INDIA REGULATORY & TRADE HIGHLIGHTS

Foreign Trade

- Plastic Export Promotion Council (PEPC) authorized to be an agency to issue non-preferential certificate of origin (CoO). [Trade Notice No. 42/2015-2020 dated March 17, 2021]

- Validity of Foreign Trade Policy, 2015-2020 extended till September 30, 2021. [Notification No. 60/2015-2020 dated March 31, 2021]

- Validity of Hand Book of Procedures, 2015-2020 extended till September 30, 2021. [Public Notice No. 48/2015-2020 dated March 31, 2021]

- Online module specified for Adjudication, Appeal and Review proceedings for trade related matters. [Trade Notice No. 44/2015-2020 dated March 1, 2021]

- Online module specified for filing applications for import authorizations. [Trade Notice No. 47/2020-2021 dated March 23, 2021]

- Procedure and criteria specified for submission and approval of applications for export of Diagnostic Kits and its components/laboratory reagents. [Trade Notice No. 45/2020-2021 dated March 02, 2021]

- Importers to submit specified information/documents for filing application for import authorization to import Denatured Ethyl Alcohol (DEA). [Trade Notice No. 46/2020-21 dated March 16, 2021]

- Online electronic filing of non-preferential CoO for export w.e.f. April 15, 2021. [Trade Notice No. 48/2020-21 dated March 25, 2021]

- Last date of filing application for claiming benefit under scheme of Rebate of State Levies (RoSL) extended till December 31, 2021 for shipping bills with Let Export Order (LEO) date prior to October 1, 2017. [Public Notice No. 43/2015- 2020 dated March 17, 2021]

- Import policy of specified items in Chapter 74 (Copper and Articles therof) and Chapter 76 (Aluminium and Articles therof) of ITC(HS) revised from 'free' to 'free subject to compulsory registration under Non Ferrous Metal Import Monitoring System' (NFMIMS). [Notification No. 61/2015-2020 dated March 31, 2021]

The Directorate General of Trade Remedies

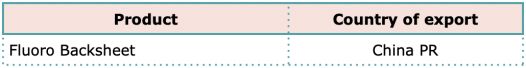

- Initiation of Anti-Dumping Duty investigation on import of:

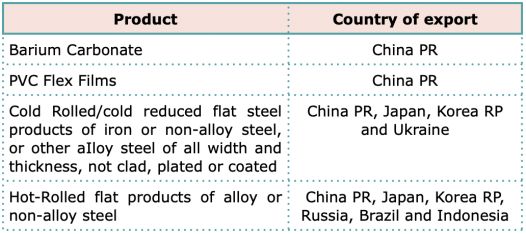

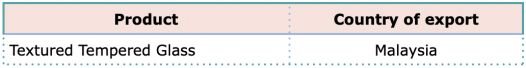

- Initiation of Sunset Review investigation of Anti-Dumping Duty on import of:

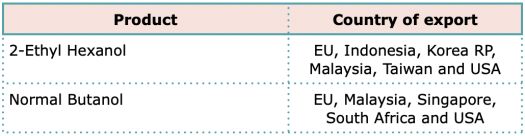

- Initiation of Sunset Review investigation of Anti-Dumping Duty on import of:

Ministry of Finance

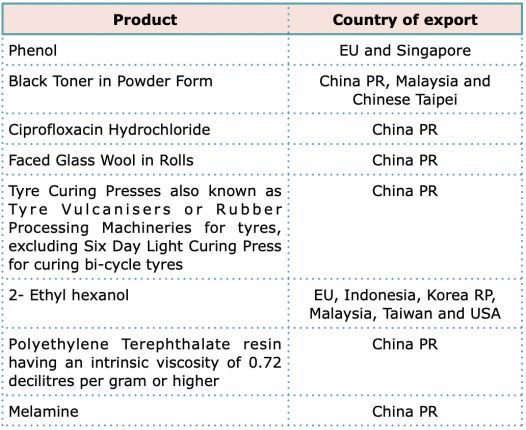

- Levy of Anti-Dumping Duty on import of:

- Levy of Countervailing Duty on import of:

India Custom Highlights

- Exemption to export oriented units (EOU) from payment of Integrated Goods and Services Tax (IGST) and Compensation Cess on import of specified goods extended till March 31, 2022. [Notification No. 19/2021-Cus dated March 30, 2021]

- Exemption from payment of Duty on import of specified goods from Japan w.e.f. April 1, 2021 under Comprehensive Economic Partnership Agreement between Japan and India. [Notification No. 20/2021-Cus dated March 30, 2021]

- The Bill of Entry (Electronic Integrated Declaration and Paperless Processing) Amendment Regulations, 2021 notified. [Notification No. 34/2021-Cus (N.T.) dated March 29, 2021]

- The Bill of Entry (Forms) Amendment Regulations, 2021 notified. [Notification No. 35/2021-Cus (N.T.) dated March 29, 2021]

- Importer to furnish details regarding bill of lading in Bill of Entry (BOE) itself while presenting on common customs electronic portal. [Notification No. 36/2021-Cus (N.T.) dated March 29, 2021].

- Exemption from payment of Duty on import of specified goods from Mauritius under the India-Mauritius Comprehensive economic cooperation and partnership agreement w.e.f. April 1, 2021. [Notification No. 25/2021-Cus dated March 31, 2021]

- Exemption from payment of IGST and Compensation Cess on import of specified goods against Advance Authorizations/ Export Promotion Capital Goods (EPCG) authorizations extended till March 31, 2022. [Notification No. 23/2021-Cus dated March 31, 2021]

- Exemption from payment of health cess on import of specified parts of x-ray machines. [Notification No. 22/2021-Cus dated March 31, 2021]

- Rate of Duty increased on import of specified goods w.e.f. April 1, 2021. [Notification No. 21/2021-Cus dated March 31, 2021]

- The Customs Tariff (Determination of Origin of Goods under the Comprehensive Economic Cooperation and Partnership Agreement between Republic of India and Republic of Mauritius) Rules, 2021 notified. [Notification No. 38/2021-Cus (N.T.) dated March 31, 2021]

India GST Highlights

- Registered person having turnover more than INR 500 million to issue e-invoice under GST w.e.f. April 1, 2021. [Notification No. 05/2021-CT dated March 8, 2021]

- Penalty waived for non-compliance of provisions of Dynamic Quick Response (QR) Code in B2C invoices during the period December 01, 2020 to June 30, 2021, subject to condition that such compliance done till July 01, 2021. [Notification No. 06/2021-CT dated March 30, 2021]

- The following clarifications issued in respect of refund

claims:

- No restriction on recipient of deemed export supplies for availing Input Tax Credit (ITC) for which refund application is filed.

- Extension of relaxation for filing refund clam in cases of zero-rated supplies has been wrongly declared in Table 3.1(a) [Outward Taxable Supply] of Form GSTR-3B.

- Value of export/ zero-rated supply of goods to be included

while calculating 'adjusted total turnover' for the purpose

of calculating refund claim.

[Circular No. 147/03/2021 – GST dated March 12, 2021]

Important Case Laws

GST

Pursuant to writ petition (WP) seeking relief for permitting rectification of Form GSTR-3B for the month of May 2019 (the Relevant Period) in relation to inadvertently wrongly uploaded details of ITC, the Hon'ble Gujarat High Court relying upon decision of the Hon'ble High Court of Delhi in case of Bharti Airtel Limited & Ors. Vs UOI has held that the Petitioner could rectify its Form GSTR-3B for the Relevant Period. Further, the High Court directed the department to give effect to claim of the Petitioner on verification. It has been further held that the Petitioner would not bear the burden of late fees for rectifying GSTR-3B for the Relevant Period.

Takeaway: Permission provided for rectification of Form

GSTR-3B.

[M/s Deepak Print Vs UOI [Special Civil Application No. 18157 of

2019, Order dated March 9, 2021 (Gujarat High Court)]

The Petitioner filed WP challenging provisional attachment of its bank account by the department under Section 83 of the Central Goods and Service Tax Act, 2017 (the CGST Act).

The Hon'ble High Court held that in case the proper officer concludes that the amount voluntarily deposited by the Petitioner falls short of the amount payable, then the proper officer shall proceed towards issuance of show cause notice (SCN) under Section 74(1) of the CGST Act. Since no SCN has been issued by the proper officer as required under law, the order attaching bank accounts has been set aside.

Takeaway: Provisional attachment of bank account to be

initiated only after issuance of SCN.

[M/s Skylark Infra Engineering Pvt. Ltd. Vs Additional General of

DGGI, Civil Writ Petition No. 21989-2020 (O&M), Order dated

February 16, 2021 (P&H High Court)]

The Applicant, an organisation incorporated in Germany (the Parent Company) is engaged in the business of promoting applied research and development established Liaison office (the LO) for carrying out activities such as representing the Parent Company in India, promoting export and import from/to India, promoting technical/financial collaborations and acting as a communication channel for the Parent Company as permitted by the Reserve Bank of India.

The Applicant sought advance ruling on (i) whether activities of the LO qualifies as supply of service (ii) whether the LO is required to be registered under the CGST Act, and (iii) if in case answer to (i) is yes, whether the LO is liable to pay GST. The Authority for Advance Ruling (the AAR) held that the LO and the Parent Company are establishment of distinct persons and thus, liable to register under GST.

In appeal proceedings, the Hon'ble Appellate AAR set aside order of the AAR and held that the LO is a geographical extension of the Parent Company having same legal identity as the Parent Company, therefore the Parent Company and the LO in India cannot be treated as distinct persons but as one legal entity. Thus, the liaison activities performed by the LO for the Parent Company is in the nature of a service rendered to self and accordingly, does not qualify as 'supply' under Section 7(1)(a) of the CGST Act. Further, since there is no taxable supply, therefore, there is no requirement for obtaining a GST registration or payment of GST.

Takeaway: Activities carried out by the LO does not

qualify as 'Supply'.

[M/s Fraunhofer Gesellschaft Zurforderung Der Angewandtenforschunge

V, Order No. KAR/AAAR/04/2021 dated February 22, 2021 (Karnataka

AAAR)]

Pursuant to WP seeking relief against arrest made by department under Section 69 of the CGST Act in relation to wrongful availment of ITC, the Hon'ble High Court held that the Petitioners have appeared before the department on multiple occasions, rendered statements and answered all queries of department regarding various transactions. Thus, merely based on apprehension of tampering of evidence without any evidence cannot be a justification to deny bail. Further, it has been held that detention of the Petitioners is also not justifiable as Petitioners has paid Tax under protest and made a statement that it would be bound to pay whatever amount is found due and payable upon investigation and adjudication subject to right of appeal.

Takeaway: Detention not justified in case material

documents not tampered.

[M/s Sunil Kumar Jha & Akshay Chhabra Vs UOI Writ Petition (ST)

No. 5484 of 2021 & 5486 of 2021, Order dated March 11, 2021

(Mumbai High Court)]

Service Tax

The Appellant is an approved air travel agent of International Air Ticketing Association (IATA) and engaged in providing Air Travel agent service to its clients. Further, the Appellant receives incentives from airlines and Central Reservation System (CRS) companies in relation to booking of tickets, taxability of which under 'Business Auxiliary Service' was contended be department.

The Larger bench of the CESTAT held that the Appellant has only provided options to the passengers about airlines and accordingly, the passengers themselves decide regarding booking of airlines. Thus, the Appellant is involved in promoting business of any airlines, accordingly incentives received by the Appellant from airlines cannot be subjected to levy of service tax.

Further, it has been held that amount received by the Appellant from the CRS companies cannot be treated as deemed commission since it has been merely an incentive.

Takeaway: Service tax not leviable on incentives

received by air travel agents from airline and CRS

companies.

[Kafila Hospitality and Travels Pvt Ltd vs CST Service Tax Appeal

No. 59716 of 2013, Order dated March 18, 2021 (CESTAT, Delhi)]

Customs

The Hon'ble Supreme Court held that proper officer under Section 28(4) of the Customs Act, 1962 (the Customs Act) for issuance of SCN for duty not levied/ shot levied/ short paid is a customs officer assigned specific functions of assessment and re-assessment of Duty in the jurisdictional area where the import concerned has been affected in terms of Section 2(34) of the Customs Act. Further, it has been held that officers of DRI have not been assigned power for exercising powers of custom officers by the Central Government under Section 6 of the Customs Act. Accordingly, the officer of DRI is not the proper officer to exercise power under Section 28(4) of the Customs Act. Thus, the entire proceedings initiated by the Additional Director General of DRI by issuing SCN is invalid without any authority of law and liable to be set-aside.

Takeaway: DRI has no authority to issue a SCN under the

Customs Act.

[M/s Canon India Private Limited V. CC Civil Appeal No. 1827,

1875,1832 & 3213 of 2018, Order dated March 9, 2021 (Supreme

Court)]

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.