- within Corporate/Commercial Law and Finance and Banking topic(s)

- with readers working within the Securities & Investment industries

This note is the first in our series on "Corporate Governance for Start-ups and Early-Stage Companies."1 In this installment, we focus on the corporate law concept commonly referred to as the "business judgment rule" ("BJR"). To us, the business judgment rule is one of the most important provisions to be enacted in 2023 under the still relatively new Companies Law (Royal Decree No. (M/132) dated 01/12/1443H).

The objective of this series is to go beyond what a start-up or early-stage company might typically learn in an accelerator or an incubator to discuss instead some of the legal concepts that often take years for founders/entrepreneurs to grasp (or even learn about).

Generally speaking, the nature and subject matter of these concepts fall within the category of things we refer to as "potential traps for the unwary," which makes learning and understanding them all the more important, especially for entrepreneurs.

So, what is the "business judgment rule?"

And why is it important for start-ups?

To frame these queries in the proper light, let us consider the following scenario: It's Sunday or Monday; either way, the weekend is over. Everyone is back at work.

Invariably, the workplace chatter turns to the pivotal play from yesterday's match between Al Hilal (blue & white) and Al Nasser (blue & yellow).

And whether you don the blue & white or the blue & yellow, there are several things about the match everyone knows— "if only" Ronaldo had done this, that, or some other thing, then the outcome of the match would have been drastically different:

- If only Ronaldo had gone left to beat the defender, he would have scored easily in the last three minutes.

- If only Ronaldo had taken the shot off his right foot....

All nod in agreement.

And as far as office banter is concerned, Monday morning quarterbacking doesn't have much "real world" impact....

Although the concept of the "Monday morning quarterback" is a term coined in connection with American "football," it's nevertheless applicable across the sporting universe. A Monday morning quarterback knows everything (after the fact).

Unfortunately, this phenomenon is not restricted to sports talks. Monday morning quarterbacks are just as prevalent in the business world—with significantly greater potential downside repercussions.

For start-ups and early-stage companies, what that means in practice is that the shareholders (e.g. friends and family, seed money investors, venture capital investors, employee stakeholders) who invested with you may now believe you and the other members of the board could have done better in terms of deploying their initial capital.

And in all fairness, they are probably right to some extent—you and your board probably could have done better.

But in your defense, you know that you, your board, and your executive management all did the best you could under the circumstances, right? Shouldn't that count for something? Shouldn't you get the benefit of the doubt?

Fortunately, for both KSA entrepreneurs and businesses generally, "probably could have done better" is not the standard by which your conduct will be measured for corporate law purposes.

An old adage says that "hindsight is 20/20," meaning that in the rearview mirror, things are much clearer, and it's obvious for all the world to see what you should have done compared to what you actually did.

Bear this in mind: Between now and the full realization of Saudi Arabia's Vision 2030, tens of thousands of new companies/business enterprises will literally need to come online in the KSA. Many of these companies/businesses will be brand new, with boards and management having limited understanding of many aspects of corporate law.

Start-ups, generally, and tech start-ups, in particular, are inherently risky.

Investing in such companies is not for the faint of heart. Even seasoned venture capitalists understand that most early-stage companies will fail. However, out of these failures will come a healthier, more vibrant system overall.

Consequently, it behooves us to ensure that start-ups have the ability to fail in a system that does not penalize or impede the founders from starting new businesses.

So, in many ways, it is that right to fail, that right to make otherwise "constructive" decisions that do not necessarily turnout well; and that right and opportunity to develop and execute even inherently risky business strategies, that the BJR is intended to preserve.

For these reasons, we believe knowing, and understanding the BJR, particular for new companies, unseasoned boards/founders is of vital importance.2

THE BJR AND THE COMPANIES LAW

The BJR is codified as Article 31 of the Companies Law, which provides as follows:

The company's manager [or] board member shall be deemed to have fulfilled his duty in a decision he made or voted on in good faith if he satisfies each of the three conditions discussed in paragraphs (a), (b), and (c) below:

[Comment: The principle behind the BJR comes out of Delaware (USA) case law, which basically insulates members of a board of directors from liability for claims of breaching their fiduciary duties, provided they meet certain criteria.]

(a) Has no personal interest in the subject matter of the decision;

[Comment: The requirement to act in good faith under Shari'a extends to all business transactions. The Shari'a principle states that "there should be neither harming (darar) nor reciprocating harm (dirar)."3 This means that board members/managers are prohibited from making decisions that will harm the company or the shareholders.]

As subparagraph (a) stipulates, the manager or board member must not have a personal interest in the subject matter of the decision/vote.

This means that the board member or manager must not be acting with a conflicted state of mind/purpose.

Although not explicitly stated within the BJR, the presence of a conflict of interest arguably creates a counter-presumption that the board member or manager is not acting in good faith, at least with respect to a particular matter. 4

However, even the potential adverse impact of a conflict of interest can be mitigated by full disclosure and transparency on the part of the conflicted party.

(b) Understands and is familiar with the subject matter of the decision to an extent he deems reasonable according to the circumstances of the decision; and

[Comment: To meet his obligation under subparagraph (b) the board member/manager must understand and be familiar with the subject matter of the decision he is taking part in.]

Notice that subparagraph (b) imposes a "reasonable person" standard to assess the director/manager's level of conduct according to the circumstances.

Interestingly, however, we see that whether the board member/manager has acted reasonably is based on a standard of conduct wherein the board member/manager determines for himself whether he is acting reasonably based on the circumstances. In that regard, the BJR creates a strong presumption in the board member/manager's favor.]

(c) Believes firmly and rationally that the decision serves the company's interests.

[Comment: What this means in practice is that under the BJR, the burden of proving that members/managers breached their duty falls on the party bringing the action for breach against the board/management.]

CONCLUSION

From the moment an entrepreneur develops a "disruptive" concept and starts to raise money (or do other things to protect or exploit the concept), there is an incredibly steep learning curve to overcome. The potential for liability and exposure exists every step of the way, with each decision taken by the board or the management potentially subject to attack by stakeholders in the future.

To sum it up, the realities of life mean that for founders, directors, managers, etc., there will always be those who question your decision-making. The BJR is a powerful tool in the arsenal for overcoming these challenges. Understanding how to ensure that your actions and those of your board of directors support its application is critical.

NEXT INSTALLMENT

In Part 2 of this series, we will consider why a company's board of directors and committee meeting minutes can be a founder/entrepreneur's best friend or absolute worst enemy.

Footnotes

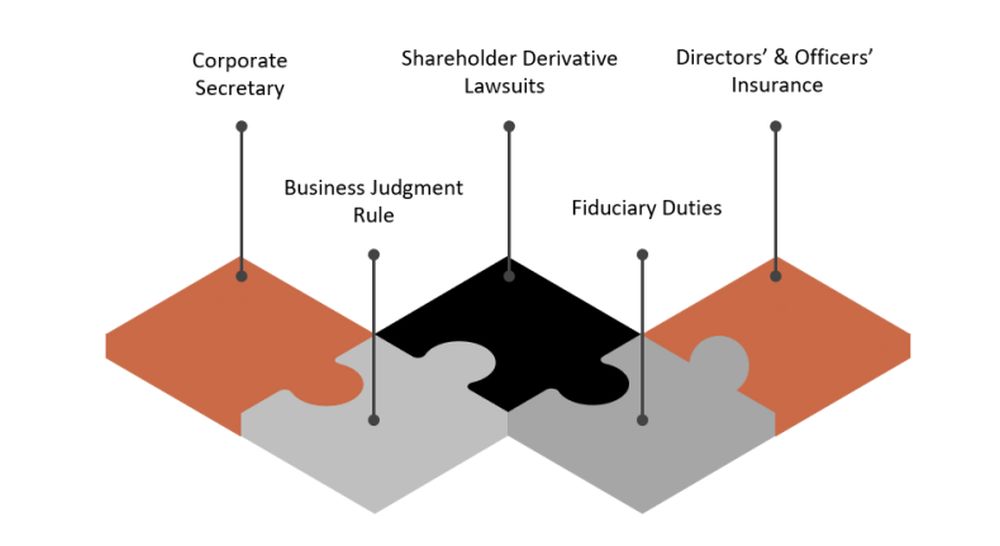

1. Our 5-part series covers the following: (1) business judgment rule; (2) shareholder derivative lawsuits; (3) the role and importance of board minutes of meeting; (4) fiduciary duties; and (5) directors' and officers' insurance.

2. Although some major transactions require the consent of stockholders as well as the approval of the board, the board generally has the power and duty to make business decisions for the corporation. These decisions include establishing and overseeing the corporation's longterm business plans and strategies and the hiring and firing of executive officers. Delaware (USA) law affords directors making such decisions a set of presumptions—known as the "business judgment rule"—that, so long as a majority of the directors have no conflicting interest (see "duty of loyalty," below) in the decision, a court will not later second-guess their decision if it is undertaken with due care and in good faith. The business judgment rule, which applies even if the business decision later turns out to have been unwise, is the centerpiece of Delaware corporation law. The Delaware Way: Deference to the Business Judgment of Directors Who Act Loyally and Carefully - Delaware Corporate Law - State of Delaware

3. Sunan Ibn Majah 2340, (Book 13)

4. See Article 26 "Duty of Care and Duty of Loyalty" of the Companies Law

Originally published by July, 2024

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.