How will it impact you?

General Outlook

Fiscal Measures

- Income Tax and Duty

- VAT

INCOME TAX AND DUTY

- During 2021, the first 100 hours of overtime was being taxed at 15% for those who do not hold a managerial level and whose basic pay does not exceed €20,000 annually. As from 2022, the 15% tax will apply on the first €10,000 one makes from overtime pay.

- As from 2022 (up to 2026), pensioners who are still actively employed, shall not be taxed on their pension income.

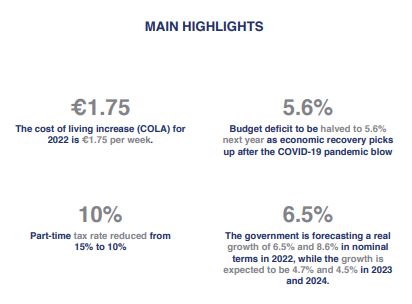

- The income tax rate on part time work will reduce from 15% to 10%.

- The income tax rate applicable to artists shall be that of 7.5% as from basis year 2022.

- For another year, employees earning less than €60,000 shall receive an ex-gratia tax refund of up to €95. The highest income earners below the €60,000 bracket would receive a refund of €45:

INCOME TAX AND DUTY

- The tax due on the first €200,000 on the value of properties bought or sold will be reduced by 50% if these were rented for at least 10 years to tenants eligible for the rent benefit given the Housing Authority. No tax will be charged if the property is then sold to the tenant.

- A temporary scheme will be introduced for enterprises which were hardly hit by the pandemic. Group of companies who did not avail from capital allowances during 2020 and 2021, due to losses incurred in the pandemic can now apply to have this deduction against any taxable income from other companies, which are part of the same group, for 2021.

- Amnesties on penalties for unpaid taxes will no longer be the norm. As from 1 June 2022, the interest rate on unpaid tax and VAT will be 7.2% annually.

- The reduced stamp duty rate from 5% to 1.5% on the transfer of family business from parent to child, which was introduced 3 years ago, will be extended again.

- A new incentive shall apply to those individuals who buy property that has been built more than 20 years ago and has been vacant for over 7 years; properties that are situated in UCA as well as new properties that are built in typical Maltese architecture. When acquiring these types of properties, no capital gains tax and no stamp duty shall be paid on the first €750,000 of property value. This scheme shall also apply to those who are currently under a promise of sale and has not yet entered the final deed. Furthermore, 1st time buyers of these type of properties shall benefit from an additional grant of €15,000. This grant shall double to €30,000 in the case of 1st time buyers acquiring the above-mentioned properties situated in Gozo. These measures shall come into effect as from 12th October 2021 for a period of 3 years.

- The stamp duty exemption for first-time buyers, second-time buyers on the acquisition of their residential property and acquisition of property situated in Gozo have been extended once again.

VAT

- As from 12th October 2021, those individuals acquiring these type of properties (built more than 20 years ago and has been vacant for over 7 years; properties that are situated in UCA as well as new properties that are built in typical Maltese architecture) as well as those individuals who already own such type of properties, shall benefit from a grant on the VAT paid up to a maximum of €54,000 on the first €300,000 costs involved in refurbishing and restoring such properties. This also applies to those individuals who already acquired such property and is currently performing refurbishing works.

- VAT shall continue to be refunded on the purchase of bikes and e-bikes while assistance shall continue to be provided for the purchase of bikes, scooters, pedelecs and bicycles using electric motors. For those deciding to convert their vehicles from consuming petrol to consuming gas, the scheme still applies.

To view the full article please click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.