- within International Law, Environment and Antitrust/Competition Law topic(s)

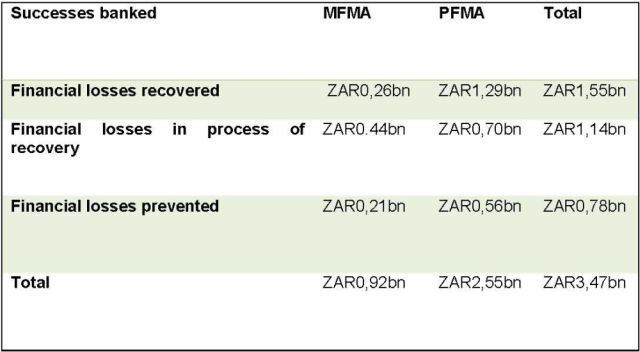

On Friday, 1 November 2024, the Office of the Auditor-General of South Africa ("AGSA") presented its annual report for the 2023-24 financial year to the Standing Committee on the Auditor General. The report revealed that AGSA was responsible for the recovery and prevention of ZAR3.47 billion in financial losses through its material irregularities process.

The Public Audit Act 25 of 2004 ("Public Audit Act"), as amended by the Public Audit Amendment Act 5 of 2018, now vests substantial enforcement powers in the AGSA, subject to procedural safeguards set out in the Material Irregularity Regulations, published in terms of the Public Audit Act. AGSA is empowered to take action against an auditee for:

"any non-compliance with, or contravention of, legislation, fraud, theft or a breach of a fiduciary duty identified during an audit performed under this Act that resulted in or is likely to result in a material financial loss, the misuse or loss of a material public resource or substantial harm to a public sector institution or the general public"

The enforcement powers vested in the AGSA entitle it to take several steps to recover losses and sanction officials, including:

- making a finding of material irregularity;

- making recommendations to the accounting officer (the Head of Department) or the accounting authority (board of directors);

- referring a material irregularity to the South African Police Service or any other law enforcement agency for investigation;

- ordering the accounting officer or authority to take remedial action, including recovery of losses from responsible officials; and

- issuing a 'certificate of debt' in circumstances where the accounting officer or authority fails to comply with remedial action, which requires the accounting officer or authority to repay the amount specified therein to the State.

According to the annual report, the AGSA identified 626 material irregularities for non-compliance and suspected fraud, resulting in:

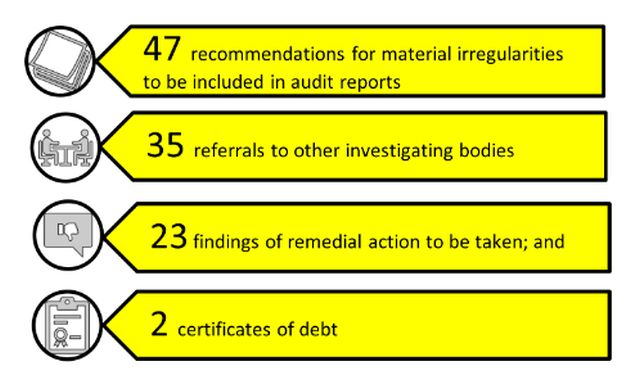

In terms of enforcement, AGSA reported that it issued:

Promisingly, the AGSA reported that it had recovered ZAR1.55 billion in financial losses, with another ZAR1.14 billion in financial losses in the process of recovery. The table below provides a helpful summary:

Although the scale of the recovery demonstrates the impact of the AGSA's new powers under the amended Public Audit Act, many questions of interpretation remain. For example, the Public Audit Act does not define or prescribe what should be considered a material loss, or how materiality should be determined or measured, leaving it to the professional judgement of the auditor instead of a prescribed objective threshold.

The absence of a definition, or guidance on the factors that weigh into the determination of when a loss is material, can lead to unintended consequences for decision-makers when exercising discretion. For example, in public procurement, evaluating tenders requires bid adjudicators to make an assessment of the proposals and to exercise discretion within the limits of the rules set out in the tender documents. Of course, tender requirements, including evaluation criteria, must be carefully and clearly articulated. However, it is not inconceivable that the AGSA may disagree with the institution's interpretation of a tender requirement or how it has been applied, and, consequently make a finding of a material irregularity, if the decision led to expenditure. This could occur on the basis of a value judgement from an auditing perspective, instead of the technical requirements of a bid or with due deference to the discretion of the decision maker.

The extended powers of the AGSA are a reminder to organs of state, including government departments and public entities, to remain vigilant in preventing non-compliance with, or contravention of, legislation, fraud, and theft while carrying out their functions. It also emphasises the need to ensure that procurement documentation and supply chain policies are clearly and precisely formulated, to avoid adverse audit findings made against them.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.