- within Employment and HR topic(s)

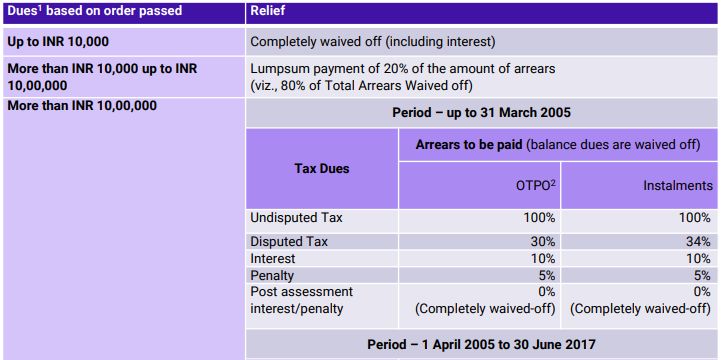

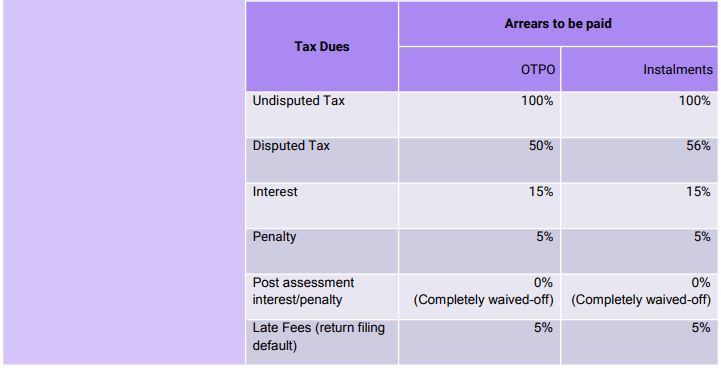

The Maharashtra Government has proposed to introduce Amnesty Scheme for providing relief to industry for long-pending tax and other arrears up to 30 June 2017. We have summarized the relevant provisions:

Arrears pertaining to which Acts

- The Central Sales Tax Act, 1956

- The Bombay Sales of Motor Spirit Taxation Act, 1958

- The Bombay Sales Tax Act, 1959

- The Maharashtra Purchase Tax on Sugarcane Act, 1962

- The Maharashtra State Tax on Professions, Trades, Callings and Employments Act, 1975

- The Maharashtra Sales Tax on the Transfer of Right to use any Goods for any Purpose Act, 1985

- The Maharashtra Tax on Entry of Motor Vehicles into Local Areas Act, 1987

- The Maharashtra Tax on Luxuries Act, 1987

- The Maharashtra Sales Tax on the Transfer of Property in Goods involved in the Execution of Works Contract (Re-enacted) Act, 1989

- The Maharashtra Tax on the Entry of Goods into Local Areas Act, 2002; and

- The Maharashtra Value Added Tax Act, 2002.

Applicability

Duration of Submission of Application

Every application must be accompanied by a payment challan evidencing the requisite amount determined and paid under this Scheme and shall be submitted during 1 April 2022 to 14 October 2022

Duration of Payment of Requisite Amount

- One Time Payment Option: 1 April 2022 to 30 September 2022

- Instalment Method:

- Minimum 25%: 1 April 22 to 30 September 2022

- Balance Requisite Amount: three equal instalments on every

quarter from the date of Application

All instalments shall be paid within nine months from the date of application. Payment of instalment beyond the due date attracts interest at 12% - Benefit will be proportionated if all instalments are not paid within nine months.

Conditions

- Appeal filed by the dealers against the statutory order passed must be withdrawn fully and unconditionally to avail the benefit under the Amnesty Scheme.

- In case where arrears are less than INR 50,00,000, the requisite amount as mentioned above must be paid together

- Dealers with arrears above INR 50,00,000 and availing relief under the Amnesty Scheme shall have an option to pay the requisite amount in instalments.

Benefits

- Unregistered taxpayers (i.e., not registered under the relevant Act though required) can also avail the benefit under Amnesty Scheme.

- Any person who had already availed the benefit under Amnesty Scheme available in the previous regime shall also be eligible to make an application under this Scheme

Corrections, Rejection and Rectification of orders passed under this Scheme

- Erroneous order passed can be rectified within a period of six months from the date of receipt of order by the applicant. The application for rectification shall be made within 60 days from the date of receipt.

- An appeal against the order passed under Amnesty Scheme can be filed before Deputy Commissioner, Joint Commissioner, Additional Commissioner, depending upon the lower Authority who has passed such order. The Appeal must be filed within 60 days from the date of passing an order.

- Order can be reviewed by Commissioner, on his own notion, and after serving an opportunity of being heard to the applicant, pass an order to the best of his judgment within 12 months from the date of service of the order.

- If the applicant has availed the benefit by suppressing material facts, serving false information, then after serving an opportunity of being heard to the applicant, the designated Authority has the right to reject the application within two years from the date of passing an order.

Our Comments

The said Amnesty Scheme is a welcome revival measure by the Maharashtra Government. This Scheme would enable the government to retrieve the undisputed amounts along with concessional disputed amounts. This time, the government has extended the Amnesty to registered as well as unregistered applicants with pending liability as of 1 April 2022.

Accordingly, the applicants should analyze the Scheme in detail and take maximum benefit of the Scheme (which could be the last one under VAT/CST) for payment of any VAT payable arising out of it.

Footnotes

1. Dues means any arears that are determined as per any statutory order for a specified period

2. OTPO means One Time Payment Option

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.