1 OVERVIEW OF NATURAL GAS SECTOR

1.1 A brief outline of Mexico's natural gas sector, including a general description of: natural gas reserves; natural gas production including the extent to which production is associated or non-associated natural gas; import and export of natural gas, including liquefied natural gas (LNG) liquefaction and export facilities, and/or receiving and re-gasification facilities ("LNG facilities"); natural gas pipeline transportation and distribution/transmission network; natural gas storage; and commodity sales and trading.

Mexico's natural gas gross production diminished by 2.3 per cent during August 2013, registering 6,325.1 MMDCF. Such quantity of natural gas includes 678.1 MMDCF of nitrogen, which is considered an associated gas, recovered from the secondary recovery process in Cantarell. In terms of proven reserves of natural gas, as of 1 January 2013, 17,075.4 billion cubic feet were registered daily; on the other hand regarding probable reserves the quantity was of 17,826.8 billion cubic feet daily; and, for the possible reserves 28,327.1 billion daily cubic feet.

Import of LNG started in 2006 when the first LNG cargo, coming from Nigeria, was received at the LNG Altamira Terminal, the purpose of which was to produce energy to be consumed by the Federal Electricity Commission ("CFE"). However, there are several projects for LNG infrastructure development, considering the Ensenada facility that is currently being developed and other planned facilities that will be located in Michoacan, Colima, Sonora, Sinaloa and offshore Tamaulipas State; nonetheless the prospective amount of liquefied natural gas imports is 747,380 MMDCF. Natural gas exports are expected to be null.

Natural gas demand is expected to increase by 27 per cent by 2025 and notwithstanding the fact that import of natural gas in 2013 was of approximately 1,244,516 MMDCF, there is still the need to develop new facilities with the purpose to increase the natural gas imports to satisfy the ongoing demand. Regarding the extent of transportation and distribution of natural gas through the country, among the developed infrastructure there are currently 40,244 km. As the National Pipeline System is overloaded and is close to its 85 per cent capacity limit, there are new projects to increase the natural gas transportation infrastructure considering Los Ramones project which consists of 1,021.57 km, with approximately an overall investment of USD$ 2.5 billion.

1.2 To what extent are Mexico's energy requirements met using natural gas (including LNG)?

The energy requirements met have increased particularly during the last decade, for example, in accordance with the National Energy Balance for 2011 the energy requirements met using natural gas was of approximately 23 per cent, 4 per cent more than in 2000. With regard to power generation, natural gas represents 47 per cent of the total energy production, while 19 per cent is based on non-fossil fuels.

1.3 To what extent are Mexico's natural gas requirements met through domestic natural gas production?

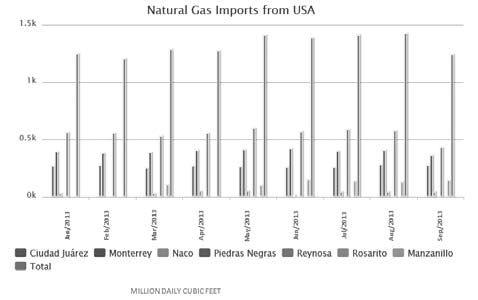

Mexico's natural gas production is yet to be further developed in order to meet the country's requirements of said hydrocarbon; hence, approximately 30 per cent of the natural gas requirement is imported mainly from the United States of America, as there is a supply deficit compared to the demand of this fuel. For these purposes, it is worth mentioning that there are seven different entries of natural gas into Mexico, considering Reynosa as the most used; all in all the natural gas imports have fluctuated between 1 and 1.5 MMDCF during the current year 2013, as shown below in the chart.

Source: Retrieved from Energy Information System from the webpage: http://sie.energia.gob.mx/bdiController.do?action=cuadro&cvecua=PMXE1C16

1.4 To what extent is Mexico's natural gas production exported (pipeline or LNG)?

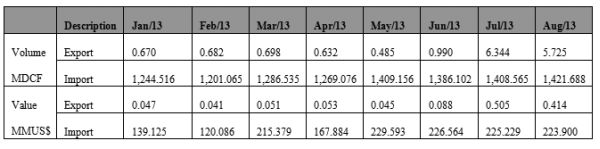

Natural gas imports in Mexico tend to increase while exports are mainly decreasing. For example, from 2006 to 2011, natural gas production exported decreased in approximately 96 per cent, while imports of this product increased in 75 per cent. In order to be able to assess the volume and value of such exports, compared to the production that is imported; the chart below shows the statistics of natural gas imported and exported monthly during 2013.

Table 1

Source: Retrieved from Energy Information System from webpage: http://sie.energia.gob.mx/bdiController.do?action=cuadro&cvecua=PMXE1C12

2 OVERVIEW OF OIL SECTOR

2.1 Please provide a brief outline of Mexico's oil sector.

Article 27 of the Mexican Constitution states that the Nation has the direct ownership of natural resources including minerals, oil and its derivatives, therefore, Petroleos Mexicanos ("Pemex"), on behalf of the State, is the only entity entitled to carry out the exploration, exploitation and any other activity considered strategic. However, services regarding these activities may be hired by Petroleos Mexicanos with particulars.

Between 2000 and 2004, oil production increased to its peak and afterwards started to decrease to 2.5 million daily barrels in 2012 (after reaching its peak around 2004 (3+ mmbbl/day)). The abovementioned seems to clash with the fact that investment has increased in the last 12 years from 77,860 to 251,900 million pesos. The main challenge is that the fields exploited for oil production are either mature or in its declination stage. Mexico has become a net importer of gasoline, diesel, turbosine, natural gas, liquefied petroleum gas and petrochemicals. Despite the biggest investment in history, proven oil reserves dereased from 20,077 MMbpce to 13,810 MMbpce in the period between 2003 and 2012; in the same period probable reserves diminished from 16,965 MMbpce to 12,353 MMbpce.

2.2 To what extent are Mexico's energy requirements met using oil?

Energy requirements are mainly met by oil production. Despite this, the use of natural gas and other renewables has increased in the last years. Only 5 per cent of the total energy production based on oil diminished from 70 per cent to 65 per cent, between the years 2000 to 2011.

2.3 To what extent are Mexico's oil requirements met through domestic oil production?

Domestic oil production is in deficit to meet current oil requirements; therefore, imports are being agreed to, though Mexico is not a net importer and actually exports important quantities to all over the world. The reason for this is that Mexico lacks the proper infrastructure to process oil and its derivatives. However, Pemex- Exploracion y Produccion (subsidiary entity of Pemex) is currently developing ten different projects that will result in an 80 per cent contribution to oil and 50 per cent of gas national requirements in order to avoid being partially dependent of foreign production.

2.4 To what extent is Mexico's oil production exported?

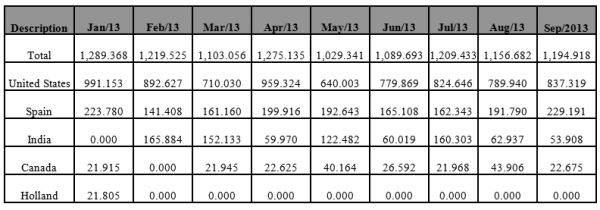

Mexico exports three different kinds of oil: (i) Maya; (ii) Istmo; and (iii) Olmeca. Among them, Maya is the cheapest and most exported. Oil production exports have increased in the last years and have diversified the export destinations as shown in the chart below, described in million daily barrels.

3 DEVELOPMENT OF OIL AND NATURAL GAS

3.1 Outline broadly the legal/statutory and organisational framework for the exploration and production ("development") of oil and natural gas reserves including: principal legislation; in whom the State's mineral rights to oil and natural gas are vested; Government authority or authorities responsible for the regulation of oil and natural gas development; and current major initiatives or policies of the Government (if any) in relation to oil and natural gas development.

The statutory framework for the exploration and production of oil and natural gas is firstly regulated in the Mexican Constitution, which establishes that it is the exclusive right of the Nation to have the ownership of natural resources including minerals and hydrocarbons in order to be able to carry out the exploration, exploitation and any other activity considered strategic. Additionally, Article 27 was ruled with the issuance of a Regulatory Law that states how Pemex, as a decentralised entity, is the only entity entitled to develop the activities considered strategic by law; furthermore Pemex is governed by its own enacted Law and regulation. Unlike the upstream and downstream oil activities which are exclusive to the State, the regulated activities are administrated through the Regulatory Energy Commission ("CRE") and the Regulatory Energy Commission Law that enables the CRE to grant different permits regarding transportation, distribution and storage of natural gas. Furthermore, natural gas is regulated through the Natural Gas Regulation and LP gas is ruled by its own regulation.

Table 2

Source: Retrieved from Energy Information System from webpage: http://sie.energia.gob.mx/bdiController.do?action=cuadro&cvecua=PMXF1C03

Notwithstanding the above-mentioned, the Ministry of Energy ("SENER") is in charge of conducting the energy policy of the country, within the constitutional framework, in order to guarantee high quality, economically advantageous and sustainable competitive and sufficient supply of energy for the national development. The SENER jointly working with the Hydrocarbons National Commission ("CNH") has the object of ruling and supervising the exploration and exploitation of hydrocarbons located in the subsoil and to rule and supervise the transportation, storage and processing activities that are directly related with the exploration and exploitation hydrocarbon's projects.

3.2 How are the State's mineral rights to develop oil and natural gas reserves transferred to investors or companies ("participants") (e.g. licence, concession, service contract, contractual rights under Production Sharing Agreement?) and what is the legal status of those rights or interests under domestic law?

Mineral rights to develop oil and natural gas reserves are transferred, in a limited basis, through the assignment of service contracts. They can be assigned through different processes such as public bidding, direct award or restricted bidding as stated in the Contracting Administrative Legal Provisions in Acquisitions, Leases, Works and Services Matters of the Substantive Activities of Productive Nature of Petroleos Mexicanos and Subsidiary Entities (DAC's) published in 2010 and amended on the same year and in 2012. Except for the regulated activities such as transportation, distribution and storage of natural gas and LP gas, mineral rights belong by and large to the Nation; therefore the ownership thereof is not transferred through any public bid or award.

3.3 If different authorisations are issued in respect of different stages of development (e.g., exploration appraisal or production arrangements), please specify those authorisations and briefly summarise the most important (standard) terms (such as term/duration, scope of rights, expenditure obligations).

As mentioned above, in relation with oil, upstream, midstream and downstream activities are exclusively carried out by the State. In accordance with the Regulatory Law of Constitutional Article 27 in the Field of Petroleum, the Ministry of Energy, on behalf of the Federal Executive, has the faculty to exclusively grant to Pemex and its subsidiary entities the allotment of oil exploration and exploitation areas.

Regarding natural gas midstream and downstream activities, permits must be granted by the CRE in order to entitle permit holders to develop any such activities. The General Terms and Conditions that will apply in the rendering of the service towards users are determined depending on the applicable case and specific situation of the permit holder. On the other hand, transportation, distribution and storage of LP gas permits are granted either by the CRE or the SENER in its different modalities, as they have different faculties in this matter. The duration of permits is of 30 years with a renewable right of 15 years if complying with the legal requirements. There are statutory rights and obligations that must be fulfilled, as well as rights and obligations specifically assigned to a permit holder if so required.

3.4 To what extent, if any, does the State have an ownership interest, or seek to participate, in the development of oil and natural gas reserves (whether as a matter of law or policy)?

Historically, the Mexican regime has gone through several amendments as the political environment is ever-evolving. Before the oil expropriation held in 1938, private parties were entitled to keep the oil revenues; afterwards, the oil revenues became the ownership of the State. However the State could decide whether to pay private contractors in cash or with a percentage of the production. Since 1958, the oil regime was modified, as currently known, establishing payment duties to be fulfilled only with currency. Hence, since 1938, strategic activities were assigned exclusively to the State and declared not as monopolistic activities. As referred above, Article 27 of the Mexican Constitution states that the Nation has the direct ownership of natural resources including minerals, oil and its derivatives.

3.5 How does the State derive value from oil and natural gas development (e.g. royalty, share of production, taxes)?

The current tax regime obliges Pemex, on behalf of the State, to pay several contributions and taxes, such as value-added oil tax, oil revenue and imports tax, as well as a special tax on production and services. Pemex, among other national oil companies, pays the biggest contribution amounts to the Government.

In the last five years (2008-2013) the integrated contracts, applicable for exploratory blocks, were firstly assigned through three different rounds. On this grounds Pemex is allowed to pay private contractors based on the exploratory success, an amount for every barrel produced under the service contracts.

3.6 Are there any restrictions on the export of production?

Regarding the export of oil production, Pemex is the only entity entitled with such faculties. On the other hand, in relation with natural gas production, according to the Natural Gas Regulations, exports of natural gas may be carried out by the private sector merely attending to Foreign Trade Laws.

3.7 Are there any currency exchange restrictions, or restrictions on the transfer of funds derived from production out of the jurisdiction?

Under the current legislation there are no currency exchange or transfer fund restrictions.

3.8 What restrictions (if any) apply to the transfer or disposal of oil and natural gas development rights or interests?

As stated herein, Mexican legislation establishes that oil rights or interests are exclusively the State's. Furthermore, first hand sales of natural gas and LP gas, exclusive for Pemex, are ruled by the CRE and have the purpose of assuring equity on the gas market. First hand sales are considered as the first sale of national gas performed by Pemex to a third party within the national territory. However, regarding such a trend, interests may be acquired with the granting of a permit for transportation, distribution or storage of natural gas or LP gas.

3.9 Are participants obliged to provide any security or guarantees in relation to oil and natural gas development?

As stated above, Pemex and its four subsidiary entities are entitled to contract with privates in order for them to carry out the exploitation, exploration and appraisal activities, however the ownership of products is exclusively the State's. Despite any special condition, guarantees and securities must always be provided for a value of the entirety of the project that is currently being developed and if there is any breach of the contract on the private side, then Pemex is entitled to execute any such guarantee or security. Environmental guarantees are the most risky and a big concern for contractors.

3.10 Can rights to develop oil and natural gas reserves granted to a participant be pledged for security, or booked for accounting purposes under domestic law?

Pursuant to the principle of the direct domain, which is also inalienable and imprescriptible, of all hydrocarbons located in national territory, including the continental shelf and the exclusive economic zone and subsoil, in any physical state; oil and natural gas reserves are not subject to be booked for accounting purposes as it is explicitly prohibited by law.

3.11 In addition to those rights/authorisations required to explore and produce oil and natural gas, what other principal Government authorisations are required to develop oil and natural gas reserves (e.g. environmental, occupational health and safety) and from whom are these authorisations to be obtained?

Regarding some additional authorisations required to explore and produce natural gas, we may consider the Environmental Impact Authorisation ("MIA") granted by the Ministry of Environmental and Natural Resources ("SEMARNAT"), construction and land use authorisations granted by the local and municipal authorities, among others.

As aforementioned, Article 27 of the Mexican Constitution sets forth that the Nation has the direct ownership of natural resources including minerals, oil and its derivatives; therefore, regarding the authorisations established for the exploration and production of oil, the Regulation of the Regulatory Law of Constitutional Article 27 in the Field of Petroleum, Pemex may apply for a "Petroleum Allotment" before the Ministry of Energy. The aforementioned Ministry will grant such title, considering the CNH opinion.

3.12 Is there any legislation or framework relating to the abandonment or decommissioning of physical structures used in oil and natural gas development? If so, what are the principal features/requirements of the legislation?

Among some legislation relating to the abandonment or decommissioning of physical structures used in oil and natural gas development, regulations have been legislated through the issuance of Mexican Official Standards ("NOMs") such as: the NOM-149- SEMARNAT-2006, which establishes the specifications for environmental protection that must be followed for the drilling, maintenance and abandonment of oil wells in Mexican maritime zones; and the NOM-129-SEMARNAT-2006 which sets forth the specifications for environmental protection for the site preparation, construction, operation, maintenance and abandonment of natural gas distribution networks; amongst others.

3.13 Is there any legislation or framework relating to gas storage? If so, what are the principle features/requirements of the legislation?

The existing regulation on gas storage is ruled by the LP Gas Regulation and the Natural Gas Regulation, which states that the CRE must issue a permit for the development of such an activity.

4 IMPORT / EXPORT OF NATURAL GAS (INCLUDING LNG)

4.1 Outline any regulatory requirements, or specific terms, limitations or rules applying in respect of cross-border sales or deliveries of natural gas (including LNG).

Regarding natural gas imports into the Mexican State, it is necessary to fulfil some specifications established in the NAFTA (North America Free Trade Agreement), the Foreign Trade Law and the Natural Gas Regulation ("NGR"). Import of natural gas is not a regulated activity, therefore anyone interested in developing such activity is allowed to, as long as they comply with commercial, technical and legal requirements.

NAFTA allows the import and export in the energy field, including natural gas, under the compliance of GATT and with an applicable import rate of zero per cent. While the Foreign Trade Law sets forth that in order to carry out the import of natural gas, the interested party requires an import authorisation issued by the Secretary of the Treasury and Public Credit.

5 IMPORT / EXPORT OF OIL

5.1 Outline any regulatory requirements, or specific terms, limitations or rules applying in respect of cross-border sales or deliveries of oil and oil products.

As stated before, Pemex, as a decentralised entity, is the only entitled to develop the activities considered as strategic by law. Therefore, the export of oil is developed by PMI Group, international Pemex's subsidiaries, through commercial activities carried out in the international market of oil, all over 20 countries, of petroleum products and petrochemicals. However, Mex Gas Internacional Group, international Pemex's subsidiaries, held commercialisation activities of natural gas, LP gas and petrochemicals abroad.

6 TRANSPORTATION

6.1 Outline broadly the ownership, organisational and regulatory framework in relation to transportation pipelines and associated infrastructure (such as natural gas processing and storage facilities).

The development of transportation pipelines and associated infrastructure is ruled by the CRE, who is entitled to grant the transportation and storage permits to private companies who mean to develop such activities. For the purposes of the Mexican regulation, there are two different transportation permits: (i) Open Access Regime; and (ii) Self-Use Regime. Moreover, the Federal Energy Regulatory Commission must issue a presidential permit to site, construct, connect, operate, and maintain a border-crossing facility for the export of natural gas at the international boundary between the United States and Mexico and there should be an approval of both the Mexican and the American commissioner of the International Boundaries and Water Commission.

6.2 What Governmental authorisations (including any applicable environmental authorisations) are required to construct and operate oil and natural gas transportation pipelines and associated infrastructure?

As for the natural gas regulation, once the CRE permit is granted in order to be able to develop such infrastructure, permit holders must count with a construction and land use authorisation granted by the local and municipal authorities, as well as with the property or possession title; in addition to the corresponding MIA with a risk study issued by SEMARNAT, as well as the archaeological impact authorisation issued by the Anthropology and History National Institute ("INAH").

Regarding oil transportation pipelines and associated infrastructure, as stated above, Pemex is in charge of developing such activities.

6.3 In general, how does an entity obtain the necessary land (or other) rights to construct oil and natural gas transportation pipelines or associated infrastructure? Do Government authorities have any powers of compulsory acquisition to facilitate land access?

In order to be able to develop a project, the permit holder shall have the corresponding rights of way, such as easements or leasing, as well as the construction consent granted by the land owner. Such negotiations shall be held by the permit holder in order to acquire the totality of the necessary land. However, when justified for public use, the Government may expropriate the land and the affected owners must be indemnified.

6.4 How is access to oil and natural gas transportation pipelines and associated infrastructure organised?

Open Access to natural gas transportation pipelines is regulated in the NGR, considering that open access is stated as an obligation that should be complied with as long as there is available capacity and the interconnection is technically viable. The charge for interconnection may be agreed, pursuant to the NGR, by the parties, though this provision is not applicable for distributors during their exclusivity period.

There is no open access regime for oil transportation pipelines and associated infrastructures since it is considered as strategic activities as stated in article 28 of the Mexican Constitution and shall be developed by Pemex and its subsidiary entities.

6.5 To what degree are oil and natural gas transportation pipelines integrated or interconnected, and how is cooperation between different transportation systems established and regulated?

Co-operation between permit holders and users falls upon de compliance of the statutory requirements and in the execution of an Operating Balance Agreement, which will allow the parties to have an organised and efficient relation.

6.6 Outline any third-party access regime/rights in respect of oil and natural gas transportation and associated infrastructure. For example, can the regulator or a new customer wishing to transport oil or natural gas compel or require the operator/owner of an oil or natural gas transportation pipeline or associated infrastructure to grant capacity or expand its facilities in order to accommodate the new customer? If so, how are the costs (including costs of interconnection, capacity reservation or facility expansions) allocated?

Open Access is regulated as an obligation of permit holders that should be exercised without discriminatory practices; however such access is limited to: (i) the available capacity of the permit holders, which is not effectively used; and (ii) the interconnection is technically feasible. Open access may only be carried out through the execution of a rendering of services agreement. If the permit holder denies the open access or is acting in a discriminatory basis, the affected user is entitled to request the CRE intervention.

6.7 Are parties free to agree the terms upon which oil or natural gas is to be transported or are the terms (including costs/tariffs which may be charged) regulated?

All regulated activities (transportation, distribution and storage of natural gas) have assigned Terms and Conditions approved by the CRE, once the permit is issued; furthermore tariffs are regulated through the Directive for Tariff's Determination and Price Transfer for the Regulated Activities in Natural Gas (DIR-GAS-001-2007) and must not exceed the approved maximum tariff established in the permit. However, if complying with the provisions of DIRGAS- 001-2007, permit holders and users may agree upon a conventional tariff which shall be inferior to the maximum approved tariff.

7 GAS TRANSMISSION / DISTRIBUTION

7.1 Outline broadly the ownership, organisational and regulatory framework in relation to the natural gas transmission/distribution network.

The development of a natural gas distribution network is ruled by the CRE, which is entitled to grant the distribution permits to private companies (which may be entitled to an exclusive right of distribution within a geographic zone established by the CRE), when such permit is first granted, with a duration of 12 years of exclusivity.

7.2 What Governmental authorisations (including any applicable environmental authorisations) are required to operate a distribution network?

Once the CRE permit is granted, in order to be able to develop such infrastructure, permit holders must count with: a construction and land use authorisation granted by the local and municipal authorities, as well as with the property or possession title; in addition to the corresponding MIA with the risk study issued by the SEMARNAT; as well as the archaeological impact authorisation issued by the Anthropology and History National Institute ("INAH").

7.3 How is access to the natural gas distribution network organised?

The natural gas distribution network is divided in geographic zones allotted around the country and assigned by the CRE either to exclusive permit holders, or if it is not a first assigned zone, then different permit holders may carry on the activity inside such geographic zone. Currently there are 15 geographic zones and approximately 24 granted permits.

7.4 Can the regulator require a distributor to grant capacity or expand its system in order to accommodate new customers?

Distributors are obliged by law to extend or amplify their systems within their geographic zone, whenever it is requested by any third party, who has not been granted a permit, as long as the service is economically viable.

7.5 What fees are charged for accessing the distribution network, and are these fees regulated?

Regarding the transportation fees, they are integrated by a use charge and a capacity charge and they can be modified every five years. Alternatively, the distribution fees are approved by the CRE independently to each permit holder and not as a geographic zone but, on the contrary, they are modified every year.

7.6 Are there any restrictions or limitations in relation to acquiring an interest in a gas utility, or the transfer of assets forming part of the distribution network (whether directly or indirectly)?

There are no restrictions or limitations in relation to acquiring an interest in a gas utility or the transfer of assets forming part of the distribution network.

8 NATURAL GAS TRADING

8.1 Outline broadly the ownership, organisational and regulatory framework in relation to natural gas trading. Please include details of current major initiatives or policies of the Government or regulator (if any) relating to natural gas trading.

Natural gas trading is not regulated, however, first hand sales are indeed regulated, and therefore, Pemex and its national and international subsidiaries are the only entities entitled to carry out such activities.

8.2 What range of natural gas commodities can be traded? For example, can only "bundled" products (i.e., the natural gas commodity and the distribution thereof) be traded?

There are no restrictions for trading gas commodities; however, with regard to first hand sales, Pemex-Gas y Petroquimica Basica, a Pemex subsidiary, shall offer a bundled or unbundled service, and depending on the agreement, the gas will be delivered either at the exit of the processing facility or at the delivery point specified by the acquirer. If unbundled, the acquirer shall have an assignment of capacity in the transportation service agreements and additionally the acquirer shall pay for the disaggregate services, including, but not limited to: the gas; the transportation; and the trading fee.

9 LIQUEFIED NATURAL GAS

9.1 Outline broadly the ownership, organisational and regulatory framework in relation to LNG facilities.

Mexico has not yet developed infrastructure for LNG transportation or distribution and it is regulated with the Natural Gas statutory provisions, however there are three operating storage facilities located in Altamira, Manzanillo and Ensenada, and other projects in development to be located at Lazaro Cardenas (Michoacan), Manzanillo (Colima), Puerto Libertad (Sonora) and Topolobampo (Sinaloa). Despite this, there is the NOM-013-SECRE-2012, a specific regulation for the safety requirements for the design, construction, operation and maintenance of LNG storage terminals, including systems, reception equipment and facilities, transmission, vaporisation and natural gas delivery.

9.2 What Governmental authorisations are required to construct and operate LNG facilities?

Once the CRE permit is granted in order to be able to develop such infrastructure, permit holders must count with a construction and land use authorisation granted by the local and municipal authorities, as well as with the property or possession title; in addition to the corresponding MIA with risk study issued by SEMARNAT, as well as the archaeological impact authorisation issued by the Anthropology and History National Institute ("INAH").

9.3 Is there any regulation of the price or terms of service in the LNG sector?

The tariff that is charged LNG storage users is regulated by the NGR and the DIR-GAS-001-2007. It consists of a capacity charge and a use charge; the latest refers to the power invoiced by the Federal Electricity Commission to the permit holder.

9.4 Outline any third-party access regime/rights in respect of LNG Facilities.

In compliance with statutory regulations and with the General Terms and Conditions authorised to the permit holder, the latter will be obliged to grant open access to third parties. Furthermore, it contemplates an open season to be carried out at any time in order to obtain either firm basis storage service requests for the available capacity in the storage terminal or requests to amplify the storage system.

10 DOWNSTREAM OIL

10.1 Outline broadly the regulatory framework in relation to the downstream oil sector.

Even though, until now, Mexico is a country with a locked upstream industry, in the year 1995, downstream activities where statutorily permitted for private parties only regarding natural and liquefied petroleum gas.

10.2 Outline broadly the ownership, organisation and regulatory framework in relation to oil trading.

As stated in the Mexican legislation, Pemex-Exploracion y Produccion, as the State-owned NOC subsidiary, is the only entity entitled to explore, exploit and trade oil, however some private entities participate through different specific schemes established by Pemex.

11 COMPETITION

11.1 Which Governmental authority or authorities are responsible for the regulation of competition aspects, or anti-competitive practices, in the oil and natural gas sector?

The Federal Antitrust Commission ("CFCE") is in charge of being aware of all competence processes and free attendance, through the prevention and elimination of monopolies, monopolistic practices and any other restriction to the efficient functioning of the market.

11.2 To what criteria does the regulator have regard in determining whether conduct is anti-competitive?

The Federal Antitrust Law establishes three anticompetitive practices described as follows:

- Absolute monopolistic practices are

all contracts, agreements, arrangements and combinations between

economic agents, the purpose or effect of which is any of the

following:

- Fix, raise, arrange or manipulate the sale or purchase price of goods or services.

- Establish an obligation not to produce, process, distribute, trade or purchase, but only with a restricted or limited amount of goods or services.

- Divide, distribute, assign or impose portions or segments of a current or potential market of goods or services, by clients, suppliers, times or locations, etc.

- Establish, arrange or coordinate stances or abstention in the call of tenders, contests, auctions or public auctions.

- Relative monopolistic practices, are all acts, contracts, agreements, proceedings or combinations, the object or effect of which is, or could be, to improperly displace other agents of the market; substantially preventing them the access or establishing exclusive advantages in favour of one or more persons, in the cases set forth in the law mentioned above; and thirdly,

- Concentrations, are the merger, acquisition of control or any other act by which societies, associations, shares, social parts, trusts or general assets are concentrated, carried out among competitors, suppliers, clients or any other economic agent.

11.3 What power or authority does the regulator have to preclude or take action in relation to anti-competitive practices?

CFCE has the faculty to impose the sanctions set out in the Federal Antitrust Law, as for the moment an anti-competitive practice is declared, which are basically based on the correction or suppression of the monopolistic practice, which could additionally consider an order for the partial or total deconcentration of a concentration, and fines that will be applicable and determined depending on each case.

11.4 Does the regulator (or any other Government authority) have the power to approve/disapprove mergers or other changes in control over businesses in the oil and natural gas sector, or proposed acquisitions of development assets, transportation or associated infrastructure or distribution assets? If so, what criteria and procedures are applied? How long does it typically take to obtain a decision approving or disapproving the transaction?

There is no provision in the Federal Antitrust Law, where the CFCE or any other authority has the power to approve or disapprove mergers, changes in control over business or proposed acquisitions of the development assets, transportation or associated infrastructure or distribution assets.

Nevertheless, the economic agents could make a query to the CFCE for the issuance of a favourable opinion, authorisation or any other resolution related to the granting of concessions, permits, transfers, sale of shares in concessionaries companies, or other similar matters, through the following procedure: (i) the application shall be submitted in writing in accordance with the instructions issued by the Commission; (ii) within five days, the Commission will issue a reception or a prevention writ to the economic agent, in order to submit any missing information or documentation within the following five days; and (iii) the CFCE must resolve within a period of 30 days, after the reception writ is issued or the documentation or information is filed, considering this period could be extended once by the President of the CFCE for justified reasons.

12 FOREIGN INVESTMENT AND INTERNATIONAL OBLIGATIONS

12.1 Are there any special requirements or limitations on acquisitions of interests in the natural gas sector (whether development, transportation or associated infrastructure, distribution or other) by foreign companies?

The Foreign Investment Law ("FIL") establishes that any interested entity who desires to have an interest bigger than 49 per cent in any Mexican company shall have the previous approval of the CFCE for the construction of pipelines for the transportation of oil and its derivatives, as well as for the drilling of oil and gas wells; notwithstanding the fact that permits may only be granted to Mexican companies.

12.2 To what extent is regulatory policy in respect of the oil and natural gas sector influenced or affected by international treaties or other multinational arrangements?

Currently, the NAFTA recognises the existence of Pemex and its subsidiary entities, and recognises its legal personality, as Pemex is not obliged to execute a risk share agreement, among other exceptions that were amended in such Agreement.

13 DISPUTE RESOLUTION

13.1 Provide a brief overview of compulsory dispute resolution procedures (statutory or otherwise) applying to the oil and natural gas sector (if any), including procedures applying in the context of disputes between the applicable Government authority/regulator and: participants in relation to oil and natural gas development; transportation pipeline and associated infrastructure owners or users in relation to the transportation, processing or storage of natural gas; downstream oil infrastructure owners or users; and distribution network owners or users in relation to the distribution/transmission of natural gas.

Regarding the energy industry, there are different compulsory dispute procedures, additionally to arbitration which is most common to be agreed by the parties regarding agreement in the energy field. However, the Energy Regulatory Commission Law states that the only administrative law appeal against any authority act against the CRE is the motion for reconsideration. On the other hand, CRE is enabled to be appointed as arbitrator in regulated activities dispute resolutions.

13.2 Is Mexico a signatory to, and has it duly ratified into domestic legislation: the New York Convention on the Recognition and Enforcement of Foreign Arbitral Awards; and/or the Convention on the Settlement of Investment Disputes between States and Nationals of Other States ("ICSID")?

Mexico is part of the New York Convention on the Recognition and Enforcement of Foreign Arbitral Awards since 1971 without any reservation whatsoever. On the other hand Mexico is not part of the Convention on the Settlement of Investment Disputes between States and Nationals of Other States, however, Mexico provides for dispute settlement mechanisms in the area of investment, which guarantees equitable treatment for investors in accordance with the international principle of reciprocity and due process. These provisions are stated in NAFTA and in other several free trade treaties executed with certain Latin American countries, as well as in bilateral investment agreements signed with Spain, Switzerland, Argentina, and Germany, among others.

13.3 Is there any special difficulty (whether as a matter of law or practice) in litigating, or seeking to enforce judgments or awards, against Government authorities or State organs (including any immunity)?

Despite the international treaties executed by Mexico, enforcing arbitral awards has become much of an issue, as there are always appealing instances that have allowed Pemex, as the NOC, to reverse arbitral awards which were already granted. Such is the case of COMMISA ("Corporacion Mexicana de Mantenimiento Integral") and Pemex. After almost 10 years since the arbitral award was granted to COMMISA, it has not yet received the due amount of compensation from Pemex.

The aforementioned is based on the grounds that Pemex's assets are considered exempt from attachment or garnishment and not subject to a statute of limitations according to the General Law of National Assets.

13.4 Have there been instances in the oil and natural gas sector when foreign corporations have successfully obtained judgments or awards against Government authorities or State organs pursuant to litigation before domestic courts?

One of the most important cases refers to the arbitral award that was granted to Conproca, a Korean and German consortium in charge of Cadereyta's Refinery reconfiguration, awarding the latter approximately USD$ 300 million that shall be compensated by Pemex-Refinacion (Pemex subsidiary).

14 UPDATES

14.1 Please provide, in no more than 300 words, a summary of any new cases, trends and developments in Oil and Gas Regulation Law in Mexico.

The last energy reform was held in 2008 with the issuance of seven decrees that modified oil and gas regulation law in Mexico. However, such reform was not enough for the challenges Mexico is facing regarding its energy sector. Nevertheless, the National Hydrocarbon Commission was created to regulate, supervise and evaluate upstream hydrocarbon production and marketing activities. After five years, 2013 is a historical time for our country, as three different proposals for substantial Energy Reform were presented by the three main political parties in the country. The evaluation of the three different initiatives is taking place at the Origin Chamber (the Senate), which has held open discussion forums that took place from 23 September to 8 October 2013, with the purpose of achieving the best alternative for an energy reform. Furthermore, the Deputies Chamber that will, afterwards, act as the Revising Chamber is currently evaluating such initiatives with the purpose of expediting the legislative process and be able to reach agreements and publish such reform by the end of 2013. Notwithstanding the future reform, the two main energy entities, Pemex and the Federal Electricity Commission ("CFE") are expected to have substantial structural and corporate governance changes, together with an important change in their tax regimes. Furthermore, the oil industry would be accessible to private industries allowing the private and public alliances that would allow the improvement of Mexico's infrastructure, leading towards an economic growth of the country.

Originally published by Global Legal Group Ltd, London.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.