INDIA REGULATORY & TRADE HIGHLIGHTS

FOREIGN TRADE

- Standard operating procedures prescribed for verification of self-certified Certificate of Origin (CoO) under Generalized System of Preferences (GSP) benefit system. [Public Notice No. 39/2015-2020 dated February 15, 2021]

- CoO to be mandatorily issued online w.e.f. April 1, 2021. [Trade Notice No. 42/2020-21 dated February 19, 2021]

- Electronic filing and Issuance of Preferential CoO for India's Exports under India-Mercosur Preferential Trade Agreement (PTA) and India - Thailand Early Harvest Scheme (EHS) made applicable w.e.f. February 25, 2021. [Trade Notice No. 43/2020-21 dated February 23, 2021]

THE DIRECTORATE GENERAL OF TRADE REMEDIES, MINISTRY OF COMMERCE & INDUSTRY

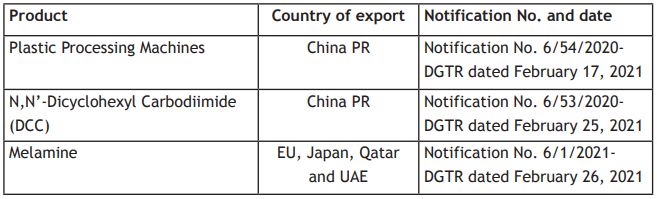

- Anti-Dumping Duty investigations initiated on import of:

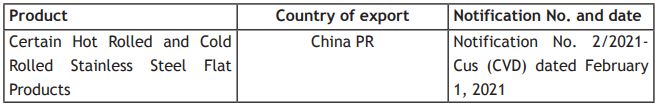

- Initiation of Mid-term Review of Countervailing Duty on import of:

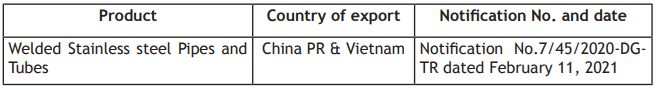

- Initiation of Sunset Review of Anti-Dumping Duty on import of:

MINISTRY OF FINANCE

- Levy of Anti-Dumping Duty on import of:

- Levy of Anti-Dumping Duty revoked from February 2, 2021 to September 30, 2021 on import of:

- Levy of Countervailing Duty revoked from February 2, 2021 to September 30, 2021 on import of:

INDIA CUSTOMS HIGHLIGHTS

- Surety required to be furnished by an independent legal entity in relation to B-17 bond executed by export oriented unit (EOU). [Circular No. 3/2021-Cus dated February 03, 2021]

- Chartered Accountant (CA) evidencing no discrepancy between refund claimed on Integrated Goods and Services Tax (IGST) and actual IGST paid on export of goods for the period April 2019 to March 2020 and April 2019 to March 2021 required to be furnished till March 31, 2021 and October 30, 2021 respectively. [Circular No. 4/2021-Cus dated February 16, 2021]

- Exporters given option to avail facility of correction of invoice mis-match errors with respect to past shipping bills irrespective of its date of filing, subject to payment of fees of INR 1,000. [Circular No. 5/2021-Cus dated February 17, 2021]

- Guidelines issued for setting up of Inland Container Depots (ICDs), Container Freight Stations (CFSs) and Air Freight Stations (AFSs). [Circular No. 6/2021-Cus dated February 22, 2021]

- Clarification issued regarding payment of Agriculture Infrastructure and Development Cess (AIDC) by EOU. [Circular No. 7/2021-Cus dated February 22, 2021]

- The Customs Tariff (Identification and Assessment of Safeguard Duty) Amendment Rules, 2021 notified. [Notification No. 12/2021-Cus (N.T.) dated February 01, 2021]

- The Customs Tariff (Identification, Assessment and Collection of Countervailing Duty on Subsidized Articles and for Determination of Injury) Amendment Rules, 2021 notified. [Notification No. 11/2021-Cus (N.T.) dated February 01, 2021]

- The Customs Tariff (Identification, Assessment and Collection of Anti-Dumping Duty on Dumped Articles and for Determination of Injury) Amendment Rules, 2021 notified. [Notification No. 10/2021-Cus (N.T.) dated February 01, 2021]

- The Customs (Import of Goods at Concessional Rate of Duty) Amendment Rules, 2021 notified. [Notification No. 09/2021-Cus (N.T.) dated February 01, 2021]

- Changes in rate of Duty on specified goods proposed in the Union Budget 2021. [Notification No. 02/2021-Cus to Notification No. 15/2021-Cus, all dated February 01, 2021]

INDIA GOODS AND SERVICES TAX (GST) HIGHLIGHTS

- Guidelines issued for implementation of provisions of suspension of registrations under GST. [Circular No. 145/01/2021-GST dated February 11, 2021]

- Due date of filing annual returns in Form GSTR-9/9A and reconciliation statement and certification in Form GSTR-9C extended to March 31, 2021. [Notification No. 04/2021-CT dated February 28, 2021]

- Specified persons exempted from Aadhar authentication for registration under GST. [Notification No. 03/2021 dated February 23, 2021]

- Clarification issued in relation to applicability of Dynamic Quick Response (QR) Code on B2C invoices. [Circular No. 146/02/2021-GST dated February 23, 2021]

IMPORTANT CASE LAWS

GST

- The Applicant sought advance ruling

on (i) whether capital subsidy (90% of Project Capital Expenditure)

received from Odisha Government for the construction of green field

public street lighting system in terms of supply installation and

maintenance agreement and escrow agreement is leviable to Tax (ii)

whether the Applicant is eligible for concessional rate of tax in

terms of Notification No. 11/2017-Central Tax (R) dated June

28,2017 (Notification No. 11/2017) for the balance 10% of the

amount received as Annuity Fees over a period of seven years?

The Hon'ble Authority for Advance Rulings (the AAR) held that capital subsidy received by the Applicant is the actual cost incurred on the project. It is not a subsidy which generally means grant/grant-in-aid or a benefit given to an individual, business or institution, usually by the Government to remove some type of burden and to promote a social good or an economic policy for overall interest of the public. Thus, 'capital subsidy' cannot be treated as a 'subsidy', rather the same is a consideration as defined in Section 2(31) of the Central Goods and Services Tax Act, 2017 (the CGST Act) and liable to be included in the transaction value for the purpose of computation of Tax.

Further since major part of the contract is supply of goods without which services cannot be supplied by the Applicant, hence, such supply squarely falls under the definition of "composite supply" where the principal supply is 'supply of goods'. Thus, question of applicability of Notification No. 11/2017 does not arise and Tax would is payable on the goods at applicable rate specified under appropriate heading.

Takeaway: Capital Subsidy for public street lightening system included in transaction value for GST.

[M/s Surya Roshni LED Lighting Projects Limited, Order No. 05/ODISHA-AAR/2020-21 dated January 20, 2021 (Odisha AAR)]

- The Applicant is engaged in

conducting clinical research services for determining safety and

effectiveness of medications, devices, diagnostic products and

treatment regimens for human use.

The Applicant sought advance ruling on (i) classification of services related to clinical research services (ii) whether services supplied by the Applicant is exempt from payment of Tax (iii) whether the Applicant is eligible to avail Input Tax Credit (ITC) of Tax paid or deemed to be paid?

The Hon'ble AAR held that the services provided by the Applicant is not in connection with diagnosis or treatment or care for illness covered under heading 9993 (healthcare services) but related to support services for research covered under heading 998599 (Other Support Services). Thus, such services not being covered under healthcare services are not exempt in terms of entry 74 of Notification No. 12/2017-CT (R) dated June 28, 2017. Accordingly, the Applicant is eligible to claim ITC of tax paid in terms of Section 16 of the CGST Act.

Takeaway: Activities in relation to conducting and facilitating clinical research services covered under 'Other Support Services' and not 'Healthcare Services'.

[M/s Vevaan Ventures Advance Ruling No. KAR ADRG 05/2021, Order dated January 29, 2021 (Karnataka AAR)]

- The Applicant is providing two types

of services - (1) consultancy services in diagnosis and treatment

of illness to the Hospitals, Laboratories and Biobank companies

(Consultancy Services) and (2) Business Promotion Services by way

of organising collaborative projects, histopathological consulting

and business development (Business Promotion Services) between the

foreign company and the clinical centres located in India.

The Applicant sought advance ruling on whether Tax is applicable on Consultancy Services and Business Promotion Services?

The Hon'ble AAR held that Consultancy services provided by the Applicant is exempt in terms of entry No. 74(a) (Healthcare services) of Notification No. 12/2017-CT (R) dated June 30, 2017.

Further, with respect to business promotion services, the Hon'ble AAR observed that the Applicant is facilitating services in relation to clinical centres in India on behalf of the foreign company as its agent and not providing any services on its own account. Therefore, the services are squarely covered under intermediary services and liable to Tax @18% under heading 9983 (other professional, technical and business services).

Takeaway: Service provided in relation to facilitating establishment of clinical centres in India on behalf of a foreign company covered under 'intermediary services'.

[Dr. H. B. Govardhan, Advance Ruling No. KAR ADRG 04/2020 dated January 29, 2021 (Karnataka AAR)]

SERVICE TAX

- The Appellant availed Cenvat credit

on Service Tax paid on Rent a Cab service under reverse charge

mechanism and claimed refund on account of unutilized amount in the

Cenvat credit account.

The Department alleged that Cenvat credit availed on Rent-a-Cab service by the Appellant is not input service in terms of Rule 2(l) of the Cenvat Credit Rules, 2004 since vehicles taken on rent by the Appellant is not registered in the name of service provider. Therefore, Department denied the amount of refund claim for the unutilized amount in the Cenvat credit account.

The Hon'ble CESTAT held that it is not in dispute that the Appellant is not entitled to Cenvat credit on such Rent-a-Cab services at the time of availment of the Cenvat credit. Therefore, Department cannot deny refund claim and raise the issue of admissibility of the Cenvat credit.

Takeaway: Admissibility of the Cenvat credit cannot be raised while deciding on refund claim.

[M/S CNS Comnet Solution Pvt Ltd Vs CST Final Order nos. 60489-60491/2021 dated February 3, 2021]

- The Appellant availed Cenvat credit

for Service Tax paid on construction of pipelines used in business

of transporting gas through pipeline for its customers.

The Department alleged that the Cenvat credit taken by the Appellant is in relation to services rendered by EPC contractors to construct the pipeline system which remains permanently embedded under earth over a long distance and constitutes 'immovable property, which is neither 'goods' nor 'service' and therefore, not eligible to avail Cenvat credit thereon.

The Hon'ble CESTAT held that the Appellant is engaged in the business of transporting gas through pipelines for which laying of pipelines between their different station is essential. Service Tax paid by the Appellant was not on the pipeline system but on the services provided for constructing such system. Hence, it cannot be said that the service for construction of pipeline is not used for providing output service. Thus, the Appellant is entitled to Cenvat credit in respect of service of laying of pipeline received directly from their contractors.

Takeaway: CENVAT credit allowed on services for construction of pipelines used for transportation of gases.

[Gujarat State Petronet Ltd Vs CST Final Order No. A/10348/2021 dated February 2, 2021]

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.