- within Criminal Law and Corporate/Commercial Law topic(s)

Two broad themes are currently emerging in relation to European private equity real estate financing.

First, market commentary has noted that €150 billion of this finance is due to mature by 2025 – the "wall of credit".

Secondly, the recent trajectory of rising interest rates, and likely continuance of a new interest rate norm materially higher than rates prevailing in recent years, is likely to lead to increased pressure on current interest-cover financial covenants and therefore ultimately debt servicing. It is also possible that market correction in real asset valuations plus a tightening credit environment separately contribute to pressure on loan-to-value norms.

In conjunction with this need to refinance and / or to address increasing pressure on financial covenants of existing structures over the coming months, three options are likely to present themselves to sponsors and finance parties:

- increase equity investment, possibly through preferred stock

- introduce second ranking credit, such as second lien, stretched mezzanine finance or PIK financing, and / or

- realise investments, whether on a voluntary or enforcement basis.

The latter will be of interest both to secured finance parties seeking to obtain repayment through security enforcement and their asset-purchase counterparts, but also to special situations / tactical opportunity investors in secured, non-performing loan portfolios.

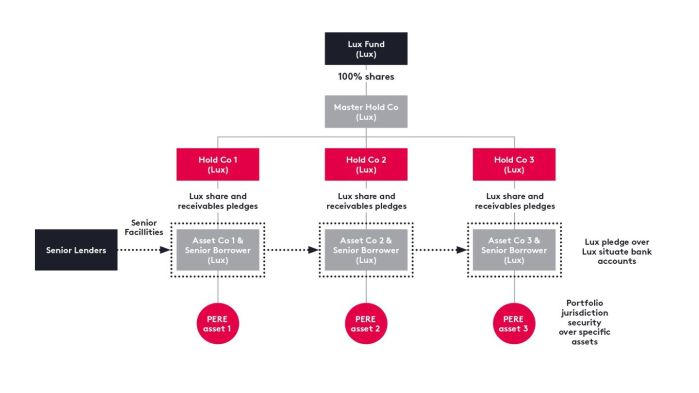

Given the inherently multi-jurisdictional character of cross-border investment and its related financing, prior to implementing any such actions, a thorough review of the efficacy of existing security and the relative merits of enforcing at different levels of the holding structure will be apposite.

In many cases, this analysis will bifurcate between either enforcement at the level of the real assets themselves or at the level of security over the holding structure. The merits of either approach will include account of the available enforcement methods, speed of execution, risk, degree of Court / insolvency office-holder / other third party involvement and costs under the respective options.

European PERE - simplified structure

Options

The secured collateral at the level of the real assets, governed in each case by the applicable law of (or applied by) each relevant, portfolio jurisdiction could include: real estate mortgages or hypothecs; charges or pledges over bank accounts, insurance claims, hedging arrangements, receivables and other book debts; plus in relation to operating businesses, intellectual property, fixtures and fittings and goodwill.

In contrast, at the Luxembourg holding structure level, the secured collateral in the context of cross-border, private equity real estate investment, typically comprises: shares in Luxembourg holding companies; the Luxembourg bank accounts of such companies; and intra-group debt financing receivables payable by such companies and / or governed by Luxembourg law (Luxembourg holding collateral).

All such collateral will be secured under a single applicable law and will provide a single point of enforcement to take control of all capital value in, and income deriving from, the downstream structure – provided the secured lender also holds first ranking security with structural priority at the asset level, to avoid being precluded from access to that value by a competing creditor with security at the level of, or at least closer to, the real assets.

Although a variety of Luxembourg corporate, limited partnership and alternative investment vehicles exist, the vehicles most widely used in such holding structures are sociétés à responsabilité limitée (Sàrl), which are private, limited liability companies. This briefing refers to interests in or held by such Sàrl and to security over the entire issued share capital, rather than over a limited proportion only, as is market norm in these structures.

Luxembourg security

The security over this Luxembourg holding collateral will typically take the form of a pledge, governed by Luxembourg law, under the Luxembourg Financial Collateral Law 2005 (Financial Collateral Law). The alternative, but less widely used security interest, available under the Financial Collateral Law is an assignment by way of security.

Both provide real, proprietary security interests. The difference is that the assignment by way of security transfers ownership of the secured collateral to the secured party at the creation of the security interest (subject to an obligation of re-transfer on discharge). In contrast, the pledge does not transfer ownership to the secured party at the creation of the security interest, ownership remains with the pledgor but subject to the pledgee's various rights, including the right to appropriate the asset on any subsequent enforcement.

The Financial Collateral Law was enacted with the express legislative policy of providing enhanced usability for secured financing of investment structures. This forms the continuing judicial policy in this area.

As a result, the creation of valid security interests, enforceable against potentially competing third parties (whether other creditors or insolvency office-holders) is straightforward. Security can be created over both present and future collateral pursuant to a written pledge agreement.

In the case of pledges over shares issued by a Sarl, perfection is achieved by joining the Sarl to the pledge agreement (by way of notice and acknowledgement) plus the notation of the creation of the pledge by the Sarl on its internal share register. Similarly, pledges over intra-group financing receivables are perfected by joining the obligor of those receivables to the pledge agreement by way of notice and acknowledgement. In relation to bank accounts, notice of the pledge, and acknowledgement of that notice, need be exchanged with the relevant account bank. In practice this will be done on the standard documents of the particular account bank.

No public registration, filings or notarial involvement in Luxembourg is required or relevant. Nor is any stamp duty or similar transfer tax levied by Luxembourg on such transactions.

Collateral usage

The Financial Collateral Law recognises the validity of contractual flexibility for the parties as regards the usage of the secured collateral during the existence of the pledge, prior to any enforcement. The parties are therefore free to agree to whatever usage, by either of them, is commercially appropriate, without this impacting on the validity of the security interest in any way.

In relation to share pledges, standard market practice is therefore for the pledge agreement to provide that voting rights attaching to the collateralised shares are exercisable by the pledgor until the occurrence of a continuing event of default. From that time, it is usual to provide that the right to exercise such voting rights vests in the pledgee only, although variations on this theme are seen from time to time.

Events of default

The events of default which may trigger enforcement action are also a matter of contractual flexibility and will be agreed as appears commercially appropriate to the parties at the time of entering into the financing. In practice these events of default are often incorporated into the pledge agreement by reference to the credit facility agreement. It is therefore possible, to agree a range of events which may constitute a default, presenting the option of enforcement.

Security enforcement

Following the occurrence of a relevant event of default, the availability to the secured party of enforcement action is also a matter of contractual flexibility to be agreed between the parties. It is standard to cross-refer to the occurrence of a continuing event of default as set out in the credit agreement. There is no statutory requirement to accelerate the underlying secured obligations prior to enforcement. However, the secured parties' duties (please see below) do require enforcement to be effected in good faith and for the purpose of repaying the secured obligations, which is likely to imply acceleration at an appropriate time.

Whilst the parties may decide to agree contractual cure periods, possibly tailored to the varying seriousness of specific types of default, there is no statutory cure or "grace" period at law. Nor is there any applicable statutory moratorium on enforcement of security interests under the Financial Collateral Law. Standard market practice is to disapply any requirement for prior notice to the pledgor (or any other party), although in practice it may often be appropriate to make written demand on all transaction obligors in respect of all available primary payment obligations as well as guarantees under all applicable laws.

The standard mechanisms of enforcement include:

- private appropriation of the secured collateral, either to the secured party or to a third party

- private sale of the secured collateral under "normal commercial conditions"

- public sale / auction under the aegis of the Luxembourg stock exchange, appropriate in relation to listed securities

- court-ordered transfer of title, and / or

- set off against the secured obligations.

In practice, private appropriation and /or private sale are the most frequently utilised mechanisms. Both are out-of-Court mechanisms carried out directly by the secured party, not through the agency of a receiver, administrator or similar officer.

In practice, appropriation of secured shares or receivables collateral is effected by written notice to the underlying company. Such notice constitutes the transfer of title to the collateralised shares and receivables without requiring further action by or on behalf of the underlying company (or any other party). From that time, title to the collateralised shares vests in the secured party who is then able to exercise all associated shareholder voting rights, including to change the composition of the board of directors of the underlying company. The new board, appointed by the secured party will then exercise control over the business and assets of the company (subject to the secured parties' other security) and therefore indirectly over all assets held downstream in the structure.

It is usual to provide contractually that such private appropriation or private sale must be at the fair market value of the collateral. Market norms are that such valuation be carried out by an independent, external and statutorily approved auditor, appointed by the secured party, and applying a standard multi-criteria valuation methodology under a recognised set of accounting principles (either IFRS or, if different, the most relevant, generally applied accounting principles). A variation on this theme may see an investment bank act as the independent valuer, which may be relevant in the rare cases of enforcement over listed securities.

Valuation may be carried out either prior to, or following appropriation (or sale), albeit with effect as at the time of appropriation (or sale). Valuation following appropriation will often allow expeditious action to take control of the structure, followed by valuation at a more methodical pace and with the benefit of access to the books and records of the company whose issued shares are collateralised, resulting in a better informed valuation.

Similarly, appropriation of secured bank accounts is effected by written notice to the account bank, blocking any further usage of the secured account(s) by the pledgor and notifying the account bank that usage of the balance credited to the secured account(s) now lies exclusively with the pledgee.

As in respect of the creation of the pledges, no public registration, filing or notarial involvement is applicable. Nor is any stamp duty or similar transfer tax applied in Luxembourg.

Duties and protections

Good faith is a duty on the parties, implied by law in relation to all Luxembourg contracts, including pledge agreements. This duty applies to pre-contractual negotiations, contractual performance and to enforcement by the secured parties. In addition, enforcement by private sale must occur on "normal commercial conditions" and any enforcement whose sole intention is to cause harm to the pledgor would constitute a breach of duty on the part of the secured party.

The other principal protection for the pledgor (and any other creditors of the pledgor's estate) is the contractual fair valuation duty, carried out by an independent, expert valuer according to generally applicable accounting principles, noted above. If the valuation is subsequently found to be inadequate on complaint to the court, the remedy is damages payable by the secured party, not revocation of the enforcement action.

Market norms are for the pledge agreement to provide contractual protection for the secured party from any liability occasioned by the exercise of powers under the pledge agreement, provided such powers are exercised without fraud, gross negligence (faute lourde) or wilful misconduct.

In relation to the enforcement of share security, the underlying company and its directors will be on notice of the share pledge and the pledge should be notated on the company's share register (with a copy of that updated register being provided as a condition of closing the original financing transaction). Following notification of appropriation on enforcement by the secured party (or sale to a third party), non-compliance with such notification by or on behalf of the underlying company may risk liability in delict, the Luxembourg law equivalent of tort in English law.

Priority over insolvency procedures

Security interests validly created under the Financial Collateral Law prior to the commencement of any insolvency procedure under either Luxembourg law or non-Luxembourg law, are enforceable in Luxembourg against the insolvency officeholder. In the absence of fraud, there are no applicable security "hardening periods" in respect of security interests under the Financial Collateral Law. Under generally applicable law, such "hardening periods" do exist but are disapplied by the Financial Collateral Law from security interests created under it.

Under the EU Insolvency Regulation, security interests validly created under the law of one EU member state are automatically recognised and accorded priority in insolvency proceedings commenced under the law of any other EU member state. The Insolvency Regulation does apply in relation to non-EU member states.

Secured collateral under the Financial Collateral Law is excluded from the pledgor's insolvency estate, although in practice, it may be advisable to act expeditiously to establish practical control over the collateral prior to any such appointment being made.

Disapplication of insolvency set-aside risk

Under Luxembourg law, the starting point is certain transactions entered into between the onset of effective cashflow insolvency and any subsequent commencement of an insolvency procedure may be at risk of being void and / or set aside on an application to the Court. The maximum period of risk is generally up to six months prior to the commencement of insolvency proceedings.

However, in the absence of fraud, all such set aside risks are disapplied by the Financial Collateral Law from security interests created under it.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.