Definition of a Business (Amendments to IFRS 3)

In October 2018, the IASB issued 'Definition of a Business' making amendments to IFRS 3 'Business Combinations'.

The amendments are a response to feedback received from the post-implementation review of IFRS 3 ('the Standard'). They clarify the definition of a business, with the aim of helping entities to determine whether a transaction should be accounted for as an asset acquisition or a business combination.

In summary, the amendments:

- clarify the minimum attributes that the acquired set of activities and assets must have to be considered a business

- remove the assessment of whether market participants are able to replace missing inputs or processes and continue to produce outputs

- narrow the definition of a business and the definition of outputs

- add an optional concentration test that allows a simplified assessment of whether an acquired set of activities and assets is not a business.

How have the amendments changed the definition?

The amendments replace the wording in the definition of a business as follows:

Old Definition

'An integrated set of activities and assets that is capable of being conducted and managed for the purpose of providing a return in the form of dividends, lower costs or other economic benefits directly to investors or other owners, members or participants.'

New Definition

'An integrated set of activities and assets that is capable of being conducted and managed for the purpose of providing goods or services to customers, generating investment income (such as dividends or interest) or generating other income from ordinary activities.'

The changes narrow the definition by:

- focusing on providing goods and services to customers

- removing the emphasis from providing a return to shareholders

- removing the reference to 'lower costs or other economics benefits'.

Insight

The last change mentioned above reflects the fact that many asset acquisitions are made with the motive of lowering costs but may not involve acquiring a substantive process.

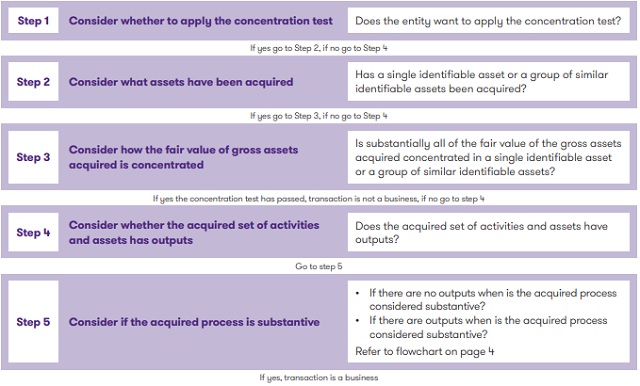

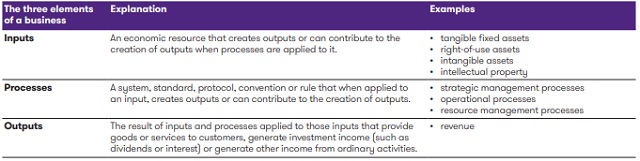

The table below explains the steps described in the amended Standard to determine if the acquired set of activities and assets is a business:

What is the optional concentration test?

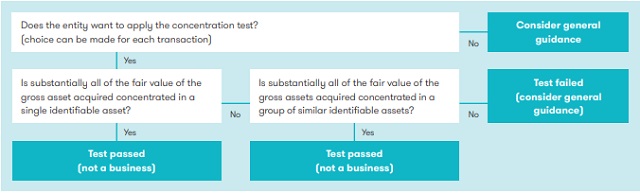

The amendments introduce an optional test ('the concentration test') that allows the acquirer to carry out a simple assessment to determine whether the acquired set of activities and assets is not a business. The entity can choose whether or not to apply the concentration test for each transaction it makes. If the test is successful, then the acquired set of activities and assets is not a business and no further assessment is required. If the test is not met or the entity does not carry out the test, then the entity needs to assess whether or not the acquired set of assets and activities meets the definition of a business in the normal way.

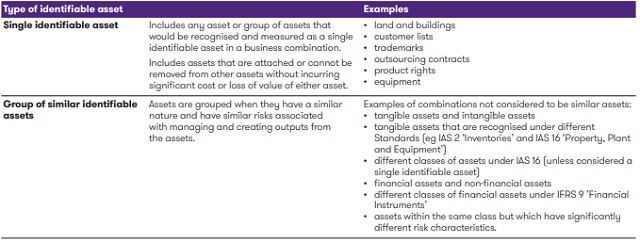

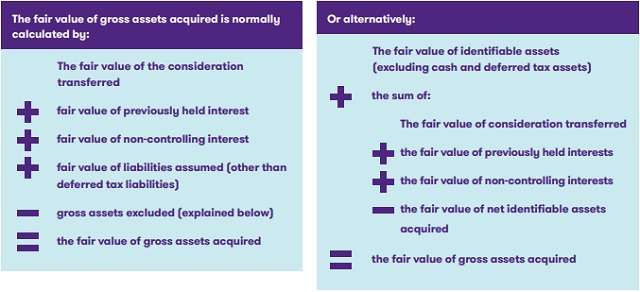

The test is met if substantially all of the fair value of the gross assets acquired is concentrated in a single identifiable asset or a group of similar identifiable assets. The meaning of gross assets is defined (there are some assets specifically excluded) and the Standard also explains how to calculate the fair value. Liabilities are not taken into account because nearly all businesses have liabilities, but they do not need to in order to be a business. Similarly, an acquired set of activities and assets that is not a business may have liabilities. The amendments also provide guidance on what a single identifiable asset or a group of similar identifiable assets would be.

Calculation of the concentration test

The Standard explains that the concentration test is met if substantially all of the fair value of the gross assets acquired is concentrated in a single identifiable asset or a group of similar identifiable assets. We look at the different parts of this test below:

Is a single identifiable asset or a group of similar identifiable assets acquired?

The different types of identifiable assets acquired are described in the following table:

How is the fair value of gross assets acquired calculated?

Refer to example 5 at the end of the publication for calculations using these methods.

Gross assets exclude cash and cash equivalents, deferred tax assets and goodwill resulting from the effects of deferred tax liabilities.

If the concentration test fails, or the entity opts not to apply the concentration test, then the entity needs to consider the minimum requirements to meet the definition of a business and if the acquired process is substantive. This is explained further in the following paragraphs.

What are the minimum requirements to meet the definition of a business?

The amendments acknowledge that despite most businesses having outputs, outputs are not necessary for an integrated set of assets and activities to qualify as a business. In order to meet the definition of a business, the acquired set of activities and assets must have inputs and substantive processes that can collectively significantly contribute to the creation of outputs.

Is the acquired process substantive?

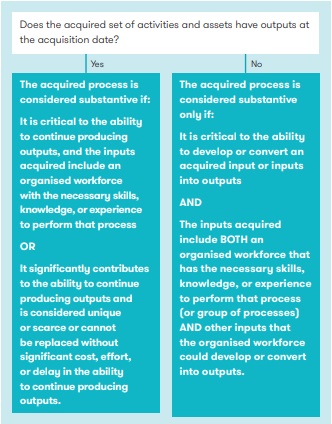

The Standard requires entities to assess whether the acquired process is substantive. Guidance and illustrative examples have been added to assist entities in making this assessment. The Standard has a different analysis depending on whether the acquired set of activities and assets has outputs or not.

An example of an acquired set of activities and assets that does not have outputs is a new entity that has not yet generated revenue. If the acquired set of activities and assets is generating revenue at the acquisition date it is considered to have outputs.

For activities and assets that do not have outputs at the acquisition date, the acquired process is substantive only if:

- it is critical to being able to develop or convert an acquired input into outputs, and

- the inputs acquired include both:

- an organised workforce that has the skills, knowledge or experience to perform the process

- other inputs that the organised workforce could develop or convert into outputs (eg. technology, in-process research and development projects, real estate and mineral interests).

For activities and assets that have outputs at the acquisition date, the acquired process is substantive if, when applied to an acquired input or inputs:

- it is critical to being able to continue to produce outputs, and the acquired inputs include an organised workforce with the necessary skills, knowledge or experience to perform the process, or

- it significantly contributes to being able to continue producing outputs and is deemed to be unique or scarce or it cannot be replaced without significant cost, effort or delay in producing outputs.

Transition

The changes are to be applied prospectively to business combinations and asset acquisitions for which the acquisition date is on or after the beginning of the first annual reporting period beginning on or after 1 January 2020. Companies can apply them earlier if they disclose this fact.

Examples

Example 1 – Acquisition of a radio station

An entity (Entity S) sells its radio broadcasting assets to another entity (Entity R). The acquired set of activities and assets sold comprise the broadcasting licence, the broadcasting equipment and a broadcasting studio. At the acquisition date, the fair value for each of the assets sold is considered similar. No processes needed to broadcast the radio shows are sold, and there are no employees or other assets, activities or processes included. Entity S has stopped using the acquired set of activities and assets before the date they are sold to Entity R.

Analysis

Entity R decides to apply the optional concentration test and determines that:

- the broadcasting equipment and the studio are not a single identifiable asset because the equipment is not attached to the studio and can be separated without being costly or causing a loss of use or fair value of either asset.

- the licence is an intangible asset, and the broadcasting equipment and studio are both tangible assets belonging in different classes. As a result, the assets are not considered similar to each other.

- there is a similar fair value for each of the single identifiable assets. Thus, the fair value of the gross assets acquired is not substantially all concentrated in a single identifiable asset or group of similar identifiable assets.

Therefore, the concentration test is failed. Entity R therefore assesses whether the acquired set of activities and assets meets the minimum requirements to be considered a business.

The acquired set of activities and assets does not have outputs, because Entity S has stopped broadcasting. Thus, Entity R applies the relevant criteria in IFRS 3 to determine whether the process is substantive. As the set does not include an organised workforce, the relevant criteria have not been met.

Therefore, Entity R concludes that the acquired set of activities and assets is not a business.

Example 2 – Acquisition of a research entity

An entity (Entity A) purchases another legal entity (Entity SolarCell). Entity SolarCell carries out research and development activities on several solar projects that it is involved in and are currently in progress. It has scientists who possess the skills knowledge and experience needed to perform these activities. It also has tangible assets which include lab equipment and a factory and laboratory to perform such activities. Currently the product is not ready to be marketed and no sales have been made. All of the assets acquired are deemed to individually have a similar fair value.

Analysis

Entity A elects to apply the concentration test and concludes that the fair value of the gross assets acquired is not substantially all concentrated in a single identifiable asset or group of similar identifiable assets. Therefore, Entity A assesses whether the set meets the minimum requirements to be considered a business.

Entity A determines that no processes have been documented for Entity SolarCell. However, the organised workforce that has been purchased has proprietary knowledge of the ongoing projects. Therefore, Entity A believes that the workforce provides intellectual capacity which provides the processes needed that can be used as inputs to create outputs.

Entity A then determines whether the acquired processes are substantive. There are no outputs derived from the acquired set of activities and assets. So Entity A applies the relevant criteria in IFRS 3 and concludes that the processes are substantive because:

- the processes purchased are essential to be able to develop or convert the acquired inputs into outputs; and

- the acquired inputs include:

- an organised workforce that has the necessary skills, knowledge, or experience to perform the necessary duties associated with the processes acquired; and

- other inputs that the organised workforce could develop or convert into outputs. Those inputs include the research and development projects that are in progress.

Finally, Entity A determines that the substantive processes and inputs it has acquired significantly contribute to the ability to create outputs. Therefore, Entity A concludes that the acquired set of activities and assets is a business.

Example 3 – Acquisition of a drug development entity

An entity (Entity D) acquires a legal entity that has:

- the rights to a research and development project that is in progress of its final testing phase to develop a drug to treat pneumonia (Project X). Project X includes the underlying knowledge, formula procedures, designs and protocols expected to be needed to complete this phase.

- a contract that provides the outsourcing of clinical trials. The contract does not state which vendor, should be used, there are several vendors that could provide these services, and the contract uses current market prices. Therefore, the contract has a zero-fair value. There is no option for Entity D to renew the contract.

Entity D has not acquired any employees, other assets, other processes or other activities.

Analysis

Entity D elects to apply the optional concentration test and determines that:

- Project X is a single identifiable asset because it would be recognised and measured as a single identifiable intangible asset in a business combination.

- because the acquired contract has a zero-fair value, substantially all of the fair value of the gross assets acquired is concentrated in Project X.

As a result, Entity D concludes that the acquired set of activities and assets is not a business.

Example 4 – Purchase of a brand

An entity (Entity B) purchases from another entity (Entity S) the worldwide rights to Product 123, including all related intellectual property. In addition, Entity B also purchases all the existing customer contracts and customer relationships, inventories of finished goods, customer incentive programmes, raw material supply contracts, specialised equipment specific to manufacturing Product 123 and documented manufacturing processes and protocols to produce Product 123. Entity B does not acquire any employees, other assets, other processes or other activities. None of the identifiable assets purchased has a fair value that comprises substantially all of the fair value of the gross assets acquired.

Analysis

As the fair value of the gross assets acquired is not substantially all concentrated in a single identifiable asset or group of similar identifiable assets, the optional concentration test would not be met. As a result, Entity B assesses whether the acquired set of activities and assets meets the minimum requirements to be considered a business.

Entity B considers whether the acquired process is substantive. The acquired set of activities and assets has outputs, and so Entity B considers the relevant criteria in IFRS 3.

The acquired set of activities and assets does not include an organised workforce, however Entity B concludes that the manufacturing processes acquired significantly contribute to the ability to continue producing outputs and are unique to Product 123. Therefore, Entity B concludes that the acquired processes are substantive.

In addition, Entity B determines the substantive processes and inputs together significantly contribute to the ability to create outputs. As a result, Entity B concludes that the acquired set of activities and assets is a business.

Example 5 – Establishing the fair value of the gross assets acquired

An entity (Entity P) holds a 30% interest in another entity (Entity C). At a subsequent date (the acquisition date), Entity P acquires a further 45% interest in Entity C and obtains control of it. Entity C's assets and liabilities on the acquisition date are the following:

- a building with a fair value of CU600

- an identifiable intangible asset with a fair value of CU350

- cash and cash equivalents with a fair value of CU150

- deferred tax assets of CU200

- financial liabilities with a fair value of CU750

- deferred tax liabilities of CU200 arising from temporary differences associated with the building and the intangible asset.

Entity P pays CU225 for the additional 45% interest in Entity C. Entity P determines that at the acquisition date the fair value of Entity C is CU500, that the fair value of the non-controlling interest in Entity C is CU125 (25% x CU500) and that the fair value of the previously held interest is CU150 (30% x CU500).

Analysis

When performing the optional concentration test, Entity P needs to determine the fair value of the gross assets acquired.

Using the following calculation, Entity P determines that the fair value of the gross assets acquired is CU1,000, calculated as follows:

- the total (CU1,250) obtained by adding:

- the consideration paid (CU225), plus the fair value of the non-controlling interest (CU125) plus the fair value of the previously held interest (CU150); to

- the fair value of the liabilities assumed (other than deferred tax liabilities) (CU750); less

- the cash and cash equivalents acquired (CU150); less

- deferred tax assets acquired (CU100) (in practice, it would be necessary to determine the amount of deferred tax assets to be excluded only if including the deferred tax assets could lead to the concentration test not being met)

Alternatively, the fair value of the gross assets acquired (CU1,000) is also determined by:

- the fair value of the building (CU600); plus

- the fair value of the identifiable intangible asset (CU350); plus

- the excess (CU50) of:

- the sum (CU500) of the consideration transferred (CU225), plus the fair value of the non-controlling interest (CU125), plus the fair value of the previously held interest (CU150); over

- the fair value of the net identifiable assets acquired (CU450 = CU600 + CU350 + CU150 + CU100 – CU750).

The excess referred to above is determined in a manner similar to the initial measurement of goodwill as stated in the Standard. Including this amount in determining the fair value of the gross assets acquired means that the concentration test is based on an amount that is affected by the value of any substantive processes acquired.

The fair value of the gross assets acquired is determined after making the following exclusions for items that are independent of whether any substantive process was acquired:

- the fair value of the gross assets acquired does not include the fair value of the cash and cash equivalents acquired (CU150) and does not include deferred tax assets (CU100) and

- the deferred tax liability is not deducted in determining the fair value of the net assets acquired (CU450) and does not need to be determined. As a result, the excess (CU50) calculated above does not include goodwill resulting from the effects of deferred tax liabilities.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.