The general VAT framework for intra-Community trade may not apply under the following regimes:

- Specific Regime for Distance Sales

- Specific Regime for Certain Persons (PRES)

- Specific Regime Applicable to the Supply of New Modes of Transport

a) Specific Regime for Distance Sales

According to this regime, for VAT purposes the supply of goods originally dispatched or transported from a different Member State is considered to have been made in the destination Member State provided that the following requirements are met:

- The dispatch or the transport of the goods is made by or on behalf of the seller.

- The recipients are the persons whose intra-Community acquisitions of goods are not subject to VAT by virtue of the content of the PRES Regime described below, or any other person who is not defined as a taxable person (unidentified business entities or individuals).

- The goods supplied are not covered by the Specific Regime Applicable to the Supply of New Modes of Transport described below.

- Goods which require installation or assembly. However, it is necessary to consider as taxable persons those who carry out operations and have a permanent establishment in the territory where VAT is applied for periods exceeding 12 months.

- Goods on which taxes have been paid in the Member State where dispatch or transport began in accordance with the Special Regime for used goods, works of art, antiques and collectors' items.

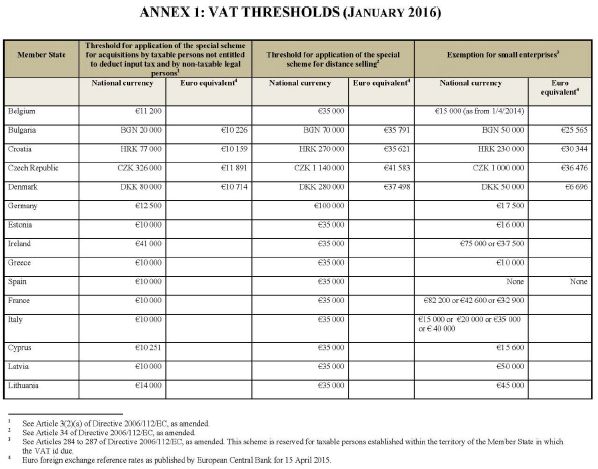

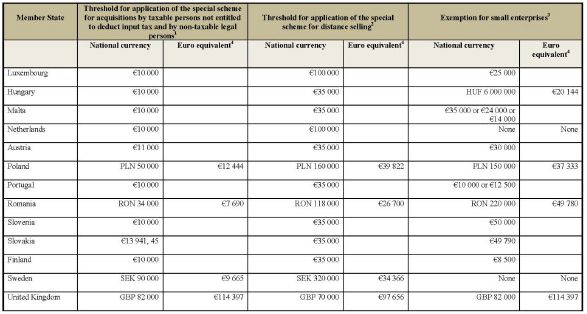

- The total value of goods in the previous calendar year exceeds €35,000 exclusive of tax, where supplies from one Member State are brought by the business entity or professional to another Member State in which VAT is applied.

- The Specific Regime for Distance Sales applies to supplies made during the calendar year in course once the threshold of €35,000 is surpassed.

It is also possible for the business entity in the Member State from which the sale is made to elect to pay VAT in Spain for the distance sales to Spain, without necessarily surpassing the limit of €35,000.

b) Specific Regime for Certain Persons (PRES)

Intra-Community acquisitions of goods made will not be subject to VAT in the following cases:

- Taxable persons covered by the Special Regime for agriculture, livestock and fishing, with respect to goods to be used in activities which are subject to this regime.

- Taxable persons who engage exclusively in operations which do not give rise to total or partial tax deductions.

- Legal entities who do not act as business entities or professionals.

However, the following limitations apply:

- During the calendar year in course, the total value of intra-Community acquisitions of goods must not exceed a threshold which the Member States shall determine but which may not be less than €10,000 or the equivalent in national currency. The total value of the intra-Community acquisitions of goods will be calculated exclusive of VAT due or paid in the Member State in which dispatch or transport of the goods begins.

- During the previous calendar year, the total value of intra-Community acquisitions of goods must not exceed the threshold determined by the Member States.

- The total value of the acquisition of goods from other Member States, not including the tax owed in those States, in the previous calendar year is less than the threshold determined by the Member States. VAT will not be applied in the calendar year in course until the threshold is reached.

c) Specific regime applicable to the supply of new modes of transport

The purpose of this regime is to apply VAT in the destination Member State in relation to acquisitions of new modes of transport.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.