The Karachaganak field (also known as Karachaganak) is one of the largest oil and gas fields in the world, located in the western part of Kazakhstan. This field is a joint project between the Government of the Republic of Kazakhstan and several international oil and gas companies.

Given that Karachaganak is one of the largest and most important projects in Kazakhstan, for regulating the distribution of production and revenue from this field, the Final Production Sharing Agreement on the Joint Development and Production Sharing of the Karachaganak Petroleum and Gas Condensate Field ("FPSA") was signed between the project participants on November 18, 1997. It should be noted that the FPSA played a crucial role in ensuring stability and predictability of activities at the field for project participants. Specifically, it guaranteed the participants the stability of legislation, meaning that the legal acts in effect at the time of the FPSA's conclusion would continue to apply.

Furthermore, to resolve contentious issues arising during the implementation of the FPSA, the Government of the Republic of Kazakhstan approved instruction No. 1525 on the tax regime of the FPSA ("Instruction") on December 13, 2011. This Instruction regulates the taxation of entities involved in the Karachaganak project.

Interestingly, based on the FPSA and the Instruction, the aforementioned legislative stability to a certain extent also applies to persons who are neither subsoil users nor even participants in the FPSA. Given the insufficient awareness of business entities regarding the Instruction and the customs aspects of the FPSA, this circumstance, in turn, entails risks for such persons in terms of additional customs duties and penalties.

For the purposes of tax and customs administration of persons involved in the Karachaganak project, paragraph 1 of the Instruction defines the term "Subcontractor". This term refers to an individual or entity that has a relationship with a party to the FPSA, a company created by it, or its legal successor (the "Contractor") for the procurement of goods and services related to activities under the FPSA. In other words, this refers to an entity that has entered into any civil contract with the Contractor for the provision of services, performance of works, and/or supply of goods for the purpose of carrying out oil and gas operations at the Karachaganak field.

Further, paragraph 115 of the Instruction stipulates that the Contractor and its Subcontractors shall pay customs duties in accordance with the Decree of the President of the Republic of Kazakhstan, having the force of law, dated July 20, 1995, No. 2368 "On Customs Affairs in the Republic of Kazakhstan" ("Customs Affairs Decree").

The above provision is consistent with paragraph 1 of art. 563 of the current Customs Code1, according to which, to legal relations that arose in the field of subsoil use (fuel and energy sector) in the Republic of Kazakhstan before the entry into force of the Customs Code and arising after its entry into force, the customs legislation of the Republic of Kazakhstan is applied, in accordance with which the relevant contracts.

Section 19.7 of the FPSA also specifies that the Contractor and Subcontractors shall pay customs duties in accordance with the Customs Affairs Decree.

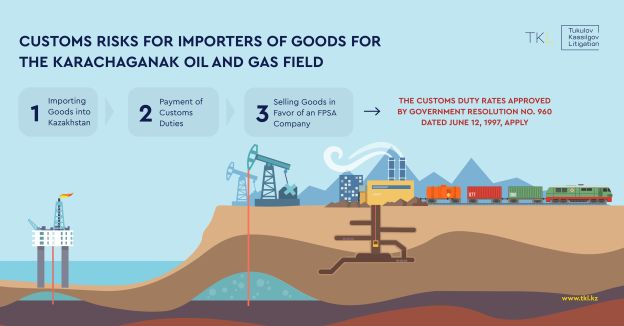

Meanwhile, in accordance with Article 110 of the Customs Affairs Decree, customs duty rates on imported goods were established by the Government of the Republic of Kazakhstan. In this regard, for the purposes of the FPSA, the customs duty rates approved by the Government of the Republic of Kazakhstan in Resolution No. 960 dated June 12, 1997, apply.

Thus, customs relations arising from transactions between Contractors and third parties are subject to the customs legislation of the Republic of Kazakhstan that was in effect at the time the FPSA was concluded.

For example, if a local LLP, which is neither a subsoil user nor has any relationship to the FPSA, engages in the trade of devices for measuring or controlling quantities of heat, sound, or light, which it itself imports into Kazakhstan, then under general rules, the LLP is obliged to pay customs duties in accordance with the Order of the Minister of National Economy of the Republic of Kazakhstan dated February 9, 2017, No. 58, at a rate of 0%.

However, if the LLP sells the same goods to KPO (Karachaganak Petroleum Operating B.V.), then in this case, customs duties for the mentioned goods should be paid at a rate of 10%, as determined by Government Resolution No. 960 of June 12, 1997.

Ignoring the aforementioned customs regulatory specifics by suppliers when interacting with FPSA companies results in them being subject to retroactive assessment of unpaid customs duties and penalties following customs inspection.

As demonstrated by the judicial practice of 2022-20232, the customs risks described in this article remain relevant for businesses. It is noteworthy that courts have established a consistent stance on the applicability of special customs duty rates for the import of goods for the Karachaganak project.

Given the above information, importers of goods into Kazakhstan should be aware that supplying goods (that could be used for the purposes of the FPSA) to any of the FPSA parties, their subsidiaries, or successors implies an obligation to apply the customs duty rates established by Government Resolution No. 960 dated June 12, 1997. Failure to adhere to this specific customs duty rate when importing goods that will be used for FPSA-related activities could result in substantial retroactive assessments of customs duties.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.