India Regulatory & Trade Highlights

Foreign Trade

- Import policy and condition revised to free for goods covered under HS Code 85423100, 85423900, 85423200, 85429000, 85423300, subject to registration under Chip Import Monitoring Systems (CHIMS) and condition 6 of Chapter 85. [Notification No. 5/2015-2020 dated May 10, 2021]

- New online module (https://www.dgft.gov.in) introduced for filing of electronic, paperless applications for export authorizations (except SCOMET) with effect from May 17, 2021. [Trade Notice No. 3/2021-22 dated May 10, 2021]

- Requirement of presentation of valid Registration Cum Membership Certificate (RCMC) relaxed till September 30, 2021 for filing of any incentives/ authorizations, where such RCMC expired on or before March 31, 2021. [Trade Notice No. 4/2021-22 dated May 10, 2021]

- Filing of application, any further submission and decision for relaxation in policy and procedures shall only be dealt in electronic mode at DGFT portal w.e.f. May 19, 2021. [Trade Notice No. 5/2021-22 dated May 19, 2021]

The Directorate General of Trade Remedies, Ministry of Commerce & Industry

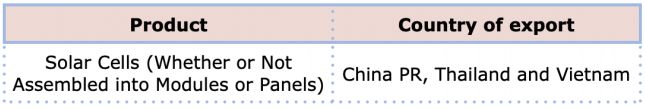

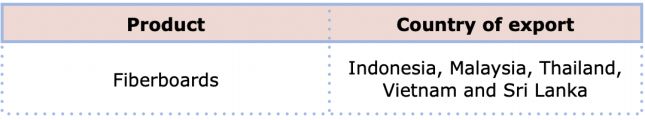

a. Anti-Dumping Duty investigation initiated against import of:

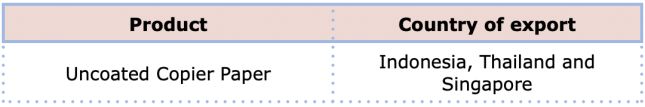

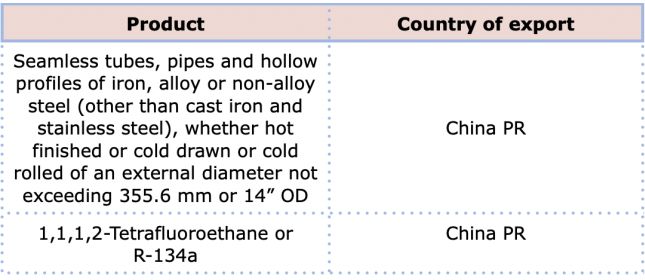

b. Sunset Review investigation initiated for review of levy of Anti-Dumping Duty against import of:

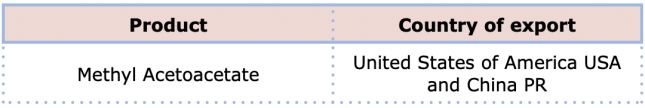

c. Final Findings in Sunset Review investigation issued concerning on import of:

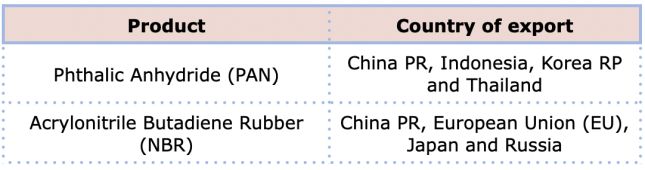

d. Final findings issued in Anti-Dumping Duty investigation concerning import of:

e. Final findings for Anti-Subsidy Investigation concerned on import of:

Ministry of Finance

a. Levy of Anti-Dumping Duty on import of:

India Custom Highlights

- Integrated Goods and Services Tax (IGST) applicable @12% on oxygen concentrator imported for personal use. [Notification No.30/2021-Cus dated May 1, 2021]

- Exemption from IGST on import of goods such as Remdesivir,

APIs, injection Remdesivir, oxygen concentrator, medical oxygen,

oxygen related equipment, goods used in the manufacture of

equipment related to production, transportation, distribution or

storage of oxygen, ventilators, masks for ICU ventilators, COVID-19

vaccine etc., for purpose of providing Covid relief subject to

following conditions:

- Goods are imported free of cost.

- Goods are received from abroad for free distribution in India and a certificate from nodal authority of State Government is submitted to the Deputy or Assistant Commissioner of Customs before clearance of goods.

- Statement containing details of goods distributed free of cost duly certified by the Nodal Authority of the State Government is submitted before the Deputy or Assistant Commissioner of Customs within six months from the date of importation.

[Ad hoc Exemption Order No. 4/2021-Customs dated May 3, 2021, Instruction No. 09/2021-Cus dated May 3, 2021] - Restoration of facility of acceptance of undertaking in lieu of bond by custom formations in certain cases of customs clearance till June 30, 2021. [Circular No. 9/2021-Cus dated May 08, 2021]

- Changes introduced through the Customs (Import of Goods at Concessional Rate of Duty) Amendment Rules, 2021 clarified. Further, all intimations and other communications as specified in said Rules to be shared with the Customs Officers through e-mail till the time suitable changes are made in ICEGATE portal. [Circular No.10/2021- Cus dated May 17, 2021]

- The Sea Cargo Manifest and Transhipment (Second Amendment) Regulations, 2021 notified. [Notification No.44/2021- Cus (N.T.) dated April 15, 2021]

- The Sea Cargo Manifest and Transshipment (Second Amendment) Regulations, 2021 notified. [Notification No.44/2021- Cus (NT) dated April 15, 2021]

- Instructions issued for custom clearance of cylinders and pressure vessels for storage and transportation of medical oxygen imported in relation to COVID-19 pandemic, without approval from Petroleum and Explosive Safety Organization [Instruction No.12/2021- Cus dated May 25, 2021]

India GST Highlights

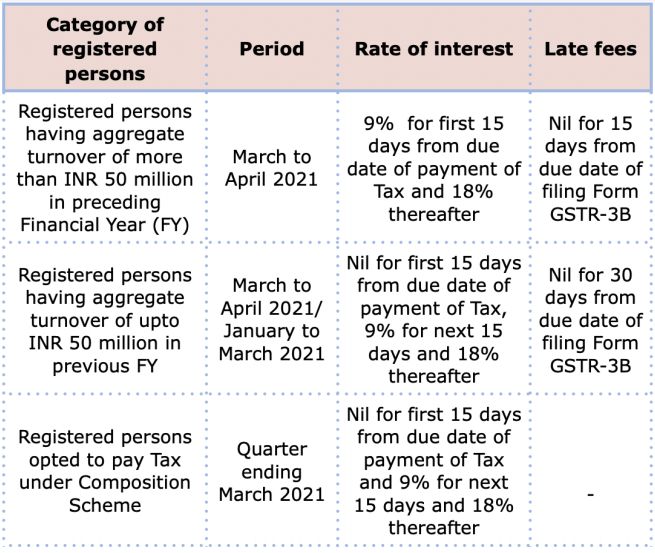

- Interest rate revised w.e.f. April 18, 2021 and late fees w.e.f. April 20, 2021 for filing Form GSTR-3B

[Notification No. 8 and 9/2021-CT, both dated May 1, 2021, Notification 1/2021-IT dated May 1, 2021 and Notification 1/2021-UT dated May 1, 2021]

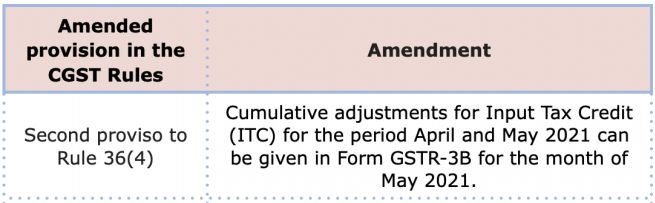

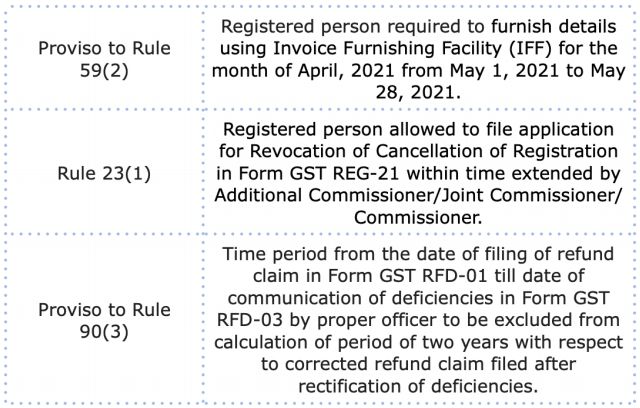

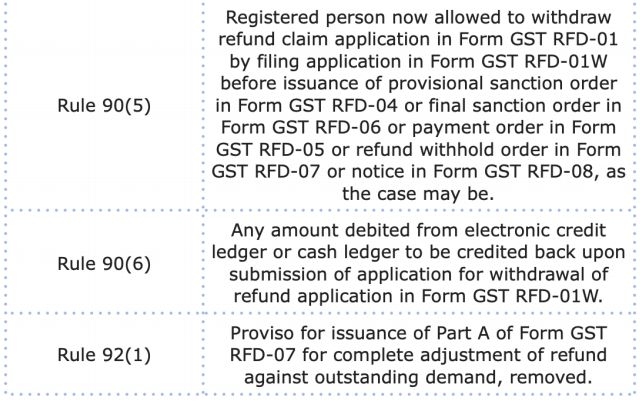

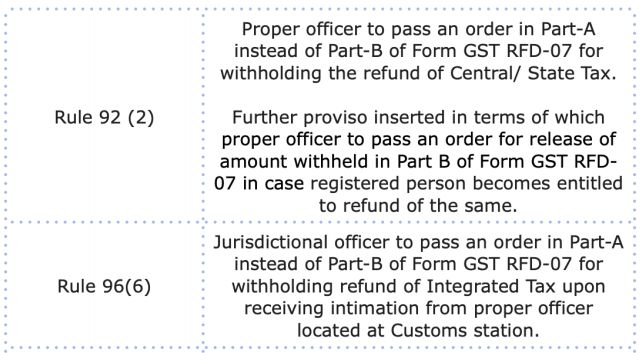

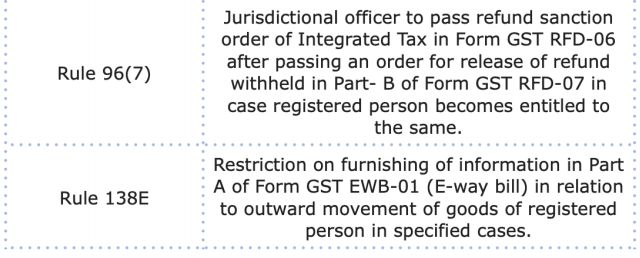

- Amendment made in the Central Goods and Services Tax Rules, 2017 (the CGST Rules)

Further, Form REG-21 (Application for revocation of Cancellation of Registration), Form GST RFD-07 (Order for withholding the refund/release of withheld refund) amended and Form GST RFD-01W (Application for withdrawal of refund application) inserted.

- Standard operating procedure (SOP) prescribed for implementation of provision of extension of time limit to apply for revocation of cancellation of registration. [Circular No. 148/04/2021-GST dated May 18, 2021]

- Guidelines issued for department regarding issuance of order within 30 days from the date of filing application for cancellation of registration. [Circular No. CBEC 20/16/34/2019-GST/802 dated May 24, 2021].

Important Case Laws

GST

The Appellant approached the Hon'ble Supreme Court against order of the High Court whereby order of Provisional Attachment of property (Attachment Order) was disposed as being not maintainable.

The Hon'ble Supreme Court held that appeals under Section 107(1) of the Himachal Pradesh Goods & Services Tax Act, 2017 (the HPGST Act) can be filed against order passed by adjudicating authorities, and that the Commissioners are specifically excluded from the definition of adjudicating authorities under Section 2(4) of the HPGST Act. Therefore, Order passed by the Joint Commissioner as a delegate of the Commissioner is not an appealable order under Section 107(1) of the HPGST Act. Thus, the only remedy available to the Appellant against the Attachment Order was in the form of invocation of Writ Petition under Article 226 of the Constitution.

The Hon'ble Supreme Court further held that an order to provisionally attach a property under Section 83 of the HPGST Act can be issued during pendency of proceeding under Section 74 of the HPGST Act. Since, the impugned Attachment Order was passed before issuance of Show Cause Notice under Section 74 of the HPGST Act, it was held to be ultra vires Section 83 of the HPGST Act. It has been further held that the power to order provisional attachment of property is draconian in nature and must be exercised only on formation of opinion basis tangible matter that the same is necessary to protect the interest of revenue. Since, there was no basis for formation of such opinion, the Hon'ble SC has allowed the appeal setting aside the Attachment Order.

Takeaway: Attachment Order must be passed on formation of opinion basis tangible material that such provisional attachment is necessary to protect the interest of the government

[M/s Radha Krishan Industries V. State of Himachal Pradesh & Ors, Civil Appeal No. 1155 of 2021 dated April 20, 2021 (Supreme Court of India)]

The Petitioner hired transporter for transporting goods (the Goods) from Dadra and Nagar Haveli to Secunderabad (distance of 867 km). The said transporter was also transporting goods belonging to another party from Dadar & Nagar Haveli to Adoni (distance of 940 Kms). The transporter decided to unload goods of the other party at Adoni first and then head to Secunderabad for delivery of the Goods.

The vehicle was intercepted and detained on its way to Adoni on the ground that documents of the vehicle were defective and that transaction wrt transportation of goods from Dadar & Nagar Haveli to Secunderabad got concluded at Secunderabad (as it comes before Adoni), however, the goods were further transported without invoice or e-way bill. The Petitioner was directed to pay tax along with penalty under Section 129 of the Central Goods and Services Tax Act, 2017 (the CGST Act) which was paid by Petitioner under protest.

The Petitioner filed a writ petition before the Hon'ble High Court seeking directions to declare action of the Respondent as illegal, arbitrary and violative of Article 14 and 300A of the Constitution of India and prayed for refund of amount deposited under protest.

The Hon'ble High Court allowed the writ petition filed by the Petitioner and held that there is no prohibition for a transporter to load two different consignments in a single conveyance for two different parties which are to be delivered in two different States. Further, it has been held that there is no rule that consignments intended for a party at a shorter distance should be offloaded first and that the transporter can deliver the goods as per its operational convenience.

Takeaway: Benefit of operational convenience of the transporter to be given in case there is no intention to evade Tax

[M/s Vijay Metal Vs. The Deputy Commercial Tax Officer, W.P. No. 2869/2021 dated April 28, 2021 (Telangana High Court)]

The Petitioner was acting as a director and also working in the capacity as a mentor/advisor for Milk Food Limited (the Company). An investigation was initiated under Section 67 of the CGST Act against the Company wherein it was alleged that the Company has availed ITC against fake invoices. In this connection, several bank accounts of the Petitioner were provisionally attached vide Attachment orders issued under Section 83 of the CGST Act.

The Petitioner filed a writ petition before the Hon'ble High Court challenging the attachment orders on the ground that the same were passed without jurisdiction.

The Hon'ble High Court allowed the writ petition filed by the Petitioner and held that the property, including bank accounts belonging to taxable person can be provisionally attached in terms of Section 83(1) of the CGST Act. Since, the Petitioner is not a taxable person, therefore, his property cannot be provisionally attached. Further, it has been held that the Department has not placed any material on record which links the Petitioner with the fake invoices and therefore, the action of provisionally attaching the bank account is unsustainable.

Takeaway: Attachment Orders can be issued only against taxable persons

[Roshni Sana Jaiswal Vs. CCT, WP(C) No. 2348/2021 dated May 12, 2021 (Delhi High Court)]

Service Tax

The appellant entered into a partnership with two other persons to form a partnership firm. The appellant was providing marketing and distribution services to the partnership firm wrt products thereof, and paying Service Tax on the services provided to partnership firm. However, later the appellant filed refund claim on the ground that partner and partnership firm are one and the same, thus, there was no provision of services. The said refund claim was rejected by the department. Against the denial of refund claim, the appellant filed an appeal before the Customs, Excise and Service Tax Appellate Tribunal (the CESTAT).

The Hon'ble CESTAT held that the services so rendered by the appellant are in accordance with the deeds of partnership and not under a separate and independent agreement. The activities carried out by the appellant are part of the duties of the partner. The CESTAT also discussed that for levy of Service Tax, service provider and service recipient must be two distinct persons. However, as per the provisions of General Clauses Act as well as Service tax laws as existing prior to July 1, 2012, partner and partnership firm are same person and as such no services can be rendered between the same persons.

Further, relying on a decision rendered under the Income tax laws, the CESTAT also held that all amounts received by the partner from the partnership firm are in the nature of share of profit and not 'consideration' for rendering any services. Therefore, Service Tax cannot be levied on activities provided by partners to the partnership firm in the due course of partnership.

Takeaway: No Service Tax is leviable on activities performed by a partner for the partnership firm which are specified in the partnership agreement.

[Cadila Healthcare Ltd vs CST, Final Order No. A/11661-11675/2021 dated April 27, 2021]

The Appellant entered into an agreement with a contractor for crushing, pulverizing, and converting whole 'turmeric' and 'chilly' as well as seeds of 'coriander' and 'cumin' supplied by the latter into powder which is then packed and returned.

The department raised Service Tax demand on the appellant under Business Auxiliary Service. The Appellant contended that activities amount to 'manufacture' which are covered within the scope of the Central Excise Act, 1944 and thus, not liable to Service tax in accordance with Section 65(19) of Chapter V of the Finance Act, 1994.

The Hon'ble CESTAT held that as a result of the processing of spices and seeds, the final product i.e. the powder has a separate market of its own. In case this activity is not carried out, there would be an unsatisfied demand of this powder in the market. Therefore, one of the basic test of manufacture has been passed as laid down in various judicial precedents. Thus, the activity amounts to manufacture and not liable to Service Tax.

Takeaway: Activity of processing of spices into powder amounts to manufacture and not liable to Service Tax

[Nilgiri Oil And Allied Industries Vs CCE, Order No. 4-5/2021 dated May 25, 2021]

Central Excise

The Appellant is a contract manufacturing unit engaged in manufacture of biscuits for its principal. The Principal raised invoices in the capacity of Input Services Distributor (ISD) in respect of advertisement and marketing expenses incurred by the principal to the appellant.

The issue before the Hon'ble CESTAT was whether issuance of ISD invoices by principal to the appellant which is a separate legal entity was correct. Further, another issue before the Hon'ble CESTAT was to decide if the appellant was eligible to claim credit of services whose cost was already included in the value of excisable goods sold by it.

The Hon'ble CESTAT held that Rule 7 of the CENVAT Credit Rules, 2004 (the CENVAT Credit Rules) does not use the word 'own' manufacturing unit and therefore, covers within its ambit a contract manufacturer who manufactures in accordance with the provisions of registration exemption certificate. As per the facts of the case, the contract manufacturer had stepped into the shoes of the principal for the purpose of manufacturing since it was carrying out all the tasks in accordance with the directions of the principal contractor.

Further, the CESTAT also discussed that the sale price fixed by the principal includes sales promotion and marketing expenses. CENVAT credit is a beneficial scheme which avoids cascading effect of taxes and duties. Therefore, credit is allowed on services whose cost was already included in the value of goods.

Takeway: Principal manufacturer can distribute credit of input services to a contract manufacturer under Rule 7 of the CENVAT Credit Rules even if the latter is a separate legal entity.

[Krishna Food Products Vs CCE, Order No. 51512-51514/2021 dated May 25, 2021 (CESTAT, Delhi)]

Customs

The Petitioner challenged validity of Notification 30/2021-Cus dated May 1, 2021 imposing IGST @12% on Oxygen Concentrator imported for personal use. Exemption from IGST vide Notification No. 4/2021-Cus dated May 3, 2021 (Exemption Notification) was provided only to oxygen concentrators imported by the State Government, or via any entity, relief agency or statutory body authorised by the State Government and not to individuals.

The Hon'ble High Court held that the Petitioner could not be denied benefits of Exemption Notification since it was violative of Article 14 of the Constitution of India since an artificial, unfair and unreasonable distinction has been drawn between persons, who are similarly circumstanced as the Petitioner and those who import oxygen concentrators through a canalizing agency.

Further, it has been held that there is no justification whatsoever in excluding individuals from the purview of Exemption Notification only on the ground that they received oxygen concentrators directly as gifts from their friends and/or relatives located outside the country. Thus, imposition of IGST on oxygen concentrators which are imported by individuals and are received by them as gifts i.e., free of cost for personal use is unconstitutional.

Takeaway: Exemption from IGST on import of oxygen concentrators on the State Government, or via any entity, relief agency or statutory body authorized by the State Government and not to individuals is unconstitutional.

[Gurcharan Singh v. Ministry of Finance, W.P.(C) 5149/2021, CM No. 16554/2021 Order dated May 21,2021 (Delhi High Court)]

The Larger Bench of Hon'ble CESTAT has held that notional cost towards freight charges is not required to be added to the Value of Aviation Turbine Fuel (ATF) remaining in the aircraft after its international flight into India.

The issue before the Hon'ble CESTAT was valuation of this remnant ATF. Department argued that in view of rule 10(2) of the Customs Valuation Rules, 2007 cost of transportation of the remnant AFT should be added to the Indian Oil Corporation Limited price, on which customs duties have been discharged by the Appellant.

The Hon'ble CESTAT held that there was no cost of transportation incurred by the airline towards ATF and therefore, only actual cost paid or payable can be added to the transaction value.

Takeaway: Transportation cost not to be included in the remnant ATF.

[M/s Jet Airways (India) Limited v. CC, Appeal No. 86898 of 2017, Order dated May 25, 2021 (CESTAT, Mumbai)]

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.