PwC Nigeria are most popular:

- within Finance and Banking topic(s)

- in United Kingdom

- with readers working within the Banking & Credit and Business & Consumer Services industries

| HIGHLIGHTS (NGN' Bn) | 2016 | 2015 | % Change |

| Total Revenue | 3,855.8 | 3,452.4 | 11.7 |

| Oil Revenue | 813.1 | 1,637.9 | -50.4 |

| Non-Oil Revenue | 1,536.8 | 1,214.7 | 26.5 |

| Independent Revenue & others | 1,581.2 | 599.8 | 163.6 |

| Aggregate Expenditure | 6,060.7 | 4,493.4 | 34.9 |

| Recurrent Non-Debt | 2,646.4 | 2,593.21 | 2.05 |

| Special Intervention Program | 300 | - | 100 |

| Capital Expenditure | 1,587.6 | 557.0 | 185.0 |

| Capex % of total expenditure** | 31% | 12% | |

| Debt Service | 1,475.3 | 953.6 | 54.7 |

| Budget Deficit | -2,204.9 | -1.041.0 | 111.8 |

| Macro-Economic Outlook Projections (MTEF) | 2016 | 2015 | % Change |

| Real GDP Growth rate (%) | 4.4 | 3.4 | -20.5 |

| Nominal GDP (N'Trillion) | 103 | 94 | 9.4 |

| Average Exch rate (NGN/$) | 197 | 190 | -3.7 |

| Inflation rate (%) | 9.81 | 10.2 | 3.8 |

| Growth of non-oil export (%) | 16.5 | 16.5 | 0 |

| Crude oil production (mbpd) | 2.2 | 2.3 | -3.4 |

| Oil price benchmark ($/barrel) | 38 | 53 | -28 |

| Budget Deficit (% of GDP) | -2.14 | -1.09 | 0.96 |

MTEF is Medium Term Expenditure Framework

- Actual inflation year on year as at April 2016 was 13.7%

- Real GDP growth rate for Q1 2016 was -0.36%

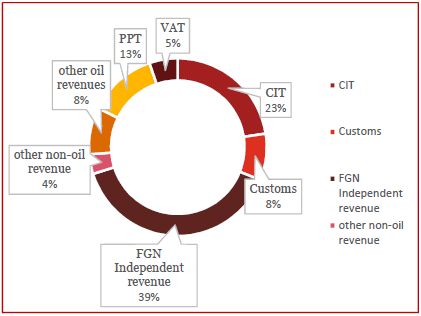

2016 REVENUE GENERATION SPLIT (MTEF)

Highlights of Revenue and Expenditure

- **Total capital expenditure is circa NGN 1.8 trillion which includes NGN156 billion under Statutory Transfers and NGN 86 billion in Debt Service.

- Oil revenue is expected to decline by 50% while non-oil revenue is projected to increase by 26.5%.

- Increase in non-oil tax revenue will come mainly from Company Income Tax and Value Added Tax expected to increase by 33.2% and 14.9% respectively.

- Spending is planned to increase in 2016 (compared to 2015) by about 35% to an aggregate expenditure of N6.06 trillion.

- Non-debt recurrent expenditure for 2016 which represents about 43.7% of the aggregate expenditure is expected to rise by 2% to NGN2.646 trillion. This includes NGN300 billion special intervention fund.

- Capital expenditure is proposed to increase by about 180% to NGN1.58 trillion which constitutes about 30% of total expenditure.

- The ministry of works, power and housing was allocated NGN423 billion or 26.6% of the capital expenditure being the top recipient of capital spending.

- The federal government has earmarked NGN2 billion for the National Job Creation/Graduate Internship scheme.

Debt service

- The debt service cost is expected to increase by 54.7% (to a record NGN1.475 trillion) accounting for about 24.3% of total expenditure or 38% of revenue notwithstanding a low debt to GDP ratio of circa 13%.

- NGN1.3 trillion and NGN54.5 billion are required to service foreign and domestic debt respectively.

- A sinking fund of 113.4 billion is for the purpose of retiring matured loans.

Capital Expenditure of KeyMinistries (NGN'Bn)

| Ministry | 2016 | 2015 | % Growth |

| Agriculture | 46.2 | 8.8 | 425.0 |

| Defence | 130.9 | 36.7 | 257.0 |

| Education | 35.4 | 23.5 | 51.0 |

| Healthcare | 28.7 | 22.7 | 26.0 |

| Solid Minerals | 7.3 | 1 | 630.0 |

| Transportation | 188.7 | 14.1 | 1238.0 |

| Works, Power and Housing | 423.0 | 26.6 | 1490.0 |

Tax Proposals in 2016 Budget Speech

- There was no proposal to change tax rates or impose new taxes in 2016.

- The budget speech was silent on the proposals to introduce a National Security Tax and the proposed increase in Tertiary Education Tax.

- Government is however focused on measures to increase the tax base and overall compliance rate in the country.

- Luxury tax is expected to generate NGN15billion but no disclosure of measures to implement.

- It was mentioned that the tax rate for smaller businesses will be reduced.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]