- within Real Estate and Construction, Government, Public Sector and Energy and Natural Resources topic(s)

- with readers working within the Law Firm and Construction & Engineering industries

INTRODUCTION

The word "Benami" means anonymous or nameless and the term "Benami Transaction" is used to describe a transaction where one person pays for property but the property is transferred to or held by somebody else. The person who pays for the property is the real beneficiary, either at present or at some point in the future, but is not recorded as the legal owner of the property. This enables the payer to achieve undesirable purposes such as utilizing black money, evading the payment of tax and avoiding making payments to creditors.

The Benami Transactions (Prohibition) Act, 1988 ('Primary Act') was enacted in the year 1988 to prohibit all benami transactions. The Act defined a 'benami transaction' as "any transaction in which property is transferred to one person for a consideration paid or provided by another person".

The Hon'ble Supreme Court in Bhim Singh v. Kan Singh AIR 1980 SC 727, explained Benami Transaction as "Where a person buys a property with his own money but in the name of another person without any intention to benefit such other person, the transaction is called benami. In that case the transferee holds the property for the benefit of the person who has contributed the purchase money, and he is the real owner."

However, the Primary Act was not comprehensive enough and lacked to make a big impact. The Rules of the Primary Act were not framed and benami transactions continued in India. The Primary Act had several loopholes, including the absence of an appellate mechanism and lack of provisions for vesting of the confiscated property with the Central government. The Benami Transactions (Prohibition) Amendment Act, 2016 ('Amendment Act') seeks to amend the Primary Act and is aimed at catching those with black money in the domestic economy hidden through benami properties.

The reason for bringing an Amendment Act instead of a new Act is that the Primary Act has penal provisions and penal provisions cannot be applied retrospectively. So if a new Act was passed in 2016, all those who acquired benami properties before 2016 would be given immunity.

PURPOSE & SCOPE OF THE AMENDMENT ACT

The Amendment Act seeks to:

- amend the definition of benami transactions,

- establish adjudicating authorities and an appellate tribunal, and

- specify revised penalties for benami transactions.

The term 'Benami Transaction' covers a transaction or Arrangement

- where a property is transferred to, or is held by, a person for a consideration provided, or paid by, another person; and

- the property is held for the immediate or future benefit, direct or indirect, of the person providing the consideration.

The Amendment Act increases the scope of transactions which qualify as benami and includes property transactions where:

- transaction is made in a fictitious name, or

- owner is not aware of or denies knowledge of the ownership of the property, or

- person providing the consideration for the property is not traceable or is fictitious.

The Amendment Act specifies the following cases which are exempted from the scope of the definition of a benami transaction. When a property is held by:

- a member of a HUF, and is being held for his or another family member's benefit, and has been provided for or paid from known sources of income of that family;

- a person in a fiduciary capacity (such as a trustee, executor, partner, director of a company, depository or participant);

- a person in the name of his spouse or child, and the property has been paid from the person's known sources of income; and

- a person in the name of his brother or sister or lineal ascendant or descendant (where their respective names appear as joint-owners in any document), and the property has been paid from the person's known sources of income.

BENAMI PROPERTY:

Property of any kind, whether movable or immovable, tangible or intangible, corporeal or incorporeal and includes any right or interest or legal documents or instruments evidencing title or interest in the property and where the property is capable of conversion into some other form, then the property in the converted form and also includes the proceeds from the property.

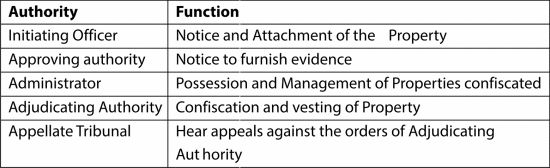

INITIATION OF PROCEEDINGS AGAINST ALLEGED BENAMI PROPERTY BENEFICIARIES:

The Act establishes four authorities who will be able to conduct inquiries regarding benami transactions:

- Initiating Officer (i.e. Assistant Commissioner of Income-Tax or a Deputy Commissioner of Income-Tax);

- Approving Authority (i.e. Additional Commissioner of Income-Tax or a Joint Commissioner of Income-Tax);

- Administrator (Income Tax officer); and

- Adjudicating Authority.

PROCESS:

- Issue of Show Cause Notice by Initiating Officer where he has reason to believe that any person is a benamidar in respect of a property.

- Provisional attachment of property if necessary.

- Revoke provisional attachment if satisfied the property is not benami.

- Continuing provisional attachment or ordering provisional attachment where not satisfied that property is not benami and refer a statement of case to Adjudicating Authority.

- Adjudicating Authority to hear affected persons and pass order holding that property is benami or not. The authority will decide within a year if the property is benami.

- Where adjudication order holds property as benami, hear affected persons and pass confiscation order. all rights and title in such property shall vest absolutely in the Central Government free of all encumbrances

- Administrator to take possession of benami property and manage it. Appeals against orders of the Appellate Tribunal will be to the respective High Court with jurisdiction.

The Act mandates Central Government to designate one or more Session Court as Special Court for trial of offence punishable under it.

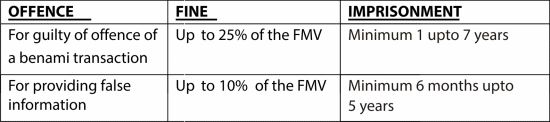

OFFENCES AND PENALTIES

Where any person enters unto a benami transaction in order to defeat the provisions of any law or to avoid payment of statutory dues or to avoid payment to creditors, the following shall be guilty of the offence of benami transaction:

- Beneficial owner,

- Benamidar

- Any other person who abets or induces any person to enter into benami transaction

The offences are non-cognizable and non-bailable.

Fair Market Value is a price that the property would ordinarily fetch on sale in open market. In cases where the price is not ascertainable, another procedure will be prescribed.

CONCLUSION

The Amendment Act seeks to clearly define the benami transactions, establish adjudicating authorities and an Appellate Tribunal to deal with benami transactions, and specifies the penalty for entering into benami transactions.

The Act is necessary to reduce generation and utilization of unaccounted black money. Real estate is considered as one of the major avenues for investment of unaccounted money in India.

All real estate transactions shall now be in the name of the actual owner who is paying the consideration from his known sources. The practice of including the correct name in property transactions will bring transparency in the sector. With increased transparency, title risks would be minimised and buyer confidence in property transactions will get a boost. A fresh breath of professionalism will be ushered in.

Moreover, this will also increase the tax revenue for the Government by curbing unaccounted money into the system. In the long term it will make India a more attractive investment destination, aligning transactions with ethical standards and will increase international institutional investors and financial institutions participation in this sector. Along with other regulatory changes such as implementation of Goods and Services Act (GST), Real Estate Regulation Act (RERA), this amendment is a step in right direction to improve the overall confidence in the real estate sector.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.