We saw in last year's GBCI report that many governments had introduced measures to alleviate pressure on businesses during the pandemic. These included tax exemptions, increasing employee rights and the acceleration of digital reporting. The changes were introduced to lessen financial or administrative stresses but often led to higher complexity for businesses.

As the world emerges from the pandemic, we have found that some of these changes are here to stay but many were short term, adaptive measures which have been, or are in the process of being, reversed. This has once again introduced short-term complexity for businesses. For example, in Brazil, which ranked top in the 2021 and 2022 GBCI rankings, complexity has been at an all-time high over the last two years due to the introduction and subsequent reversal of pandemic-related regulations.

Pandemic tax exemptions reversed

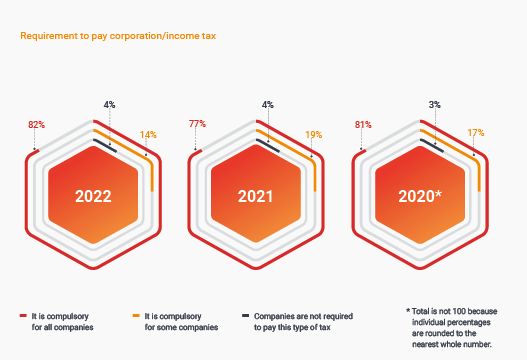

Last year we saw a reduction in the number of jurisdictions where all companies were required to pay corporation/income tax. GBCI 2022 shows that this was a short-term measure, with the proportion of jurisdictions where it is compulsory back up to 2020 levels.

New Zealand's government was particularly progressive and supportive in its response to Covid-19, introducing a variety of measures to support businesses. For instance, the authorities introduced the ability for businesses to pay outstanding tax in instalments, or have it written off completely in the case of serious hardship. These measures are still in place but will most likely come to an end.

Requirement to pay incorporation/income tax, 2020-2022

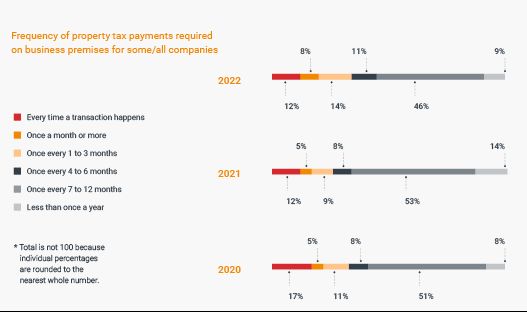

Property tax payments on business premises also reduced in frequency during the peak of the crisis. In 2021, just over a quarter of jurisdictions required some or all companies to pay the tax at least every three months. This compares to one in three jurisdictions in 2020 and has since rebounded to 2020 levels.

Frequency of property tax payments required on business premises for some/all companies, 2020-2022

Temporary measures to protect employees in 2021

At the height of the pandemic, many businesses were considering reducing their workforce due to decreased revenues and fears for survival. Governments around the world identified that it was crucial for unemployment levels to remain as low as possible. As such, many introduced temporary relief programmes such as the 'furlough' scheme in the UK, or 'chômage partiel' in France, to encourage businesses to keep their staff employed.

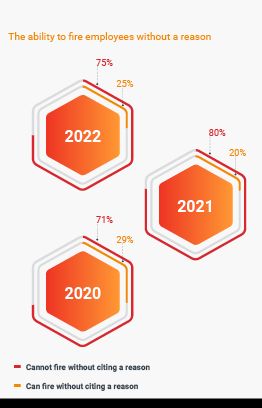

As well as these supportive schemes, some governments went a step further, introducing legislation to force the hand of companies. In 2021, we saw employee protection rights temporarily strengthened, with the ability to fire an employee without citing a reason reducing to only one in five jurisdictions.

The ability to fire employees without a reason, 2020-2022

In Italy, emergency pandemic laws called the 'Cura Italia' came into force which made it illegal to fire any employee, even with a valid reason. In South Korea, the government made it practically impossible to fire employees. This, coupled with South Korea's maximum 52-hour working week, makes the business environment more complex and legislation around firing employees remains strict in 2022. The Labour Standards Act (LSA) mandates that any company with more than five employees must have a fair reason for terminating an employee. It is also mandated that businesses pay redundancy to any fired employees.

The peak of the pandemic saw an increase in companies offering, or being required to offer, paid sick days to their permanent staff, from 89% of jurisdictions in 2020 to 95% in 2021. This year, we've seen pay for sick days drop back down to 90%, meaning that in one in ten jurisdictions permanent employees don't receive pay when off work due to illness.

The Danish government reimbursed companies for their employees' sick days. This proactive measure led to an increased administrative burden to recoup funds, and in extreme cases led to an increase in fraud and subsequent fines.

Some financial benefits were deprioritised during the pandemic. The requirement for companies to offer pension funds was relaxed, dropping from 58% of jurisdictions in 2020, to 48% in 2021. This was a temporary change, and it has since rebounded to pre-pandemic levels.

Flexible working will outlive the pandemic

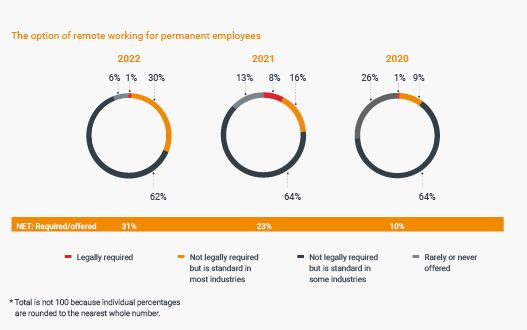

The pandemic has caused a major and long-term shift in working patterns. Many governments mandated the closure of offices in the initial stages of the pandemic, and workers had to set up office at home. In 2021, we saw almost one in four (23%) jurisdictions offering, or being legally required to offer, the option for remote working as a benefit for permanent employees, up from 10% in early 2020.

While offices are reopening or have reopened, the trend for remote working has increased, to the point where it's legal or standard in most industries in 31% of jurisdictions. It is evident that employees have adapted well to working from home and shown that a remote workforce can be effective, even beneficial. Businesses have recognised the potential for overhead cost savings, and that flexible working arrangements can be necessary to retain their

The option of remote working for permanent employees

The rise of remote working does have tax implications, however. In the USA, if an employee is working in a different state to that in which the company is registered, they must adhere to tax regulations in the state in which they are working. This was not the case during or before the pandemic, but post-pandemic legislation has been passed because remote working is here to stay.

Temporary shift to more internationalised regulations

During the pandemic, many governments temporarily relaxed rules when it came to director residency and share transfers from one entity to another.

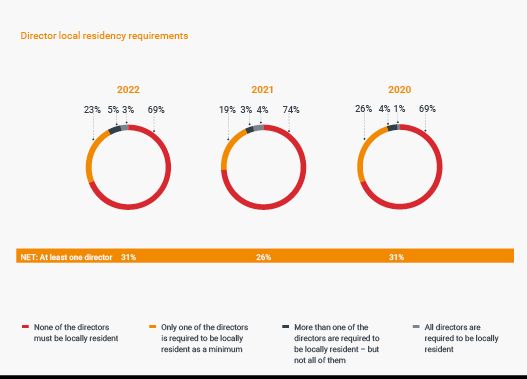

In 2021, we saw an increase to 74% of jurisdictions not requiring any company directors to be locally resident. Yet in 2022, this returned to the same level as 2020, with only 69% of jurisdictions allowing this – so nearly a third of jurisdictions now require at least one company director to be a local resident.

In Sweden, having a local resident as a company director brings clear benefits, including driving business simplicity. BankID is a key aspect of operations, which only local residents with a Swedish personal number are able to access. Opening a bank account, making payments, logging-in to digital mailboxes and receiving mails from authorities all require a BankID.

Director local residency requirements

In 2021 there was also a temporary relaxation of company shares being freely transferred from one entity to another. In 2021, only 5% of jurisdictions didn't allow this, yet 2022 has seen a return to 2020 levels, with 12% once again restricting the free transfer of shares.

Shares being freely transferred from one entity to another, 2020-2022

Digitalisation of reporting accelerated and permanent

The final major change brought about by Covid-19 is the accelerated digitalisation of reporting processes. Many countries were forced to adjust their digitalisation trajectories, and this has yielded varied levels of success. For example, in Turkey, the expediting of digitalisation has led to divergent approaches from different authorities, rather than the adoption of centralised processes, therefore causing confusion and overcomplication for companies that are required to use them. There is no evidence to suggest the centralisation of these platforms will happen soon.

In Greece, where digitalisation has been introduced, business complexity has seemingly shifted into the digital sphere, rather than being reduced by it. For instance, organisations can in theory incorporate a business online. However, this process must conform to an online template, and if any circumstances arise that require deviation from this template, business representatives will need to visit a notary in person. Only an estimated 10% of businesses have been able to incorporate using the online template with no changes. So, even though the effort to reduce the complexity is there in theory, in practice it's not working for 9 out of 10 users.

At the other end of the spectrum, Jersey's digitalisation journey has been a success, reducing the need for face-to-face interaction between businesses and government bodies, making doing business significantly easier.

The GBCI

Explore the Global Business Complexity Index rankings, analysis and global trends to help you find your path to growth, amid the complexity of corporate compliance.

To download and read the report in full, visit the Global Business Complexity Hub today.

To find out more about the drivers of business complexity in the jurisdictions that matter to you, why not explore our Complexity Insights Dashboard?

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.