- within Employment and HR, Government, Public Sector and International Law topic(s)

GST on services by way of transportation of goods by aircraft/vessel is certainly on a roller-coaster ride these days. The story began in September 2022, when certain exemption entries pertaining to goods transportation services witnessed a sunset from 1 October 2022 onwards. This resulted in taxing the transportation of export cargo by the Indian transporters/freight forwarders, liable to Integrated GST (IGST), which generated a buzz amongst the exporters as well as the Indian transporters/freight forwarders. Consequently, owing to the hardships, various associations and trade bodies filed representations before the government against the withdrawal of GST exemption.

The following challenges were faced by the Indian transporters/freight forwarders:

- As per the proviso to Section 12(8) of the IGST Act, the place

of supply for export cargo was the destination, i.e., outside of

India. Due to this, the question arose whether the exporters in

India could claim Input Tax Credit (ITC) on the GST so paid since

it was believed that such credit could only be taken at the place

of supply.

Nevertheless, the exporters took a chance and rightly so, as principally, it did not make sense to deny the benefit of ITC, which culminated in a refund to exporters when exports are zero-rated.

- The larger issue was that Indian transporters/freight forwarders became uncompetitive as compared to the foreign transporters/freight forwarders, given that the place of supply for export cargo for the latter would be the destination of goods by virtue of Section 13(9) of the IGST Act.

The Central Board of Indirect Tax and Customs (CBIC), pursuant to the decision in the 48th GST Council meeting, cleared the air on the part "a)" above Section by issuing a clarification that ITC shall be eligible even if the place of supply was outside India.

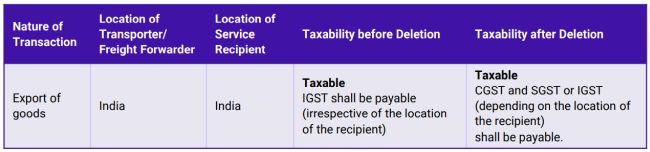

This is also being provided the legislative blessing by way of deletion of the proviso, which created the anomaly, vide the Finance Bill, 2023. Now the impact would be as follows:

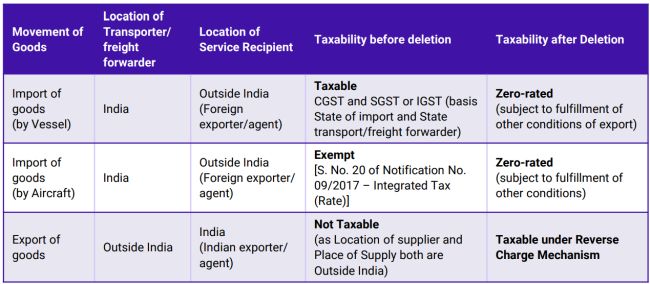

However, this did not resolve the larger issue adversely impacting the logistics industry. The stakeholders in the government were in no mood to re-introduce the exemption allowed till September 2022. However, to everyone's surprise, in its 49th meeting held a few days ago, the GST Council recommended deleting Section 13(9) of the IGST Act, thereby subtly correcting the disparity between the Indian and foreign logistics industries. The said amendment shall now allow export benefits to Indian transporters/freight forwarders rendering transportation services to foreign exporters/agents, as they shall be entitled to benefits of zero rating on the satisfaction of other conditions. Notably, transportation services for import shipments through aircraft already enjoy exemption from GST. However, the supplier is warranted to reverse proportionate input tax credit to the extent of inward supplies used vis-à-vis the aforesaid exempted supplies (Rule 42 and 43 of the CGST Rules). By virtue of this change, such reversals would also not be required.

Apart from the above, another implication of the proposed amendment would be that if the exporter from India chooses a foreign transporter/freight forwarder, then the exporter has to discharge GST on reverse charge basis. Whereas, if an Indian service provider is appointed, then GST is discharged by the service provider, for which the exporter can continue to enjoy an extended credit period prevalent in the market. Hence, this amendment may not be a perfect solution for the Indian logistics industry, but at least they may become a preferred choice for exporters. To summarize, the impact of the proposed amendment is discussed below:

The above recommendation of the GST Council was inserted in the Finance Bill 2023 by way of an amendment. The said amendment will be effective from the date when the Central Government notifies the same.

This is yet another instance showcasing that the concerned stakeholders in both the Central and the State Governments have ears on the ground and are responsive to business-critical issues. Initially, it seemed apprehensive how the machinery of Central and State Governments would jointly make decisions on the challenges/issues faced in a newly introduced indirect tax legislation with a vision of "One Nation, One Tax."

However, the GST Council has been adept in addressing the industry concerns such as the present one and in the days to come, we hope that all vexatious issues are put to rest.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]