- within Family and Matrimonial, Employment and HR and Accounting and Audit topic(s)

- with readers working within the Banking & Credit industries

During the Maharashtra State Budget for FY 2022-23, the Deputy Chief Minister Ajit Pawar announced an amnesty scheme for pending sales tax dues. Both the houses cleared the Bill, thus paving the way for 'The Maharashtra Settlement of Arrears of Tax', Interest, Penalty or Late Fee Act, 2022' that would benefit around 1 lakh small dealers.

Recently, the Maharashtra State Authorities issued Trade Circular No. 01T of 2022, explaining the salient features of the scheme. Some of the key features and conditions are captured below for your reference:

Scope & Eligibility

- The scheme covers inter alia arrears of VAT, CST, Entry Tax, Luxury Tax, Purchase Tax, and Professional Tax, etc. along with interest, penalty and late fee thereon.

- Arrears outstanding on 1 April 2022 as per any statutory order for the periods ending on 30 June 2017 or arrears as per any statutory order passed during the period 1 April 2022 to 30 September 2022 for the periods ending on 30 June 2017 shall be eligible for settlement.

- Similarly, return dues outstanding as of 1 April 2022 as well as arrears outstanding as per the auditor's recommendation in an audit report are also covered under the scheme.

- A statutory order may be an order of assessment, re-assessment, rectification, revision, review, or appeal.

- While determining the outstanding arrears for settlement, any payment made in respect of any statutory order on or before 31 March 2022 shall be adjusted sequentially towards the arrears.

- Additionally, cases litigated by the State Department are eligible for settlement, even if they are pending in reference/appeal before the Maharashtra Sales Tax Tribunal or the High Court.

Benefit (except Entry Tax)

- The scheme provides an option to pay a lumpsum of 20% where the outstanding dues as per any statutory order is INR 1 million or less, while the balance of 80% would be waived off by the Department.

- The Act provides a one-time payment option to avail the benefit of settlement of arrears, whereas arrears more than INR 5 million can be paid under an installment option.

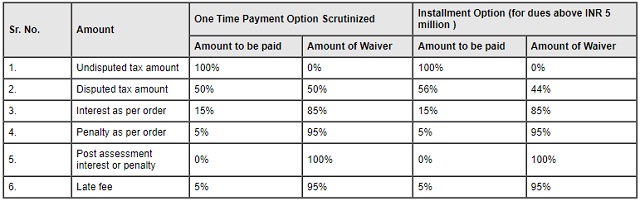

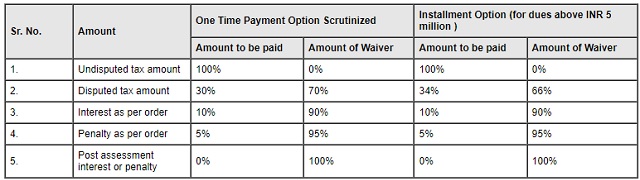

- The extent of undisputed tax, disputed tax, interest, penalty, and late fee to be paid and waiver thereof under the relevant Acts is as follows:

For the period 1 April 2005 to 30 June 2017

For the periods up to 31 March 2005

Any dues upto INR 10,000 per financial year would be written off suo moto by the Department.

Scheme for Entry Tax arrears

- The requisite amount to be paid shall be equal to the entry tax payable as per statutory order or the amount of set-off reduced or denied, whichever is less.

- A statutory order under the Tax on Entry Act is a pre-requisite; however, a corresponding order under the VAT Act or Bombay Sales Tax Act is not a mandate.

- The lumpsum and installment options would not be available for settlement. On the other hand, interest and penalty dues can be paid as per the extent of waiver provided under the one-time payment option tabulated above.

Payment Options

One-time

- An applicant should calculate the arrears i.e., requisite amount and pay the same between 1 April 2022 and 30 September 2022. The same would also apply to the 20% lumpsum option preferred for dues less than INR 1 million.

Installment

- Minimum of 25% of arrears should be paid between 1 April 2022 and 30 September 2022 and the remaining amount would be payable in 3 equal quarterly installments starting from the date of application. Any late payment shall attract interest at the rate of 12% p.a. Any amount paid after 9 months will not be considered towards the settlement and only proportionate benefit would be granted.

Payment Duration

- Application for claiming the benefit can be filed between 1 April 2022 to 14 October 2022. A delay upto 30 days i.e., upto 13 November may be condoned by the designated authority after recording the reasons for delay.

- Part payment made while filing an appeal during the period 1 April 2022 to 30 September 2022 shall not be treated as a requisite amount for settlement of arrears.

Conditions for availing the scheme

- To avail the scheme benefit, it is mandatory to withdraw fully and unconditionally the appeal pending before an appellate authority or Tribunal or the High Court. An appeal includes appeal, reference, Writ Petition and SLP filed by the applicant. The said appeal should be withdrawn by 30 September 2022.

- Alternatively, the applicant can get his appeal decided within the period from 1 April 2022 to 30 September 2022.

- Appellate Authority, including the Tribunal, is required to pass the order allowing withdrawal of the appeal. However, if audit objections have been raised with regard to any order and an appeal is preferred against such order, the such appeal cannot be withdrawn.

Other noteworthy points

- The designated officer is required to pass an order within 3 months from the last date specified for payment of requisite amount under one-time payment option or the specified date for payment of last installment.

- If the application is rejected on the ground that same is not in accordance with the provisions of the Settlement Act, the applicant can apply for reinstatement of the appeal withdrawn earlier.

- Furthermore, an appeal against the order passed under the Settlement Act shall be filed within 60 days from the date of receipt thereof.

- The amount paid towards settlement shall not be refunded in any circumstances.

The Trade Circular also lays down the detailed procedure for submitting the application, supporting documents to be enclosed, and other procedural aspects.

Our Comments

The Maharashtra State Government has announced the amnesty/settlement scheme primarily with an intent to settle the pre-GST disputes, which in turn would allow the State Tax administration to focus on GST matters.

Given this, the dealers have an opportunity to diligently evaluate their eligibility and avail the benefit offered under the scheme. In cases where the proceedings are still at the adjudication/appeal stage, taxpayers may seek expeditious closure of their proceedings latest by 30 September 2022 in order to avail the benefit.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.