New rules apply as from 1.10.2021 increasing the tax-exempt bracket for parental gifts, as well as gifts between close relatives (spouses, parents, children and grandchildren) to Euro 800,000, instead of the previously applicable threshold of Euro 150,000 for assets excluding cash. The same exemption applies for gifts in cash, which until now have been subject to a 10% tax, without any tax-exempt bracket.

Click here for the GR version – Πατ?στε εδ? για το ελληνικ? κε?μενο

To be noted that, until today, inheritance and gift taxation have both been assessed on the basis of uniform tax brackets. Following introduction of the new rules, gifts become subject to lighter taxation, compared to inheritance, given that the inheritance tax exempt bracket of Euro 150,000 remains unchanged.

The new rules apply with respect to gifts performed as from 1.10.2021, whereas the value of any gifts that have taken place prior to that date is disregarded for purposes of calculating the Euro 800,000 tax-exempt bracket. What renders the new provision even more favorable compared to the previous regime is that any such gifts up to the amount of Euro 800,000 are not taken into account, when applying inheritance tax brackets for the remaining estate.

Changes in question may reduce the tax leakage with respect to parental or close relative gifts of any type of asset performed by Greek tax residents, as well as gifts of real estate or other assets situated in Greece, performed by non-Greek tax residents. The new rules, combined with the anticipated increase of real estate statutory values as from 1.1.2022, are expected to accelerate gift transactions over the next months.

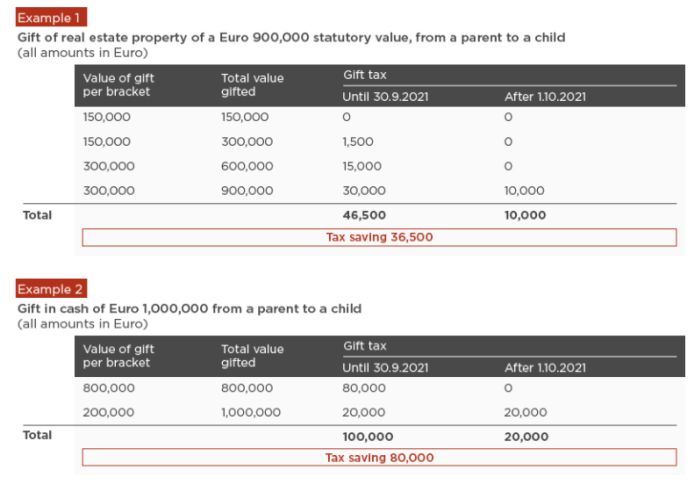

Potential tax benefits deriving from the new rules are depicted below, by way of example.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.