- within Family and Matrimonial topic(s)

- within Employment and HR and Accounting and Audit topic(s)

- with Senior Company Executives, HR and Inhouse Counsel

We can help ANSWER the important QUESTIONS

- Can a trust structure help in ring-fencing of assets?

- Will inheritance tax be applicable in a foreign jurisdiction?

- How do I manage my overseas income and assets to avoid double taxation?

- Do I have to file my tax returns in the countries where I earn revenue?

- Do you get a consolidated real-time view of your wealth?

As the assets of individuals and businesses grow, so does the magnitude and complexity of the monetary risk. Tax efficiency for the wealth of individuals and families is a fusion of assets held by the family and the expectations.

We work closely with promoters and family offices to provide tailor-made solutions through a comprehensive risk analysis of your profile, to help your family or business achieve its intended objectives by reducing administrative work and balancing your lifestyle.

With over 25 years of experience in handling complex tax matters, our dedicated team understands your needs and addresses them by providing innovative and comprehensive solutions.

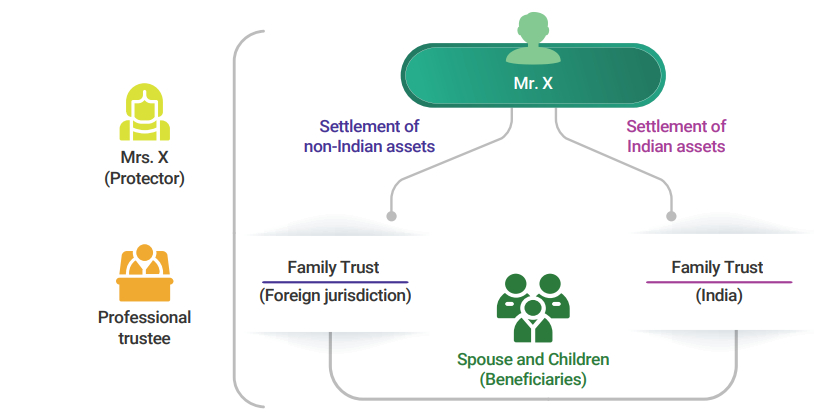

1 Estate Planning (US and India Perspective)

Background and Objective

Hong Kong resident contemplating moving to and becoming resident of USA was looking at the most effective structure from an estate tax planning perspective and also an efficient cash repatriation strategy from the corporate entities

Our Value Propositions

- Trust structure proposed to meet estate planning objective within USA and Indian tax and regulatory framework

- Nuances and measures around rights and entitlements of parties to help meet client need of retaining control over assets

- Recommended ideal jurisdiction with procedural aspects considering time sensitiveness for Trust formation

- Efficient fund extraction strategies recommended taking cognizance of sensitivities due to the involvement of a Joint Venture partner

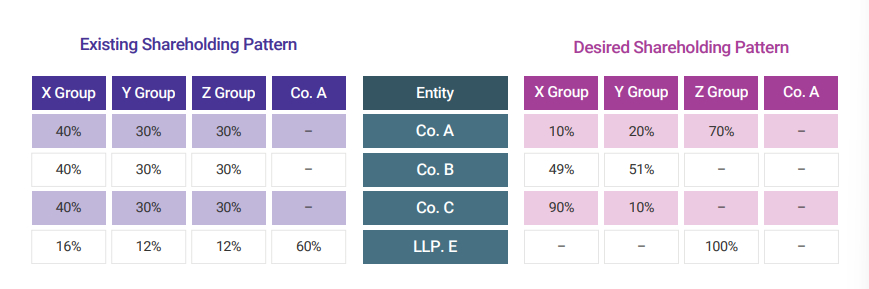

2 Realignment of Family Holdings in Multiple Entities

Background and Objective

- A business Group consisting of 4 entities was held by 3 branches of a family

- One family was looking at obtaining controlling stake, the second one was looking at cashing out while the third family wanted control in some entities and exit from the others

- Multiple entities in a family control settled in a tax-efficient manner

Our Value Propositions

- Combination of family arrangement mode and cashing out through the capital reduction option recommended

- Presented an unique proposition to claim tax exemption by the shareholders on the contention that even capital reduction has been undertaken as a part of family arrangement

- Supported family in obtaining a view from Senior Tax Counsel

- Our options resulted in substantial tax savings

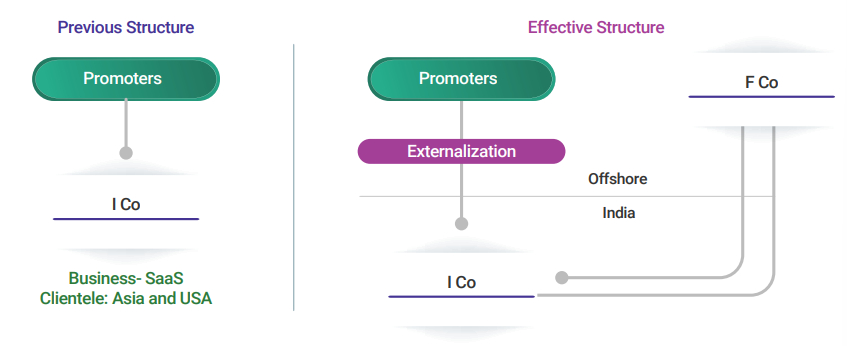

3 Externalization of Promoters and Business

Background and Objective

- Indian promotor looking at hiving off the business

- Typically, promotors are expected to continuing as employee directors post acquisition for 3-5 years to meet EBITDA targets

- Re-structuring required in view of high tax rates for UHNIs

Our Value Propositions

Structures evaluated

- Settlement of overseas Holding Company shares into an overseas Trust with Indian residents as beneficiaries

- Use of overseas funds earned by resident overseas to invest in shares of overseas Hold Co

- Investment under portfolio route – in certain cases without management control

- Providing ESOPs to Founders at overseas Hold Co level under an ESOP scheme

- Receipt of gift of overseas Hold Co shares from NR relatives/ associates

Areas advised upon

- Personal tax implications in the hands of the promoters

- Round trip issues under FEMA

- LRS and ODI Regulations

- Trust taxation

- Black Money Act

- Cost of set-up and administration

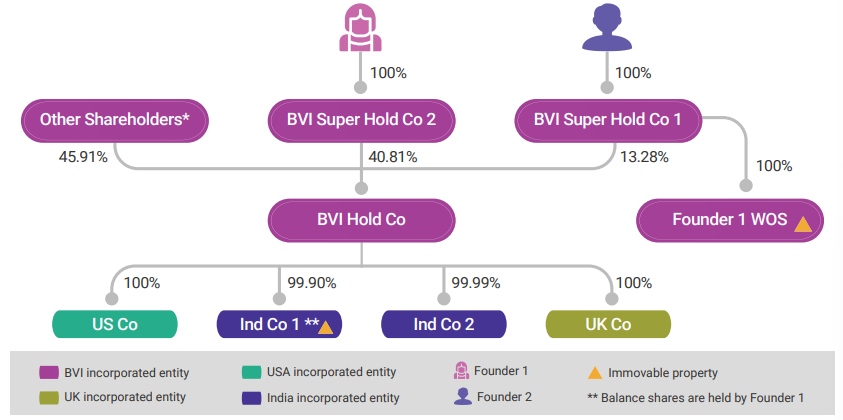

4 Rationalizing Inbound Structure

Background and Objective

- Current Structure non compliant from LRS read with ODI perspective

- Downstream investment as well as round tripping issues

Our Value Propositions

- Evaluated implication of restructuring option for making the structure compliant from a regulatory perspective

- Best structure recommended considering the below aspects:

- Resolving the downstream investment

- Resolving the Rounding Tripping issue

- Evaluating tax and regulatory implications on certain share transfers and merger options

- Tax and regulatory implications in UK, US and BVI

- We also supported the Group with implementing the recommended step plan in India as well as in overseas jurisdiction

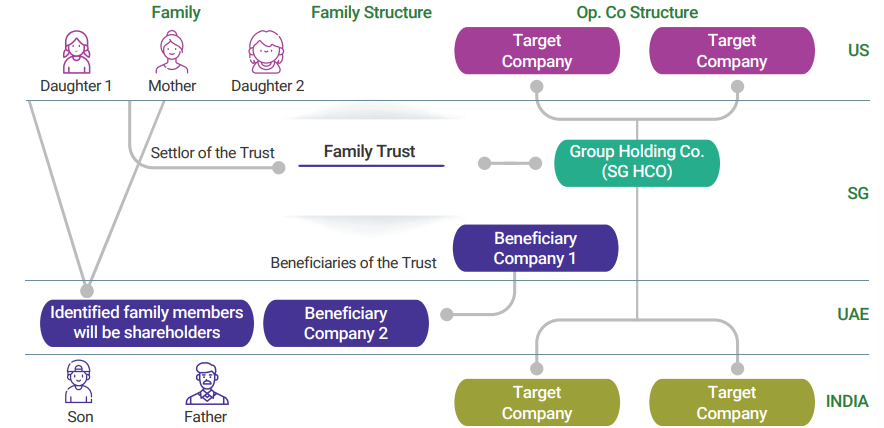

5 Settlement of Foreign Trust

Background and Objective

To create a structure for streamlining and consolidation of holdings in various operating entities, effective administration and monetization of the investments in future

Our Value Propositions

- Combination of private trust formation with discretionary nature and holding company structure evaluated

- Mitigation strategies suggested from FEMA risk perspective

- Settlor to settle trust out of own funds

- Appointment of independent / professional trustees and directors

- Beneficiary companies to be engaged in active business

- Timing the distribution of surplus funds

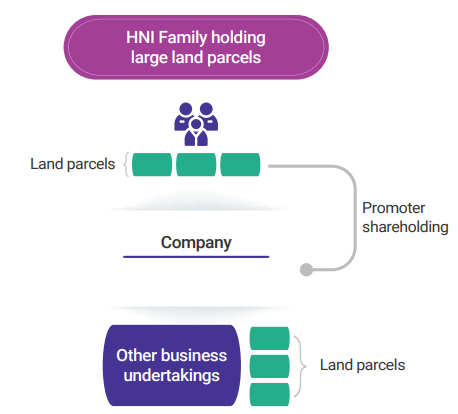

6 Divestment Structuring

Background and Objective

HNI family holding vast parcels of land wanted to unlock the value and build a Private Equity friendly structure for attracting investments

Our Value Propositions

- Helped the family in restructuring their holdings in the most tax-efficient manner while achieving their objective

- Planned conversion of agricultural lands to non-agricultural and systematic transfers from individuals to SPV while meeting the land ceiling limits

- Advised on stage of entry of Private Equity fund to monetize the wealth in hands of promoters while ensuring dilution of stake at desired levels only

- Also advised on the conversion of company to LLP/formation of new SPV for a specific project to enjoy tax incentives

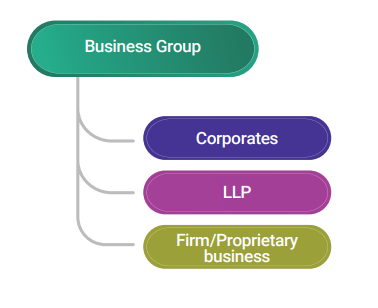

7 Legal Entity Rationalization for Better Control

Background and Objective

- Promoters of family businesses housed in varied entities (12

corporate entities, 2 LLPs) wanted to achieve varied objective of:

- Bringing efficiencies in terms of minimizing the time and cost of managing multiple entities

- Smooth succession planning while balancing the family arrangements

Our Value Propositions

- Guided the HNI on tax efficient method of distribution of properties held in an HUF

- Substantial saving of stamp duty cost by structuring the partition process and suitably drafting the partition document

- Suggesting trust structure from future inheritance perspective

8 Partition of HUF

Background and Objective

- Distribution of properties held in in an Hindu Undivided Family (HUF) in the most feasible manner

- Future inheritance planning

Our Value Propositions

- Evaluated and put forth various structuring options including mergers, slump sale, run-up and run down of operations, conversion into LLP etc. from the perspective of reducing the number of entities as well as ensuring eventual smooth succession

- While suggesting the restructuring modes, the impact on the eligible tax incentives was taken into consideration

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.