Introduction

The Vietnamese economy is one of the fastest growing in the Asia-Pacific region, averaging close to 7% growth over the past decade.1 Vietnam was one of the very few countries globally to achieve economic growth in Covid-disrupted 2020, recording an increase in GDP of 2.9%.2

Home to a population of close to 100 million, Vietnam's energy needs are substantial and ever-increasing. Consuming more energy per unit of economic output than the Philippines, Malaysia, Indonesia and India, Vietnam is one of the world's most energy-intensive economies.3 It is expected that Vietnam's electricity demand will continue to increase at an average rate of up to 9% annually over the next decade.4

Vietnam's onshore, nearshore and offshore wind power potential is particularly significant, and is attracting diverse global interest, including recent characterization by the World Bank as world class.

This guide seeks to provide investors with a brief overview of the current Vietnamese wind energy market, exploring the primary opportunities and challenges from a legal perspective.

Current Policy Settings and Market Overview

As a means to avoid anticipated mass energy shortfalls by as early as 2030, recent draft versions of the National Power Development Master Plan VIII (2021-2030 with a vision to 2045) (PDP8) confirm that Vietnam is seeking to attract up to US$128 billion in energy investments, including US$32 billion in grid infrastructure, for the period from 2021 to 2030.5 PDP8 is expected to be released in Q4 2021, and solidify Vietnam's commitment to wind energy and renewables more broadly. Current draft wind targets aim for up to 12 GW by 2025 and 19 GW by 2030, inclusive of both onshore and offshore asset classes.6 PDP7 (revised edition) previously set wind capacity targets of up to 2 GW by 2025 and 6 GW by 2030.7

Such commitments are further supported by Resolution 55, Vietnam's other core energy policy instrument along with PDP8, providing strategic guidance on the development of the energy sector to 2030 with a vision to 2045.8 Resolution 55, released by Vietnam's Politburo in early 2020, sets an objective to achieve a 25-30% renewables ratio by 2045,9 prioritizing the development of the offshore wind sector, amongst other asset classes, in pursuit of this objective.

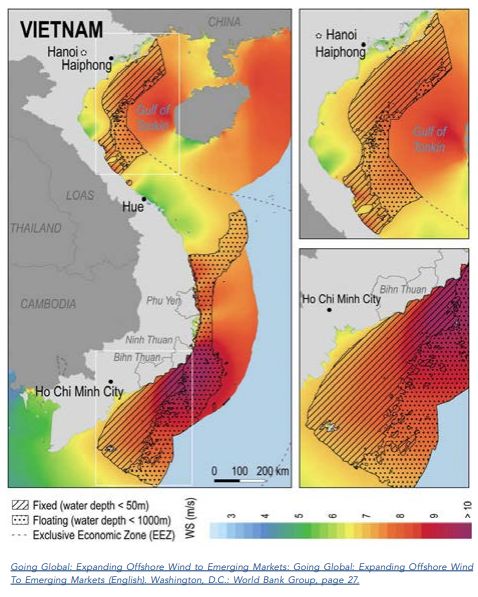

Vietnam's topography and climate naturally lends itself to wind power development, with more than 3,000 km of coastline, average annual wind speeds of 6m/s (as high as 10m/s in the southeast provinces of Binh Thuan and Ninh Thuan), and favourable offshore water depths.10 Natural conditions are most attractive in the southeast regions and it is anticipated that a 500 kV transmission line will be installed to cater for future offshore wind development in these regions.11 Grid upgrades are also necessary and expected in the northern regions around the Gulf of Tonkin, catering for increased capacity flowing to the greater Hanoi area.12 Significantly, the latest World Bank forecasts indicate a technical potential for offshore wind alone of up to 475 GW (within 200 km), inclusive of both floating and fixed installations,13 whilst Wood Mackenzie expects Vietnam to account for 66% of total new wind capacity (onshore and offshore) to be added in Southeast Asia to 2030.14

As at June 2021, government figures confirm that close to 600 MW were in operation, 130 projects signed power purchase agreements (PPAs) with Vietnam Electricity (EVN), with approximately 5.6 GW of those projects on track to achieve commercial operation prior to the feed-in tariff deadline of 1 November 2021.15 Thirty-five potential offshore wind projects were also listed in the latest draft PDP8, with several 3 GW+ projects proposed,16 although many of these are very early-stage and subject to further approval processes.

Footnotes

1 The World Bank Group, Macro Poverty Outlook, East Asia and the Pacific (Vietnam), April 2021.

2 Ibid.

3 Le, P.V., Energy Demand and Factor Substitution in Vietnam: Evidence from Two Recent Enterprise Surveys, Journal of Economic Structures, 8:35 (2019); The World Bank Group, Energy Intensity Level of Primary Energy, 2019.

4 Fitch Ratings, Fitch Affirms Vietnam Electricity at 'BB'; Outlook Stable, 15 September 2020.

5 Ministry of Industry and Trade, Draft Proposal (Version 3, 22 February 2021), National Power Development Master Plan VIII (2021-2030 with a vision to 2045).

6 Ministry of Industry and Trade, Draft Proposal (Version 3, 22 February 2021), National Power Development Master Plan VIII (2021-2030 with a vision to 2045).

7 Decision on the Approval of the Revised National Power Development Master Plan for the 2011-2020 Period with a Vision to 2030, Decision No. 428/QD-TTg, 18 March 2016.

8 Resolution of the Politburo Regarding the National Energy Developmental Strategy of Vietnam to 2030 with [an] Outlook to 2045, Resolution No. 55-NQ/TW, 11 February 2020.

9 Ibid.

10 The World Bank Group, Going Global: Expanding Offshore Wind to Emerging Markets, October 2019.

11 Ibid.

12 Ibid.

13 Ibid.

14 Wood Mackenzie, Southeast Asia's Wind Power Needs US$14 billion [of] New Investments by 2030, 22 September 2020.

15 EVN Official Letter to Ministry of Industry and Trade, No. 3331/EVN-TTD, 14 June 2021.

16 Ministry of Industry and Trade, Draft Proposal (Version 3, 22 February 2021), National Power Development Master Plan VIII (2021-2030 with a vision to 2045).

To view the full article click here

Visit us at mayerbrown.com

Mayer Brown is a global legal services provider comprising legal practices that are separate entities (the "Mayer Brown Practices"). The Mayer Brown Practices are: Mayer Brown LLP and Mayer Brown Europe – Brussels LLP, both limited liability partnerships established in Illinois USA; Mayer Brown International LLP, a limited liability partnership incorporated in England and Wales (authorized and regulated by the Solicitors Regulation Authority and registered in England and Wales number OC 303359); Mayer Brown, a SELAS established in France; Mayer Brown JSM, a Hong Kong partnership and its associated entities in Asia; and Tauil & Chequer Advogados, a Brazilian law partnership with which Mayer Brown is associated. "Mayer Brown" and the Mayer Brown logo are the trademarks of the Mayer Brown Practices in their respective jurisdictions.

© Copyright 2020. The Mayer Brown Practices. All rights reserved.

This Mayer Brown article provides information and comments on legal issues and developments of interest. The foregoing is not a comprehensive treatment of the subject matter covered and is not intended to provide legal advice. Readers should seek specific legal advice before taking any action with respect to the matters discussed herein.