Residential real estate due diligence is a process that can never improve enough. There is always scope for more detail and efficiency. And let not macroeconomic optimism and builder assurances assuage you into resting carefree.

But there is no reason for cherophobia either. Your dream space may just happen to exist in the real world. The word we are looking for is cautious optimism.

|

TOPOGRAPHY |

The sector is at a low.

There's slumping buyer confidence and increasing liquidity crunch. Reports of 10 per cent drop in sales on an average across the top 9 Indian cities indicative of bad shape. The government has attempted to give it a push. Focus on projects infrastructure, affordable housing and tax relief on real estate transactions. |

Suppose a real estate investor does have the liquidity to buy preferred property. The property complies with their personal preferences. Location and locality, size, layout and condition, facilities and security, etc are great.

It also meets the initial checks of comparative value for money (after surveying a decent sample size) and reputation of the builder.

A majority of hidden costs in real estate investment come in the form of legal costs.

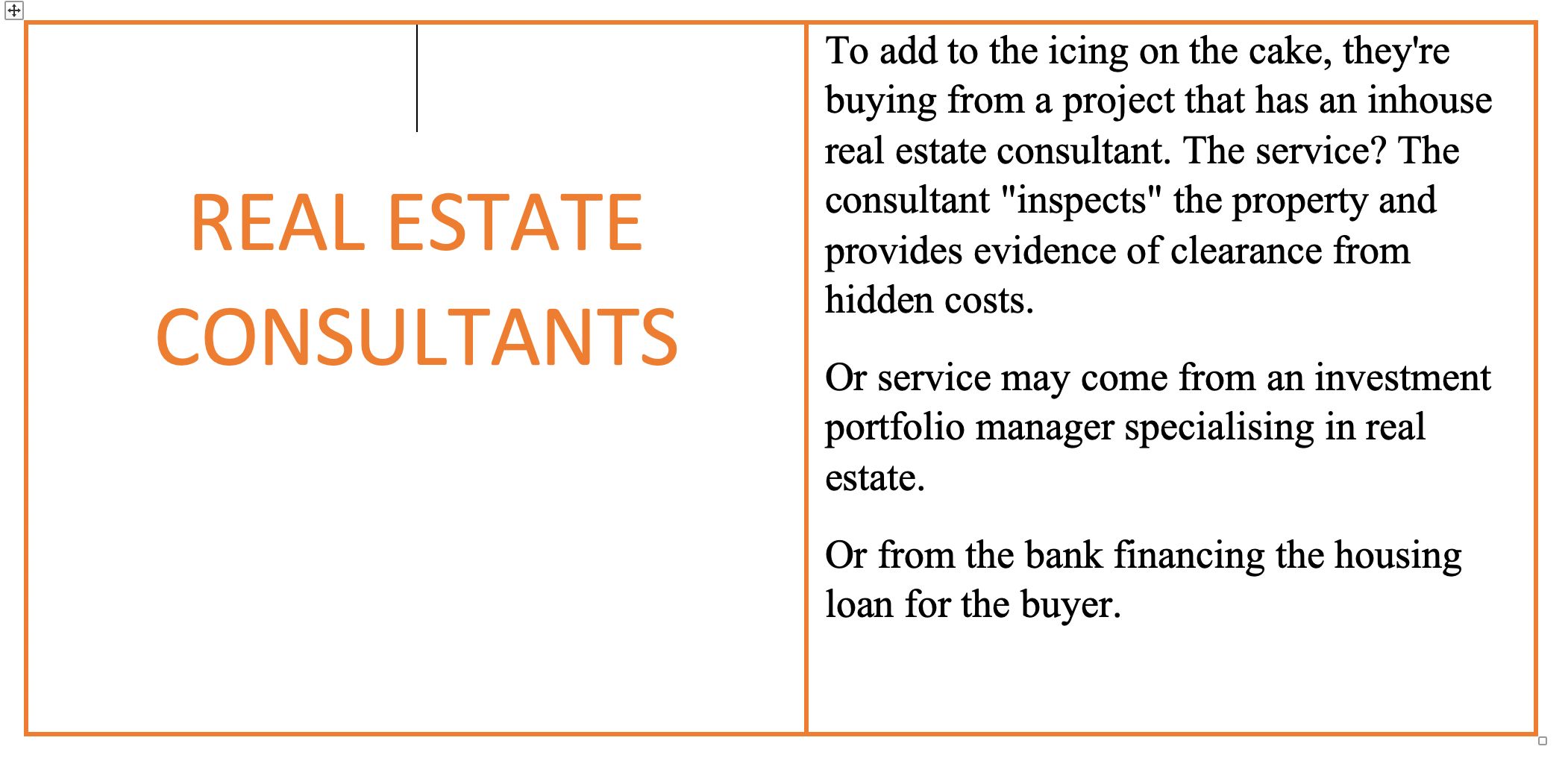

The majority of pending real estate disputes in Indian courts, some running into a decade, are to do with

.. And these are just the top few of many, many potential dispute scenarios.

So experienced real estate specialists may run up an "exhaustive" list of checks. But their naked eye may still miss out on several due diligence checkboxes visible to the lawyer.

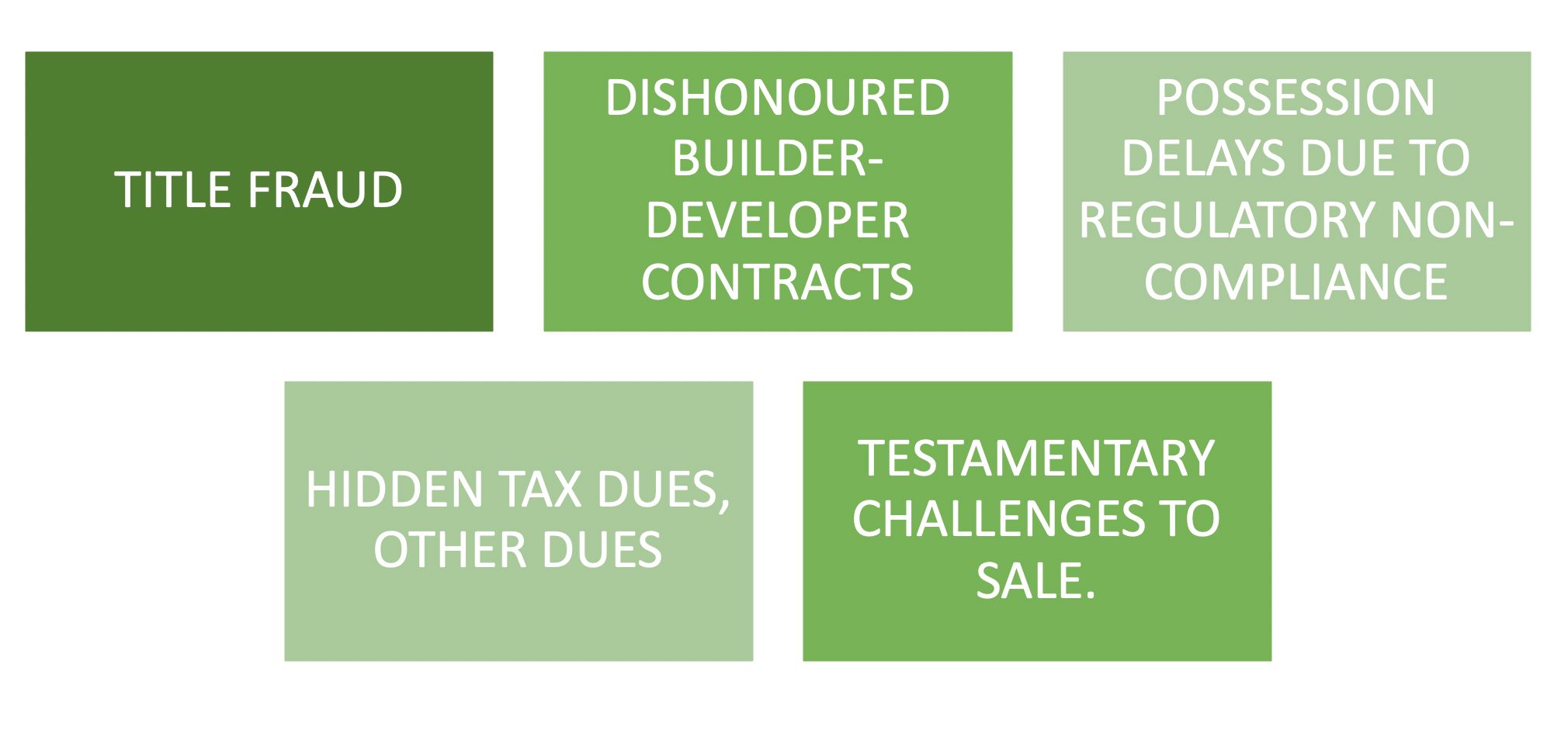

A real estate vertical in a law firm has the following advantages over a non-legal consultant:

–Massive systems to improve the accuracy and scale of the due diligence (DDs) process

Through countless DDs performed across several practice areas, such as real estate, M&A, investment, etc.

The mechanisms honed in one of these over years do come in use in the other

– A legal perception of fail scenarios

The ability to back-calculate legal risks comes from the exposure of years to reading pending cases. It also comes from market intelligence

– Efficiency tools

It is not a good idea to rely on only market reputation before buying. So where else to look? One place you can check for dishonoured buyer-developer contracts is the RERA registry.

But you probably knew that, because of the popularity of RERA. What about the rest?

Law firms have mapped out strategies to systematically go through every possible authority, regulation, rule, statute and document that can make you secure in your purchase. They also do this in a time-efficient manner.

Because unlike real estators whose focus is the real estate market, the focus of lawyers is dabbling in rules.

DUE DILIGENCE PARTS

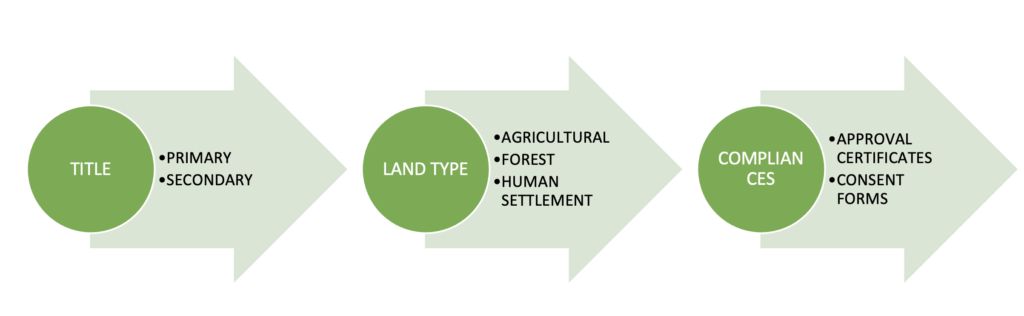

- Title of the Property

'Nemo dat quod non habet' : no one gives what he does not have.

Do not buy from someone who does not own the property.

Primary Source of Title : The title document

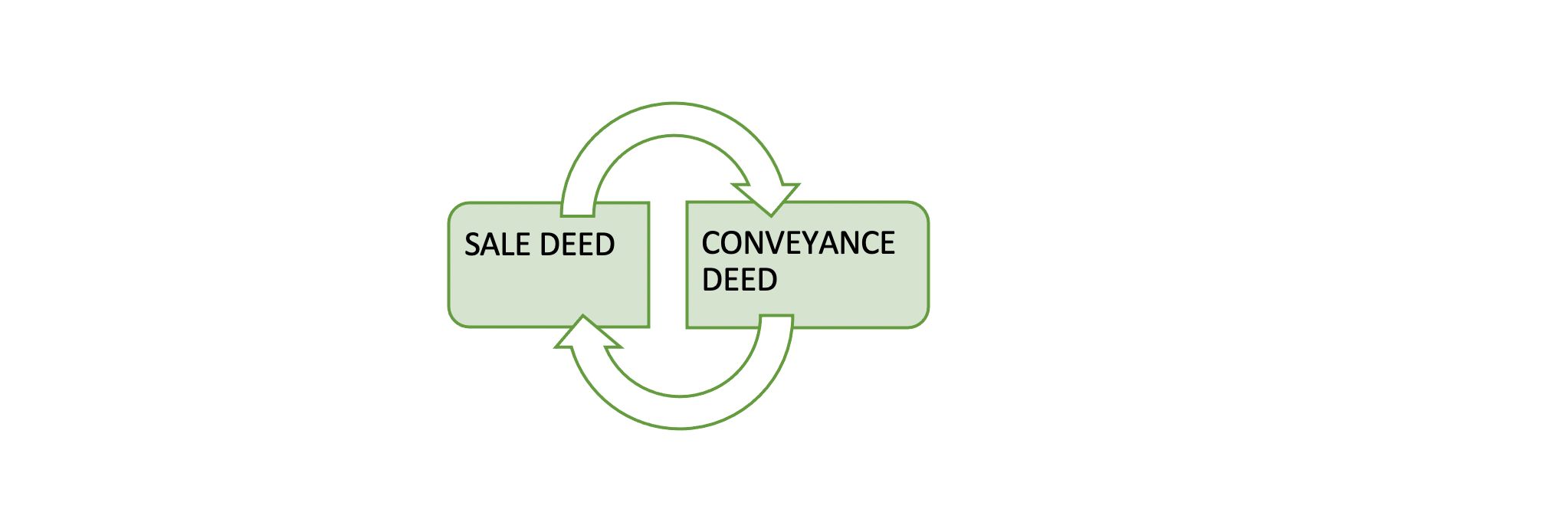

At this stage, many people confuse a sale deed with an agreement to sale. An agreement to sale is not a title document, it simply records the agreement between parties to enter into a conveyance deed at a later stage. The words used in the agreement determine whether it is an agreement for sale or it is a sale deed.

For example, if the agreement reads that 'A agrees to sell to B and B agreed to purchase from A.', the nature of the agreement is an agreement for sale and it cannot establish B's title over the property. Agreement to sale is commonly executed in case of commercial properties wherein the construction is to begin or is either underway.

Registration of the sale deed also is an important aspect of the sale deed being a valid title document. A sale deed is a compulsorily registerable document under the Indian Registration Act, 1908.

Secondary Source of Title

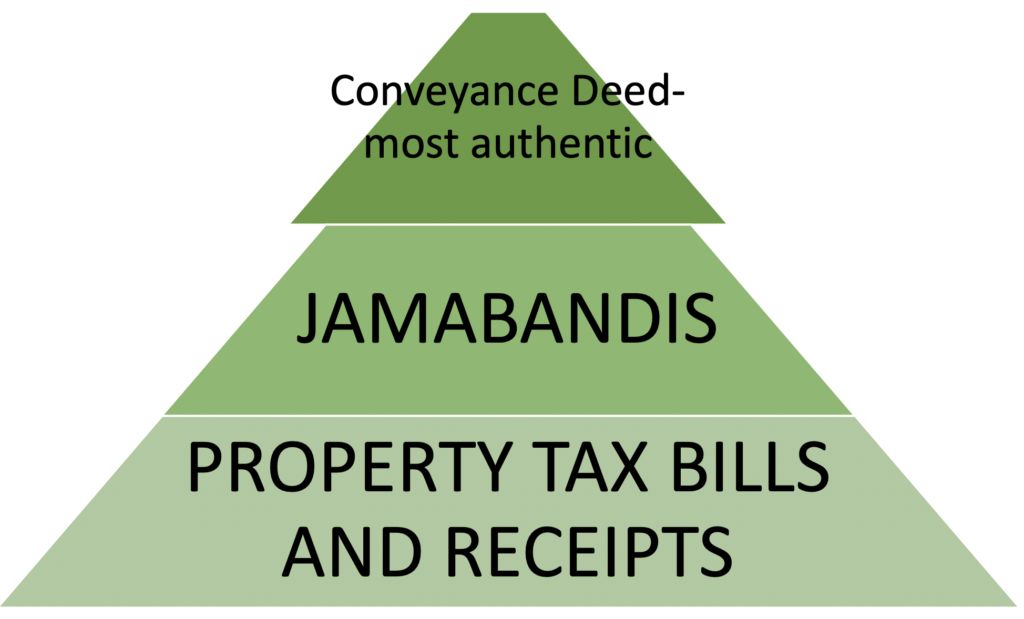

Order of importance in deciding title.

Many times, the title of the property is determined by the records maintained by the Revenue Department or the Municipal Corporation. Such records, however, cannot be said to be the primary source of the title of the property.

The revenue records are updated based on the submission of the copy of a registered sale deed to the Revenue Department. Revenue records are maintained in the form of 'Jamabandis' which are updated in every 5 years. The 'Jamabandi' itself has a column which records the change in title of the property during such 5 years. Hence, after the sale deed, the revenue records are the most authentic source of the title.

The property tax bill is raised in the name of the owner of the property hence, property tax bills and receipts are also a source of establishing title over the property.

- Nature/ Type of the Land

A buyer, before purchasing the property, should also consider the nature of the land. In North India, the land is usually either agricultural, forest or land under human settlement. Many a time, the land use of the property is required to be undertaken by the the buyer or the seller (as they may contractually agree). It is also important to determine rights and restrictions (if any) over the property.

- Approvals and Consents

Depending on the nature of the property, the buyer should determine whether approval or consent from concerned authority is required to be taken by the seller or a builder before the sale of such property.

it is pertinent to check whether approvals such as fire NOC, lift NOC and occupation certificate has been obtained by such seller/developer. A consultant can guide the buyer regarding the kind of approvals and consents required for the property depending on the area at which the property is situated.

- No Dues Certificate

The buyer should require the purchaser to provide proof of paying the expenses with respect to the property such as water bill or property tax receipt. Alternatively, a no-dues certificate can also be obtained by the buyer. In case of land originally owned by the authorities such as New Okhla Industrial Development Authority, Mumbai Metropolitan Region Development Authority or Pune Metropolitan Authority, a no-dues/ no-objection certificate may also be required to be obtained by the buyer.

- Encumbrance

A charge or an encumbrance created over the property may be difficult to find, however

in case of mortgage of the property by handing over the title document, the buyer should verify the original title document granting ownership rights to the seller.

For other forms of encumbrances, the sale deed should clearly capture that the property is free of any encumbrances or charges.

5. Litigation

Often the property to be purchased by the buyer is subject of pending dispute in court.

The most common reason: challenge to ownership of ancestral property.

A litigation search runs up a list of the court cases the property is embroiled in.

Additionally, the language of the sale deed should capture that there is no litigation pending with respect to the subject property.

A litigation search is a tedious exercise. The process usually followed by us is an online search on the district court's website, relevant high court, the Supreme Court, consumer court and NCLT (in case the seller is a company).

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.