- in United States

- in United States

- within Real Estate and Construction, Law Department Performance and Criminal Law topic(s)

- with readers working within the Law Firm industries

1. General and Contractual

1.1 What are the typical structures available for financing the purchase of an aircraft?

In a wet lease arrangement, the lessor provides not only the aircraft but also the crew, maintenance, insurance, and other operational services to the lessee. Wet leases are often used for short-term capacity needs, such as seasonal fluctuations in demand or aircraft maintenance downtime.

The Nigerian Civil Aviation Regulations 2015 (NCAR) provides for dry lease, wet lease, damp lease and interchange operations. It further mandates that holders of air operation certificates who intend to borrow or lend aircraft between themselves must obtain prior approval from the Nigerian Civil Aviation Authority (NCAA).

In the case of a finance or capital lease arrangement, the lessor acquires the aircraft from a manufacturer, which it in turn leases to an airline or other lessees. The lessee also assumes most of the risks and rewards of ownership. The lease is usually structured like a loan, with fixed payments covering both principal and interest.

A leveraged lease resembles a finance lease, but in a leveraged lease arrangement, lenders extend loans to the owner or lessor to cover a significant portion of the aircraft's acquisition cost, while the remaining balance is covered by the owner. The owner utilises the lease payments to repay the loans and fulfil its commitments under the loan agreement. The loan is secured by a primary lien on the aircraft and associated assets, as well as receivables from lease rentals.

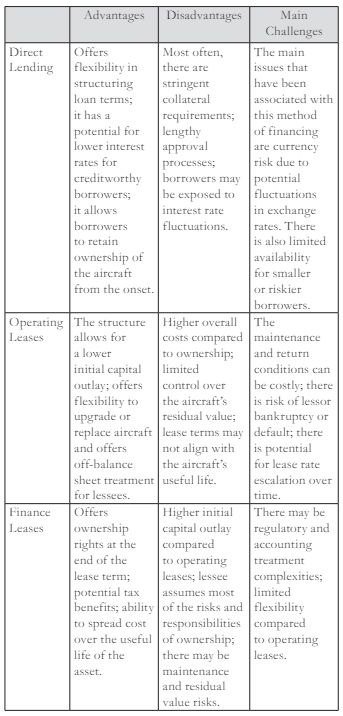

1.2 What are the key advantages/disadvantages and main issues arising in relation to these financing structures?

1.3 What types of leasing are possible under the laws of your jurisdiction? What are their essential characteristics?

Under the laws of Nigeria, various types of leasing arrangements are possible and these arrangements are typically governed by specific regulations. The major leasing arrangements are: 1) operating lease arrangements; and 2) finance lease arrangements. However, there is a clear tilt towards operating leases due to specific practicability issues.

In an operating lease arrangement, the owner or lessor procures or possesses the aircraft that is leased to an airline or other lessees and largely maintains all the risks and benefits associated with aircraft ownership. The lessee usually does not have an option to purchase the asset at the end of the lease term. Operating leases usually come in two forms, 'dry lease' or a 'wet lease'.

The dry lease involves leasing an aircraft without crew, maintenance or other operational services. The lessee assumes full operational control and responsibility for the aircraft during the lease term. Dry leases are suitable for airline with existing operational capabilities and infrastructure.

1.4 Are there any proposals for reform in the area of aviation finance?

There are wide-ranging reforms, with deep ramifications on taxation, registration and substance of aviation finance structure and operators alike. The 2020 Finance Act imposed an Economic Community of West African States (ECOWAS) Trade Liberalization Scheme charge on aircraft leases from outside ECOWAS, while the Finance Act 2023 imposed an additional 0.5% charge on imports from outside the region. The Finance Act 2023 also mandates operators and lessors with income derived from Nigeria to file tax returns as a condition of continued operation.

The recent inauguration of the Equipment Leasing Registration Authority (ELRA) is likely to import additional registration obligations on lessors and lessees within the country.

1.5 Is it possible according to the laws in your jurisdiction to enter into non-binding or partially binding pre-contractual agreements (e.g. 'letters of intent') that will NOT take effect as fully enforceable agreements?

In Nigeria, the law recognises the concept of nonbinding or partially binding pre-contract agreements. These may take the form of letters of intent (LOI), memorandums of understanding (MOU), Heads of Agreement (HOA), or even clear-cut offers made subject to contract.

However, whether a "pre-contractual agreement" will be construed as being legal and enforceable will depend largely on the intention of parties, which can be determined by negotiations and the provisions of the pre-contractual agreement.

1.6 Is there a doctrine of 'good faith' in your jurisdiction that applies to all pre-contractual agreement, financing and leasing transaction documents, and the conduct of parties connected to them?

In Nigerian contract law, the principle of good faith is recognised as an implied term in contracts including pre-contractual agreements, and can serve to validate an otherwise unenforceable contract, especially where non-enforcement will lead to manifest injustice.

The court will usually consider the following factors in enforcing the good faith duties:

- partial performance or alteration of the parties' position;

- the spirit and terms of the agreement;

- Liberima Fidei;

- subsistence of standard terms; and

- the balance of convenience.

2 Taxation and Related Matters

2.1 Which government authority in your jurisdiction has primary responsibility for the accounting for and regulation of revenue control and taxes?

The Federal Inland Revenue Service (FIRS) has primary responsibility for the taxation of the income of all companies in Nigeria. However, depending on the structure of the counterparty, the State Inland Revenue Service may take a portion of the tax responsibilities. Also, the Nigerian Custom Service, the Equipment Lease Registration Agency and the Nigerian Civil Aviation Authority also collect certain taxes, duties, fees, levies and changes that may significantly impact the revenue of the aviation owners and operators.

2.2 What are typically the taxes in your jurisdiction that may arise in relation to a sale, a lease or a financing of an aircraft or an engine?

The global income revenue of a Nigerian Company is taxable under the Companies Income Tax Act (CITA), while the income of a non-Nigerian company is duly taxable to the extent that they derive from Nigeria. For foreign-based lenders, their interest income is chargeable to income tax while the capital component of the transaction is exempted from taxation. For lessors, the gross rental income under an operating lease is chargeable to tax while only the net earnings of a lessor in a finance lease is chargeable to tax.

Aircraft import transactions are exempt from value added tax (VAT) and import duties but are subject to ECOWAS Trade Liberalization Scheme (ETLS) charges, as well as a 0.5% levy under section 4 of the Finance Act 2023. A 10% withholding tax is chargeable on earnings from aircraft leases and finance. While the capital gains of a Nigerian financier or lessor are subject to capital gains tax, the gains of a foreign lessor or financier are generally not subject to capital gains tax. Stamp duties are payable on every lease or financing agreement.

2.3 Is the provision of a current tax-residency certificate by a payee sufficient for a lessee or a borrower potentially subject to withholding taxes in your jurisdiction on rental or interest payments to avail itself of treaty access and the mitigation of tax liability?

A payee's residency certificate issued by a state party offers certain protection for the payee in relation to Double Taxation Agreements (DTAs) with Nigeria. The extent of the protection will depend on the specific DTA. DTAs do not serve to exempt the payee from the payment of withholding tax in its entirety, but rather modulate the applicable withholding tax payable on each financing/lease transaction based on the agreed maximum rate prescribed in the DTA. Thus, where the prescribed domestic withholding tax rate is below the one prescribed in the DTA, the domestic rate will apply. However, where the domestic rate is higher than the rate in the DTA, the DTA rate will apply.

The benefit of the DTA applies only to the passive income of the lessor/financier. Where the income of a foreign lessor/ financier is attributable to a permanent establishment or fixed base of business, the domestic rate shall apply.

To view the full article click here

Originally Published by International Comparative Legal Guides (ICLG)

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]