- within Corporate/Commercial Law, Privacy and Real Estate and Construction topic(s)

- with readers working within the Oil & Gas, Retail & Leisure and Transport industries

INVESTMENT AND DEAL ACTIVITY ANALYSIS

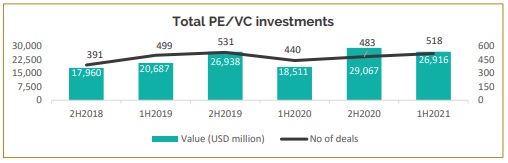

On a half yearly basis, PE/VC investments in H1 of 2021 recorded a 45% increase year on year. In terms of number of deals, this period recorded an increase of 18% with 518 deals as against 440 deals in H1 of 2020 and 483 deals in H2 of 2020. This increase is indeed impressive, more so given the lower base effect as H1 of 2020 was significantly affected by the uncertainties that came along with the onset of the Covid-19 pandemic and the strict nationwide lockdown that ensued shortly thereafter.

Pure play PE/VC investment (excluding real estate and infrastructure sectors) recorded its highest ever value of USD 21.9 billion in H1 of 2021, which is 32% higher compared to H1 of 2020 (USD 16.5 billion) and 5% higher than H2 of 2020 (USD 20.9 billion). This period saw 64 large deals aggregating to USD 19.1 billion (compared to 30 large deals aggregating to USD 13.6 billion in H1 of 2020). The largest deals included Blackstone along with ADIA, UC Investments and GIC acquiring a majority stake (~75%) in Mphasis for around USD 2.8 billion and a group of investors including QIA, GIC, Goldman Sachs, Naspers and others investing ~USD 800 million in Swiggy.

Source: IVC Association and Ernst & Young Monthly PE/VC Roundup, June 2021

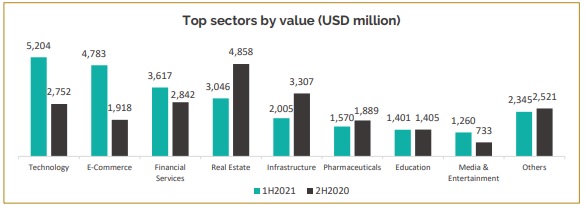

From a sector perspective, technology was at the top (USD 5.2 billion across 67 deals), with e-commerce at second place (USD 4.8 billion invested across 83 deals) followed by financial services sector (USD 3.6 billion across 90 deals). Media and entertainment sector is noteworthy for recording an all-time high number of USD 1.3 billion across 25 deals.

Source: IVC Association and Ernst & Young Monthly PE/VC Roundup, June 2021

This period also saw significant exits via strategic sale with transactions worth USD 12.7 billion recorded across 29 deals. Next in line were exits via secondary sale (sale to other PE funds) at USD 4.5 billion (31 deals) that recorded the highest ever half-yearly value and four times the value recorded in entire 2020. Open market exits recorded 38 deals worth USD 2.9 billion. PE-backed IPOs too recorded highest ever half-yearly value of exits in H1 of 2021 and second highest in terms of number of IPOs (USD 1.6 billion in sale proceeds across13 IPOs). From a sector perspective, technology sector recorded the highest value of exits in this period (USD 11.8 billion across 11 deals), which is more than the exits recorded by the sector in the preceding eight years combined. This is primarily on account of Hitachi's buyout of the stake held by CPPIB and Partners Group in GlobalLogic for USD 8.6 billion. Financial services was the next big sector with 22 exits worth USD 2.5 billion.

Indian PE/VC investment activity grew at a record setting pace throughout this period and the deal pipeline indicates that this pace is only going to intensify as 2021 progresses. Technology, e-commerce, financial services, pharmaceuticals, education and media and entertainment sectors are likely to witness enhanced deal activity. PE/VC exit activity is also on track to notch up a record setting year. With ~USD 22.5 billion of exits in the first six months and several large deals in pipeline, 2021 is expected to materially eclipse 2018's high of USD 27 billion. Large, multi-billion dollar exits to strategic buyers is expected to remain the main driver, while exits via secondary deals, open market sale of listed positions as well as IPOs are also expected to remain strong. A positive response by the equity markets to the Zomato IPO and the soon to follow IPOs by other VC funded new age unicorns are expected to catalyze even more investment and exit activity in the Indian start-up ecosystem.

SECURITIES AND EXCHANGE BOARD OF INDIA – KEY UPDATES

SEBI (SUBSTANTIAL ACQUISITION OF SHARES AND TAKEOVERS) (AMENDMENT) REGULATIONS 2021

SEBI vide Gazette notification dated May 05, 2021, notified the SEBI (Substantial Acquisitions of Shares and Takeover) (Amendment) Regulations, 2021 (Amendment) which amends the SEBI (Substantial Acquisitions of Shares and Takeover) Regulations, 2011 (Regulations).

The primary aim of the Regulation is to monitor and control acquisition of shares and voting rights in publicly listed companies of India. During the course of the time, the Regulation has gone through multiple amendments to keep up with the dynamic trading platforms and investor behavior patterns. The current Amendment aims to amend the Regulations to insert certain provisions relating to the Innovators Growth Platform and the trigger point for making open offer by an acquirer.

Amendment

The Amendment has amended the nomenclature wherein the Institutional Trading Platforms (ITP) has been substituted with Innovators Growth Platform (IGP). Further, the trigger for making a public offer under Regulations 3 and 6 of the Regulations, in the listed entities on IGP has been enhanced to 49% from the erstwhile 25%, pursuant to the Amendment.

Pursuant to the Amendment, the requirement to disclose further acquisition of shares to the board of that company, beyond the threshold of 5% has been revised to 10%. Regulation 29 (2) of the Regulations requires disclosure of change in shareholding or voting rights of the acquirer if such change exceeds 5% of total shareholding /voting rights from the erstwhile 2%, pursuant to the Amendment.

Furthermore, Regulation 26 (6) of the Regulations, which deals with the analysis by the committee of independent directors, the Amendment seeks to introduce disclosure of voting pattern of the meeting in which the open offer proposal was discussed as a part of the detailed public statement issued along with the open offer by the acquirer

Conclusion

The Amendment is seen as another modification by SEBI to revive the market lows, as the trade and market experience a decline in value creation by different firms using such platforms. Setting the bar lower for shareholders and voting rights was intended to stamp on fair market play and encourage more transparency on the acquisition of shares, voting rights, and standing on the shareholder's board. However, intending to give liberty to the acquirers and motivate them to indulge in trading in companies, SEBI has relaxed the regulations to some extent. It would mean that the acquirer can buy such shares without triggering the need for making an open offer until 49%, unlike other listed entities whereupon acquiring 25% shares, the acquirer shall have to make an open offer to the public mandatorily. Any acquirer will now be able to exercise a little more room to avoid the procedural formality of public disclosures and infuse capital in cash straped companies.

NEW NORMS FOR LARGE IPOS

SEBI has eased the listing norms for certain companies by reducing the threshold for minimum public shareholding. These changes were brought in considering the decline of Initial Public Offerings (IPOs) and constraints faced by companies with post-issue Market Capital (MCap).

Key takeaways

- Reduced MPO requirements: The prevailing norms mandated that for companies with a post-issue capital above INR 4000 crore, the minimum public offer size was 10% of shares. However, this caused several practical problems, especially for Very Large Companies (VLCs), as the requirement of offering at least 10% stake to the public made compliance troublesome. The new norms have brought in changes to reduce the burden on VLCs and the requirement of Minimum Public Offer (MPO), for post-issue capital has been reduced from the existing 10% to INR 1,000 crore plus 5% of the incremental amount when MCap is beyond INR 10,000 Crore.

- Revised MPS tenure: The other amendment brought in is with respect to the Minimum Public Shareholding (MPS) tenure. In view of this proposal, it has been observed that Large and Very Large issuers may find themselves in a position of having to issue 10% public shareholding during the listing and being jeopardized under Rule 19(2)(b) of the Securities Contracts (Regulations) Rules, 1957, (SCRR), which mandates such companies to have at least 25% of their MCap in MPS within a period of 3 years from the date of listing. There arises a need for such companies to have a requisite interval to first raise 10% of public shareholding and then subsequently comply with the 25% MPS requirement. Under the new norms, companies with MCap inside the bracket of INR 10,000 to 100,000 crore are directed to achieve 10% of their public shareholding within 18 months and 25% MPS within 3 years from the date of listing. Similarly, for companies having a market capitalization of more than INR 100,000 crore, 10% public shareholding is to be achieved within 2 years and 25% MPS within 5 years from the date of listing.

These amendments, effective from June 18, 2021, have been hailed as a progressive change in recognizing the expanding scale of companies in India. The newly updated norms will prove significantly beneficial in allowing companies with substantial market capitalizations to successfully conduct IPOs and fulfill MPO requirements without the burden of making a huge offer for newly listed companies.

To read the full article click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]