The Anti-Money Laundering Act (AMLA) has been further amended by Republic Act No. 11521,1 which took effect on February 8, 2021 (or immediately after its publication in the Official Gazette). (The new provisions introduced by R.A. 11521 to the AMLA are underlined below for ease of reference.)

A. Spotlight on New Provisions

B. Covered Persons and Covered Transactions

C. Targeted Financial Sanctions

D. Other Relevant Provisions

A. Spotlight on New Provisions

R.A. 11521 adds two new covered persons who are now required to report covered and suspicious transactions to the Anti-Money Laundering Council (AMLC) – (1) "real estate developers and brokers;" and (2) "offshore gaming operators, as well as their service providers, supervised, accredited or regulated by the Philippine Amusement and Gaming Corporation (PAGCOR) or any government agency." (Please see part B below for more information.)

This amendatory law provides a new kind of covered transaction as well -- for real estate developers and brokers, a single cash transaction involving an amount exceeding P7.5 million will be a covered transaction.

There are also two new unlawful activities under this latest AMLA amendment.2 The first one is a violation of Section 19(a)(3) of R.A. 10697, also known as the Strategic Trade Management Act (STMA) dated November 13, 2015, which penalizes activities "prohibited by, or in contravention of, any orders or regulations issued by the National Security Council-Strategic Trade Management Committee (NSC-STMCom) to implement the provisions" of the STMA. The second one is tax evasion under Section 254 of the National Internal Revenue Code, as amended (NIRC), "where the deficiency basic tax due exceeds P25 million per taxable year, for each tax type covered and there has been a finding of probable cause by the competent authority."

R.A. 11521 grants AMLC the power to issue freeze orders to implement targeted financial sanctions in relation to financing of the proliferation of weapons of mass destruction, terrorism, and financing of terrorism. Furthermore, this latest amendment provides that the AMLC and its Secretariat must protect information received by them by virtue of their office, and imposes criminal liability for violation of such confidentiality.

B. Covered Persons and Covered Transactions

Two new covered persons

Under the AMLA, covered persons are required to report covered or suspicious transactions to AMLC. Covered persons who fail to report these transactions are guilty of money laundering.

The AMLA defines and lists down these covered persons, and under Sections 3(a)(9) and (10) of R.A. 11521, "real estate developers and brokers"; and "offshore gaming operators, as well as their service providers," are new covered persons and are now required to report covered and suspicious transactions to the AMLC.

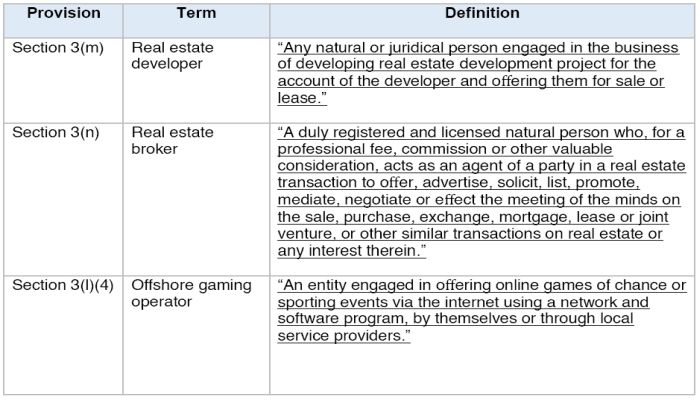

R.A. 11521 likewise defines these new covered persons, as seen in the table below:

To see the full article click here

Footnotes

1 Please see https://www.officialgazette.gov.ph/downloads/2021/01jan/20210129-RA-11521-RRD.pdf for reference.

2 Under AMLA, unlawful activities are acts or omissions involving or having relation to any of the 36 (previously 34) crimes listed under Section 3(i) of the AMLA. Money laundering is committed when a person transacts, converts, conceals, attempts, abets, among others, any monetary instrument or property, knowing that it relates to the proceeds of an unlawful activity. Furthermore, covered persons are required to report suspicious transactions to the AMLC regardless of the amount involved, and one such suspicious transaction is when it relates to an unlawful activity. Money laundering is likewise committed when covered persons fail to report covered or suspicious transactions.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.