- within Employment and HR, Government, Public Sector and International Law topic(s)

Notifications

01/2023- Central Tax (Rate) Dated 28 February 2023

Explanation clarifying that any authority, board, or body set up by the Central Government or State Government, including the National Testing Agency, shall be treated as an educational institution, in respect of services provided by way of conducting entrance examinations for admission to such educational institutions has been added in Notification 12/2017 Central Tax – Rate effective from 1 March 2023.

02/2023-Central Tax (Rate) Dated 28 February 2023

Provisions of the principal RCM Notification as applicable to Central Government and State Governments have been made applicable to "Courts and Tribunals."

Circulars

03/2023 and 04/2023- Central Tax (Rate) Dated 28 February 2023

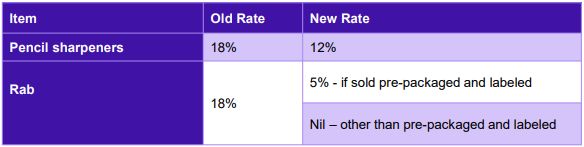

Notification seeks to amend the GST rate of the following goods:

01/2023- Compensation Cess (Rate) Dated 28 February 2023

Coal Rejects supplied to a coal washery or by a coal washery, arising out of coal on which compensation cess has been paid and input tax credit of the same has not been availed by any person has been chargeable to Nil rate of Compensation Cess.

GST Technical Updates

Introduction of Negative Values in Table 4 of GSTR-3B dated 17 February 2023

The impact of credit note and their amendments will now be auto-populated in Table 4(A) instead of Table 4(B) of GSTR-3B. If the value of credit notes becomes higher than the sum of invoices and debit notes put together, then the net ITC would become negative, and the taxpayers will be allowed to report negative values in Table-4A. Also, taxpayers can now enter negative values in Table 4D(2) of GSTR-3B.

Advisory on Geocoding of Address of Principal Place of Business 24 February 2023

Functionality for geocoding the principal place of business address is now available on the GST Portal for normal, composition, SEZ units, SEZ developers, ISD, and casual taxpayers who are active, canceled and suspended.

Advisory on New e-Invoice Portal dated 25 February 2023

GSTN has onboarded four new IRPs (Invoice Reporting Portals) for reporting e-invoices in addition to NIC-IRP.

In compliance with Notification No. 03/2022-Central Tax (Rate), dated 13 July 2022, an option is being provided on the portal to all the existing taxpayers providing Goods Transport Agencies Services desirous of opting to pay tax under the forward charge mechanism to exercise their option.

They can navigate through:

Services > User Services > Opting Forward Charge Payment by GTA (Annexure V)

Annexure V has been made available on the portal for GTA's to exercise their option for the Financial Year 2023-24, which would be available till 15 March 2023.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.