Summary

On 2nd September 2021, the Central Bank of Nigeria (CBN) issued a Circular to all banks in Nigeria titled Basel III Implementation by all Deposit Money Banks ("the Circular"). The Circular aims to inform all banks of the issuance of Guidelines for the implementation of the Basel III standard which is a voluntary global regulatory framework that addresses bank capital adequacy, stress testing, and market liquidity risk.

Details

The Basel Accords ("Basel I, II, III") are sets of regulations for the Banking sector established by the Basel Committee on Banking Supervision (BCBS) which is a committee of banking supervisory authorities established by the central bank governors of various jurisdictions. The purpose of these "Accords" is to improve the regulatory framework for the banking industry worldwide.

Basel I was designed to enhance understanding of key supervisory issues and improve the quality of banking supervision across countries. Basel II accord is primarily focused on financial soundness. It was designed to enhance capital regulation by introducing risk weights, aligning bank regulation with best practices in risk management, and provide banks with incentives to enhance risk measurement and management capabilities.

The Basel III accord was developed by the BCBS due to the impact of the global financial crisis of 2008 – 2009 on banks. Given that the global financial crisis resulted in unprecedented losses and almost total collapse of the world financial system, there was a need for a critical rethink of risk management practices which were hitherto based on the Basel II Accord. Thus, Basel III is the response to the deficiencies of Basel II and introduced major changes to the Basel II framework. Some of these changes are highlighted below:

- Introduction of a non-risk based leverage ratio which require banks to hold at least a 3% leverage ratio;

- Increased minimum capital requirements for banks from 2% in Basel II to 4.5% of common equity, as a percentage of the bank's risk weighted assets. There is also an additional 2.5% buffer capital requirement that will bring the common equity to 7%.

- Introduction of two liquidity ratios – the 'liquidity coverage ratio' and the 'net stable funding ratio' (NSFR). The liquidity coverage ratio requires banks to hold sufficient high-liquid assets that can withstand a 30-day stressed funding scenario as specified by the bank supervisor. On the other hand, the 'net stable funding ratio' require banks to maintain stable funding above the required amount of stable funding for a period of one year of extended stress.

Although, the CBN had completed the development of the Guidelines for Basel III implementation in 2020, the implementation was suspended due to the COVID-19 pandemic outbreak to minimize the regulatory compliance burden on the banks.

The CBN has now issued the underlisted Basel III Guideline/Reporting Templates for implementation;

- Guidelines on Regulatory Capital

- Guidelines on Leverage Ratio (LeR)

- Guidelines on Liquidity Coverage Ratio (LCR)

- Guidelines on Liquidity Monitoring Tools (LMT)

- Guidelines on Large Exposures (LEX)

- Guidelines on Liquidity Risk Management and Internal Liquidity Adequacy Assessment Process (ILAAP)

Some of the key provisions introduced by some of these Guidelines include the following:

- Banks are required to maintain a minimum leverage ratio of 4% at all times;

- Banks must calculate the leverage ratio in accordance with the relevant requirements specified to supplement their risk-based capital requirements;

- The calculation of the LeR will be at both the entity and consolidated levels. Consolidated levels will include banking and Holding Company group level;

- The leverage ratio exposure measure should generally be based on gross accounting values. Therefore, unless specified otherwise, banks should not make use of physical or financial collateral, guarantees or other credit risk mitigation techniques to reduce the leverage ratio exposure measure, nor should they net assets and liabilities.

- Banks are required to disclose and detail to the CBN the sources of material differences between their total balance sheet assets as reported in their Audited Financial Statement (accounting assets) and their on-balance sheet exposures for their leverage ratio exposure measure.

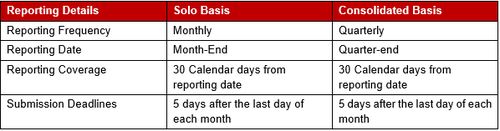

Reporting entities are required to comply with the minimum LCR on an on-going (daily) basis to help monitor and control their liquidity risk. However, for the purposes of supervisory oversight, reporting entities shall submit their respective LCR returns to the CBN in the manner prescribed below.

The CBN stated in the Circular that the recommendations will be implemented in a parallel run beginning November 2021 for a six-month period, which could be extended by another three months if supervisory expectations are achieved. According to the CBN, the Basel III Guidelines will run concurrently with the existing Basel II Guidelines during the parallel run, and the Basel Ill Guidelines will become completely effective after the parallel run is over.

Furthermore, the CBN also instructed all banks to submit their monthly returns no later than five working days after the end of the preceding months, with effect from November 2021.

The CBN also added that banks are to note that capital add-on will be introduced in a phased manner as part of the overall supervisory process of Pillar II assessment, which is a principles-based standard premised on sound supervisory judgment. This is to enhance better risk management practices and better align the capital of banks with their risk profiles.

Implication

Given that these Guidelines address issues such as specifying the minimum Liquidity Coverage Ratio (LCR) standards for reporting entities in the Nigerian banking system, it is our view that the Guidelines will help in controlling liquidity and will make banks stronger and more resilient to unfavorable conditions because it will strengthen regulation, supervision, and risk management within the banking industry. It is also expected that the Basel III Standard will prevent banks from taking excessive risks that can negatively impact the economy.

Thus, greater financial industry stability should be achieved under Basel III Standard which should allow investors to focus more on financial institution risk and worry less about the economic backdrop or the possibility of broad-based financial collapse. It is however important to note that for banks to satisfy LCR liquid-asset criteria introduced by the Basel III Guidelines, they will need to hold more liquid assets and increase their proportion of long-term debts. In addition, business operations that are more liable to liquidity risks will be minimized and banks will need to exercise caution with respect to high run-off assets such as Special Purpose Vehicles (SPVs) and Structured Investment Vehicles (SIVs).

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.