- in India

- within Tax, Food, Drugs, Healthcare, Life Sciences and Real Estate and Construction topic(s)

- in India

- with readers working within the Pharmaceuticals & BioTech and Law Firm industries

INTRODUCTION

For the eighth consecutive time, the Honourable Finance Minister, Nirmala Sitharaman, tabled the Union Budget 2025 in the Lok Sabha, outlining a series of key proposals aimed at shaping India's economic future.

It charts a clear path for India's rise as a global leader, with key announcements set to fuel innovation, education, and economic growth. The extension of the tax holiday for start-ups, coupled with the creation of an INR 500 crore Centre of Excellence (COE) in Artificial Intelligence (AI) for education, positions India as a ground for future entrepreneurs and technological advancements.

From tax reforms to investment in infrastructure, digitalisation, and social welfare, the Budget highlights several transformative initiatives designed to stimulate growth, enhance inclusivity, and drive sustainability.

In order to boost private consumption and savings, it is proposed that individuals and HUFs with incomes up to INR 12 lakhs (INR 12,00,000/-) will not be required to pay income tax. This measure, along with tax slab rationalisation for individuals, will lead to enhanced consumption-driven economic growth. Other key proposals in the Union Budget include 100% FDI in the insurance sector to support the underserved market, a continued commitment to GIFT City's development as a global hub through tax incentives, and an increased focus on skill development. These measures are expected to enhance the sector's overall competitiveness and efficiency.

The domestic taxation proposals include an extension of the 'sunset clause' for the incorporation of an eligible start-up to claim a tax holiday and the inclusion of inland vessels in the existing tonnage tax regime.

The International Financial Services Centre (IFSC) is gaining global traction as a prime destination for financial activities. Key policy changes include expanding the scope of aircraft leasing to include ship leasing, extending sunset dates for various IFSC units, and rationalising the definition of 'dividend' for treasury centres. The proposals for the rationalisation of various Tax Deducted at Source (TDS) and Tax Collected at Source (TCS) provisions aim to provide enhanced cash flow for various individuals, including senior citizens. Greater emphasis has been placed on the 'trust first, scrutinise later' approach by increasing the time limit for filing updated tax returns. In an effort to simplify tax legislation, a new Income Tax Bill is proposed to be introduced in Parliament in the coming week.

The government has also proposed expanding the application of Safe Harbour Rules, details of which will be released later by way of a notification.

This year's Budget focuses on the country's economic growth by stimulating grassroots rural economic development and introducing schemes for MSMEs and farmers.

The Union Budget 2025 continues to focus on the 'Make in India, Make for the World' initiative, with specific assistance to industries such as toys, leather, food processing, electric vehicles, and electronics through customs tariff rationalisation. The Budget's alignment with the Make in India agenda is clearly reflected in three broad themes — incentivising manufacturing through customs duty reduction on inputs and capital goods, simplifying the tariff structure, and increasing certainty through procedural ease.

Further, some other significant changes in customs include establishing clear timelines for finalising provisional assessments and permitting voluntary rectification of errors without penalties.

On the GST front, as expected, most of the GST law amendments, as recommended by the GST Council, have been introduced in the Budget

KEY PROPOSALS UNDER DIRECT TAX

1. The Finance Minister announces introduction of a new Income Tax Bill

The most important announcement by the Finance Minister in the Budget speech relating to direct taxes was the proposed introduction of a new Income Tax Bill in the current session of Parliament.

2. Tax Rates:

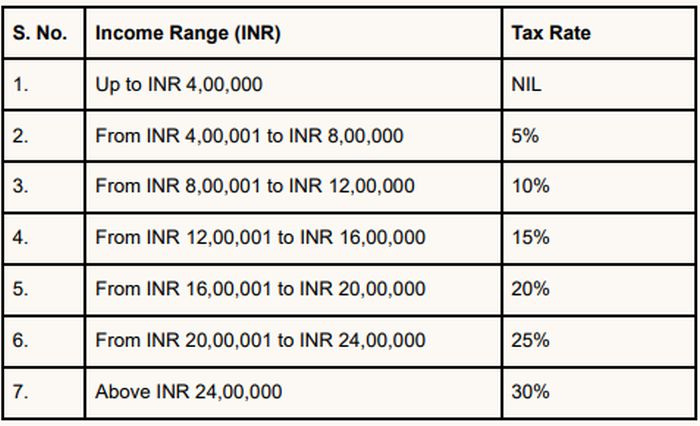

The Finance Bill 2025 proposes to change the income tax slabs for individuals and HUFs under the New Tax Regime (Section 115BAC). The new rates are as under:

A tax rebate under Section 87A would be available under the New Tax Regime, equal to the tax on income of INR 12,00,000/-. As a result, individuals, and HUFs with an income of up to INR 12,00,000/- would not have to pay tax. This limit was INR 7,00,000/- earlier.

- Surcharge and Cess: No change is proposed in the rates of the Union Surcharge and the Health & Education Cess.

- Tax rates for individuals and HUFs opting for Old Tax Regime remain unchanged.

- The tax rate for domestic companies remains unchanged.

- The tax rate for foreign companies remains unchanged at 35% in respect of incomes other than those chargeable at special rates.

3. Thresholds for making Deduction of Tax at Source (TDS) are being changed as under:

4. Taxation of Salaries

The standard deduction admissible to salaried employees remains unchanged at INR 75,000/-.

5. Changes in respect of Income from House Property:

Currently, income from up to two self-occupied properties is exempt, subject to fulfilling various conditions. These conditions are being removed, and income from up to two self-occupied properties will now be considered nil without any other conditions.

6. Updated Returns

Presently, where a taxpayer has failed to include some income in his tax return, he can file an updated tax return for up to two years, admitting additional income and paying tax and interest on it. It is proposed that updated returns can be filed for any assessment year up to four past assessment years, instead of two years as at present.

7. Proposed changes relating to International Tax Issues

- Presumptive taxation regime is being provided for non-resident entities engaged in providing services to residents involved in establishing or operating an electronics manufacturing facility. Income of such non-residents can be presumptively determined at 25% of the amount payable to them.

- Safe Harbour Rules will be provided for non-residents who store components for supply to specified electronics manufacturing units.

- A new scheme for determining the arm's length price of international transactions is being introduced under which, the arm's length price will be valid for a block period of three years.

- The scope of the existing Safe Harbour Rules for determining the arm's length price of international transactions is being expanded.

- Benefits available to units in International Financial Centres (IFSCs) are being extended to ship-leasing units, insurance offices, and treasury centres of global companies set up in IFSCs.

- The cut-off date for commencement in an IFSC for claiming these benefits is being extended by five years to March 31, 2030.

- To promote funding from Sovereign Wealth Funds and Pension Funds in the infrastructure sector, the eligibility date for making investments is being extended up to March 31, 2030.

- Long term capital gains arising on the sale of securities by Foreign Institutional Investors (FIIs) covered by Section 115AD will now be taxed at 12.5% instead of 10%.

8. Certain other proposed changes:

- Tax benefits are presently available to start-ups incorporated up to March 31, 2025. These will now be available to eligible start-up units incorporated up to March 31, 2030.

- Threshold for levy of TCS on overseas remittances is being increased from INR 7,00,000/- to INR 10,00,000/-. Further, the TCS of 0.5% on overseas remittances out of education loans is proposed to be withdrawn.

- Registration period for certain categories of charitable trusts will be valid for ten years instead of five years as at present.

- The prosecution provisions relating to failure to collect tax at source (TCS) are being dropped.

KEY PROPOSALS UNDER CUSTOMS EXCISE AND SERVICE TAX

Legislative changes under Customs Ac

1. Two years prescribed for finalisation of provisional assessment, extendable by one year under Section 18 of the Act. The time limit for past cases, would be reckoned from the date of the Finance Act, where the provisional assessment is on account of any of the following reasons, the period of two years to start from the date when such reason ceases to exist.

- Information is being sought from an authority outside India through a legal process

- Pendency of similar matters before the Tribunal, High Court, or Supreme Court

- Interim stay by Tribunal, High Court, or Supreme Court

- Specific direction issued by Board

- Pendency of an application before the Settlement Commission or Interim Board

2. Procedure for amendment of an entry after the clearance of goods and consequential selfassessment.

If the amendment of an entry, results in a short payment of duty, then the same is to be paid voluntarily along with interest, but without penalty. This enables importers and exporters to pay duty without penalty, if any short payment is discovered after clearance of goods. There is no time limit for making such voluntary payment, except that the payment should be before detection by the Department, that is prior to an audit, search, seizure, or summons communicated to importer or exporter.

If the amendment of an entry, results in a refund, then such revision shall be deemed to be a claim for a refund under Section 27. The self-assessment is to be completed within one year of the payment of duty, which is subject to verification by the proper officer. If the self-assessment is found to be incorrect, the proper officer may reassess the duty.

No amendments would be allowed if an order has been passed under Section 17 or Section18 or Section 84 of the Customs Act.

3. Time limit prescribed for claiming a refund consequent to an appellate order or in the case of an amendment in the entry under Section 18A or Section 149 of the Act shall be one year from the date of payment of duty.

4. Settlement to be discontinued: With effect from April 01, 2025, the powers and functions of the Settlement Commission shall be exercised by the Interim Board, and the provisions of the Settlement Commission shall apply mutatis mutandis to the Interim Board. All pending applications, that is, applications filed before April 01, 2025 which have been admitted under Section 127C but where no order has been passed under the said section before March 31, 2025, shall now be taken up by the Interim Board. No fresh applications shall be entertained after April 01, 2025.

Amendments to Customs Tariff

In order to prioritise domestic manufacturing, and to strengthen integration with Global Value Chains, duties on inputs and raw materials have been reduced, and duties on finished articles increased. Special emphasis is on electric vehicles (EVs), critical minerals, telecommunication and technology sectors.

- Basic Customs Duty (BCD) increased from 20% to "20% or Rs. 115 per kg, whichever is higher" in respect of knitted or crocheted fabrics of elastomeric yarn or rubber thread or other knitted or crocheted fabrics of heading 6004 and 6006.

- BCD on monitors, other than those for automatic data processing machines increased from 10% to 20%.

- BCD on Frozen Fish Paste and Fish Hydrolysate reduced to 5%.

- BCD on Glycerol reduced from 30% to 20%.

- The effective BCD on Marble and Granite items changed from 40% BCD to 20% BCD + 20% AIDC.

- BCD reduced on Liquefied Propane and Liquefied Butane to 2.5% and LPG to 5%.

- The BCD on Phosphoric Acid and Boric Acid reduced to 7.5%.

- BCD on synthetic flavoring essences and mixtures of odoriferous substances used in food and beverage industry reduced to 20%.

- BCD rate on pharmaceutical reference standard reduced from 30% to 10% and on Sorbitol from 30% to 20%.

- BCD rate on plates, sheets, films, foil, and strips of plastics—non-cellular and not reinforced, laminated, etc.—falling under Chapter 39 has been reduced from 25% to 20%.

- BCD rate on Wet Blue leather and crust leather (hides and skins) exempted.

- BCD on footwear reduced to 20%.

- BCD on articles of jewellery and parts reduced from 25% to 20%.

- BCD on items/articles of metal industry reduced on Platinum (5%), Iron and Steel (15%), Zinc (nil), Tin (nil), Lead waste and scrap (nil), Copper waste (nil), Cobalt powder (nil), etc.

- Exemption given to capital goods used for the manufacture of Lithium-Ion Batteries for mobile phones and EVs.

- BCD reduced on solar module and semiconductor devices from 40% to 20%. However, AIDC of 20% to be levied.

- Raw materials, inputs, parts or sub-parts used in the manufacture of some electronic items such as camera module, wired headsets, mobile phones, etc. are exempted.

- BCD reduced on motor vehicles (8702 and 8703) and motorcycles (8701).

- BCD reduced on all dutiable goods imported for personal use under Chapter 9804 from 35% to 20%, including on drugs and medicines.

- The requirement to follow the procedure under the Customs IGCR End Use Rules, 2022, to avail exemption of BCD on import of seeds for use in manufacturing of rough lab-grown diamonds, removed.

- The time for compliance of IGCR End Use Rules has been extended from 6 months to one year, and quarterly instead of monthly statements to be filed.

- After a comprehensive review of exemptions/concessional rates under Notification No. 50/2017, the Government has extended the exemptions on certain items including ships and vessels, drugs and medicines, crude Glycerin for use in the manufacture of Epichlorohydrin, parts of windoperated electricity generators, etc.

To view the full article click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.