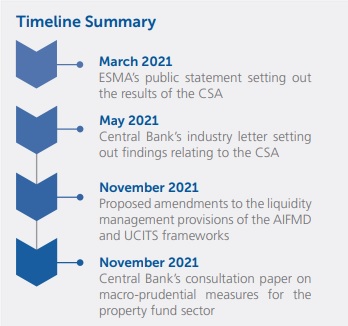

While regulators including the European Securities and Markets Authority ("ESMA") and the Central Bank of Ireland (the "Central Bank") begun to increase their focus on fund liquidity management over the course of 2019 in response to a number of high profile liquidity issues affecting UCITS funds, this issue really came to the fore in 2020 and 2021 as a result of the impact of the COVID-19 pandemic on the asset management industry and the wider global economy. In its recently published Securities Markets Risk Outlook Report, the Central Bank set out its expectations for fund management companies ("FMC") in respect of fund liquidity. The Central Bank states that FMCs should have regard to a number of reports, recommendations and industry letters issued by the Central Bank, ESMA and the European Systemic Risk Board ("ESRB") in relation to fund liquidity management. In this update we provide an overview of this and other guidance and proposals issued on this topic as highlighted in the timelines on the right-hand side of these pages.

IOSCO Recommendations and Reports - February 2018

In February 2018, the International Organization of Securities Commissions ("IOSCO") responded to a request for liquidity risk management recommendations from the Financial Stability Board with the publication of a final report containing recommendations for liquidity risk management for collective investment schemes. These recommendations supplement the Principles of Liquidity Risk Management for Collective Investment Schemes published by IOSCO in 2013 and cover the liquidity risk management process, liquidity management practices and tools and daily liquidity management. In February 2018 IOSCO also published a final report entitled "Open-ended Fund Liquidity and Risk Management - Good Practices and Issues for Consideration" which provides practical information on measures that can be taken to address liquidity risk management in the context of open-ended investment funds. This report covers three key issues: (i) ensuring consistency between a fund's redemption terms and its investment strategy; (ii) liquidity risk management tools; and (iii) liquidity stress testing.

Central Bank's Liquidity Management Letter - August 2019

On 7 August 2019 in response to the potential liquidity challenges posed by Brexit, the Central Bank issued a letter to FMCs regarding the importance of effective liquidity management for UCITS and AIFs. Similar to IOSCO's reports, the Central Bank highlighted the requirement to appropriately calibrate the liquidity risk management framework to take into account the: (i) dealing frequency; (ii) investment strategy; (iii) portfolio composition; and (iv) investor profile for each individual investment fund under management. The Central Bank highlighted that the responsibility for managing the liquidity of each fund lies with the board of the FMC, the individual directors and the relevant designated persons. In addition, this letter set out the Central Bank's expectation that assessments of the liquidity position of each fund should be undertaken on an ongoing basis to ensure that the liquidity of the fund's portfolio remains in line with its redemption policy, taking into account investor redemption demands.

ESMA's Guidelines on Liquidity Stress Testing in UCITS and AIFs - September 2019

In September 2019 following a consultation process with industry, ESMA published its final report containing its guidelines on liquidity stress testing in UCITS and AIFs (the "Guidelines"). These Guidelines applied to fund managers (AIFMs, UCITS management companies and self-managed UCITS/ AIFs) from 30 September 2020 and set down minimum standards for how managers should carry out liquidity stress testing ("LST") for the funds they manage. The Guidelines apply in respect of UCITS, open-ended AIFs and leveraged closed-ended AIFs. The Guidelines are intended to supplement and add to existing applicable regulatory requirements and are designed to provide a common framework throughout the EU for the conduct of LST and provide convergence in the way EU regulators supervise fund LST.

ESRB Recommendation, ESMA's Report Relating to this Recommendation and the Central Bank's letter relating to the report - May 2020 to March 2021

On 6 May 2020, the European Systemic Risk Board ("ESRB") published a recommendation relating to liquidity risk in investment funds which requested that ESMA coordinate with the national competent authorities ("NCAs") across EU member states to undertake a focused piece of supervisory work in respect of investment funds that have significant exposures to corporate debt and real estate assets. The purpose of this supervisory exercise was to assess the preparedness of these two segments of the investment funds sector to potential future adverse shocks, including any potential resumption of significant redemptions and/or an increase in valuation uncertainty.

In November 2020, following the completion of this supervisory exercise, ESMA published a report setting out its findings. While the main finding from the report is that funds with significant exposures to corporate debt and real estate assets managed to adequately maintain their activities when facing redemption pressures and/or episodes of valuation uncertainty with only a limited number of analysed funds temporarily suspending subscriptions and redemptions, the data collected shows areas with weaknesses that need to be addressed. Five priority areas were identified where action may need to be taken to enhance the preparedness of funds for future adverse market shocks:

- ongoing supervision of the alignment of a fund's investment strategy, liquidity profile and redemption policy;

- ongoing supervision of liquidity risk assessment;

- fund liquidity profiles;

- increase of the availability and use of liquidity management tools ("LMTs"); and

- supervision of valuation processes in a context of valuation uncertainty.

In March 2021, the Central Bank published a letter it had issued to boards of FMCs that took part in the supervisory exercise. In this letter the Central Bank stated that the results of the exercise showed that only a few funds had adjusted their liquidity set up according to the pursued investment strategy and in light of liquidity issues encountered. It was further stated that some funds presented potential liquidity mismatches as a result of a combination of their liquidity set up and investment in either illiquid assets or assets whose liquidity was reduced during the period of market stress. Those FMCs that received this letter were required to consider how their liquidity risk management frameworks and fund structures should be adapted to take into account the findings from ESMA's report and to put action plans in place before the end of December 2021.

UCITS CSA - ESMA's Results and Central Bank's Findings - March 2021 and May 2021

ESMA began working on a methodology for an EU-wide Common Supervisory Action ("CSA") on UCITS liquidity risk management in 2019 and launched the CSA on 20 January 2020 with the assistance and participation of the NCAs.

On 24 March 2021, ESMA issued a public statement setting out the results of the CSA together with a list of the following areas where it was felt improvements were necessary: documentation of liquidity risk management arrangements, processes and techniques; liquidity risk management procedures; quality of liquidity risk management mechanisms and methodology; overreliance on liquidity presumption with regard to listed securities; application of liquidity presumption to financial instruments which are not admitted to or dealt in on a regulated market; delegation; data reliability; disclosures; governance; internal control frameworks; and external controls.

On 19 May 2021, the Central Bank published a letter it sent to all Irish authorised UCITS managers (including self-managed UCITS) relating to its review of UCITS liquidity risk management as part of the CSA (the "Industry Letter"). Entities that received the Industry Letter were required to conduct a specific review of their practices, documentation, systems and controls relating to liquidity risk management, taking into account the findings set out in ESMA's public statement in addition to those specifically referenced in the Industry Letter. These entities were also required to prepare an action plan based on the results of their review for consideration and approval by their boards before the end of December 2021. An overview of the key findings set out in the Industry Letter is contained in our advisory from May 2021.

Proposed Amendments to AIFMD and UCITS Frameworks - November 2021

On 25 November 2021, the European Commission adopted a package of measures including proposed targeted amendments to the AIFMD and UCITS frameworks with liquidity risk management being one of the key areas of focus. In its letter to the European Commission of 18 August 2020 relating to the review of AIFMD, ESMA specifically highlighted the availability of additional LMTs as an issue to be considered as part of this review with specific reference being made to the ESRB's recommendations of 7 December 2017 on liquidity and leverage risks in investment funds. Both ESMA and the ESRB have advocated for a codified set of LMTs that should be available to both UCITS and AIFs. The proposals note the recommendations from ESMA and the ESRB to harmonise the rules on the use of LMTs and that the existing frameworks do not provide for a minimum harmonised set of LMTs. It is proposed to introduce a list of LMTs from which managers of UCITS and open-ended AIFs are required to choose at least one appropriate tool that could be activated should circumstances so require. In addition, it is proposed that ESMA be tasked with developing regulatory technical standards: (i) to specify the characteristics of the LMTs to be included in AIFMD and the UCITS Directive; and (ii) on criteria for the selection and use of suitable LMTs by the managers for liquidity risk management, including appropriate disclosures to investors, taking into account the capability of such tools to reduce undue advantages for investors that redeem their investments first, and to mitigate financial stability risks. Our advisory on the AIFMD proposals provides an overview of the other amendments being considered.

CP145 Property Fund Consultation Paper

https://www.centralbank.ie/docs/default-source/publications/consultation-papers/cp145/cp145-macroprudential-measures-for-the-property-fund-sector.pdf?sfvrsn=5

On 25 November 2021, the Central Bank published a consultation paper on macroprudential measures for the property fund sector. The Central Bank consulted on two key proposals, one being proposed guidance relating to liquidity mismatches. While the consultation paper is aimed at in scope property funds, the paper states that the proposed guidance may have more general value to other types of AIFs when interpreting Regulation 18 of the AIFM Regulations. Our advisory relating to this consultation paper provides more detail on these proposals. As at the date of this update the Central Bank has not published a feedback statement relating to this consultation or any final form guidance.

Next Steps

It is clear from the Central Bank's Securities Markets Risk Outlook Report that the Central Bank expects FMCs to have an appropriate risk management framework in place to identify, manage and mitigate the potential risks arising from liquidity risk within a fund's portfolio. Regular stress testing of the liquidity within a portfolio against plausible shock scenarios is also expected together with assessing the impact on the fund's performance and investors' redemption requests. Assessments of the LMTs available including the use of redemption gates, anti-dilution levies and swing pricing should also be undertaken. Now would seem like an opportune time for FMCs to critically assess their liquidity risk management frameworks and liquidity stress testing policies to ensure that all supervisory findings are addressed.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.