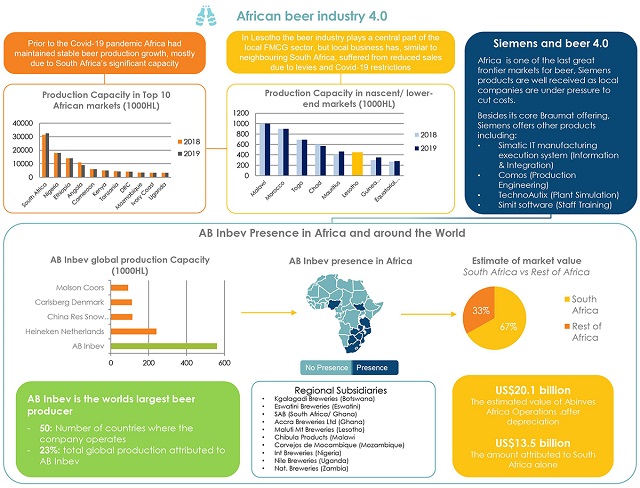

10 AB Inbev partners with Siemens to automate its Lesotho operations

Maluti Mountain Brewery, the subsidiary of AB Inbev in Lesotho, announced a partnership with Siemens South Africa over September to help improve efficiency and curb waste at its production facilities in the country. The new system brings the plant more fully in line with the 4IR ideal with the old automation system being replaced with a fully digitised central control panel which incorporates both the brewery and cellars. The software governing the process uses the Siemens Braumat system which has been specifically designed for beverage manufacturing and allows for virtual oversight of the entire manufacturing process. Despite its small size the Lesotho market appears to be an attractive one for fast-moving consumer goods and beverages in particular. In May this year Coca-Cola bought out the soft drink arm of Maluti Mountain Holdings to form Coca-Cola Beverages Lesotho, an initiative also supported by the local finance ministry and its investment arm.

Sources: Siemens, EE Publishers; 2021

OTHER NOTABLE STORIES

Guinea coup plotters face off against stiff opposition from regional community

West Africa was rocked this month by a forceful takeover of the Guinean government, which has led to the detaining of now former leader Alpha Conde and suspended the constitution. Regional leaders have come out against the coup plotters and have imposed sanctions on the country and promised to host a democratic election next year.

MTN secures renewed 20-year license in Nigeria

Nigeria's leading telecoms provider has received another extended 20-year license to operate in the country. The news comes as some respite to MTN who has suffered in recent years amid a stiff stance by the Nigerian government towards telecoms and tech companies who have been accused of reneging on tax obligations and contributing to fraud and cybercrime.

Shoprite restructures, cedes Ugandan market to Carrefour, withdraws from Madagascar

South African-based Shoprite, Africa's leading retail giant, has continued its restructuring process during September, withdrawing from its struggling operations in Madagascar and Uganda. In the latter case the gap left by the firm's exit has been absorbed by French-based Carrefour, a long time mainstay in Francophone markets only recently vying for market share in Anglophone Africa.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.