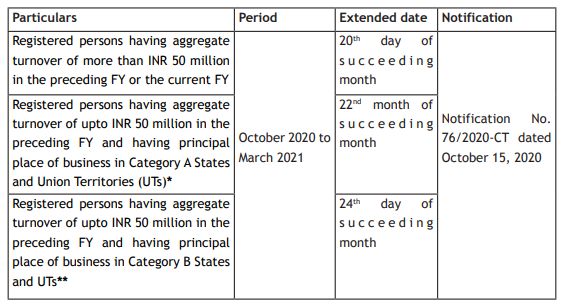

a. Due date for filing Form GSTR-1 extended

b. Due date for filing Form GSTR-3B extended

*Category A States and UTs: Chhattisgarh, Madhya Pradesh, Gujarat, Maharashtra, Karnataka, Goa, Kerala, Tamil Nadu, Telangana, Andhra Pradesh, the UTs of Daman and Diu and Dadra and Nagar Haveli, Puducherry, Andaman & Nicobar Islands and Lakshadweep.

**Category B States and UTs: Himachal Pradesh, Punjab, Uttarakhand, Haryana, Rajasthan, Uttar Pradesh, Bihar, Sikkim, Arunachal Pradesh, Nagaland, Manipur, Mizoram, Tripura, Meghalaya, Assam, West Bengal, Jharkhand or Odisha, UTs of Jammu and Kashmir, Ladakh, Chandigarh and Delhi.

c. Option of filing Form GSTR-9/9A (Annual Return) for registered persons having turnover of up to INR 20 million for FY 2019-2020. [Notification No. 77/2020-CT dated October 15, 2020]

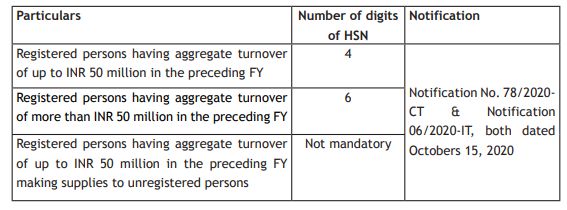

d. Number of digits of Harmonized System of Nomenclature (HSN) Code to be mentioned in tax invoice revised w.e.f. April 1, 2021 for specified persons

e. Exemption from payment of Tax on Satellite Launch Services supplied by the Indian Space Research Organizations, Antrix Corporation Limited or New Space India Limited. [Notification No. 05/2020-CT(R), IT(R) & UT(R), all dated October 16, 2020]

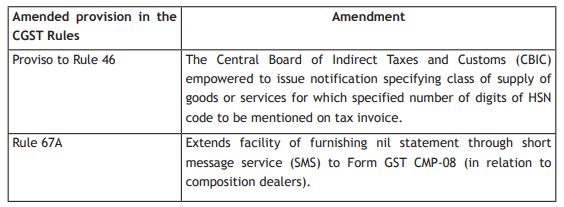

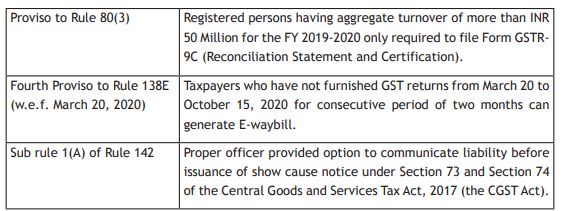

f. Various amendments made in the Central Goods and Services Rules, 2017 (the CGST Rules), as enumerated below:

Further, various forms amended. [Notification No. 79/2020-CT dated October 15, 2020]

g. Relaxation from implementation of E-invoice in the month of October 2020 subject to obtaining of Invoice Reference Number (IRN) from the Invoice Reference Portal (IRP) within 30 days of date of issue of invoice. [Notification No. 73/2020-CT dated October 1, 2020]

h. Due date for filing annual return in Form GSTR-9 and reconciliation statement in Form GSTR9C for financial year 2018-19 extended to December 31, 2020. [Notification No. 80/2020 dated October 28, 2020]

i. Reconciliation of Input Tax Credit (ITC) availed in Form GSTR-3B with Form GSTR-2A to be done cumulatively for the period February to August 2020 and excess ITC claimed if any to be reversed in the Table 4(B)(2) of Form GSTR- 3B for the month of September 2020. Reconciliation of ITC for the month of September 2020 to be done independently. [Circular No. 142/12/2020-GST dated October 9, 2020]

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.